EtherDelta was once the only usable decentralized exchange for ERC20 tokens, but it has suffered from numerous issues and setbacks throughout the last several months. If you’re looking for a newer, safer alternative for decentralized Ethereum-based token trading, DDEX is a great platform to check out! The migration process from EtherDelta to DDEX is quick and smooth.

If your primary exchange was EtherDelta and you’re coming to DDEX, there are a few things that might cause confusion initially:

- Wrapping ETH and Unwrapping WETH vs Depositing and Withdrawing

- Limit orders

- Enabling Trading A New Token Type

- Token Listings

This article explains all of these in detail.

Wrapping ETH and Unwrapping WETH vs Depositing and Withdrawing

One difference between EtherDelta and DDEX is a difference in approach to smart contracts for token security. In EtherDelta, users are familiar with the process of depositing ETH into EtherDelta, purchasing tokens, then withdrawing the tokens. With DDEX, there is no depositing or withdrawals at all. In DDEX’s interface, all of your tokens stay in your digital wallet — so if you buy some ZRX on DDEX, it immediately appears within your wallet: there is no extra step to withdraw it from the exchange!

DDEX does this through utilizing the 0x protocol. There is one step though that can cause some confusion regarding 0x settlement: the need for “WETH”. WETH is simply wrapped ETH — ETH is not normally an ERC20 token itself, and it does not adhere to the typical rules that ERC20 tokens do. EtherDelta got around this through their smart contract structure which required depositing and withdrawing. 0x does this through “wrapping” the ETH into an ERC20 token called WETH. WETH is completely equal to ETH (always a 1:1 ratio), and can be converted back and forth on DDEX and a few other 0x websites (and other 0x relayers).

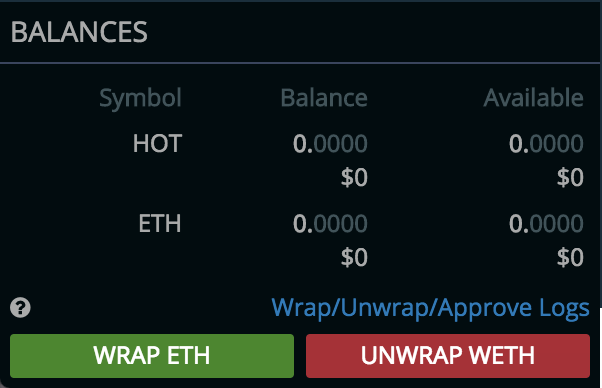

So in order to buy a token using ETH on DDEX, you first have to wrap your ETH into WETH. This requires a transaction on the blockchain (Metamask will prompt when you click either of the buttons).

We also recommend adding the WETH token contract address to your MetaMask wallet. It’s nice just to see that the WETH stays in your wallet and isn’t held by some 3rd party.

WETH Contract Address: 0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2

WETH Symbol: WETH

WETH Decimals: 18

Limit Orders

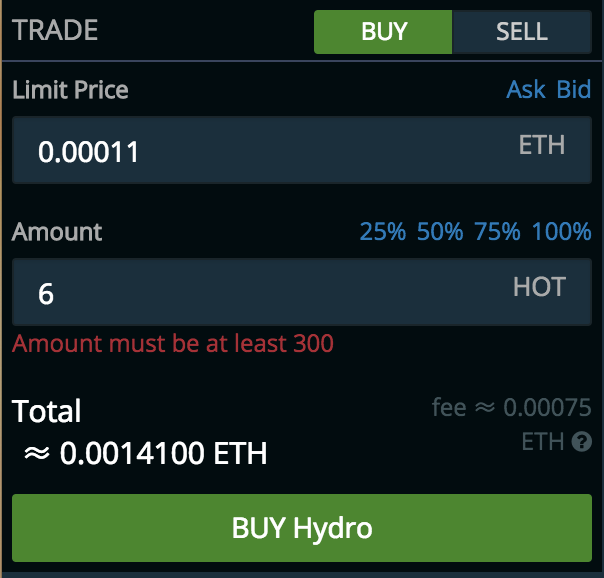

DDEX allows for limit orders. This is similar to what you would typically experience on centralized exchanges, but if your experience is primarily on EtherDelta it might be a bit unfamiliar.

Rather than having to click on many individual orders manually to purchase or sell large quantities of tokens, you can simply place a single limit order on DDEX. The matching algorithm will find all current buy/sell orders within your limit and fill them immediately. If there is any left over, the remaining limit order will appear in the order book.

There are a few nice advantages here - really this is just a more user-friendly system. Most notably: typos will not result in such devastating consequences. For those that liked being able to click on an order to fill it, that capability still exists. Clicking on an existing order populates the buy/sell limit price accordingly.

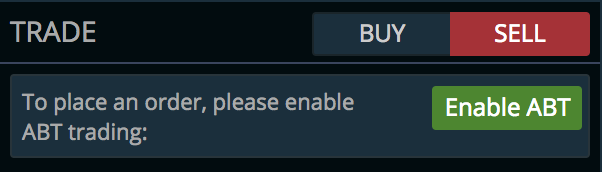

Enabling Trading A New Token Type For Selling

In order for the 0x Smart Contract to interact with your digital wallet, 0x relayers like DDEX require a one-time “enabling” before selling a new token type.

You will only need to enable selling a new token type once ever. After that initial enabling, you can place as many sell orders as you want without additional prompting from MetaMask.

When clicking this enable token button for the first time, MetaMask will prompt you to sign a transaction. After you accept the transaction, it typically takes less than 2 minutes for token trading to be enabled. That’s it! No more depositing/withdrawing tokens constantly.

Token Listings

One thing a lot of users really enjoyed about EtherDelta was the vast number of different tokens they listed. If you’re concerned that DDEX only lists a couple of that tokens you are interested in trading and you need more options: you can actually request tokens to be listed here — https://medium.com/ddex/how-to-get-new-tokens-listed-on-ddex-a8117c4ed05c

Lower Fees

Etherdelta charges a 0.3% transaction fee plus gas cost for transactions, while DDEX charges only a 0.1% transaction fee plus gas cost. DDEX also has a tooltip that automatically estimates your fee for a given order depending on the current Ethereum network traffic.

Summary

There are a few things that are really nice about the DDEX system coming from ED:

- Everything stays in your wallet. You don’t have to constantly deposit and withdraw tokens and ETH

- Limit orders are awesome

- System is super fast and support is great

Compared with EtherDelta, the DDEX platform provides a better overall experience, lower fees, and the customer support is excellent. While the volume is still a bit low now, that seems likely to change in the near future. I’m excited to have a new great DEX option available as users look for more decentralized trading options.

Congratulations @bowenwang! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!