The mainstream media has become obsessed with the crypto frenzy with the main focus on Bitcoin price. By treating cryptocurrencies like any other asset class or just as a fad, journalists are missing the elephant in the room: investment banks are about to be disrupted big time.

More than 1,500 cryptocurrencies already

These days it is much easier to raise funds through an ICO than through traditional venture capital funds. As a result, there are already more than 1,500 cryptocurrencies out there. Just a few years ago, it would have been unthinkable for a small company with just a handful of employees to raise millions of dollars on the back of a simple white paper. Now, startups can do it with just an exciting concept and a white paper of a few dozen pages (sometimes less). Thanks to the ERC20 standard that uses the existing Ethereum Blockchain, anyone can launch a token at a limited cost without having to worry about building a Blockchain infrastructure from scratch.

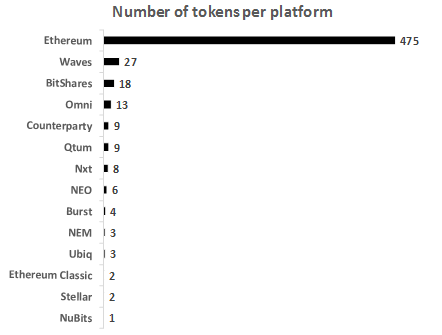

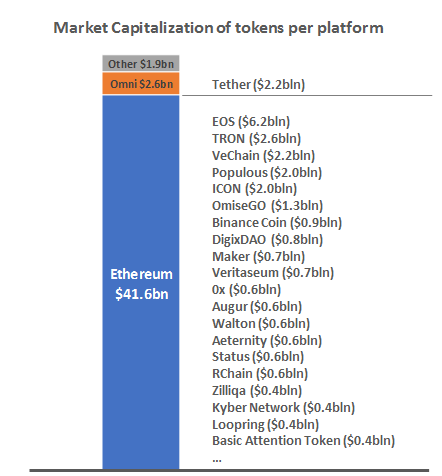

Obviously, Ethereum can be taken by another, more advanced platform. But for now, it makes more than 80 percent of the market. Out of the 580 tokens out there, 475 are on the Ethereum Blockchain.

Source: Coinmarketcap.com, February 2, 2018

The genius of the Ethereum Blockchain was making fundraising so incredibly easy: all you have to do is create a smart contract to do an ICO. Every time ETH (Ethereum tokens) are sent to the contract address, the contract issues newly minted tokens that are automatically sent back to the sender. Wall Street should be terrified because Ethereum has just made investment banks redundant.

Book building (the process of lining up investors to buy security to be issued) has historically been very juicy for Wall Street, and investment banks acted as intermediaries between asset managers and companies or governments wishing to raise debt (bond offerings) or equity (IPOs). Until recently there was no way to bypass them. Now there is. Banks have not started feeling the pain yet, but venture capitalists have. Nowadays, it is not uncommon to see them in the list of pre-ICO investors (see the upcoming Telegram ICO). VCs have to adapt or be history, and Wall Street is next.

Source: Coinmarketcap.com, February 2, 2018

Beyond Uberization

Initially, I entitled this post “The Uberization of Wall Street,” but then realized that what Uber is doing is what banks are already doing: connecting supply (of capital) with demand (investors) and taking a hefty fee in the middle. Uber simply disrupted a sector that had not evolved ever since it had been invented where supply and demand were just incredibly inefficiently connected. Banks are already connecting supply and demand, but with the Blockchain technology, they are not needed anymore, at least not for what they are doing now.

How Ethereum can disrupt the bond market

Let’s have a look at one of the most lucrative businesses on Wall Street: the issuance of corporate bonds. Last year, companies around the world issued more than $3.5 tln worth of bonds. The way this currently works is the following: a company mandates an investment bank that is going to sell the bond to be issued to pension funds and asset managers. Investment banks control this market because they have access to these funds managers. But as ICOs have successfully demonstrated, you do not need such intermediaries anymore, and companies could reach investors directly by issuing smart bonds. How could this work in practice?

The issuance

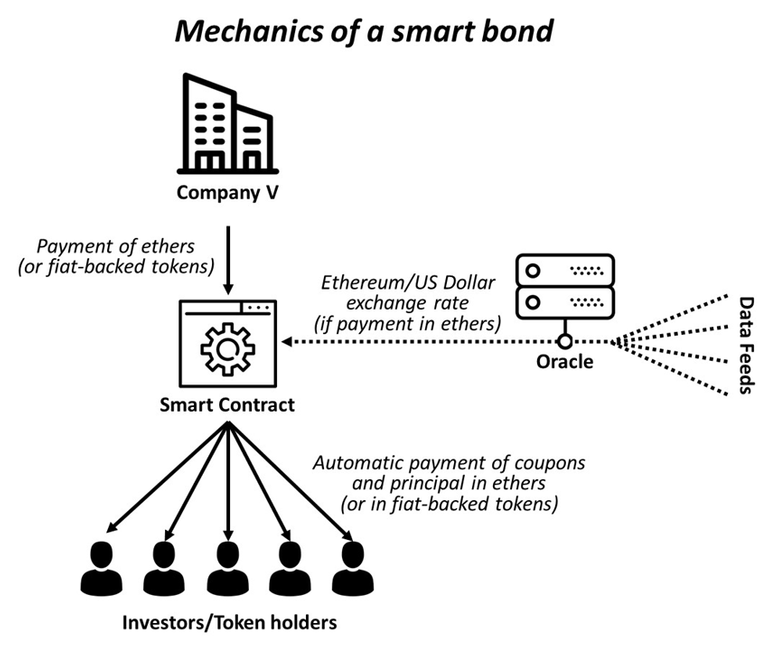

1-Company V creates a smart contract on the Ethereum Blockchain that replicates how a bond works (i.e., payment of coupons semi-annually and repayment of principal at maturity).

2-Investors who wish to participate in the IBO (Initial Bond Offering) send ETH to the contract address and specify the lowest coupon they are willing to receive.

3-Once the IBO is over, the smart contract automatically builds the order book with investors willing to accept the lowest coupon first, the marginal investor needed to fill the order book sets the coupon for a bond.

4-All the investors who did not make it to the final order book automatically get back the ETH they had sent to the smart contract.

Debt servicing

1-Every six months, investors receive the coupon (interest) as set in the original smart contract.

*If company V does not want to take the risk that the value of Ethereum increases substantially, payments can be made in ETH but adjusted with the exchange rate of Ethereum with the fiat currency of the bond. Before payment of the coupon, the smart contract will get the exchange rate between the fiat currency and Ethereum from an oracle (data provider) and pay the right amount of ETH such that the bond replicates precisely how a fiat currency bond would have behaved.

*Alternatively, payments of coupons and repayment of principal can be made directly in tokens backed by fiat currency and redeemable with a reputable, audited financial institution.

2- At maturity of the bond, the smart contract pays out both the coupon and the principal (either the same amount of ETH or the same amount of US dollar paid in Ether or fiat-backed tokens).

How many human actions were required to run all this process? Zero. The only thing that needs to be done is to write the smart contract. But just like with the ERC20 standard, you can expect standardized smart bond contracts to be available soon. A well reviewed and audited smart bond contract would mitigate the risk of bugs in the smart contract.

Huge potential for smart bonds

The way the bond market currently works keeps many investors out. Buying a single piece of a bond often requires from $5,000 to $200,000. Hence, many investors are left with no choice but to buy mutual funds or ETFs that include a basket of bonds. With a smart bond, anyone could invest as little as $10 and get a piece of the bond. Diaspora investors who want to invest in their home countries will be able to do so, small and medium enterprises will have access to new financing options beyond what commercial banks can offer them and micro-bonds could also be issued, all at close to zero cost. ICOs were just the beginning, the real disruption of financial markets is yet to come.

Read More : https://cointelegraph.com/news/the-ethereumization-of-wall-street-is-inevitable-expert-take

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://coss.io/news/article/e0a27194-18db-405c-97ed-02705314b5d2