Cryptocurrency these days have become a means of exchange for goods and services. As it stands, it has come to stay. This currency can either be purchase with our fiat money and transfer to a wallet or we can mine or work to earn it. We can also purchase this through exchanges and trading platform. Reports as of January 2018 state that there are OVER 120 Cryptocurrency exchanges where we can trade more than 1000 individual markets. As the days goes by, more and more cryptocurrency keep coming out. Exchanges have gone de-centralized. From centralized exchanges that charges customer’s Huge amount of money for transaction.

Also Asset Managers This Days are seeing increased demand for cryptocurrency exposure in their portfolios. The future looks brighter in the world of cryptocurrency.

But Few things hinder the steady grow and development of cryptocurrency. This Includes:

Complex Web of Exchanges: this involves combination of different requirements and interfaces ranging from KYC Policies, means of funding, etc. Trading in an automated in an automated fashion with full awareness of best pricing and currents liquidity necessitates the issue of different accounts on different platform. For members to trade properly, fiat currency must be converted to crypto on an exchange or escrow site. One major concern for participants ranges from unmitigated slippage and counterparty risk to hacking prevention and liquidity.

HIGH FEES:

Transaction cost is also another major problem participants do face. Traders are trying to avoid or move from centralized platform to de-centralized exchange platform due to high cost on the centralized platforms. Also Exchange commissions are in the 0.1% -0.25% range per transaction but the effective fees are much higher when taking into bid and ask spreads maintained by the exchanges. Some exchanges are not regulated therefore it gives way for high internal exchange activities.

THIN LIQUIDITY

When a whale places a buy or a sale order in the market, it can automatically change the market of that particular currency. i.e. A single Buy order of 1millionusd worth of BTC can cost an extra $50,000 - $100,000 per transaction given a lack of liquidity if not managed correctly and executed on only one exchange. By way of comparison, similar trades on FX exchanges barely move markets a fraction of a percent. Those price changes cost traders money and after investments.

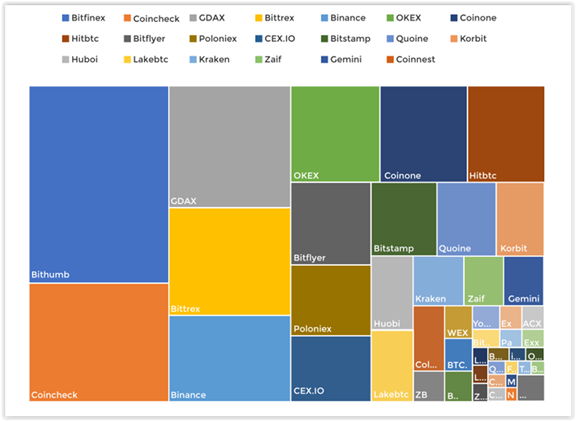

THE CRYPTO EXCHANGE BY DAILY DOLLAR VOLUME AS OF 12/10/2018

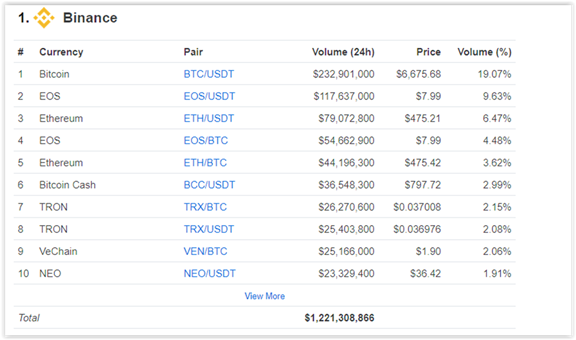

As of today , the Crypto Exchange by daily dollar volume is LED By Binance, Followed By

Okex, Huobi ,Bitfinex, ETC. there could be changes depending on traders uses this platforms.

XTRD PROJECT;

XTRD is launching three separate products in sequential stages to solve the ongoing problems caused by having so many disparate markets: low per-market liquidity, unfamiliar interfaces that lag behind financial industry standard and decentralized execution in crypto.

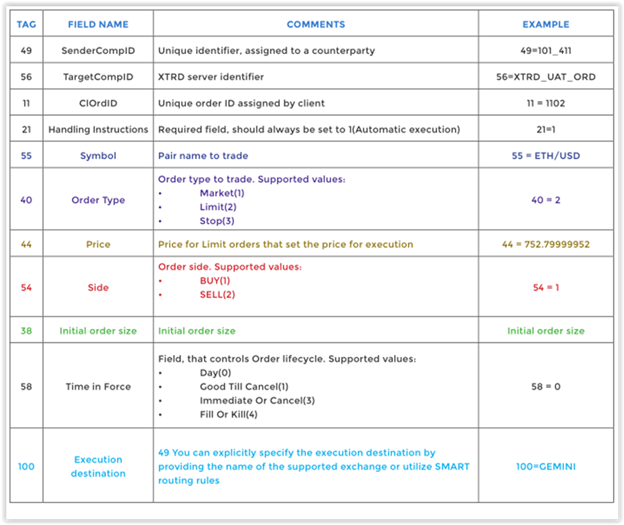

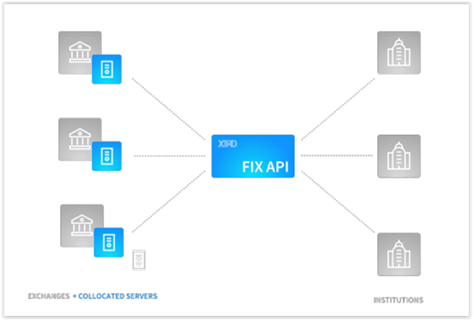

How will XTRD achieve this, By implementing different process in the buildup. The first one is a multi-exchange FIX API. This is a protocol created in 1992 to serve as the universal communication language for international financial transactions. Since all order systems are different, there was a strong need to

Communicate all executions between brokers, exchanges, mutual funds, investment banks and direct market access participants using a universal format. FIX is the standard means of communication for trading in global equity markets and is also heavily used in currencies, bond and derivatives. An interesting ting to note is that every large institutional and professional market participant users FIX to trade and has been doing so for over 5 years.

XTRD Plans to launch a universal low latency FIX Base API Connecting to all crypto exchanges to make it easy for major institutions, hedge funds and algorithmic traders to access all cryptocurreny markets by coding to just one FIX application in one format. This will bridge large markets participants to easily add multi exchange crypto execution to their exiting transaction system.

A FIX TABLE TO SHOW BASIC XTRD ORDER ENTRY FOR CRYPTOCURRENCY PAIRS

STAGE 2:

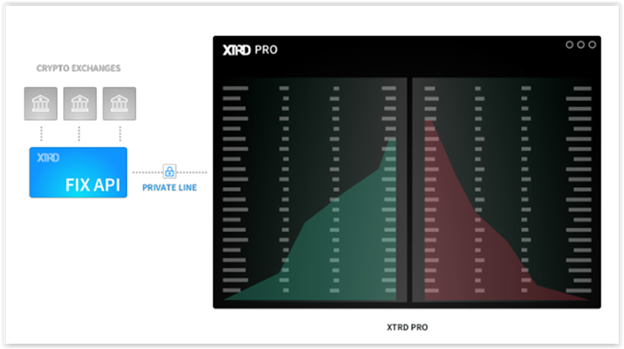

LAUNHING THE XTRD PRO TRADING PLATFORM

Professionals and active traders these days prefer robust, secured and standalone applications for trading. These applications provide customer support including features development tailored to their customers’ demands. Currently such platforms are yet in existence. The web based exchanges are slow and difficult to use. XTRD will LAUNH AN Application Known as XTRD Pro in 2018. A highly robust multi-exchange standalone trading platform for active traders.

The platform will include features and advanced consolidated order books, hotkey order entry and custom order types, with 24x7 uptime.

STAGE 3

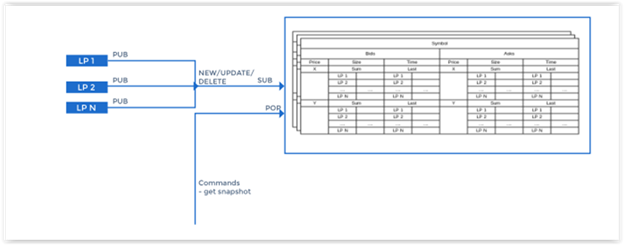

SPA (SINGLE POINT OF ACCESS) Liquidity aggregation/cross-exchange execution)

XTRD creates a single unified point of access to aggregate liquidity across exchanges for traders. This will allows traders to clear out the best possible prices while delivering the lowest possible transaction costs.

XTRD SPA will be facilitated via Joint venture partnerships with existing exchanges to minimize the regulatory hurdles as XTRD will function purely as a technology provider. Exchanges will fulfill the custodial function, while XTRD will clear balances from its inventory accounts at other exchanges to close the trades made by clients within the JV exchange.

Also XTRD will focus on becoming the de-facto trusted, US-based technology platform for large financial players to easily execute on crypto. Revenues will be generated via execution fees, market data sales. VPS Services, software, licensing and other ancillary income streams.

XTRD TOKENS

XTRD tokens will be BASED on ERC20. designed on the ethereum blockchain and will be used as a means of payment by trading participants for services provided by XTRD. This will be created via a token generation event scheduled for q1 of 2018.

STAKING: As XTRD tokens are used to pay for services on the XTRD Trading network, line tokens will be cycled back into the network. Discounts of 25% of XTRD Services (execution, colocation, market data, software licensing) will be available for token holders in general and discounts of 40% on XTRD Services will be available for token holders who maintain an average monthly stake of at least 50,000 XTRD Tokens.

XTRD PROJECT

This project is to build a trading infrastructure (software and hardware) in the crypto space and become one of the first full-services shops in the cryptourrency markets for large traders and funds.

The most important components are:

A single FIX API for trading across all connected exchanges.

A robust GUI for manual cross execution on all crypto markets.

A large liquidity pool, based on order books from all connected exchanges

Best prices and best top of book execution net of fees

Low transaction fees

99.99% reliability and uptime

Fast execution

Parent/child orders on multiple exchanges to minimize individual market impact

Advanced order types Common in the equity and FX trading space.

Establish XTRD as a premier market-making entity to mitigate spreads and increase liquidity in the cryptocurreny space.

Derivative trading –XTRD Plans to connect to legerX (US based, approved by the CFTC) for cryptocurrency options and swaps to offer unified hedging and derivate trading strategies.

Robost , US Based technicial support

Reliable and familiar development methods for institutions:

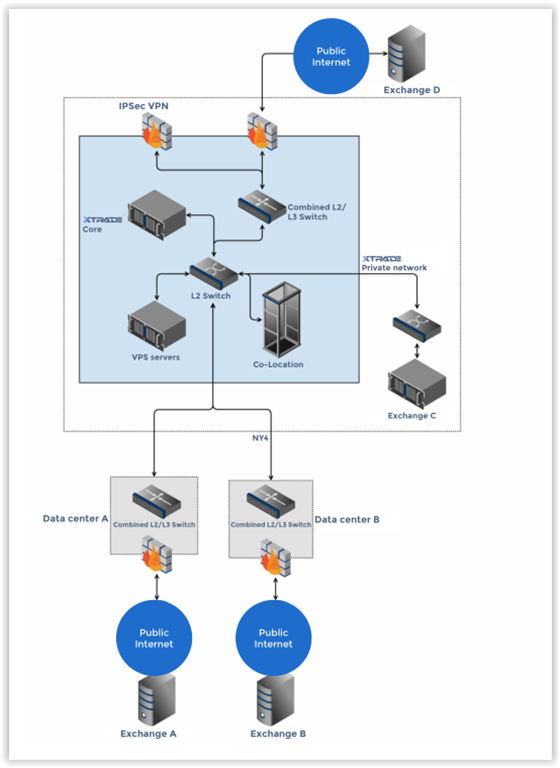

There is a plan to initially deploy the servers in NY4/LD4 where many of the large us crypto exchanges already have a point of presence. There are several Exchanges that already has a point of presence in the NY4 Datacenter. To improve latency to Non-NY4 exchanges, we will build custom routing paths using dedicated internet access technologies (DIA).

A diagram below shows how XTRD internet can be fasted compared to the public Network;

SECURITY:

Another issue that can be a problem to XTRD is CYBERSECURITY. Currently all exchanges have public internet connectivity. Even with 2FA authentication and complex passwords, there is still threat of hacking, ranging from simple password phishing to more sophisticated intrusions such as(Man-in-the-middle) attacks where network traffic is intercepted between two parties.

A bad actor can gain access to crypto trading account with an obfuscated IP and simply move funds.

NOTE::XTRD will not allow public internet connectivity to the XTRD private Network. All market participants will connect via IPsec VPN with hardware based IP whitelisted, end to end encoded communications for both FIX and XTRD PRO that encrypt all data packets. All VPS and cross-connects will be on the private network, not accessible to the outside internet.

ROADMAP::

A simplified ROADMAP Diagram can be seen below

FIX API(Q1 2018)

Exchanges this day offers an HTTP-Based REST API/WEB Socket for execution and market data. Even though these APIs are mostly similar, they are still heavily fragmented, requiring many resources to unify into a single trading application. FIX is widely adopted and much faster. This is widely adopted and much faster.

XTRD PRO(Q2 2018)

As an advanced trading platform, XTRD have a combined 30 years of experience developing and administering front end systems for active traders in FX and equity, as well as creating and maintaining the back-end systems required to support end trading.

Most cryptocurrency exchanges have an antiquated, bare bones system that is accessed through a webpage with limited functionality. Also huge traffic can affect exchanges. This case leads to the

Disable of an advanced order placed on an exchange in august 2017. This affected traders seriously. Some even lose their money due to stop losses and trailing stops.

XTRD PRO(Q2 2018)

XTRD PRO IN DEPTH- FAST EXECUTION, AGGREGATED MARKET DATA, CUSTOMIABILITY, ADVANCED SCANNERS.

XTRD will introduce fast transaction Execution of orders on the servers and pass executions to exchanges using the FIX API, allowing for faster and more advanced order types that are currently either executed too slowly due to internal network latency or don’t exist natively on the exchanges, or both.

If a client wants to buy 100USD worth of ETH, depending on his selected execution strategy,XTRD will split the order into several pieces and execute them on multiple exchanges. The client can then utilize different order types and time in force(FillOrKill,Immediateorcanel,GoodTillcancel) commands will work on a custom basis depending on available liquidity.

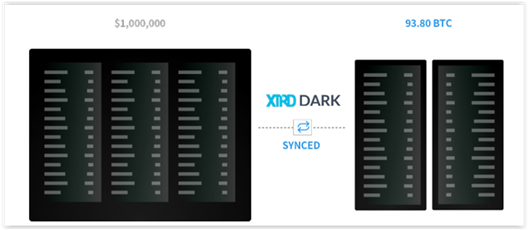

XTRD DARK POOL (Q2 2018)

The XTRD Dark pool will allow traders to buy cryptos using fiat currencies after passing through KYC with registered banks in U.K, U.S and in Hong Kong. Instead of paying 1% commission, they will pay 1% allowing them to save huge amount of money

SPA (Q4 2018)

SPA or single point of access, will XTRD to improve executions across multiple exchanges with one account. SPA will be facilitated via a JV agreement with existing cryptocurrency exchanges. The first exchange to participate as a JV Partner with XTRD is CEX.IO. an exchange company with over $400millionusd.Over 1.2 million active traders and 7million unique visitors per month.

If an order needs to fill outside the JV exchange, XTRD will do the execution by transaction using the inventory account at another exchange and move the position over to the JV exchange where the customer’s account is resident. The customer will be debited for the transaction at the JV Exchange and settlement will out there. XTRD will employ continuous Net settlement (CNS) to settle trades. CNS is like the National securities clearing corporation settlement system.

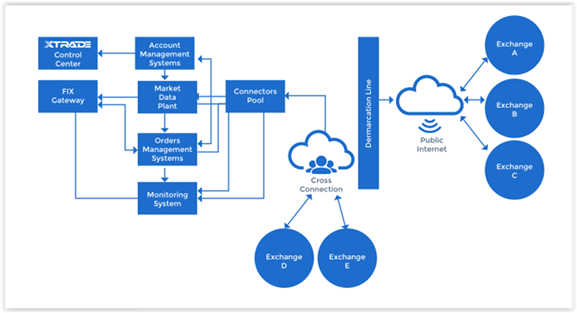

XTRD TOP LEVEL ARCHITECTURES:

The XTRD has a structural architecture which displays the pattern on how the platform works. The general representation is shown below.

MARKET DATA PLANT

ORDER MANAGEMENT SYSTEM

ACCOUNTS MANAGEMENT

CONNETOR POOL

XTRD TOKEN GENERATION

XTRD introduced a service known as SAFT which is an agreement being utilized by XTRD to allow accredited investors and institutions to participate in a future token generation event. It is a token presale open to accredited investors, or those with an annual income of least 200,000usd or net assets of 1,000,000usd,Exclusive of their primary residence. This is modeled after the simple agreement for future equity,or SAFE, Which originated out of Y-Combinator, and when used properly is fully complaint with the securities Act of 1933 and regulation D promulgated thereunder.

Token Generation Event: XTRD will conduct a crowd sales if necessary to accredited investors under Reg D and Non-accredited US investors under Reg S. Non-acreditied US investors will not be allowed to participate in the Token Generation Event to ensure proactive compliance with current us securities laws and regulations.

TERMS USED IN TOKEN SALES:

XTRD TOKEN GENERATION EVENT (TGE) : XTRD will generate tokens only as funds arrived.

TIMELINE-Q1 2018: Institutional private sale SAFT platform accredited presale ---pre-sale---TGE/public Sale---Institutional private sales,public sales will take place at disounts,tokens will be generated and sent to whitelisted participants at pre-agreed discount as the TGE occurs.

TOKEN PER VALUE: $0.10 PER TOKEN, PEGGED TO USD

XTRD TOKEN GENERATION

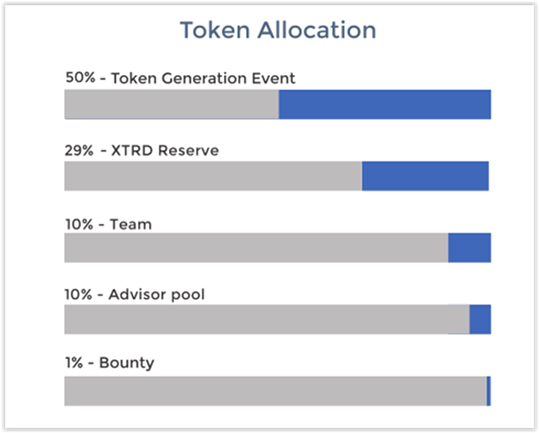

50%- Token Generation Event: Event tokens will be sold via SAFT followed by crowd sales if necessary.

29%-XTRD Reserve; These tokens will be held in reserve by XTRD

10%-TEAM: Team will have their share of the token for job well done and will be subject to 180-day vesting period from the date of the token generation event.

10%- Advisor pool: for project advisors.

1% - for bounty hunters

MEET THE TEAM

The XTRD Project is coordinated by a strong team which has members with over 30 years of experiences in Real-world trading systems. They have specialist Knowledge in all aspect of Brokerage services, Execution, market data, trading platforms, learning, settlements, colocation, algorithmic trading ,and automated trading systems. They have worked in active trading firms and financial institutions around the world. Eg BARCLAYS, LEHMAN, DEUTSCHE BANK, MORGAN STANLEY AND JPMORGAN.

ALEXANER KRAVETS

CEO AND CO-FOUNDER:: An experience in trading for over 12 years. Worked with Genesis securities, a broker/dealer and clearing firm that provided direct market access and co-location services.

Highly experienced in entrepreneurship, trading platforms, market data, operations and sales.

SERGII GULKO

TO AND CO-FOUNDER:: Owner of Axon software. A company that spends years developing high frequency algorithmic models for hedge funds and broker/dealers in the US equity and forex markets.

Experienced in FIX and other proprietary protocols, market data handlers, development and control of advanced hardware infrastructure systems specializing in low latency and network security.

JON GIACCOBBE:

COO AND CO-FOUNDER:: JON has 6 years in finance. He worked with Goldman Sachs and JP Morgan-equity derivatives, structured products, market liquidity, senior Bank debt, executed institutional client orders.

OTHERS Are:

OLEKSANDR LUTSKEVCH

ADVISOR:: he is a co-founder and CEO at CEX.IO LTD. He is a pioneer in the Bitcoin industry and one of the investors of cloud mining.

LEX SOKOLIN

ADVISOR:: Lex is a futurist and entrepreneur on the Next generation of financial services. Director at Autonomous Research, a global research firm for the financial sector.

ADDISON HUEGEL

ADVISOR: He is the managing partner and media director at elevator communications, LLC.

OTHERS ARE

STEVEN M. WASSERMAN: ADVISOR

GARY ROSS: ADVISOR

JUSTIN WU: ADVISOR.

MUSHEGH TOVMASAYAN: ADVISOR.

RAN NEU-NER: ADVISOR.

TOM OSMAN: PRODUCT GROWTH CONSULTANT & MARKETER.

SERGEY GRISHKIN: DEVELOPER

IRYNA LEBEDEVA: BUSINESS ANALYST

ALEKSEY PEKAR: DEVELOPER

SERGEY POGORELOVSKY: DEVELOPER

ALEXANDER LEVAKOV: DEVELOPER

NIKITA TROPIN: DEVELOPER

USE OF FUNDS

Funds raise during sales will be used for various activities Like Balancing sheet for SPA, Sales and Marketing, Tech acquisition, Platform development and operations.

70% of the funds will be used for balancing sheet for SPA Structure; funds will be allocated across inventory accounts in a spectrum of crypto exchanges. 5% will be used for sales and marketing the project. This is necessary to further the goals of the project.

5% will be used to acquire more ideas and current technologies on how to manage the platform.

15% will be used for developing the platform and operations. Another 5% will be used for legal and compliance issues.

KINDLY NOTE: THE PUBLIC PRESALES HAS CLOSED.

FOR More information about XTRD

VISIT: https://xtrd.io/

Linkedin: https://www.linkedin.com/company/xtradeio

MEDIUM: https://medium.com/@community.xtrd

BITCOINTALK LINK: https://bitcointalk.org/index.php?topic=4477503

BOUNTY LINK: https://bitcointalk.org/index.php?topic=4477525

WHITEPAPER: https://xtrd.io/xtrd_whitepaper.pdf

TELEGRAM: https://t.me/xtradecommunity

MY BITCOINTALK PROFILE:https://bitcointalk.org/index.php?action=profile;u=1294292

THANKS

Congratulations @michaelangello! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

Congratulations @michaelangello! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

Congratulations @michaelangello! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @michaelangello! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @michaelangello! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard and the Veterans on Steemit - The First Community Badge.

Congratulations @michaelangello! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP