Altcoins: what do they have to offer?

When Bitcoin came out, the idea of cryptocurrencies was unknown. Its process to gain significant public recognition was not easy, it took years and concentrated efforts from the community. Later, the crowd arrived driven by the network effect, with the opportunity to invest and get “easy” money.

Early adopters became involved by the unique features Bitcoin had: wanting to stay anonymous, feeling captivated by the idea of a decentralized currency, interested in the opportunity of transferring funds at low costs or, simply feeling cool using a currency backed by complex cryptography and cutting-edge hardware.

But as Bitcoin got more popular, problems with its network started to pop out. The Blockchain frequently cannot handle the number of transactions it receives, causing the raise of fees and confirmation times. The Blockchain has also proved to be limited in other aspects, where alternative coins have demonstrated to have something to offer.

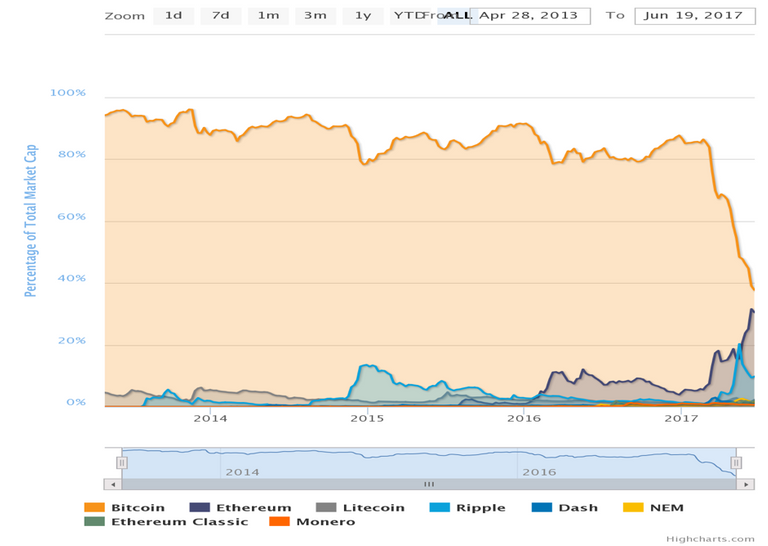

As 2017 passes, Bitcoin loses more and more ground in the battle to control the market of cryptocurrencies. Four altcoins are particularly defying its traditional dominance: Ethereum, Ripple, Litecoin and Ethereum Classic.

Bitcoin’s market capitalisation decreasing every day.

What are altcoins and what are their strong points?

Altcoin was a term coined to call any cryptocurrency that is not Bitcoin, regardless of its origin or particular features. More than 700 altcoins exist at the moment, and new ones are thrown into the market every other day.

While some of such coins are completely worthless and just lazy clones of Bitcoin or any other digital currency already in existence, a couple of them do actually provide added value and are here to stay.

Ethereum

Ethereum came out on July 2015, thought to improve Bitcoin by providing a scripting language that works directly on the blockchain and makes it easier to develop applications. The public reception was extremely positive, gathering millions of dollars during its crowdfunding stage.

When the currency was still in its childhood, a hack to one of its iconic projects put at risk about 3.6 million ETHER and compromised the future of the whole Ethereum network. But the situation was carefully solved and the coin came back on track in no time.

After its security issues were fixed, the only thing left to be seen were its groundbreaking features: the Ethereum Virtual Machine (EVM), which can execute code of any algorithmic complexity; and, smart contracts, which allow arrangements without third-party mediators, automation of many business processes and the tokenization of virtually any asset.

Ethereum is now set to take the lead in market capitalization, as the gap between it and Bitcoin shrinks. The platform is relatively new and there are plenty of services still to be built on top of it. Big players like Microsoft, Santander and J.P. Morgan (members of the Enterprise Ethereum Alliance – EEA) have endorsed this technology, president Vladimir Putin met with Vitalik Buterin (Ethereum’s creator) in what many considered an act of public approval by Russia, South Korea is increasingly interested and flooding the ETH market with KRW and, even the United Nations are testing with Ethereum to send humanitarian aid to refugees.

Ripple

The banking sector moves billions of dollars and Ripple Labs., the company behind the Ripple protocol and the token of the same name, knew it. Committed to solve key problems of the industry, they developed a solution to address slow transactions, high costs and, problems with access and traceability.

Ripple recently catched up VISA in transaction throughput, fees are as low as 0.00001 XRP (1 XRP ~= 0.28 USD), Ripple Labs. takes care of liquidity by periodically injecting tokens to the network and traceability comes embedded with any blockchain solution.

Ripple estimates it could save about 60% in settlements to banks. And banks already believe in and support Ripple, which has more than 75 customers all over the world and works with 15 of the top 50 largest banks.

Litecoin

Litecoin came out during the early years of Bitcoin and was initially promoted as the silver to Bitcoin’s gold. It features 4x faster confirmation times (with 2.5 vs. 10 minutes on average per block) and coin supply (84 vs 21 million in total) and a memory-hard mining algorithm which discourages centralization.

This altcoin was traditionally second in market capitalization until Ripple took off, perhaps never reached a representative share that could challenge the Bitcoin supremacy. But the situation suddenly changed this year, when the adoption of segregated witness (SegWit) and the resignation of Charlie Lee from Coinbase to dedicate full-time to its creation (LTC), brought life and attention to Litecoin.

Segregated Witness is a solution proposed to fight the network delays that currencies like Bitcoin are facing, which consists in moving transaction signatures to the end of the block in order to allow the allocation of more transactions. BTC is planning to adopt SegWit in the near future, but no date has been given yet, while Litecoin just proved that success smiles at those that do not fear change.

Ethereum Classic

Born when Ethereum was forked after the DAO hack, this currency is backed by those who preferred to stay loyal to their principles and respect the “code is law” maxim.

Ethereum Classic (ETC) shares many of the elements that have given Ethereum (ETH) great success. Besides being a personal favourite of hard-line crypto-enthusiasts, it has also received public support being listed on Bloomberg terminals and used to control ticket hoarding.

If true anonymity is important to you, some interesting altcoins to watch are Monero, ZCash and Dash. They focus on untraceable transactions which respect user’s right to privacy.

Other coins exist to address more specific issues including GameCredits for gaming, Waves for crowdfunding and NEM (XEM) to promote equality. The altcoin scene is rich and crowded, go ahead and explore it by yourself!

Let the race begin to supremacy, pick your coin!