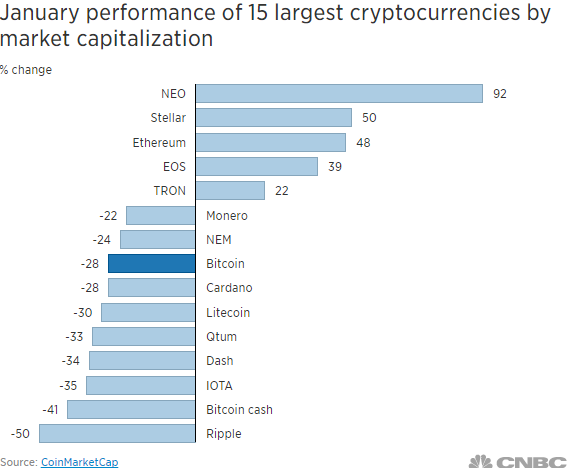

Bitcoin tumbled 28 percent in January amid a widespread sell-off that saw just a third of the 15 largest cryptocurrencies by market capitalization rise for the month, according to CoinMarketCap data.

In contrast, ethereum, neo and stellar jumped last month.

"Altcoins are going to become more dominant," says CNBC's Jon Najarian, co-founder Investitute.com. He expects many more cryptofunds will launch and the total market capitalization of cryptocurrencies will quadruple to $2 trillion this year.

After bitcoin's struggles last month, several analysts see other digital coins gaining ground in a cryptocurrency world that is trying to mature.

Bitcoin tumbled 28 percent in January amid a widespread sell-off that saw just a third of the 15 largest cryptocurrencies by market capitalization rise for the month, according to CoinMarketCap data.

"Altcoins are going to become more dominant," said CNBC's Jon Najarian, co-founder Investitute.com. He noted that bitcoin transactions are getting more expensive, and the cryptocurrency is turning into more of an investment asset than a unit of exchange.

"I love bitcoin. I trade it. I own some right now, but I own far more of ethereum, neo and some of the others," Najarian said. He expects the total market capitalization of cryptocurrencies will quadruple to $2 trillion this year.

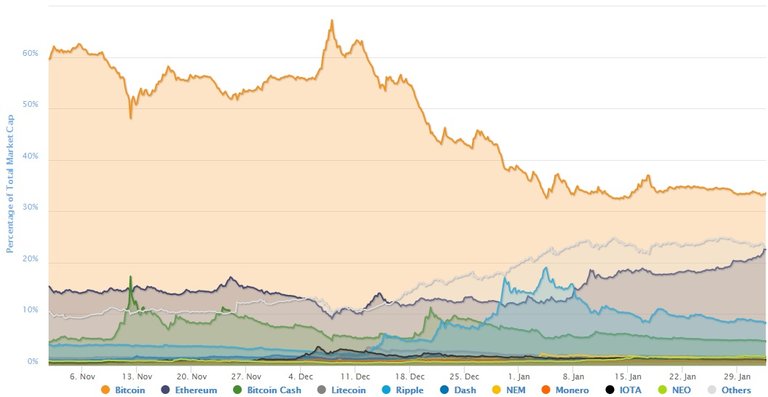

The top three performing cryptocurrencies in January, among the 15 largest, were neo, stellar and ethereum, according to CoinMarketCap. Bitcoin's share fell from about 38 percent to 33 percent of the market capitalization of all cryptocurrencies, the website's data showed.

"I think ethereum will overtake bitcoin in terms of market size," said Nick Kirk, quantitative developer and data scientist at Cypher Capital, a cyrptocurrency trading firm. He expects more projects based on ethereum's platform will deliver throughout the year, such as coin for online casinos called FunFair, and Dent, a coin for buying mobile data.

But the majority of lesser-known cryptocurrencies fell in January. Ripple, which stole the spotlight from bitcoin in 2017 with a gain of 35,500 percent, lost half its value in January. Litecoin, which had soared in December, fell 30 percent last month. Monero, which focuses on user privacy, dropped 22 percent.

More from Global Investing Hot Spots:

Next stop in the cryptocurrency craze: A government-backed coin

A robotics ETF has taken in $650 million in cash this month

What the US can learn from Sweden about how to launch a bitcoin fund

"The sad truth with the cryptocurrency market today is that market capitalizations and price fluctuations are not necessarily correlated with actual user adoption traction and on-the-ground reality," said William Mougayar, blockchain investor and author of "The Business Blockchain." "Many other alternative currencies will have their moment in the limelight, but their lasting value will remain to be proven."

However, based on measures of ecosystem size, and the number of developers and adopters of real projects, Mougayar said bitcoin and ethereum should remain dominant and ripple has a "good chance" to be a leader in enterprise use cases.

The overall market capitalization of cryptocurrencies dropped 40 percent, to about $500 billion at the end of January, from a record hit earlier in the month of $832 billion.

"The major trend is [it] just appears that the big bubble is cooling down or popping," said Erik Voorhees, CEO of digital asset exchange ShapeShift. It's a "speculative cycle cool off."

He told CNBC on Wednesday that the recent sell-off could send bitcoin into a $4,000 to $9,000 range.

Change in market share of bitcoin and other cryptocurrencies over the last three months

The cryptocurrency briefly fell below $9,000 Thursday for the first time since late November, following reports that raised concerns about increased regulation in India and potential price manipulation at a major exchange. On Friday, it dropped below $8,000 for the first time since Nov. 24.

Worries about a crackdown in South Korea and tighter restrictions in China weighed on bitcoin's price in January. The U.S. Securities and Exchange Commission also stepped up its efforts to halt speculation in digital currencies, particularly token sales known as initial coin offerings, or ICOs.

"I think regulation is a recognition that something is both valuable and potentially dangerous," Najarian said. "I expect that ICOs will be the initial focus and eventually exchanges will be more and more of the focus."

As a result, Najarian expects half of the cryptocurrency exchanges in the world to close this year. But he expects more so-called cryptofunds to grow.

Financial research firm Autonomous Next also predicts the number of cryptofunds will jump to 500 this year, nearly triple 2017's year-end figure of 175.

Anecdotally, interest is growing. Najarian said his lawyer, who helps clients set up hedge funds and investment vehicles similar to private equity funds, was getting one call a month about setting up a cryptofund. In the last few months, the number of calls jumped to 50 a month, and since December the lawyer has set up three such funds a week, Najarian said.

"What we're going to see is an explosion," he said. "As they come through, they're going to change volatility and change markets because that's an awful lot of capital that's going to be charging into markets."

nice content

very informative

Informative Artical Thanks Admin

hmmm.. great post i seen today, thanks for sharing so much valuable info with all of us !

Informative article