UVD: A Potential EOS Community Project

U nified V alue D enomination is …

A tool aiming to solve many issues associated to high volatility currencies (e.g. cryptocurrencies, crypto assets, tokens, …)

A reference (standard) to help navigate in a blockchain economy composed of potentially hundreds of thousands different currencies/assets with different attributes and value

A new paradigm to better express intent in any kind of transaction (business, personal, IoT, donations, trading, tips, quotes, inventory valuation, …)

not a currency

not a token

not an asset

not a blockchain

not pegged to something (gold, silver, USD$, commodities, …)

not subject to inflation or deflation

not controlled by any entity

nor centralized

So, what is UVD?

Before defining UVD properties and attributes, let's have a look at the problems we are trying to solve

Traditionally, reference (FIAT) currencies were relatively stable, more so when used within their respective countries (note 1) .

In the new (blockchain) economy, a token/currency/asset has no frontier from inception and is therefore exposed to worldwide subjective valuation and fluctuations

It is common to experience relative value variations of more than 10% between a pair of cryptocurrencies or FIAT currencies in a few hours span

Transaction confirmation time may vary significantly from one currency to the other (e.g. Bitcoin few hours vs Bitshares few seconds)

In the old economy, we had to deal with less than 300 circulating currencies (note 2). In the new economy, we will have to manage possibly hundreds of thousands (or more) different tokens / currencies / assets.

Moreover, during the transition from a FIAT based to a blockchain based economy, we will have to also bridge FIAT with Blockchain (e.g. FIAT-Blockchain pairs), adding to the complexity of trading and exchanging.

Invoicing a product that will be delivered over a period of a few weeks represents a challenge in itself when you take in account the volatility of the currencies used to transact.

The price volatility of cryptocurrencies is probably the biggest barrier to widespread adoption that blockchains face today

Establishing selling prices, calculating costs, comparing historical business data, analyzing purchase power parity, providing quotes, paying employees, assessing market trends, writing business contracts, appraising real estate, interpreting legal market value, dealing with real and nominal values, doing cross-sectional comparisons, …

These challenges are exacerbated by the sheer expansion of number of tokens/currencies/assets and their specific properties, making it difficult to express clear intent when transacting.

ATTEMPTS TO SOLVE THESE PROBLEMS

FIAT pegged currencies (e.g. Tether, BitUSD, BitCNY, …) are mimicking debt-based currencies mathematically to artificially implement central banks control over inflation and currencies stability.

The problem is that any form of debt-based currency is mathematically destined to eventually go to zero (note 3), and this trend will certainly be accelerated by blockchain adoption. Not a long-term solution.

Commodity pegged currencies (BitGold, BitSilver, …) are also subject to major price variations over time under market pressures.

Algorithmic price-stable cryptocurrencies like Basecoin (notes 4 and 5) try to solve the puzzle with mathematics, but are also exposed to the subjective market and are subject to eventually spiral down to zero.

WHAT ABOUT THE HERO TOKEN? (note 6)

The HERO token (re: Bitshares DEX) aims to provide a predictable (mathematical) price to the space, trying to solve the previously discussed problems. However, the collateralized nature of this token and the very fact that it is a currency are playing against the fundamental objective. Open market exposure and liquidity issues bring back the subjective valuation and we are more or less getting back to volatility challenges, as with every other token or currency.

UNSOLVABLE?

Under the Subjective Theory of Value (note 7), all the previously discussed challenges could in fact be summarized by the two following statements:

Value and all concepts revolving around value (price, open market value, production costs, labor costs, nominal value, real value, …) are subjective.

Trying to implement an objective, absolute or universal measure of value of any sort is doomed to fail.

UVD: A SUBJECTIVE TOOL

Based on these previous assumptions, we can already conclude that the UVD (Unified Value Denomination) concept will represent a subjective practical tool to solve an equally subjective problem.

This is an important statement.

Nothing absolute will be achieved here, but we may end-up with a new subjective tool able to solve most of the new economy challenges previously enumerated.

Quantum mechanics shows how subjective our experience of reality is. Maybe there is some wisdom in trying to unify value measurement subjectively, whereas we sometimes use Newtonian mechanics instead of Relativity for practical purposes.

MEASUREMENT VARIATIONS

We previously concluded that for a specific subjective value, any existing measurement may vary in such a way that makes it difficult to extract the original value intent from a transaction occurring over time (e.g. Bob send a 1 BTC quote to Alice for a product that will be manufactured next month, but who knows what the BTC value will at the time of production).

As we see in this illustration, the outer layer stability (value measurement) is correlated to currency and token embedded layers. In other words, when exposed to the open market, any value measurement will experience variations from one or more layers, no matter how hard we try to stabilize it.

STABILIZE MEASUREMENT VARIATIONS

By removing the currency and token layers, we are left with a subjective unified way to establish (measure) value (intent), thus eliminating market and liquidity influences.

Thus, UVD emerges as a purely subjective stabilized unit of measurement, resistant to market pressures and liquidity issues.

THE FUTURE

As we saw previously, any value unit of measure is subjective.

However, we know by facts that a human brain trained by trial-and-error methodology will eventually internalize a reasonably stable subjective measure and be able to use it as a tool to express intent in transactions or decisions.

In a FIAT (debt-based) economy, a child will internalize the value of its national currency (e.g. USD$, CAN$, Euro, …) in the same way he or she does for any other measurement systems, like metric system, imperial system, … by trial and error and practical use in concrete situations.

Assumption: In a worldwide economy where the population majority has access to blockchain networks and dapps, we postulate that country and frontier notions will no longer create disparity among humans in terms of value measurement internalization. Therefore, any human exposed for a long time to the same value unit of measure will be able to transact on a unified base with others (e.g. everybody would develop skills to transact in UVD with anyone).

In this context (worldwide decentralized economy), UVD eventually emerges organically as a reference system of value and becomes the de facto standard against which every token/currency/asset can be relativized.

UVD IS OPTIONAL

The best way to understand the UVD concept is to imagine a session on the popular coinmarketcap website. You can choose in a dropdown to view prices in many popular currencies:

Now, imagine that this dropdown also includes UVD as an option. You would analyze the market from an UVD perspective in terms of value. At the time of writing this paper, FIAT currencies are relatively stable in time, so the UVD adoption as a system of reference would be marginal. As FIAT decline and become more volatile (downward), the UVD perspective will gain traction via network effect.

The very notion of a smart contract occurring over time requires the notion of a unified value system. One only need to figure the impact of volatility on a smart contract exchanging value over one month, expressed in currencies subject to market pressures, political decisions, and liquidity issues, to realize the urge to implement a unified system of valuation.

HOW DO WE DO THAT?

As with any paradigm shift, we must implement a strategy taking in account the necessary transition over time from the old FIAT based economy to the disruptive blockchain economy.

Again, UVD is a subjective implementation relying on the peculiar human brain talent to internalize valuation systems.

UVD ATTRIBUTES

For the sake of discussing UVD possible implementation scenarios, we must initialize UVD with an absolute value. It can be a snapshot of anything (absolute, invariant) at a specific moment in time. Once assigned, UVD can (and must) not be subject to modification in any way. It is a subjective value guaranteed to be invariable in function of time (a mandatory requirement to achieve human internalization over trial-and-error, education, and persistence of use).

To take in account human brain limitations, I propose to specify a value range using 2 decimals. My brain will easily manage dealing a candy for 0.01 UVD, a bike for 100 UVD and a house for 400,000 UVD.

In contrast, as experienced with a system like BTC, assuming the currency has stabilize, a candy cost must be expressed at 8 decimals, requiring me to switch from one internalization system (BTC) to another (Satoshis), depending on the type of transaction I am dealing with. This is a lot more difficult (note 8).

We have plenty of examples of successful currencies operating with 2 decimals (USD$, CAN$, EURO, English Pound, …) and a lot of use case to demonstrate the pertinence of a 2-decimal system of value (rounding, pricing, quoting, exchanging, invoicing, accounting, …)

Also, as we must bridge blockchain with traditional (FIAT) economy for at least a generation, we must find an initial value that can be easily converted back in time with minimal effort, based on simple decentralized feeds.

UVD INITIALIZATION

So, one UVD could be set to any absolute value, as long as it can be internalized by humans in a 2-decimal range. Remember, UVD is not pegged to any fluctuating currency or asset, it is only initialized with a known measure of value easily internalized in a 2-decimal range). We also aim to be able to trivially convert any currency/token/asset back to UVD with minimal effort.

It could be:

--The price of a specific commodity basket in any currency (e.g. 0.1 bushel of wheat +0.5 gallon of jet fuel) as of January 1st, 2018

--A percentage of a specific FIAT currency at a specific date (e.g. 25% of 1.00 $USD as of august 15, 1971).

--The price of a specific commodity (e.g. 0.001 oz of platinum as of January 1st, 2018)

To help discuss implementation scenarios, let's use the third example (0.25 $USD as of august 15, 1971). See notes 9, 10 & 11.

Assuming that 1.00 $USD as of August 15, 1971 is worth 6.00$ today, our UVD would be initialized at roughly $1,50 USD in today's value. The intent here is to give value significance to the last digit. The US$ has lost so much value that $0.01 coins (or the denomination last decimal) of an actual USD$ is not relevant anymore. Same thing in Canada where the 0.01$ CAN coins are removed from circulation (e.g. you can't buy a candy for 0.01$ anymore …).

It is very important to realize that UVD is not pegged to another system, but initialized to a specific value, keeping in mind ease of implementation.

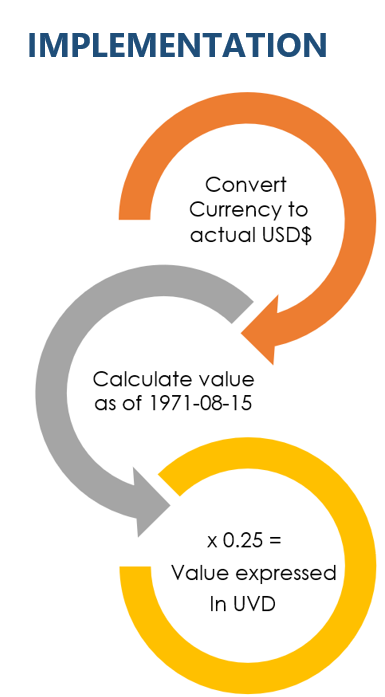

Step 1 – Convert a currency (FIAT or crypto) to its equivalent in USD$ as of today, using oracle feeds based on order book history from decentralized exchanges like Bitshares, AriseBank, or others to come on EOS, …

Step 2 – Calculate value as of 1971-08-15.

A database must be maintained (via a smart contract or distinct blockchain) of USD$ inflation rate for a determined tick (e.g. each 5 seconds), beginning at the mainnet date (to be set). For data prior to this date, the calculation will be completed mathematically (re: note 12 as an example).

Step 3 – As discussed earlier, the final value is obtained by multiplying the precedent result by 0.25.

Step 4 - A verification feed could be implemented based to validate the above feeds statistically, warning the user to try again later in case of significant discrepancy (e.g. waiting for more confirmations from exchanges to avoid marginal spikes or corrupted data).

If the USD$ eventually goes down to zero or is replaced by a reasonably stable other currency, a replacement feed would have to be determined and bridged to maintain the ability to track value in terms of $USD prior to the bridge. To insure long term longevity, Step 2 could track history of other commodities or currencies (e.g. 5 other) to insure continuity in the advent of $USD disappearance.

POSSIBILITY OF A DISTINCT PROJECT

The potential usage of a unified value denomination is broad:

- --Wallets

- --Exchanges

- --Smart contracts exchanging value over time

- --Accounting/management

- --Gaming, etc.

For example, if UVD is developed as a smart contract on EOS, it will be available for other dapps, directly on the EOS blockchain or via inter-blockchain communications.

Note 1

https://www.indexmundi.com/world/inflation_rate_(consumer_prices).html

Comment: inflation in developed countries is 0% to 4% typically, in developing countries, 4% to 10% typically; national inflation rates vary widely in individual cases; inflation rates have declined for most countries for the last several years, held in check by increasing international competition from several low wage countries and by soft demand due to the world financial crisis.

Note 2

https://en.wikipedia.org/wiki/List_of_circulating_currencies

Note 3

https://www.evolvingwealth.org/value-fiat-money-goes-to-zero/

Note 4

Note 5

https://medium.com/tokenmonk/basecoin-money-out-of-thin-air-d895fba562a2

Note 6

http://docs.hero.global/en/master/

Note 7

https://en.wikipedia.org/wiki/Subjective_theory_of_value

Note 8

https://www.coindesk.com/no-dont-buy-whole-bitcoin/

Note 9

https://www.federalreservehistory.org/essays/gold_convertibility_ends

Note 10

https://www.seeitmarket.com/august-15-1971-changed-course-u-s-economic-history-15823/

Note 11

https://www.dollartimes.com/inflation/inflation.php?amount=1&year=1971

Note 12

https://www.dollartimes.com/inflation/inflation.php?amount=1&year=1971

Great article! Very interesting project. I think UVD is the next step with fiat going down. We need a global currency and having it on EOS would great.

The fact that UVD is not a currency makes it a perfect global tool to express value. It is not an easy concept to grasp because we are so used to express value with currencies.

Glad you're thinking about currencies, but I think you're fundamentally misunderstanding what a store of value is. If you just "pick a number" that signifies what the medium represents, then anyone can just move in an out of that medium at an infinte supply. A perfectly stable store of value comes about as liquidity goes to infinity. This is impossible, but improves when one opens up a completely free market economy in both space AND time (ie exchanges and futures/options contracts)... and most importantly has a significant supply/demand that tries to determine the price of the actual "currency" or "store of value." The U.S. dollar is the dominant global currency because it has the highest liquidity (is accepted in a very high percentage of other countries and dealt with when transacting with Earth's most precious commodity... oil). If a number is just made out of thin air by the community, then there is no market created to price the store of value, and by definition, will never be used.

Thanks for taking the time to study and comment this community project. UVD is not a store of value. It is a tool to establish value without using a currency. Once the value of a transaction is established in UVD (e.g. defining a smart contract between two parties), it can be converted on the fly in any currency at any time by the contract (e.g. when a product is delivered), without being influenced by market volatility. To thrive in a blockchain economy, one has to undo its FIAT beliefs (debt-based) and start to imagine a new value-based economy. Humans systematically use "out of thin air" systems of measurement (e.g. perceived temperature vs reading by a thermometer) to discuss and evaluate subjective perceptions. Value is a subjective measure, even if you are used to transact with currencies or tokens (see note 7). The trick here is to detach the value measurement from the token/currency objective attributes to create a purely subjective and unified tool. I will try to sponsor a proof of concept on EOS testnet and keep you posted. By using the smart contract, it will be easier to grasp UVD as a tool (not a currency).

Just one more note. You mentioned that the bitShares assets (bitUSD) mathematically go to zero, assuming blockchain adoption. The opposite is actually true. BitShares stable assets are backed by BTS, which gives credence bitUSD market as the price of BTS increases. Theoretically, as BTS goes up, the tighter the bitUSD peg.

I truly believe that EOS can bring about a relatively stable currency through liquidity across decentralized exchanges, but those exchanges will need to be able to handle futures contracts to eliminate black swan events.

bitUSD is pegged to USD, a debt-based currency. When USD goes to zero value (see note 3), bitUSD or any USD pegged token will follow by definition, even if it is backed by collaterized currencies that have value (it will take less and less bitshares to support a near zero valued USD). Moreover, future contracts are debt-based economical tools that will easily be replaced by smart contracts in a value-based (blockchain) economy.

Congratulations @whyknot! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!