Past month was one of the most memorable and important month for EOS Project. The month of June was memorable not only by achievements like launch of the most awaited "launch of EOS mainnet" as well as end of the ICO Phase , but also filled with controversy where EOS Block Producers was asked to freeze 27 accounts doubting these accounts were related to theft and phishing.

Last week Huobi Talk brought together a wonderful discussion between Block Producers and Block Producer Candidates of EOS to discuss the challenges that EOS has faced since its mainnet launch. EOS is one among the top 10 coins in volume traded on Huobi Pro with EOS/ USDT, EOS/BTC, EOS/ETH and EOS/HT trading pairs. If you want to have a trading account , you can sign up here to be a part of this wonderful project

This forum discussed three main hot topics in EOS community, namely

- The role and actions of EOS Core Arbitration Forum (ECAF)

- RAM Trading and its after effects development of ecosystem

- Surprising vote by Block.one which has gotten the community worried.

The talk Moderator was Denny Wu - Operations Manager (Huobi Mining Pool ) . The talk was divided into two parts with Part 1 disusing State of Governance . The participants were David Packham - Head of Strategy and Community ( EOS42 ), Kevin Rose - Co-Founder and Head of Community (EOS New York )and Dongwon Shin - CEO of EOSeoul China . If you want to watch or want have a snapshot of the first session you can read it here

The second part was dealing with the State of Technology which was participated by Luke Stokes from eosDAC Launch Team, - DaFeng Guo of EOS Asia , Ross Dold, Co-Founder EOSphere.

A Bit background

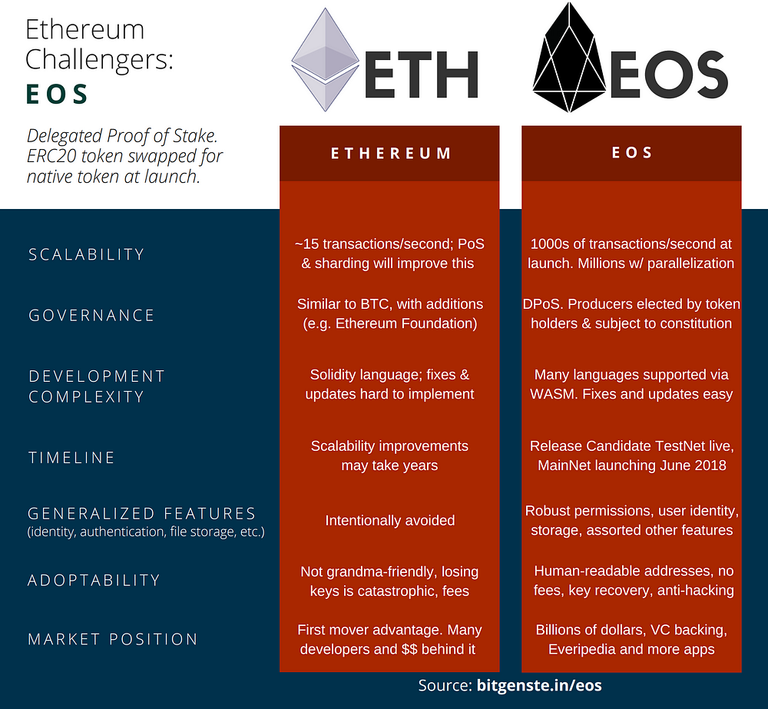

EOS project is we can say fairly young in the blockchain space that aims to radically improve on what is on the market today by bringing together positive elements of both the Bitcoin and Ethereum platforms .The decentralized operating system will, much like Ethereum, allow developers to build decentralized applications through smart contracts.

The major focus EOS platform is to eventually allow for industrial-scale applications, through elimination of transaction fees and an ability to process tens of thousands of transactions per second in contrast, to Ethereum that can currently handle around 15 transactions per second and Bitcoin with 7 transactions a second, only. This differentiation is critical in terms of wider general adoption in industrial terms, as corporate will prefer a coin that could be transferred instantly without any hold up or delay in the network.

PoW Vs PoS Vs DPoS

EOS uses Delegated Proof-of-Stake (DPoS) to validate its transactions,. DPoS is a method invented by Dan Larimer ( creator of the Bitshares, Steem, and the EOS blockchains ) , resolves many of the problems seen in POW and POS systems. Before we get into DPoS lets first try to understand about POS and POW

Proof of Work (POW)

Most of the first generation cryptocurrencies like Bitcoin, Ethereum, etc in the market today use the proof-of-work model. In Proof of Work (PoW) mechanism, Miners work to solve a cryptographic puzzle repetitively consisting of the mathematical function (hash). For every problem these mining computers solve, they are rewarded with cryptocurrency on which they are working. That's will be their reward for the work they have done to verify all transactions and adding it to the blockchain .

In the POW , to commit a fraud on the blockchain , the hacker will require to have over half of the total hashrate of the entire network, which is known as the 51% attack. Since this process requires an immense amount of energy and computational usage, it was thought to be extremely hard for a malicious party to attack and make fraudulent transactions on the network. In the initial days it was consider to be a great solution but in the coming years this proved to be wrong with repeated instance where 51% attack happened (Ex Verge). Also PoW turned out to be non friendly to nature as well due to the high usage of Electricity.

Proof-of-Stake (PoS)

As an alternative to POW, Proof-of-Stake (PoS) was conceptualized in 2012 by Sunny King and Scott Nadal. In Proof of Stake (PoS) concept, rather than using hashpower, the miner will be required to hold a large amount of the cryptocurrency in oder to gain so called more hashpower. In simple terms the more currency he stake the more will be hash power. Let's take an example of Nxt (NXT) coin which deploys PoS. If the miner owns 3% of all of the NXT in existence his probability of mining a proof-of-stake block is 3%.

In order to attack a PoS network , the attacker would need to obtain 51% of the same cryptocurrency first. This itself act as a deterrent to an attacker to attack a coin where he has 51% stake. Its not only costly to accumulate 51% of the given currency but also in doing so the attacker will be risking his money as well . Since crypto is know to be a volatile asset, if the value of the cryptocurrency falls, this means that the value of attacker holdings would also fall. So an attack will be an unlikely event in the PoS model

Delegated Proof-of-Stake (DPoS)

We can safely assume that Decentralization is one of the founding value behind Blockchain Concept. If in any way an entity owns 51% of "Hashpower / Coin" in POW and POS concept , the entire concept of Decentralization gets defeated. In order to avoid this kind of "too much power in a single hand" DPoS was proposed.

DPoS is in a way almost similar to PoS, but has different and has more "democratic" features that EOS community feels it makes more efficient and fair. In DPoS, token holders are able to cast votes to elect block producers or we can say the miners. Votes are weighted by the voter’s stake, and the Block producer candidates that receive the most votes are those who produce/mine blocks. These Block producers validate transactions and form consensus, and are paid for their efforts through the system. This avoids a pitfall of POS, which is that, just like in POW, consolidation will eventually occur. In a way the process is more democratic and makes all the token holders the part of the ecosystem.

One of the major criticism of the DPoS was about Vote lobbing and Fairness of the Block Producer which was discussed in the talk . But as per the participants the beauty of the DPoS concept is that Block producers can be voted in or out at any time . In a way we can say that by adapting the DPOS, EOS will have no transaction fees, waste no resources (energy, currency, and otherwise), and will be built around representative democracy.

EOS RAM Trading

One of the major discussion point in the "EOS: The State of Current Technology" talk was frenzy around RAM trading and its consequence in the EOS ecosystem.

Before going into more details about RAM trading, lets first understand about role of RAM in EOS Ecosystem and why it is so important

On the EOS network, RAM is mostly used by DApps (decentralized applications)developers to store the data which will be used in the launching and production of various dApps. Apart from that RAM is also needed to create new accounts. Users have to purchase a minimum of four kilobytes to open an account, essentially staking out a portion of the network's processing power for their own projects . In such cases, users will be required to purchase the RAM from the traders who own them, which in turn started to push the demand. Once people started buying more RAM the price started to rise up and all goes into a spiral of rate hike.

The RAM wars

All the frenzy surrounding RAM trading started with a Redditor Sadisticcrypto, started a discussion saying:

“Someone turned 10k EOS into 80k EOS just by RAM Trading. where can i get involved.”

An Another Redditor commented

" I suddenly realised that RAM is the true EOS token, at least for the next couple of years. If RAM supply is to grow at max 20% per annum as Dan [Larimer] suggested, then RAM supply is extremely limited for the foreseeable future. Remember, what the EOS token is for? It's not a cryptocurrency per se, but a token which you buy so as to CLAIM resources on the EOS network to run Dapps. However, the EOS token itself is not the resource. RAM is the resource."

In EOS ecosystem RAM is rationed using the Bancor algorithm. That means EOS uses price itself to ration the supply of RAM. The more people who buy RAM, the higher the price will go until there is no more RAM to buy. If people go and sell their RAM, the Bancor algorithm pushes the price down.The Bancor algorithm which acts as market maker, it raises the prices up when people buy and If someone sells, it lowers the price for the next seller.

In the discussion one of the participant discussed that due to a small flaw in the Bancor Algorithm this volatility was introduced

" Due to an unintentional configuration of the Bancor Relay weights on the EOS blockchain, this parameter is set at .05% rather than 50%. This introduces some heavy slippage for buying and selling large quantities and causes more volatility than desired."

On June 20th RAM prices stood only at 0.01EOS per Kb. 1st of July it jumped to 0.1 EOS /KB. As on today's rate, the price is at 0.42 EOS/KB. So inorder to open an account the user will have to spend around 1.6 EOS which is roughly around $14 per account. Just think about a DApp with millions of users. This price will not be viable at all and there is high chances that the developeres will start looking for cheaper alternatives which will threatens the success of EOS itself.

Currently instead of being bought for its utility, RAM has become a commodity that is bought and sold for profit, it potentially won't be available as a resource to actually develop DApps. Additionally, if the price starts going up it will make EOS simply too expensive to be used which defeats the purpose of it offering as a better alternative to Ethereum

Proposed Way out

There were detailed discussion in the talk about the various approaches currently in making to resolve the solution.

One of the major and kind to be a practical approach is to introduce a side-chain . Once RAM availability gets to a critical level, a side chain can be formed offering fresh RAM for users and DAdpp developers which will help them to develop DApps without having a large financial impact. Since EOS has the capability to introduce any number of side chains, the participants feel that this can be addressed to .

One more solution came from a community member is the voting of Block producers . Currently, if the EOS Block Producers want to change anything, there is a 2/3 approval vote. If the block producers vote to increase the RAM capacity, scarcity and price will drop. This however has high chance to turn controversial like the previous instance of freezing 27 accounts as the power vested in the block producers again raises concerns about authority and decentralization . There is also ongoing speculation that EOS CEO Dan Larimer was planning to “change its fundamental constitution and replace it with a new one.” A new constitution could also change the rules on RAM, drastically changing the price.

In conclusion we can say that EOS community is keenly watching the current situation unfolding. Currently EOS project is in the growth stage with lot of growth potential .We may see new developments in the coming week as be sure Huobi Talk will the there to update you will latest happenings

If you wish to watch the full episode of the talk, you can watch it here.

If you wish to own some EOS , its currently traded on Huobi Pro. If you want to have a trading account , you can sign up here to be a part of this wonderful project

Remember that speculating on anything is a risk, I am not telling you what to do with your money or giving financial advice.

good article

I briefly heard something about Ram wars concerning EOS, thanks to this article I am now up to date as to what exactly is happening. Great article, very well researched.

Great article! Didn't know about EOS RAM trading, I must look into that.

Hi - This post has been upvoted by an in-development voting bot!

My algorithm is getting optimised to automatically upvote "good" content.

Please also leave a upvote for me, so that my votes will mean more in the future!