EOS has been the winner this summer when it comes to making money off day-trading. In just a few short days, EOS has gone from trading at a low of $0.68 to a high of nearly $7. But, since it was impossible to buy and sell at the extreme points due to the low volume most investors have made a 2x-3x return by holding.

But, more important than that is the beautiful volatility that the currency has making it a big win for day-traders. So far I've pulled in about a 6x return, but, I've been trying to build a more structured methodology to how I trade and I thought I'd share my strategy so far as others may have some insightful feedback.

Remember the statements made here are not financial advice, trading is risky and you should only invest what you are willing to lose.

So, What is important to know?

Before diving on in there are a few things that are important to note:

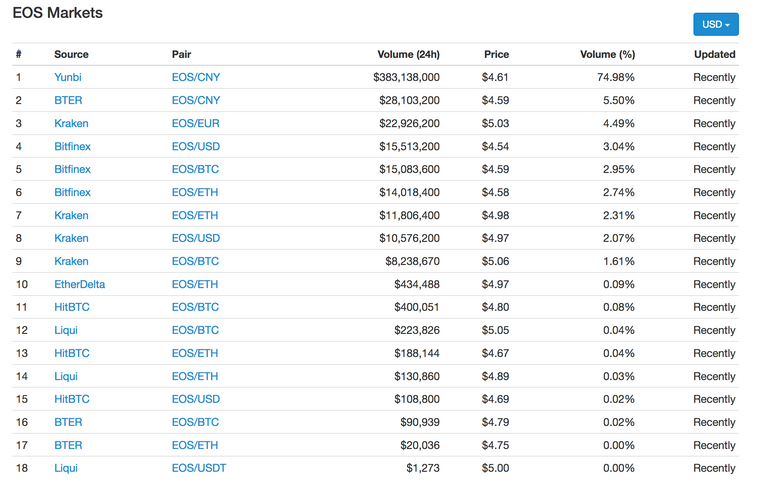

- The market is 80% owned in China.

- EOS has a year long ICO at www.eos.io

- EOS will be issuing 1 billion tokens. So if it reaches the market cap of Ethereum they'd be worth $35~ a piece.

- EOS tokens don't do anything yet and they are a gamble on the future EOS platform.

Now let's get started.

Step 1: Follow the Chinese:

Since the market for EOS is currently controlled 85% in Chinese exchanges they ultimately end up dictating the price.

I usually open up the Yunbi trading exchange pair for EOS/CNY and watch it.

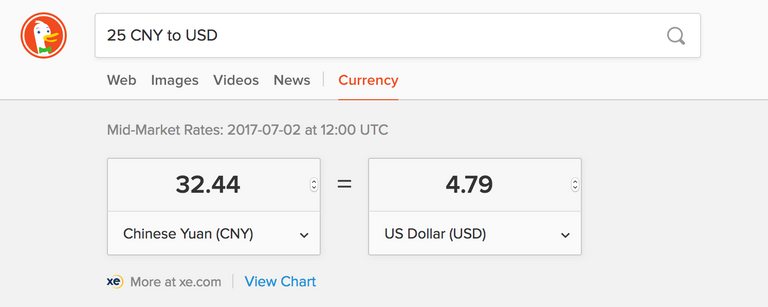

I'll keep the DuckDuckGo search engine currency converter open in another tab to quickly see the comparison between CNY and USD value throughout the day as it changes quite rapidly:

If I'm trading on Bitfinex at $4 per EOS and I see that Yunbi has $4.25 (28.81 CNY) then I can be pretty confident in buying the $4 EOS on Bitfinex as the market will likely follow the Chinese trend.

Step 2. Watch for the Sleeping Dragon.

In most stock markets there are expected spikes in activity levels when trading first opens for the day and then again when it is about to close. Normally you don't see this in cryptocurrency, but EOS is proving to be an exception right now.

Because such a large volume of the currency is held in China the trading slows down a lot between 11AM - 7PM Eastern Standard Time. But, as China starts their day (around 7PM - 9PM EST) you can see huge rallies in the coins value. However, as this kicks into gear the rest of the market over reacts and starts to sell bringing the value back down by about 25% each time.

This has happened at least once a day without fail so far:

I think this is a great opportunity to make some big plays, but they can be painful if you miss the sell out point. I think it's likely better to take a 1% - 3% loss below peak than to hold over priced tokens all day unless I traded on margin.

Step 3. Watch EOS.IO's ICO Price:

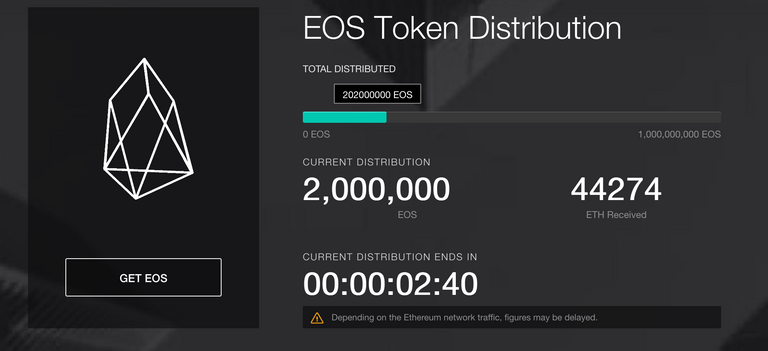

Eos.io is running their ICO for the next year and selling 2M tokens per day using an Ether bidding system. Each day at around 6AM Eastern the sale closes and the 2 million EOS tokens are divided by those who put in ETH.

Yesterday for example the balance closed at 44274 ETH for 2M EOS, which at yesterdays price of $279 per ETH. This means that each person paid $6.17 per EOS yesterday.

You might be asking "Why the hell did they pay that much?" - there is a lot of game theory that goes into a pairing a daily auction versus a free market. Most of the day the EOS ICO fund sits below 3000 Ether and it looks like you are getting a great deal, but as it gets closer to the end of the auction more and more money flows in.

Everyone is trying to time the auction to see if they can get a deal, and the price of EOS on the free market exchanges like Bitfinex changes based on this.

But, the other issue is Whales. If someone bought a large amount of EOS already, then at the end of each day it makes sense for them to over pay for EOS.

- Imagine I bought 100 EOS and I paid $1 each for them. My total balance is $100.

- The next day on auction I paid $3 for 10 EOS ($30)

- This causes the market price of EOS rises to $2.5, which seems like I overpaid.

- But, this means my initial $100 is now worth $250 and my initial $30 is now worth $25.

- So my net profit is $225.

Imagine that some Whales likely have millions of dollars in EOS. It is worth it for them to drive up the ICO price each day to make their current EOS worth more. If a lot of people put in to buy EOS they will drive up the price. If not a lot of people but in then they price will be low and the Whale will get a ton of cheap EOS.

But what does this mean traders? Two things:

- Near the end of the ICO auction each day I'd probably expect the price to rise a bit as people will be comparing the price of market EOS to ICO EOS.

- I also want to watch the ICO carefully as there will be days where Whales are out over leverage and I might be able to get some EOS at $1 even if it is trading at $5. If that happens you can sell your EOS below market price, convert it into Ether and cash in on the ICO.

Step 4: Spreadsheets

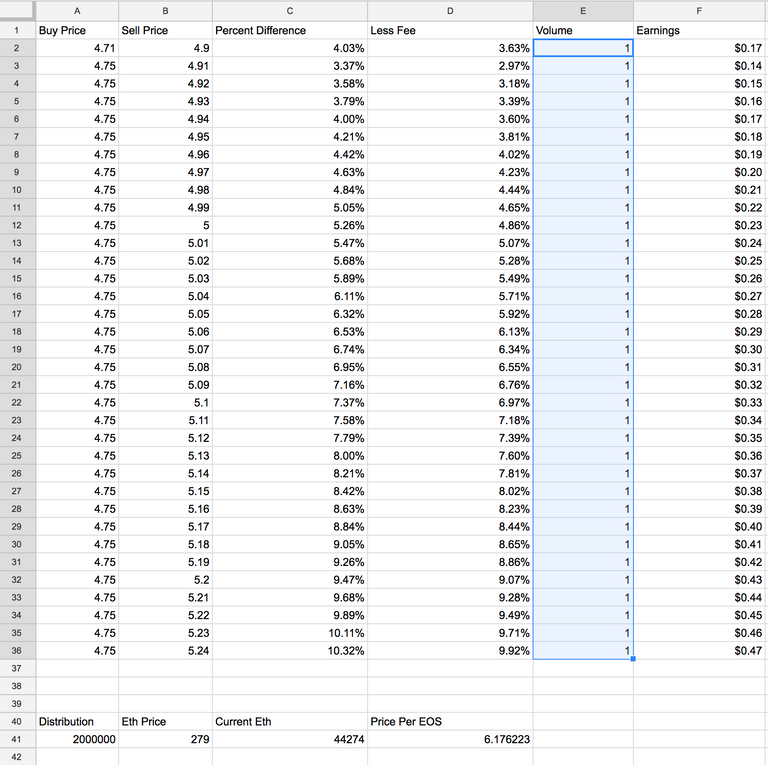

Last but certainly not least is the spreadsheet.

There is a lot to keep track of here and most of my profit has been made in trades that are fractions of a percent different than each other.

I found it really helpful to create a spreadsheet where I can plug-in the buy price and sell price, factor in my fees and see how much profit that trade would make.

I also use it to to quickly convert the daily EOS ICO number throughout the day to see how it's growing. Given that I have to keep track of so many factors this sheet has been a lifesaver. My next step is to plug it in directly to some of the APIs so I can better monitor live trades.

If don't know how to set up a spreadsheet with formulas let me know and I can try and help out.

Bonus: Reversals!

EOS has been nice to trade on smaller exchanges so far as it has some pretty clear reversal indicators.

If you're thinking to yourself "What's a reversal indicator?" simply put it is a trend in the graph that suggests the price may be likely to head the other direction.

For example:

This image suggests to me that it is likely the price is going to see a pretty heavy drop in the next 30 minutes or so. When you see that many full green bars in a row with no red it usually means one or two big buyers have come in and bought up liquidity causing a major price spike. These are often followed by other traders seeing the new price and rushing to sell because it is higher.

These can be amplified by the fact that many novice traders will use "market orders" which buy or sell at the best price available. But, since the market has such little liquidity available it will cause a massive price swing.

Your Turn:

That brings me to you. What are you strategies for trading? Or what do you want to learn more about?

Post in the comments below and share your ideas, ask questions or tell me what my next blog topic should be about!

As always this is not financial, legal or trading advice. I am not encouraging anyone to trade, but if you do please trade responsibly. I am not a financial expert by any means. Note that cryptocurrencies or ICOs may or may not be legal or regulated in your jurisdiction and you should speak with an attorney if you are unsure.

This post is extremely undervalued. Unlike those worthless posts that gets upvoted by whales. You sir deserve the Upvote. Followed you as well.

No doubt this takes hours of work. Thanks for the resteem. Will look forward to OP's next post as well.

I've given up on trading and arbitrage as I do admit that I'm dumber than the market, and see EOS as an attractive investment. I' still hesitant though as to what would be a good price to buy again assuming that the ico price is indeed $1.

I kinda feel it is overvalued at this point. With no blockchain yet and no definite timeframe this is purely speculation at this time.

I really enjoyed reading your article as I'm extremely curious about EOS, and also stellar. They have my attention :) I am not yet full - on crypto trader (I trade rather their futures) so I would appreciate even the basics of "getting in" with least amount of steps involved. Right now I was hoping to get in via RobynHood but guess what?. RH promised to roll out cryptos in February, and millions of people are STILL "standing in line". Anyways forgive my rambling...Followed, upvoted ;)

Upvoted. This is amazing thank you. What website can I go to in order to find out the daily price per EOS?

Nice to meet a fellow Canadian on steemit, nice analysis as well, I was also one of those people staying up late to take advantage of the various arbitrage opportunities. Found a wicked one with kraken and bitfinex the first night. Anyways looking forward to seeing future content homie.

I agree with several other commenters that this is fantastic information and offers great insight into drivers of price movement. However, in practice, it is unlikely to be something I can use. I am at work all day, have three young kids to deal with all evening, and if I am lucky, I can check in on my crypto portfolio before bed. I imagine there are many others out there like me.

With the EOS ICO, my best case scenario is to check in about three hours before the end of the period, see the number of ETH contributed at that point and compare it to the final number when I get up in the morning, to try to decipher a trend.

For someone like me, do you have any advice on the best time to participate in the ICO? Best to just try to cost average over several random periods?

On another note, with the volume of ETH necessary for this ICO, do you think it has moved the ETH price significantly (contributed to the run up ahead of the ICO, and now the downturn, since all those coins could be reentering the market)?

Excellent post - thank you !

Thanks for sharing. I also noticed a good opportunity for arbitrage between Kraken and Bitfinex exchanges, at least in the beggining, now the prices seem to be more even. Either way the tip about watching Asian markets before entering any position is very helpful. Cheers! :)

This is incredible info, that is so well thought out. You've explained a lot about what to look for in the charts when trading EOS. Thank you for making sense of everything!

i agree. alot of research was probably done to get this info. But you are incorrect on something. First, you state in STEP 3. to watch eos price, because everyday at 6am EST the sale closes and all is divided. This is aboslutely wrong. The ICO ends every 23 hours, making the time that sale ends and eos divided to ether contributors, moves down an hour at every crowdsale end. They do this purposely to allow everyone in the world, the chance to get the best sale times of a day throughout the sale. So if tonight the crowdsale ends at 11pm, tomorrow it will end at 10pm. And so on. So your schedule of best time to buy/sell is only correct on the days that the crowdsale ends at 6am EST. So referencing your statement of the times that is best to buy China time, you have to wait until the crowdsale ends in EST time to get those best prices. I agree with everything else you say. EOS will reach or near 8-10 dollars before ICO ends. This is my prediction.