👋 Greetings, Hive community! 🐝

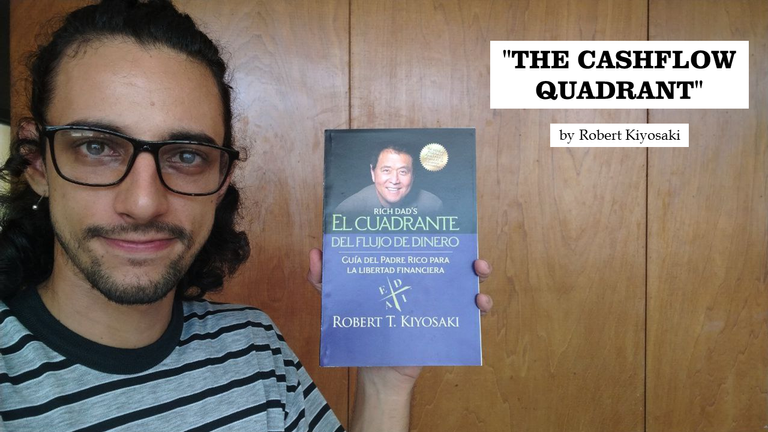

Are you tired of living paycheck to paycheck and feeling like you never have enough money? "The Cashflow Quadrant" by Robert Kiyosaki is a must-read for anyone looking to take control of their finances and build a life of abundance.

This book offers practical advice and insights on how to manage your money effectively, including the importance of understanding the different quadrants of income generation and how to transition from being an employee to a business owner or investor.

One of the key takeaways from the book is the importance of financial literacy. Kiyosaki emphasizes the need to understand the basics of accounting, taxes, and investing in order to make informed decisions about your money.

Another important concept in the book is the idea of passive income. Kiyosaki explains how building assets that generate passive income can provide financial freedom and allow you to focus on the things that matter most in life.

Of course, managing your finances is not without its challenges. Kiyosaki acknowledges that there will be setbacks and failures along the way, but encourages readers to persevere and stay focused on their goals.

In addition to practical advice, "The Cashflow Quadrant" also offers a mindset shift when it comes to money. Kiyosaki challenges readers to think differently about wealth and to embrace the idea that abundance is possible for anyone who is willing to put in the work.

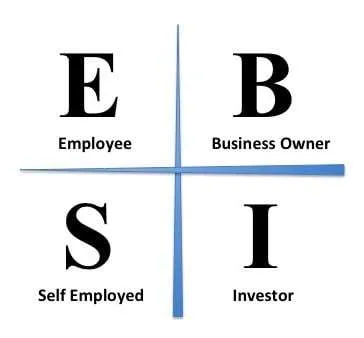

😎The 4 Cashflow Quadrants

We all have a habitual way of dealing with money and the emotions it produces.

Based on that, people are divided into these four quadrants:

Image created in Photoshop using the book image.

Employee (E): Love "security" to counteract fear. They seek solid agreements of the type "I will give you this, and you will give me that in return." They care more about certainty than money. They also want benefits like a retirement plan or health care plans.

Self-Employed (S): Love "freedom" and doing things their way. They don't like to be supervised or have their income depend on someone else. If they work hard, they believe they should be paid well. They are perfectionists and don't like to delegate because they believe no one else can do it better than them. Their freedom is more important than money.

Business Owner (B): They are the opposite of S. They love to delegate to excellent people from all four quadrants. Their motto is "why should I do it when I can hire someone who can do it better?"

Investor (I): Makes money with money. They don't work, their money works for them.

📝 A little more summarized:

E: You have a job.

S: You own a job.

B: You own a system, and people work for you.

I: Money works for you.

❗ Beware of this trap

Many people believe they are moving towards quadrant B when in reality they are moving towards quadrant S.

That is, they start a business in which they invest all their time and that depends 100% on them. They can't delegate. That's being self-employed, not a business owner.

🤔 Different forms of success

Another "little detail" that is not usually taken into account is that:

In the quadrants on the left side (E and S), success involves dedicating more and more time to work and therefore having less free time. In addition, in these quadrants, the higher the income, the higher the tax obligations.

In the quadrants on the right side (B and I), as one becomes more successful, they have more free time and more money (and lower tax obligations).

So be careful what success you pursue. 👀

❤️🔥 As Kiyosaki says:

"The definition of wealth is: the number of days you can survive without physically working (or having anyone else in your household physically work) while maintaining your standard of living."

— Robert Kiyosaki

Ultimately, "The Cashflow Quadrant" is about taking control of your financial future and creating a life of abundance and fulfillment. By understanding the different quadrants of income generation, building financial literacy, and embracing the power of passive income, anyone can achieve financial freedom.

💡 Key takeaways:

- Financial literacy is crucial for making informed decisions.

- Passive income can provide financial freedom.

- Persevere through setbacks and failures.

- Think differently about wealth and abundance.

- Take control of your financial future.

👋 Thanks for reading! Best regards from Migue at MOE.

📚 Bibliography:

Kiyosaki, Robert T. (1998). "The Cashflow Quadrant: Rich Dad's Guide to Financial Freedom".