THE ONGOING EXTINCTION OF BANKS BEGAN WITH DECENTRALIZED FINANCE. Their total obliteration will be signed, sealed, and delivered by a far superior iteration of DeFi and it will be a glorious time in history.

Before DeFi, financial freedom was an expensive aspiration and loan borrowers were at the mercy of their banking overlords. Then came Bitcoin - the breakthrough that jump-started the cryptocurrency revolution and is the great grandfather of awesome coins we all enjoy today such as POLKADOT, Cardano, and Solana which are all cutting edge cryptos with better tech.

The financial world was just not quite the same after crypto entered the scene but the obsolete Centralized Finance players are not dead yet and they are not going to make it easy for DeFi to shake up the current financial system completely. This is where RELITE Finance comes in to finish the job that the previous DeFi innovators can’t.

RELITE Finance’s mission is to REDESIGN the DeFi lending space and overcome existing barriers. They will take Centralized Finance head on and they want to be THE protocol that will truly CHALLENGE the existing status quo.

To redefine money markets, Relite is working very hard to provide a stress-free platform where lending and borrowing are UNSTOPPABLE and fairly ACCESSIBLE to ALL.

Ladies and gentlemen, we’d like to present to you THE REASONS why you should SUPPORT and INVEST in RELITE FINANCE!

Let’s get it.

THE IDEA

Relite Finance is a mission-oriented startup with a great idea that could develop into very interesting ways. The team wants to take Decentralized Finance to the nth level and that’s why they are working non-stop to help solve the major problems in the DeFi scene first.

More and more users want simpler ways to access the market without the current downsides. The market DEMANDS and Relite wants to DELIVER!

The top issues in DeFi that are barriers to mass adaption are the following:

- Interoperability

- Scalability - transaction fees/delays

- Over-collateralization

- Ease of Use - increasing complexity

INTEROPERABILITY ISSUES

Cryptocurrency assets are currently segregated by their chains/protocols and users cannot use native $BTC, $ETH, $DOT, and other assets in one protocol. Because of this fragmentation, users are limited to transacting assets that are only native to the same blockchain. In the case of the Ethereum chain, a large portion of investors are shut out because of the high fees.

SCALABILITY ISSUES

Scalability is a result of the blockchain behind the platform’s ecosystem. Some DeFi platforms can’t scale to meet daily demands and to make things worse, increasing gas prices make transactions unaffordable to many.

It is costly to do transactions in blockchains like Ethereum and their fees are unsustainable.

Small DeFi users are often priced out of the market because making a small trade with a fee that’s half as big or bigger than the trade itself doesn’t make sense. This is something that often happens on Ethereum.

OVER-COLLATERALIZATION

To access loans in some DeFi platforms, borrowers are required to surrender an average of 180% minimum collateral as protection from liquidation. These collateral amounts coupled with enormous fees for contract execution discourages potential participants from these platforms.

EASE OF USE

Most blockchain ecosystems are not user friendly and bad UX is a barrier to entry not just in DeFi, but across different industries too. Relite performed a very thorough research on why UX in DeFi is bad and came up with a list of things to improve and roll out in Relite’s user experience to help accelerate mass adaption.

Relite is relentlessly working on solving all these issues by developing the most ambitious DeFi platform ever.

THE PRODUCT

Relite Finance is a new generation lending platform that’s set up in a way that enables users to lend and borrow with their native cryptocurrencies in one place. Its biggest advantage is its cross-chain nature which overcomes segregation of blockchains.

To achieve full interoperability, it is built on top of the Polkadot ecosystem that has parachains and bridges which enables Ethereum, Bitcoin, Polkadot, and other blockchain users to participate in the market using their native assets.

With great interoperability comes great results:

move your loans from centralized finance to decentralized finance

a mixed asset basket in a simple to use interface

more options for users to borrow or lend cryptocurrencies

tokens from different blockchains will be able to move smoothly

native Bitcoin and ERC-20 assets can now co-exist in one ecosystem

enable chains to interact with each other while maintaining their technical sovereignty

different assets can reside and be ported on multiple networks

an easy path to deploy Solidity contracts to Polkadot

From great results come great benefits for both Relite and its users:

simplicity, superior usability, and faster contract execution

lower collateralization requirements, fair APY, and great ROI for lenders

lower fees (if Aave users pay $100 on transactions, Relite users pay a bit of a cent only)

sustainability

Relite can scale faster than other lending platforms

ability for Relite to quickly utilize any existing contracts they already have on Solidity

Polkadot’s analytics gives Relite better insights to predict user behavior and lending/borrowing risk

RELITE USE CASES

Users can use Relite to hedge against crypto volatility. By collateralizing volatile assets, they can acquire stable value coins without losing the future upside of the deposited crypto.

They can also earn passive income by becoming liquidity providers or lenders where they can put their crypto assets to work.

Users can use their assets to access other cryptos that may have better liquidity in their decentralized exchange of choice which means that the platform gives users better access to liquidity indirectly within the market.

For the unbanked, Relite Finance could efficiently act as their bank (if you will). They can make “deposits” through staking for a specified period and earn rewards. Credit facilities are also extended making the experience similar to banking but even better and sexier. They have access to a wide range of financial products and services with fair rates unlike the predatory rates of banks.

LOWER COLLATERALS

Reasonable collateral is only achievable if the platform is sustainable and Relite wants to make it happen by having a maturity contract and a reserve fund.

Maturity contracts are introduced to Fixed Term pools, mitigating rates and expiration threshold, to ensure that loans are repaid on time and not liquidated. Borrowers are protected from loss using this format.

Relite utilizes a reserve fund that allows them to push the limits of collateralization and liquidation ratios than any other project to provide better loan conditions to borrowers. On the other hand, Relite also protects the lender’s principal and is a top priority.

RESERVE FUND AND $RELI TOKENS

Relite is a safer system for everyone thanks in part to the Reserve Fund.

The fund is a vital component of the Relite protocol because it protects the community from over-collateralization and ensures a lower collateral ratio when it’s needed the most. It de-risks the system and provides insurance in case of a shortfall event due to a particularly volatile market.

The Reserve Fund gives more users access to borrowing due to the low collateral requirements. It can guarantee a loan even if there’s a sudden dump in the price of a supplied collateral. If a loan is liquidated and the collateral is insufficient to cover the loan cost, the security module is used to cover the gap. If their loan is in danger of being under-collateralized, borrowers have more wiggle room.

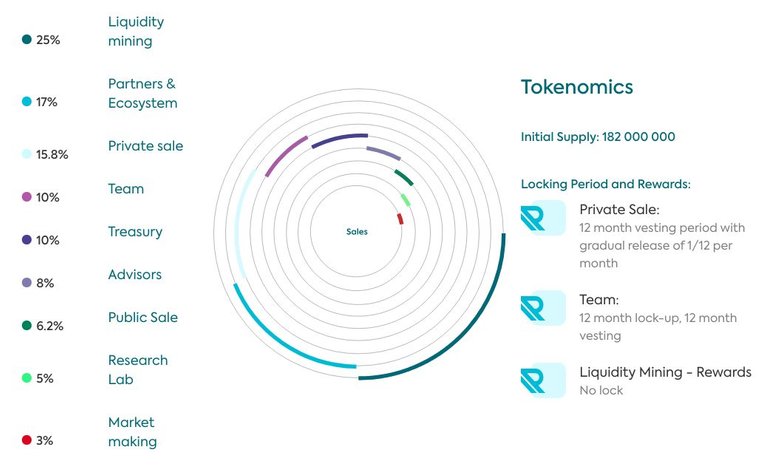

The fund will primarily hold $RELI governance tokens. By the way, Relite allocates 10% of $RELI tokens to the reserve fund as indicated in their tokenomics. $RELI also plays a crucial role of sustaining fees at the lowest possible levels. These tokens are used in a recapitalization mechanism (in a shortfall event) together with a staking mechanism. The tokens can be staked and provide additional rewards for $RELI hodlers in the form of fees. Staking strengthens the Relite ecosystem by enabling lower collateral and improved system stability.

Users who stake their tokens in the reserve fund receive payouts from the loan margin proportional to their stake and is currently set to 1%.

STAKING AND REWARDS

Aside from voting rights, $RELI gives users the chance to earn more through rewards and staking. By simply staking their $RELI, they can earn passively from loan margins based on the amount staked.

Lenders and borrowers earn RELI tokens on a daily basis thanks to liquidity provision and market participation. Those with RELI tokens will also be able to stake them in the Reserve Fund pool, letting them yield additional rewards from Relite platform fees while strengthening the ecosystem by enabling lower collateral requirements and improved system stability.

Stakers start receiving rewards as a percentage of revenue - 1% from margin proportionally on their stake. An increase in RELI staked will produce an increase in the fund capitalisation, enabling RELI price appreciation, safety during market correction, and better lending/borrowing terms for the users.

The more $RELI staked, the more rewards and payouts a user is likely to receive. The alternative wealth generation model also adds value to Relite, making their platform a more attractive option for the larger blockchain community.

LIQUIDITY POOLS

Aside from low fees and a fair governance system, participating in the ecosystem through $RELI also has other beneficial factors. The benefits are in the form of two pools that they offer: Standard pools without maturity and Pools with Fixed interest rates and maturity.

For merely actively participating in the ecosystem, Relite will reward users from the proceeds of liquidity mining. They have a fixed percentage of liquidity mining pool tokens that they will distribute to their borrowers and lenders daily. The provision of $RELI will help keep the token in circulation within the ecosystem consequently increasing the overall health and performance of $RELI. Moreover, free $RELI means more tokens to increase your token holdings.

Lenders and Borrowers will receive RELI governance tokens (0.1%) distributed daily. Stakers, who create a safer protocol environment, will be rewarded further with a percentage from the revenue in the form of DAI, ETH, and other assets.

There are Liquidity Pool programs in which users can take their LP tokens and stake them within the Relite ecosystem to earn additional rewards. More rewards will be offered when more capital is staked in the Reserve Fund via a variety of pools that have fixed terms and non-fixed terms.

Hodlers of DOT and related Polkadot projects will have dedicated lending and borrowing pools enabling high liquidity. This is unique to the Relite protocol. There are also Liquidity Pool tokens in Uniswap and Pancakeswap.

FARMING

Relite will also be offering farming and cross-chain farming is the next highest returns strategy for DeFi users. With Relite’s awesome multi-chain set-up, they will be able to farm on BSC, Ethereum, or elsewhere.

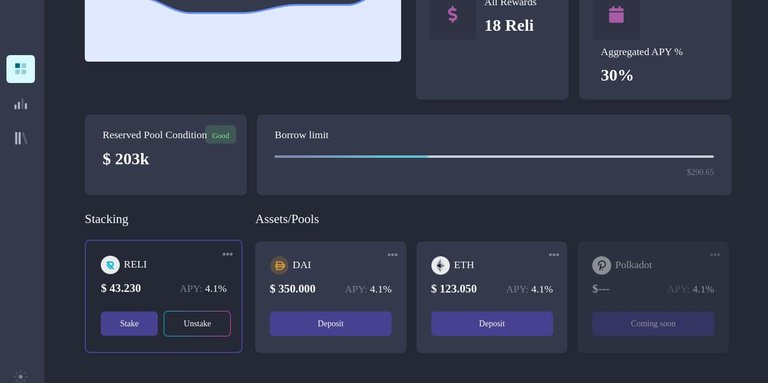

GREAT USER EXPERIENCE

Relite’s app interface is simple, intuitive, and accessible. It is designed with simplicity and sustainability in mind so that it is very user-friendly to newcomers. There is a How-To-Guide directly in the UI that will be presented during the whole user journey.

Relite will leverage user data in order to deliver a unique and customized experience for each individual. Some unique features and competitive advantages of Relite include “Wallet Credit Scoring” to better analyze a user’s risk profile (when applicable), a “Unique Pool Utilization” with pools offering both Fixed and Variable terms, and an option to use NFTs as collateral during the loan process.

In just a few clicks, users can unlock services and they can easily deposit assets to supply liquidity or provide collateral to get a loan. They can also track their earnings in real time. As the project matures, Relite will fully enable lending and borrowing for assets from more blockchains.

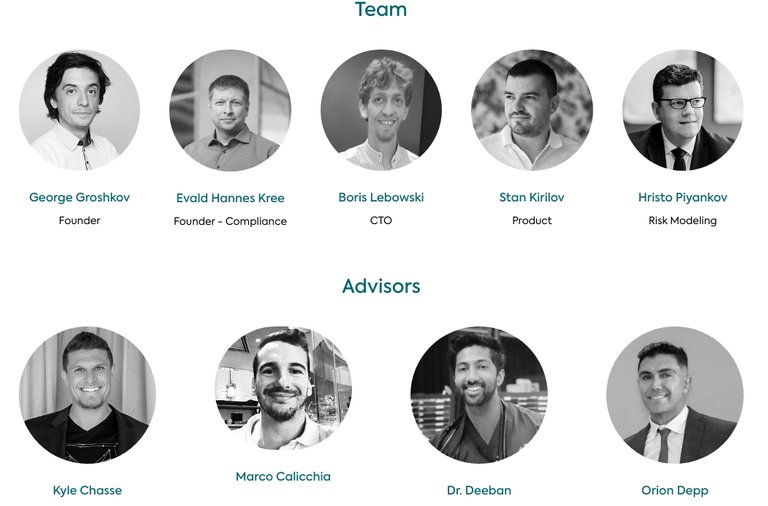

THE TEAM

Because Relite is mission-oriented, the team is fueled by the burning passion to achieve their goals and realize their vision. They are on track to change the game in Decentralized Finance. Founder George Groshkov’s inspiration to create Relite came from his desire to help usher in a new financial era that gives fair access to DeFi products to those who need it.

The development team is always growing, their organizational structure is taking shape, and they’re on a roll. Relite has the support of some of the most recognized investors in DeFi that share their vision of providing a simple and sustainable lending platform to everybody. They are backed by multiple large-scale VC firms that are set to take their product offering, visibility, and marketing to the next level.

BACKERS

- Master Ventures

- Au21 Capital

- A195

- Gd10 Ventures

- Blocksync Ventures

- Rarestone Capital

- Spark Digital Capital

- Parsiq

- Phoenix Crypto VC

- Sky Ventures People's VC

- X21 Digital

- CryptoDormFund

- Squares Capital

- ExNetwork

- GenBlock Capital

- Stanford Blockchain Club

Relite also has great partners to help them develop a great product that their users will love.

PARTNERS

- DragonLabz

- Distributed Lab

- Paid Ignition

- Certik

- Misfit

- Piixpay

- Shield Finance

- Cryptomeria Capital

- Parsiq

- Reef

- Nsure Network

The following are some key partnerships to help Relite achieve what they promise to deliver.

REEF PARTNERSHIP

This partnership allows Relite access to more partnerships, advisory, grants, exchange listings, investor access, and marketing. Both projects will enjoy top tier guidance and support to help each other with exponential growth and sustained development.

Having some of the best minds in DeFi working together will make every problem easier to solve and in a synergistically more efficient manner. Relite enjoys access to Reef’s comprehensive array of features that they can integrate to the platform to offer a suite of new functionalities.

The partnership also enables a cross-chain bridge between Ethereum and Reef Chain which will enable cross-chain liquidity for other tokens in the Reef ecosystem and provide more options for the users. It allows for $RELI to be swapped on decentralized exchanges deployed on Reef.

Relite will also introduce a dedicated $REEF token staking pool and enable lending and borrowing for $REEF hodlers who will enjoy Relite’s user-friendly platform that gives them additional rewards in the form of fees while they strengthen the ecosystem.

Reef Finance DEX also listed $RELI which will make the token tradable on the DEX and further expands the token’s accessibility in the DeFi space.

SHIELD FINANCE PARTNERSHIP

Shield Finance is a multi-chain DeFi insurance aggregator. Their Market Crash Protection contracts gives $RELI hodlers a financial protection option for their funds. They will cover the loss in case of a potential price drop due to a market-wide sell-off. This insurance will guarantee a fixed price for the assets no matter the market situation so the users’ $RELI tokens will always be repurchased.

The partnership with Shield Finance which aims to protect user funds is one more significant step towards building a reliable and sustainable lending platform.

There will also be a $SHLD pool on the Relite platform so that once it rolls out, the Shield Finance native token will become available for instant cross-chain lending on Relite.

PARSIQ COLLABORATION

Parsiq is a cutting-edge blockchain analytics platform that connects blockchain data with off-chain apps. Parsiq tracks activities throughout a particular blockchain, provides its users with real-time data on network performance, and notifies them according to preset trigger criteria.

Working on an interoperable money market protocol, Relite needs to actively monitor a great number of wallets and pools to track their status and condition. Parsiq’s technology is an excellent solution to this.

Relite will integrate Parsiq’s technology to adpt their exceptional monitoring solution to the Relite platform. This will implement real-time visibility on all transaction thresholds and help predict capital movements using analytics. Relite will be able to monitor the activities of all the wallets in the platform. This partnership is significant because it will secure the protocol with real-time analytics and automation making it one of the most transparent DeFi protocols in the industry.

Relite will also provide a dedicated $PRQ (PARSIQ’s native token) pool on the platform so that users can use it as collateral against the loans in other currencies and generally expand PRQ’s trading capabilities. The partnership will also allow for cross-chain lending between $PRQ, $DOT, and Binance Smart Chain (BSC) tokens.

Reliable DeFi lending data is very valuable so the cooperation with an industry-leading data analysis provider adds a lot of value to the Relite Finance ecosystem.

INTRO TO GOVERNANCE

There’s this thing they call “The Sixth Man” in the NBA. They are the home crowd or the fans that follow their teams on the road to cheer and show their full support and backing. When it comes to Relite Finance, all the $RELI hodlers can be their Sixth Man by being part of the community and joining their Governance program. In a way, they become part of the Relite team!

GOVERNANCE

Serving the community is one of Relite’s core driving principles. Their platform is designed to prioritize service to the community first before everything else. Therefore, they believe in putting the community at the very heart of decision-making concerning the future and the direction of Relite as it directly affects their overall experience in their ecosystem.

Using $RELI (Relite’s native token that powers transactions), the community will be able to vote on product features, token utility, and even decide which chains will be integrated into the protocol. This is fair governance in the ecosystem and it provides the foundation through which they will achieve a fully functional DAO (Decentralized Autonomous Organization) with the goal of making their community the essential contributing pillar that decides the future of Relite.

The governance model has been crafted such that the users have power over the operations of the platform. Users speak through their votes to decide on various issues concerning the platform.

THE EXECUTION

MVP

The company's Minimum Viable Product is deployed on both Polkadot and Ethereum with an efficient and fully functional supply and borrowing functionality.

MVP Functions:

- Lend/borrow DAI or ETH

- Earn interest

- RELI staking and rewards

- Collateralize ETH position and get rDAI + RELI

CERTIK

The initial smart contract has been audited by Certik.

BSC<>ETH BRIDGE

Binance Smart Chain and Ethereum bridge is live. Users are able to swap RELI tokens between the Ethereum & BSC networks in a matter of minutes. When the $RELI pool on PancakeSwap was launched, the demand for this bridge increased rapidly.

The launch of the BSC bridge is vital to Relite’s long-term goal of scalability and interoperability. It helps Relite to prepare for their full-scale platform launch by building a stronger user base and providing those users with almost negligible fees relative to the high ETH network transfer & gas fees. This enabled asset transferability between ETH, RELI, & BNB and eliminated high gas fees.

The launch on Binance Smart Chain & PancakeSwap allows Relite to offer amazingly attractive APYs, cross-chain interoperability, and low gas fees and tap into a unique and highly-coveted community within Binance Smart Chain and open up many doors for them. With this, they will be launching a Trading and LP program with staking pools on PancakeSwap.

UNISWAP

$RELI is listed on the world’s largest decentralized exchange platform, Uniswap. $RELI’s performance following the initial listing was a tremendous success and has continued to perform well ever since. Their listing provides more liquidity to all their token holders. You can now trade $RELI comfortably over on Uniswap.

Relite is also working on a Liquidity provider program for Uniswap that allows users to share in the trading profits from Uniswap transactions. Overall, they believe this will result in a much better overall trading experience for their users.

REEF

Building Relite on Reef will make it possible for users to access liquidity across Ethereum, Reef Chain, and other blockchains.

NFT

Relite Finance finds itself in a unique position of providing more value by leading the market into a new lending era that involves collateralizing NFTs. As more people mint NFTs, it becomes increasingly clear that NFT collateralization is inevitable. Relite is ready for it.

QUANTUM LEAP

Relite has a hot roadmap and their blockchain will gradually move to full interoperability with other chains. This will happen with the introduction of bridges and parachains on Polkadot.

While the markets fluctuate, Relite is here for the long term and will build in both bull and bear markets.

Relite will be launching Synthetic & Real-world asset lending & borrowing as well as one-click lending in Q4 of 2022. They call this phase “The Synth Phase”.

If Relite succeeds in its mission, it will usher in an era of faster, cheaper, and broader crypto lending, making this DeFi primitive accessible to retail users. Should this vision come to pass, no one will be priced out of accessing lending and borrowing services thanks to Polkadot’s scalable framework and Relite’s commitment to unlocking the true value of cross-chain lending.

They hope this will help onboard thousands, if not millions, of new crypto users that can benefit from DeFi services.

Relite will be the benchmark in cross-chain lending protocol services and nobody will even come close. They will soon dominate competitors like Aave, Celsius, Maker, Compound, and Nexo.

FULL ROADMAP

Take a look at the full roadmap of Relite Finance here:

https://www.relite.finance/blog-posts/relite-2021-22-roadmap-the-road-ahead

TOKENOMICS

Relite has user-focused tokenomics to keep their community happy through various passive earning mechanisms via token generation.

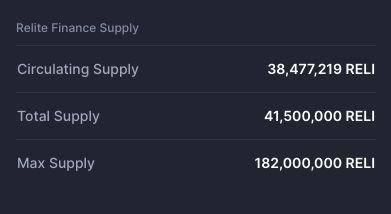

As of publishing time, the circulating supply of RELI token is around 38.5 million with a total supply of 41.5 million. The maximum initial supply will be 182 million.

OUTRO

Relite Finance is going to disrupt the ordinary type of DeFi (like Aave and Celsius) which is already disruptive on its own. Skip DeFi 2.0, DeFi 3.0, etc, Relite is DeFi 99.0! Of course we’re exaggerating but we hope you get what we mean.

Relite is solving the most difficult problems in DeFi and they’re getting the best teams, partners, and backers to expedite the solution.

There’s common advice in the startup world that founders should target a market that’s going to be BIG in 10 years. They should care about the growth rate of a market instead of its current size. Crypto/DeFi is a small but rapidly growing market with users who have a desperate need for solutions that Relite is offering. This is the perfect set-up for success and investors should take note of this.

Be part of the greatest financial revolution, be a $RELI hodler and participate in Relite’s Governance!

WHERE TO BUY $RELI

Pancakeswap

https://pancakeswap.finance/swap

Uniswap

https://app.uniswap.org/#/swap

To get the latest updates from Relite, check out their blog:

https://www.relite.finance/blog