INTRO

A blockchain is a growing list of records, called blocks, that are linked using cryptography, with each block having a cryptographic hash of the previous block, a timestamp, and transaction data (generally represented as a Merkle tree).

Technically, a blockchain which was invented by Satoshi Nakamoto, in 2008, is resistant to modification of the data. It is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way". For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for inter-node communication and validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without alteration of all subsequent blocks, which requires consensus of the network majority. Although blockchain records are not unalterable, blockchains may be considered secure by design and exemplify a distributed computing system with high Byzantine fault tolerance.

Blockchains as a decentralized control mechanism automatically gave rise to cryptocurrencies, the alpha cryptocurrency being bitcoin. A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. Cryptocurrencies use decentralized control unlike centralized digital currency and central banking systems. With the advent of cryptocurrencies, arises the need for swapping from one cryptocurrency to the other. This births the concept of cryptocurrency exchanges.

WHAT THE HECK IS A CRYPTOCURRENCY EXCHANGE?

A digital currency exchange, or commonly a cryptocurrency exchange is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid-ask spreads as a transaction commission for is service or, as a matching platform, simply charges fees. There are 2 main categories of cryptocurrency exchange, centralized exchange, also known as a cex, and a decentralized, also known as a dex. Centralized exchanges were the initial types existing. Examples abound. Huobi, Binance, Bittrex, Kraken, Coinbase etc. But challenges such as security and high trading fees have severely hampered and restricted their operations. Horror stories of centralized exchange hacks exist. From the legendary Mt. Gox, to the Binance pilfering and then the Upbit affair. Decentralized exchanges such as Forkdelta, Tokenjar, Idex do not store users' funds on the exchange, but instead facilitate peer-to-peer cryptocurrency trading. Decentralized exchanges are resistant to security problems that affect other exchanges.

How does Emirex step into the cryptocurrency exchange fray?

In early 2017, having identified a gaping chasm in the market that represented a crying and adept need for a change, the Emirates Group of Companies started working on a digital assets exchange that allowed users to easily and securely buy and sell cryptocurrencies and non-security tokens such as protocol, utility, payment and commodity tokens.

Headquartered in Dubai, the United Arab Emirates, The Emirates Group of Companies, meet the challenging demands of the current regulatory landscape in the cryptosphere. Founded in July 2014 as a technology and advisory provider focusing on digitalization of traditional legacy businesses by making efficient use of emerging technology such as blockchain and artificial intelligence, the Group founded The digital assets exchange, called Bitcoin Middle East Exchange, or BitMeEx, in early 2018.

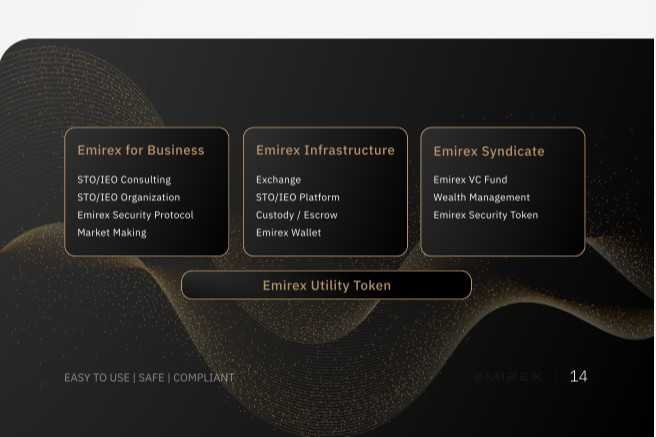

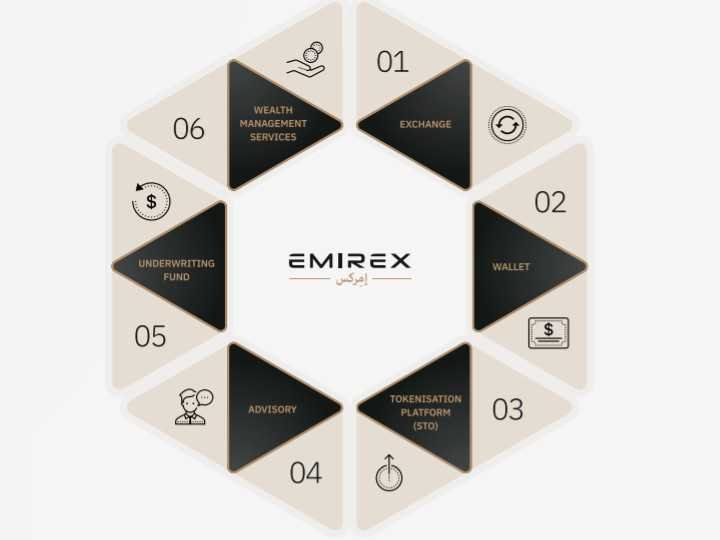

This brainchild of the Emirates Group is intelligently designed to be a world beater. This platform was built from the ground up, to deliver a full range of services that address the major requirements of the investors and issuers of the digital assets in the Middle Eastern region, as well as the needs of investors, traders and connoisseurs in the rest of the world. Each of the product offerings takes the user to the next level in cryptocurrency adoption, all powered by the Emirex token.

The many heads of this behemoth known as the Emirex Platform include many of the following

- Emirex Exchange

- Emirex Wallet

- Emirex Wealth Management Services

- Emirex Custody Services

- Emirex Underwriting Fund

- Emirex Tokenisation Platform

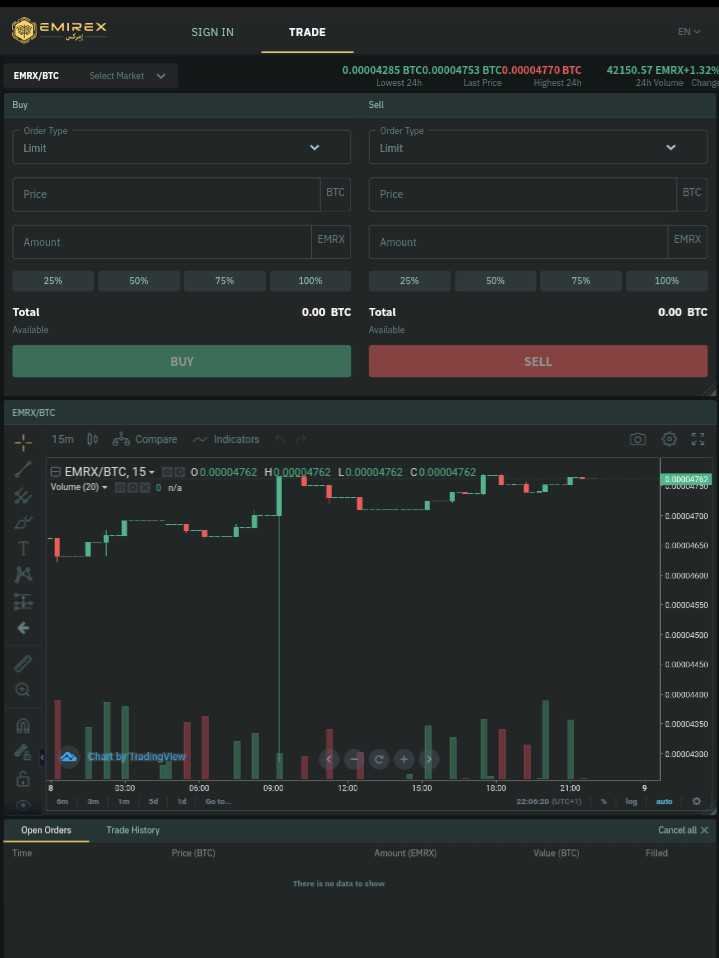

THE EMIREX EXCHANGE

The Emirex Exchange, a platform for investors and traders, is a place where crypto assets can be traded easily and quickly in a secure and enabling manner. Additional assets for both top-tier and aspiring projects are in the process of being listed, and already in late stages. The Emirex fiat gate supports deposits and withdrawals directly to and from a users’ bank account, while also supporting purchase through credit/debit cards and other payment methods. Security measures that are compliant with international financial services IT security standards are offered, like two factor authentication, IP security etc. Margin trading, trading interaction chats and a VIP concierge service are all on offer, along with a refreshing user interphase UI and user experience UX. Primarily it offers an easy to use interface that lets non-professional traders take part in the digital asset markets. It also offers a professional platform for expert traders, complete with the functionality expected from established trading platforms in the traditional markets such as foreign exchange or commodities, thus improving asset liquidity. In this way, the Emirex exchange is a complete deviation from your regular exchanges that focus on single group of traders. Other features to enhance the awesome trading experience include copy and social trading functions which will allow traders to mimic positions opened and managed by selected professional traders. These traders will be remunerated according to the number of subscribers they attract.

The Emirex matching engine include

- An order book that is capable of handling 1,000,000 orders/second

- Spot trading with professional order types as well as margin and futures trading

- Highly customizable trading view charts for professional traders, as well as advanced functionality for order book, trade-history, markets, and market depth

- Technical analysis and indicator toolbars

- Trade analysis history

- Advanced asset liquidity aggregation technology.

THE EMIREX WALLET

As wallets come and go, they are an integral part of the cryptocurrency world. They represent a means of crypto storage. A cryptocurrency wallet is a device, whether physical medium,program or a service which stores the public and/or private keys and can be used to track ownership, receive or spend cryptocurrencies or digital assets. The cryptocurrency itself is not in the wallet. In case of bitcoin and cryptocurrencies derived from it, the cryptocurrency is not centrally stored and maintained in a publicly available ledger called the blockchain. A cryptocurrency wallet, comparable to a bank account, contains a pair of public and private cryptographic keys. A public key allows for other wallets to make payments to the wallet's address, whereas a private key enables the spending of cryptocurrency from that address. There are many types of cryptocurrency wallets depending on the criteria. It can be a hardware (Ledger Nano) or software, multi-sig or single sig, An HD Wallet, or Hierarchical Deterministic wallet, which is a new-age digital wallet that automatically generates a hierarchical tree-like structure of private/public addresses (or keys), thereby addressing the problem of the user having to generate them on their own, 'cold' or 'hot' wallets etc. Cryptocurrency wallets are vital components of the cryptocurrency eco-system and must be designed with highest levels of security in mind. Wallets interact with the blockchain ledger directly to keep track of the assets belonging to a user and allow them to create and issue new transactions.

In the case of the Emirex wallet, it is a 'hot' software, single sig wallet. The Emirex Wallet lets retail users safely and securely store digital assets on multiple operating systems, providing privacy, security and reliability when sending, receiving and storing the assets. The Emirex Wallet will support all coins traded on the Emirex Exchange and will be free of charge for a standard version. A small fee in EMRX tokens will be charged for a professional version which allows for extended functionality such as management of multiple private keys on any device thus allowing for efficient, simultaneous management of multiple portfolios.

THE EMIREX TOKENIZATION PLATFORM

Emirex has been helping companies, organizations and government agencies make the most of the opportunities that the digital economy offers since its inception five years ago, with the team already working on a corporate bond and tokenized commodities platform and advised on multiple equity tokenization projects, we are currently developing a primary issuance platform for tokenized securities and assets.

The Emirex Tokenisation Platform is built on our experience coupled with accepted best practices. It offers:

- Investor onboarding

- Third-party assessment

- Investor dashboard for issued token management

- Optional two-factor authentication for investors

- Document signing

- KYC/AML and accreditation qualification

- Deposits and withdrawals in fiat and crypto

- Real-time cap table management

- Investor limits enforcement

- Tax reporting

- Multi-protocol support

- Support for both public and permissioned blockchains

- Third-party service provider integration, to ensure expedient legal and tax advice

- Dedicated customer support

There is already a significant demand from Middle East-based potential issuers that want to tokenize their assets, as well as issuers in Africa, Asia, and Europe that want to access Middle Eastern liquidity to support their tokenized assets and projects.

EMIREX WEALTH MANAGEMENT SERVICES

Family offices and high net worth individuals (HNWI) are looking to diversify their investment portfolios into digital assets because they are a non-correlated asset class and can be used as a hedge against inflation. The Emirex Group is in the process of obtaining financial intermediary licenses in Tier 1 jurisdictions to meet the requirements of family offices and HNWI that are either operating in the Middle East or aiming to secure their wealth by operating in the Middle East.Emirex Group is positioned to see the best deal flow in the markets and has the technical and industry knowledge to select the best performing assets for our current clients.

EMIREX UNDERWRITING FUND

Emirex Underwriting Fund is aimed at supporting long-term Emirex growth by strategically investing in the best projects in the area of digital assets issuance, management and trading. These strategic investments will give Emirex access to the best technology stack and enable us to stay ahead of the market growth curve. Emirex Underwriting Fund shall be set up as a regulated investment vehicle, raising funds from our current strategic investors, as well as investing own funds. Once the fund has made enough investments, it will be tokenized and traded on the Emirex Exchange, making entry levels into the fund lower and providing additional liquidity to the existing investors. Management fees and carried interest will form the overall revenue of the Emirex Group.

EMIREX CUSTODY SERVICES

Emirex Custody Services aims to solve the localised need for secure storage of digital assets, which is one of the barriers to adoption of digital assets adoption for institutional investors. Emirex will use 100% cold storage, ensuring that users’ crypto assets remain secure and available to meet investor redemption and verification requirements. Emirex custody model will protect assets by ensuring that they are never commingled with assets held in customer trading accounts. The service level for cold storage will meet the current levels of leading European banks. Clients will receive regular and auditable consolidated reporting, including market and performance valuations for their asset portfolio. Reporting will be issued at monthly, quarterly and annual intervals.

Emirex Token, with the ticker EMRX, fuels The machine of the Emirex Platform. It is an erc-20 token, thus it runs in the powerful and trustworthy Smart Contract of the Ethereum Blockchain, with a total circulating volume of 500,000,000(five hundred million) tokens. Emirex shall burn up to 50% of all of the EMRX every quarter received for the sale of its products and services until the circulating supply reaches the 250,000,000 EMRX, 50% of the originally issued 500,000,000.

As the native token of the Emirex Ecosystem, EMRX has multiple use cases: listing fees for placement of tokenized assets, transaction fees from buy/sell transactions, custody and servicing fees, commission and partner incentive schemes, and others as the offering develops.

PROLOGUE

A great combination of the Emirex Exchange, coupled with the functionality of the Emirex Wallet and the versatility of the Emirex Tokenisation Platform will create a superb pool of liquidity that will attract innovative projects from around the world.

Emirex Resources

Website https://emirex.com/

Facebook https://www.facebook.com/emirex.official/

Twitter https://twitter.com/EMIREX_OFFICIAL

Reddit https://www.reddit.com/u/Emirex__official

Linkedin https://www.linkedin.com/company/emirexgroup/

Medium https://medium.com/@EMIREX_OFFICIAL

Instagram https://www.instagram.com/emirex_official/

Telegram https://t.me/joinchat/DqGU61OCcKlwpg073YO0fA

Whitepaper https://emirex.com/whitepaper

Giveaway Program https://emirex.com/referral

Referral: https://emirex.com/referral?refid=ID8B4839AA00

About the Author

Joseph Johns is a successful Emergency Medicine Physician and an ardent cryptocurrency and Blockchain connoisseur

Bitcointalk Username: Redoc

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2409725

Eth Address: 0x8dC02f9a3255C0cE32536E698447F2E3915AE948

Emirex ID UID : ID8B4839AA00