Trusting that as good students they have been involved with the technical-cryptonian terminology expressed in the dictionary ABC of the new financial world: The Blockchain and the Cryptocurrencies, we can infer that for you as well as for us the birth of guidelines by the Digital Chamber of Commerce of the United States represents excellent news because it can give more legal weight to the advances of the Blockckain world, in this opportunity the regulation is focused on the ICOS 1 and Tokens 2 that are in the market and those that may arise in the near future, so we hope you are attentive to receive another special message from your favorite team: "The Emeeseese Team" ;-)

Information extracted from the white paper of the document entitled: "Understanding digital tokens: Market Reviews and Guidelines for Politicians and Practitioners"

Do not worry, if you forgot the concepts of Ico and tokens , we will give you a review of them:

ICO1: If we translate the initials "Icos" we will find the phrase "Initial Coin Offerings", that is, Icos is a form of financing a business project that offers actions instead of virtual tokens, or what is the same, new cryptocurrencies. Information extracted from the dictionary ABC of the new financial world: The Blockchain and the Cryptocurrencies of the Emeeseese Team

Tokens 2: According to the concept provided Javier Pastor, tokens are "digital assets based on bitcoin technology and that nowadays have a joint value of billions of dollars". It also represents an alphanumeric string, such as a key stored in a Blockchain.Information extracted from the dictionary ABC of the new financial world: The Blockchain and the Cryptocurrencies of the Emeeseese Team

Explaining from the beginning about the emergence of these new guidelines:

As we mentioned in the Introduction to the post, the guidelines came from the Digital Chamber of the United States, but it would be worthwhile to ask ourselves the question:

What is the Digital Chamber of Commerce (DCC)?

Using words from the White Paper (which we intend to explain and show them in various parts), the DCC is the largest trade association in the world whose intention is to represent the Blockchain industry.

What is your mission?

To our pleasant surprise, its mission is to **promote **the acceptance and use of digital assets and blockchain technology. Among the activities that will allow to achieve it are: education, promotion and joint work with those responsible for policy formulation, regulatory agencies and industry, among others.

What's your objective?

Its main objective is to develop an optimal and favorable legal environment that allows growth and promotes innovation, employment and investment in the virtual world.

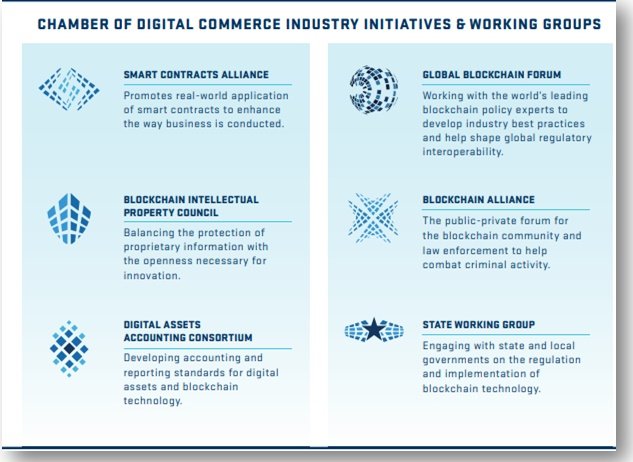

What are the alliances or working groups that make up the digital chamber of commerce?

With the intention of achieving alliances, a new idea, the birth of "Token Alliance"emerges, which is formed by more than 350 participants from the global industry (each of them can be visualized on page 8 of the book), which indicates that it is counted with support for the development of the Blockchain and expert tokens, this is why professionals such as: technologists, economists, former regulators and professionals from more than 20 law firms. Even the digital chamber of commerce is composed of experts not only from the United States but also from countries such as Canada, Australia, United Kingdom and Gibraltar.

The conjugation of the knowledge of these professionals seeks that ** Token Alliance ** develop through thoughtful guidelines the responsible creation of tokens, likewise it tries to expand the concept that until now we have known about "token", since from now on ahead we would not be talking only about crypto-assets of different platforms that have a commercial value, but of usable tokens to lend or generate products or services to the community.

Among the initiatives and groups that have been formed are:

Note: The concept, mission and objective, as well as the names of the alliances and the figures of the working groups were extracted from the following Source

On the other hand, the 108 pages of the white paper are distributed in three parts, perfectly identified in its Index, titled as follows:

- PART 1: REGULATORY OVERVIEW OF DIGITAL TOKEN MARKETS

1.1. UNITED STATES

1.2. CANADA

1.3. UNITED KINGDOM

1.4. AUSTRALIA

1.5. GIBRALTAR

- PART 2: PRINCIPLES AND GUIDELINES OF TOKEN

2.1. SPONSORS OF TOKEN

2.2. PLATFORMS OF COMMERCE TOKEN

- PART 3: TOKEN ECONOMIC LANDSCAPE

On this occasion we will only talk in a summarized way of the regulatory landscape of the digital token markets of the aforementioned countries, that is, Part I of the white paper, so pay attention to our summary: D

Take into account that Token Alliance does not seek to replace laws established in the countries that comprise it, nor to eliminate legal advice in the case of creating or distributing Token, so as the ICO or tokens grow and change, problems will continue to be studied for maintain appropriate regulation offering additional ideas, as appropriate.

Likewise, Part I differentiates between two categories of digital tokens and their regulations:

- basic products;

- Tokenized values.

1.1 Regulatory considerations regarding virtual currencies:

The "bitcoins and other virtual currencies" are a type of "commodity" and therefore have economic function and statutory language. It should be noted that although there is no legal definition for the term virtual currency, in December 2017, the Commodity Futures Trading Commission (CFTC) stated in a regulatory interpretation that the terms "virtual currency" and "digital currency" must include:

» Any digital representation of value (a "digital asset") that functions as a means of exchange, and

» Any other digital account unit that:

• it is used as a form of currency (that is, it is transferred from one part to another as a means of exchange);

• it can be manifested through units, tokens or coins, among other things; and

• it can be distributed through digital "smart contracts", among other structures.

In a recent regulatory action related to the virtual currency, the CFTC stated that Rule 180.1 gives it the "ability to apply actions for fraud or manipulation in connection with ... contracts for the sale of any commodity in interstate commerce."

And as if that were not enough, thanks to events that took place in January of this year, the CFTC was given power to exert influence over the activities that imply fraud in the sale of virtual currencies in interstate commerce ".

Another curious fact that caught the attention of the Emeeseese Team, is the expression shown in the following image:

The essence that is evident behind this sentence is that digital tokens can evolve from values to no values, but only the development of them will allow the user to obtain the security that can be exchanged in the future, since it will enjoy demand and value within From the market.

The following image shows the considerations that must be developed and implemented by money transmitting entities, as well as the negotiation platforms and thus maintain effective AML programs that address the updated strategies to deal with money launderers and terrorists trying get access to the financial system.

The Anti-Money Laundering Compliance Program (AML) must have minimum elements, such as:

- A system of internal policies, procedures and controls.

- A designated official

- Training for appropriate personnel

- Independent tests of the program

1.2 Definition of Security and its application to digital tokens

Statutory concepts that encompass the subject of "security" include an "investment contract," which is the category that Canadian courts and securities regulators use to assess whether a new type of transaction is secure.

Likewise, the Canadian Securities Administrators (CSA) have a space where digital tokens issuers are received with the idea that they can discuss their business models, the laws that may be applicable as the case may be and the start of operations giving 1 or 2 years of testing.

Factors to consider if a token is safe:

» What is the use or purpose of the token?

» Does the token represent access to a company's platform, or does it represent a property interest in a company?

business that could increase or decrease in value depending on the success of this?

» At the planned time of the sale of the token, the platform still needs to be developed or is it an existing and functioning ecosystem in which the token can be used?

» Will the buyer receive the token after payment of the full price?

» Does the market value of the token reflect the overall attractiveness of the business?

» Is the token transferable, and is the anticipated value derived from the future demand of the market?

» Does the token expire after a certain period of time of not being in use?

» Is the purpose of the buyer to buy the use or personal consumption of the token, instead of just investment purposes?

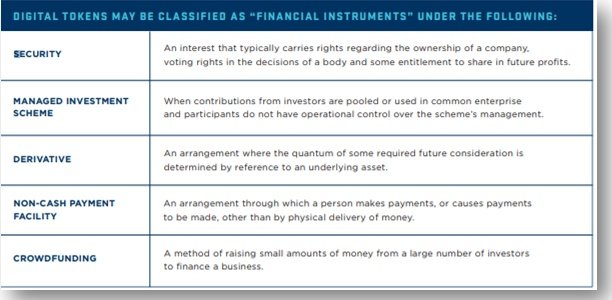

1.3 Potential legal classification and related regulatory considerations

The following image summarizes the generic regulatory approaches applicable to tokens in the United Kingdom:

The tokens can be framed within 3 generic approaches with the intention of being regulated in the United Kingdom. In the first place they can be treated as a good or another form of physical property. When this is the case, the commercialization, purchase and sale of the digital token will largely not be regulated from the perspective of the financial services law of the United Kingdom, unless the contracts for the negotiation of the digital tokens fall within the scope of the definitions of the law of the United Kingdom.

Another way is to treat them as a financial instrument (mainly a value) as well as a unit in a fund (including a collective investment scheme, which is broadly defined and is capable of capturing arrangements involving digital tokens or an alternative investment fund) .

The third approach is to treat them as money or a currency (potentially electronic money or that involves the provision of a payment service).

- A MERCHANDISE OR OTHER FORM OF PHYSICAL PROPERTY

- A FINANCIAL INSTRUMENT

- MONEY OR OTHER CURRENCY FORM

Money Analysis

Electronic money is defined in Directive 2009/110 / EC as electronically stored (magnetically included) and its monetary value represented by a claim on the electronic money issuer that:

(i) it is issued when receiving the funds for the purpose of making the payment transactions;

(ii) is accepted by a person who is not the issuer of electronic money; and

(iii) It is not excluded in any other way. The electronic money directive is implemented in the United Kingdom through Electronic Money Regulations 2011.

1.4 Classification of digital tokens as financial instruments

In Australia, the entity in charge of classifying, regulating and controlling financial tokens is the Australian Securities and Investments Commission ("ASIC").

For tokens to be considered financial assets must meet certain requirements that can be summarized as follows:

Offer Security: An interest that generally involves rights over the ownership of a company, voting rights in the decisions of an organization and a certain right to share future benefits

Offer a Managed or Managed Investment Scheme ("MIS"): When the contributions of the investors are combined or used in a joint venture and the participants do not have operational control over the administration of the scheme, the cryptoactive is said to lack an MIS, whose evaluation must include what rights are associated with the tokens generated by the Token Sponsor

Derivative:An arrangement where the amount of some future consideration required is determined by reference to an underlying asset that may include a cryptographic asset or digital token

Grant ease of payment without cash: As we all know they are arrangements where payments are received or made without the need for physical delivery of money

Crowdfunding:It could be said that it is a method to collect small amounts of money from a large number of investors to finance a business.

1.5 Obligations of information when generating digital tokens through the internet

If the digital token is offered online, it falls within the scope of application of the EU E-commerce Directive, which is framed in the Electronic Commerce Law 2001.187 of Gibraltar. Likewise, each of the agreements that are generated must be included in electronic contracts.

Another of the laws involved in the process of generation of digital tokens is the consumer protection that requires to provide specific information of them, as established in the Regulation of Consumer Rights in Contracts 2013189.

Gibraltrar is currently leaning towards Marco Token's Proposal ("Framework") 194, as it provides a high-level outline of what is expected. In the same way, a new legislation is expected and proposed that regulates the following activities:

»The promotion and sale of digital tokens;

»The operation of secondary market platforms that trade with digital tokens; and

» The provision of investment and auxiliary services related to digital tokens.

We remind you that the points detailed today are a summary of those shown in the White Paper on ** the new guidelines arising in the Digital Chamber of Commerce of the United States as well as the topics taken into consideration by the other countries that comprise it * *. If you like to evaluate each of them in detail, you can access through the hyperlink that we have left in each mentioned Source.

We want to remain with the sensation that many countries are studying and analyzing in a serious, organized and futuristic manner, processes that involve the growth of the chain of blocks, the digital tokens that are generated and the extension of the utility that these can give to the incorporate not only the monetary or crypto-monetary investment but the offering and granting of services and products making use of this means and this new form of payment that is well deployed to us and gives us free access so that we can make the choice of what we want.

Remember that you have our trails at your disposal

- Quick guide to join |