Yes, oil is a commodity, and its price fluctuations have a tremendous impact on all our lives. Everyone, starting with retail traders and central bankers end ending with the regular Joe on the streets, are influenced by the price of oil.

When talking about oil is impossible not to talk about money and power. And, above all, politics, influence, wars, strategic alliances, and more.

Throughout history, oil was a good enough reason to start a war. Oil put nations on the world map, changing the balance of power and influence as we knew it.

But above all, oil changed everyone’s lives. We live in a global economy, mostly due to oil.

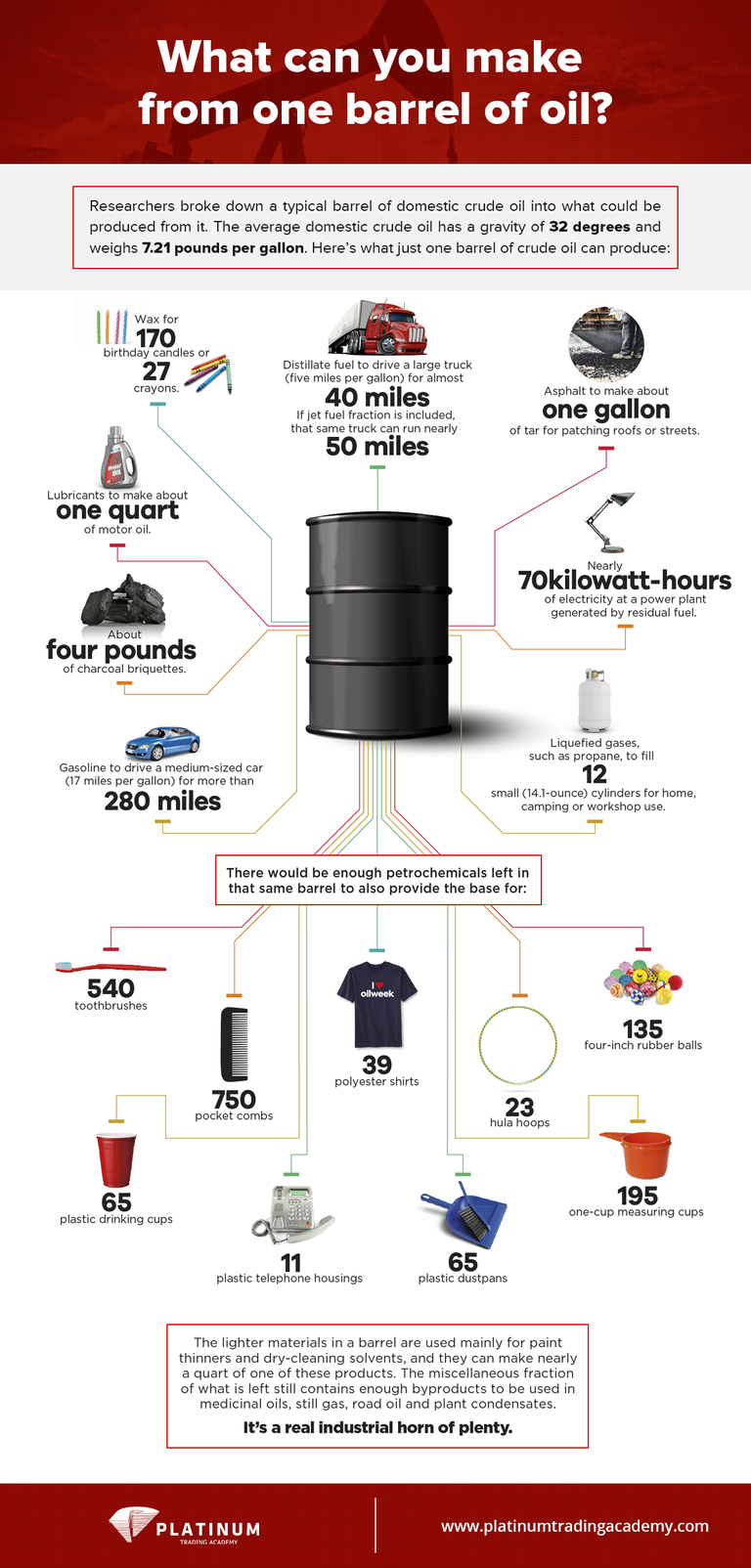

We tend to think of oil as fueling our cars, but that’s merely one of its qualities. Gasoline is a by-product, so as kerosene, that fuels our planes.

The maritime industry depends heavily on the price of oil too. Moreover, the petrochemical industry witnessed a fantastic development since oil was discovered, as by-products derived from petroleum are used in manufacturing fiber for t-shirts and other clothes, plastic for all kinds of uses, asphalt for the roads, and so on.

All these are known. Since oil’s discovery, the world entered a new phase, as the last hundred years or so led to a dramatic increase in the standards of our civilization.

For traders, oil has a crucial role. Like it or not, it sits on the top of the list when central bankers set the monetary policy for the period ahead.

Oil has a strong connection with inflation levels. More precisely, with inflation expectations, and that’s what matters for any central bank in the world.

Oil and Inflation – Key in Knowing How to Trade Oil

Perhaps the most important thing for traders is the direct relationship between the price of oil and inflation. Because inflation is part of every central bank’s mandate, it means the price of oil has a big saying in every day’s currency market fluctuation. Furthermore, the entire financial system shakes on big moves on the oil market.

Most central banks in the world have price stability as their mandate. It refers to stability around the desired inflation target and an important concept when learning how to trade oil.

Studies showed that two percent inflation stimulates economic growth. Hence, most central banks target inflation around two percent, below but close to the level.

It so happens that inflation is directly correlated with the price of oil. Namely, when oil rises, inflation rises too. Or, when the price of oil tanks, inflation drops dramatically.

In other words, to maintain their mandate (i.e., price stability), central banks around the world react to inflation’s moves. When inflation rises, central banks tighten the monetary policy (e.g., raising interest rates). When inflation falls, central banks tighten monetary conditions, to accommodate for lower prices.

Based on everything written so far, as oil is a significant driver of inflation, central banks calibrate their monetary decision based on the price of oil.

How to Trade Oil Considering Oil and Deflation

Many traders associate oil with the rise in inflation. But the most profound fear for every central banker (at least in the last few years), is deflation, and not inflation.

When inflation drops below zero, or it turns negative, it means that prices for goods and services in an economy drop. While it may seem at first like a good thing, in reality, it is devastating news for the economy.

A drop in price triggers a vicious economic circle. First, consumers postpone the decision to buy. With that, selling inventories are on the rise.

Second, inventories on producers’ side rise too, as retailers won’t order more goods. Consequently, producers start lowering production levels, and extra capacity becomes available.

Finally, the next thing you know is that the unemployment rate will rise due to layoffs and the government fiscal deficit will rise too due to increasing contributions for unemployment benefits. No one’s happy, despite the first impression when prices drop is a positive one.

Central banks are aware of this circle. And therefore, they intervene when inflation drops or turns negative so that this doesn’t happen.

They ease the monetary policy by dropping the interest rate levels to zero. In some cases, as we’ve seen lately, many central banks turned to negative interest rates.

Unconventional monetary policies appeared as well. First, in the United States and Japan, and then embraced as a standard monetary policy tool, quantitative easing seems to be here to stay as an extra easing tool.

And all these, because of inflation. And oil.

How Oil Affects Markets

To better illustrate oil’s influence, we need an example. For years, the WTI crude oil hovered around the $100 level.

It formed a contracting triangle (a technical analysis pattern) that could’ve broken both ways. How to trade oil when such a triangle form? The answer is to wait until one of the trendlines break.

The broke lower, and in a matter of a few months, the price of oil reached values well below the $30 mark.

The move triggered a deflationary wave throughout the world. Central banks needed to adapt fast, and they cut the interest rates further into negative territory.

The oil shock didn’t go away soon enough, and here we are, five years after the oil price drop, with inflation still unable to rise significantly. In some regions of the world (e.g., United States), it reached the two percent target, in other parts (e.g., Japan) it barely moved from below zero.

In the end, it depends on the economic activity, the central banks’ decisions, and the economic strength. But one thing is sure: for traders, the price of oil is a critical factor in understanding central banks decisions regarding the interest rate level. And, when it comes to Forex trading, interest rates are all that matter.

How to Trade Oil - What Moves the Price of Oil?

As with any commodity, supply and demand levels play an essential role in the price of oil. In periods of economic boom, more oil is needed to fuel expansion.

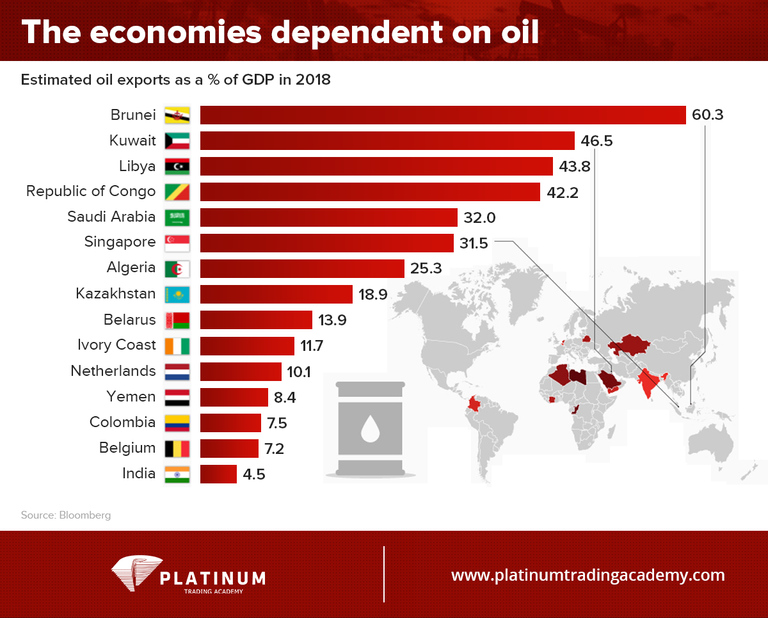

It goes without saying that production levels move prices too. And, that means that producing countries benefit from great powers as they can increase or decrease production levels.

Learn to Trade Crude Oil - OPEC Meetings

OPEC (Organization of Petroleum Exporting Countries) emerged as one of the greatest cartels of the century. OPEC meetings and decisions, therefore, matter a lot for the price of oil and are mandatory to follow for anyone interested to learn how to trade crude oil.

OPEC meets regularly in Vienna, Austria, to decide the production levels for the period ahead. It goes without saying that OPEC decisions are mostly political, as oil is a weapon used in negotiating many deals.

The price of oil fluctuates greatly when OPEC announces increases or decreases in output levels. Such fluctuations translate in fluctuations in other markets, as traders and investors try to update their positions to the new reality.

Oil producing countries have their currency reacting the most to such news. Canada, for instance, is a major oil producer and its economy is dependent on the oil industry. The Canadian Dollar (CAD) is heavily traded when oil-related news comes out.

Learn to Trade Crude Oil - CAD and Oil Relationship

The Canadian Dollar is a vital currency part of the Forex dashboard. It reflects the price of oil in the FX market, as the CAD is directly correlated with it.

The USDCAD is a particular currency pair too. It shows the economic differences between the two nations that share a common border: the United States and Canada.

On top of that, it is the first one to react to the changes in the price of oil. So, if OPEC decides to increase production levels unexpectedly, that would trigger a move lower in the price of oil.

As a consequence, CAD will move lower and USDCAD higher. On the other hand, if OPEC announces production cuts, the price of oil jumps, and the USDCAD tanks as CAD moves higher too.

This is an example that illustrates the strong connection between the price of oil and the currency market. But an even better example is to show what happened with the USDCAD pair by the time the price of oil dropped from the $100 levels, as shown earlier.

The pair dramatically moved higher. The impact on the USDCAD was so strong, as when the pair reached values above 1.46, Americans living near the Canadian border started buying goods from Canada as they were much cheaper due to the exchange rate differential.

Moreover, it comes as no surprise now as the sideways consolidation that followed on the oil chart is reflected on the USDCAD pair too.

Therefore, we can say without making a mistake that every trader involved in currency trading trades oil. If not directly, as many brokers offer WTI or Brent oil quotations, indirectly, via the CAD pairs.

If you add to this the fact that oil’s price is responsible for major central banks monetary policy decisions, you have the full picture of oil’s importance for all financial markets.

How to Trade Oil

As with any market, there are two ways to trade oil: one is fundamental, and the other one is technical. However, another way is to trade it indirectly, by speculating on directly correlated markets, like the CAD pairs.

Learn to Trade Crude Oil - Fundamental Analysis

From a fundamental point of view, look at changes in inventory levels. Because the United States is the largest economy in the world, and it borders Canada, a major oil producer, the inventory levels and Canadian oil shipments to America provide a powerful insight into the oil market.

Over three-quarters of Canadian oil is shipped to the United States, so a drop in inventory levels in the United States means that more oil will be imported. Hence, a demand for oil is positive for the CAD, and the CAD pairs will be among the first ones to react to such news.

Higher inventory levels in the United States, on the other hand, imply lower quantities imported from Canada and lower CAD consequently. Because the oil industry is a big component of Canadian GDP, the Canadian currency is the first one to react to such changes.

This is just an example showing how to trade oil on fundamental news. But technical analysis plays an important role too.

Learn to Trade Crude Oil - Technical Analysis

It is said that markets are efficient, and three forms of market efficiency exist: weak, semi-strong, and strong. In strong efficient markets, everything is priced in, and there’s no room for speculation. However, as we’ve seen throughout the years, successful speculation is possible, and it means the weak form of market efficiency exists.

Technical analysis uses historical prices for forecasting future ones. As we’ve shown in this article, the price of oil dropped from the $100 level after forming a reversal pattern: a triangle that acted as a reversal pattern.

Such a triangle, according to the Elliott Waves Theory, forms at the end of complex corrections, like double or triple combinations. It implies that the entire move, before the triangle’s formation was corrective so that the bigger degree cycle may be a triangle on its own or a flat.

This, again, is just an example of how to use technical analysis when trading oil. Many other indicators, oscillators, and trading theories exist.

Conclusion

The oil market is fascinating. From the times of Rockefeller’s Standard Oil to Saudi’s Aramco, it evolved into one of the most influential markets of our time.

When Harry Kissinger revealed the deal, the United States made with Saudi Arabia in the ’70s, it became clear that oil is here to stay as a critical element in the world’s balance of power. In the early 70s, the United States decided to drop the U.S. Dollar’s peg to gold. It simply let the fiat currency to free float.

With the world in shock, the United States quickly revealed the source of strong demand for its dollars: oil money. Also called petrodollars, the deal Kissinger made with the Saudis was that the Arabian oil is sold in dollars only, in exchange for military protection.

The rest, as they say, is history. Decades later, the deal is still in place, and the petrodollars are responsible for much of the economic growth the United States enjoyed all this time. And it continues to do so.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.

Congratulations @platinumfx! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!