Something happened Tuesday that we haven’t seen since December 2007. . .

The spread between treasury bills due in 5 years and the 30 year collapsed. It went as low as 96 bips, or less than 1%.

The 30 year rate is most influenced by inflation expectations. When creditors loan money out for three-decades, they need to have an idea of what their nominal and real returns will be.

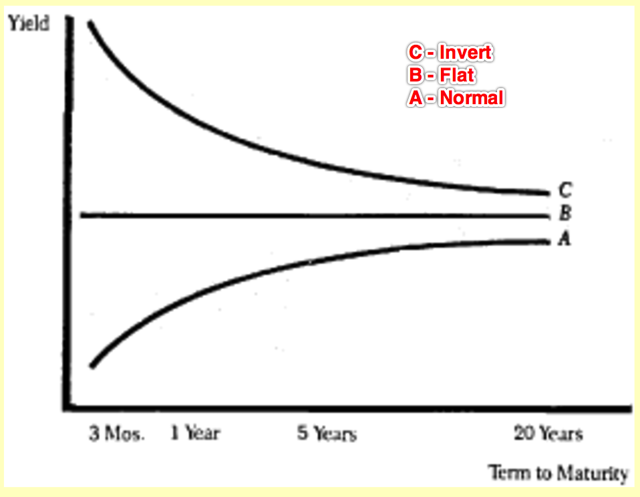

The yield curve is flattening as bond investors buy longer term paper. And the last two times this happened, the economy entered recession.

Today it is signaling deflation and recession yet again. . .

Why? What’s going on?

The Fed’s hawkishness and rush to hike is contrasting weakening inflation.

Data last Wednesday showed that the so-called core Consumer Price Index i.e. CPI, which strips out food and energy costs, increased 1.7 percent year-on-year in May, the smallest rise since May 2015 – wrote Reuters.

Chicago Fed President, Charles Evans, spoke on Tuesday in an interview that he is worried about recent inflation softness. He is skeptical the Fed will even reach and maintain its 2% inflation objective. Evans also made the bold statement that if inflation stays soft, they will have to reduce hiking aggressiveness.

“I will say that the most recent inflation data made me a little nervous about that. I think it’s much more challenging from here on out,” Evans said in an interview with broadcaster CNBC.

It appears that the market does not believe the Fed’s pro-growth hype. . .

In fact, the more the Fed boasts this extremely aggressive hawkish message, the more longer term yields continue to fall.

I wrote last week that this current pace of deteriorating economic growth, coupled with a hiking and unwinding Fed, will lead to inversion. And it appears today the market is nearing that outcome.

Yields have to be flat first before they can invert.

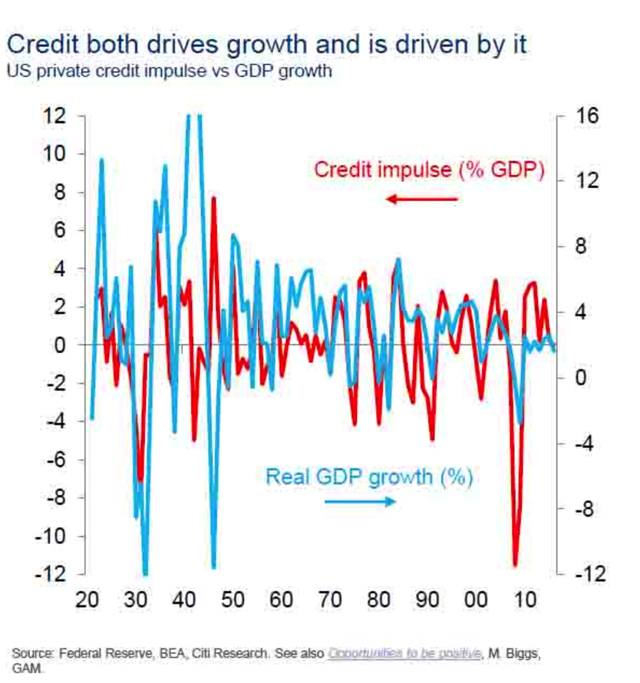

Softening inflation is only just a symptom of a deeper problem. Weaker credit growth is at the root.

UBS Bank warned that the ‘Credit Impulse Gauge’ has stalled, and rolled over. This allows individuals to track the economy’s credit creation.

And since credit drives growth in the United States, with nearly 2/3 of our GDP from consumption, we need consumers to keep borrowing and spending. The faster money changes hands, the more velocity there is. Velocity is a key input in the economy’s inflation growth.

The Credit Impulse Gauge not only drives consumers, but also drives investors as credit growth has a correlation with inflation, velocity, and therefore asset prices. The more consumers have to spend, the more corporations sell, thus higher earnings.

The dire warning the Credit Impulse Gauge tells is concerning. Not only has growth in credit stopped, but its sharply reversing. UBS said, “from peak to trough, the deceleration in global credit growth is now approaching that [which was] during the global financial crisis.”

But right now, we aren’t in a financial crisis. . .

Is this what the bond market is telling us? The economy is sliding into a recession as they chase the yield curve flat during a stubbornly hawkish Fed? That the deceleration of credit growth, softening inflation, and asset prices is entering crisis levels?

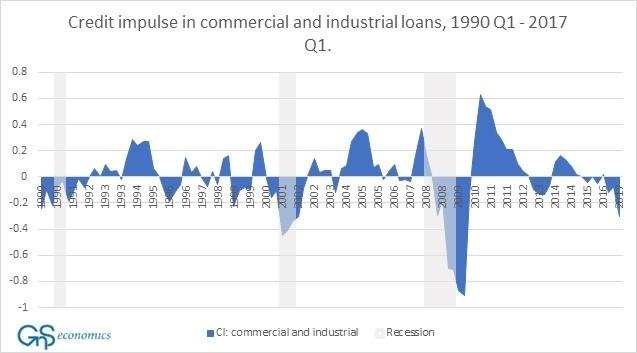

The commercial and industrial loans (C&I) are also signaling dire warnings. If the flow of credit declines, the businesses and consumers are constraining their expenditures.

The last three times since the 1990’s when C&I loans were as low as they are today, the economy was in recession.

The credit impulse in the US has also turned down, seemingly on the back of a sharp drop in demand for C&I loans – said UBS.

Everything is pointing to a massive deflationary collapse of the global economies. Decelerating credit growth, inverting yield curve, and softening inflation. After a near decade of cheap credit, the tide has turned.

Have we learned nothing from business cycle theory? Specifically the Austrian Business Cycle, which is unilaterally ignored.

What is the next catalyst that will suddenly reverse this downward collapse of credit growth? It would have to be sudden spike from inflation and growth, or a dovish Fed. And as I don’t expect the former, the Fed is the only option.

That crazy u-turn would send gold(NYSEARCA:GLD) soaring.

I expect a lag from the softening economic data which will show itself truly by year end 2017.

I wonder how the market will react then. . .

Reposted from my blog: https://lonewolf.liberty.me/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://seekingalpha.com/article/4082896-bond-market-calling-feds-bluff

The Fed has been the only thing keeping the market propped up. I think your right that we will start to see softening economic data by end of year or at least early 2018.