Sam Eisenstadt was the director of research at leading investment research firm Value Line. He retired after 63 years and over 3 decades of modeling stock market returns.

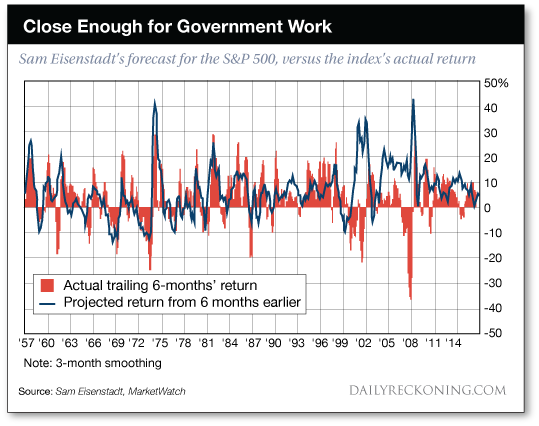

MarketWatch’s Mark Hulbert says Eisenstadt’s model ranked first in risk-adjusted performance over the three decades Hulbert tracked competing models.Between the scale of zero and one — dead wrong and dead on — it scores 0.31.

However, it seems Eisenstadt's record over the last 2 decades is not so great - he missed the dot-com crash AND the Great recession, as well as the Brexit uncertainty.

So it seems the grain of salt with Eisenstadt's prediction is that some unfortunate news is likely to derail those returns (like in '99 and '14) I'll give him the benefit of the doubt for the Great Recession - hardly anybody saw that coming.

In a year where it seems like major headlines keep getting, um, more major, I don't think this prediction will stand.

The recent snafu over the jobs numbers, coupled with not-so-distant tweets aimed at North Korea (about WW3, no less) and what I sense is increase exuberance is enough to make even Recession-experienced investors look twice.