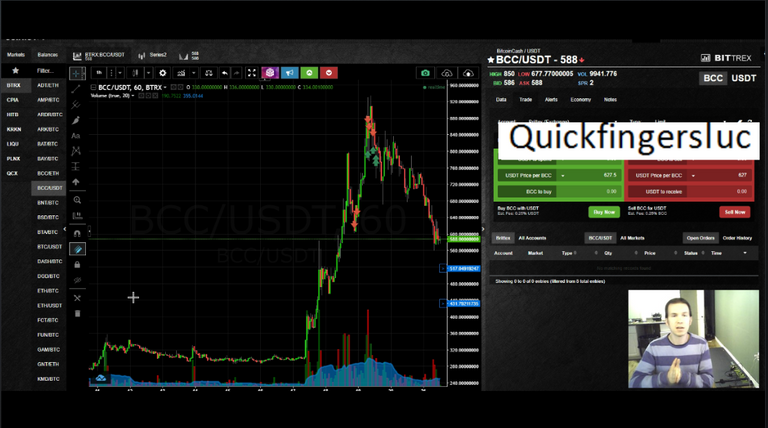

Watch Check out D-Tube and lets mark up some charts video on DTube

My first DTUBE video.. Im very excited about this newer and better YouTube. I feel very fortunate to be uploading in the first few days that DTUBE is online!!!

Here is the link to set up your Dtube: https://steemit.com/@heimindanger

Luc

@quickfingersluc some account building trades & positions:

plz make videos on daytrading, i doubt there will be a day when people will stop making mistakes with your trading style

Upvoted!! thank you for sharing your charts and trades.. awesome job.. those are great account building trades and I like how you did not get greedy, but too those profits at reasonable levels

At 4:40 you say that if NEO continues to do a "nice little pop and then comes down.." you won't be participating and it makes sense because that's not much of a panic.

So that reminds me of a trade I took on BitBay.

Luc would you have taken this trade (buying in the blue circle)?

https://www.coinigy.com/s/i/599b3316b5d53/

Luc, I'm a little bit confused with our base method now. Do we have to wait for a panic and huge dive in order to buy coins if they crack their bases? Or as @freshprince4 pointed out, is the blue circle a safe zone to buy the coin? There is no panic in this circle.

I am confused as well...

If there is a strong base (where it tests the base 4 times), like what freshprince4 posted, and it finally breaks the base. Would @quickfingersluc trade in the usual "safe zone"/blue circle?

Also, I've been noticing that your trades aren't following your usual rule, where you only trade during breaks in bases. Do you use other technical analysis to conduct those trades? If so, what sort of analysis?

Please make a video on Dtube so we can take notes and learn :)

Thank you for everything, really. You've changed my life!

Sincerely,

Frank T.

tl;dr

everything under bases is tradeable, u just get lower returns the faster u buy if u sell at base

luc prefers to trade panics that give high returns on coins that allow him to get in size

u can trade any crack or break but risks vary

how do you make the link to your chart on coinigy?

Hi Luc,

I've been thinking about your trading style and as I was getting impatient many times while practicing it because bases would just not break and I could only get in 1 or 2 trades a week or so after putting in so many hours and then I came up with a trading idea.

What if every time there's a solid base (support level), I buy and if the price goes up I set a certain profit margin, I don't get to greedy (5-10%), to guarantee a profit. If the base gets broken I use your trading style like you thought us and start buying in the safe zone. Once the price goes back to it's normal level I can break even on the amount I bought at the base (support level) and I can still profit on the money I bought in the safe zone the same way I would using only your style. But this way I don't have to miss out on low risk trades since I can most likely break-even and I don't have to wait so long for trades to happen.

The downside I see of this of course is if the base breaks but there's only a mild drop into a downtrend and the price doesn't bounce back. However, the chances of a solid support level being broken and it not being a panic seems very small to me. Thoughts?

My method of trading is by no means the only method that would be successful. There are hundreds of ways for you to take successful trades. However you have to be able to calculate your odds. Thats the key, any type method you want to develop, you need to be able to have a clear set up that you can backtest and know what your odds are.. Also, you need to know the story of the trade, in my method, (1) we wait for a base to form and qualify that base by the amount of buying or buying reaction that occured the last time that price was hit.. then we know there are buyers that like that pricepoint.. so thats our base.. we have the first piece of information in our story.. (2) Then by looking at a 1-2 month view of the chart, we can see if there has been alot of interest in this chart, if there are buyers that come in on every dip, this gives us context and odds.. (3) then when a panic happens below the base, we know why there was a panic, because all those buyers where surprised, and started to stop loss their positions.. now we know the whole story and really have the odds in our favor... Unfortunatly Patience is one of the most important skills you need to develop as a trader.

it can work but size is a problem

u will be losing profit from positions if u go in big at support

u will be losing profit from support trade if u go small at support

the base return is not 100% to exact level

there are many small cracks which dont collapse the base

Ok @quickfingersluc I did my first "day trade" last night. Everything I have done before this is buy and HODL...

I've been following a few of your recommended steady eddy charts..particularly BTC/USDT and ETH/BTC

Tell me what you think...

I placed a very clear solid base at .0786, then smaller bases at .0779 and .0750. After looking at the 2 month timeline I thought I could play off of the clear base at .0786, it did break that base and rebound making my newest base the .0750.

It never broke the .0750 base and had broken the major base and returned twice soo..... I took a gamble and bought 1.5 ETH at the Green arrow and sold at the Red.

Any advice? In the future when you place the sell limit on the graph is there a way to change it without canceling and replacing?

I'm a dentist and as we all know doctors are the worst with money so I can't thank you enough for your guidance! Hopefully one of these days my crypto investments will pay off my 330K in student loan debt!

Thanks!

David

tl;dr base is at 750 u bought the broken and returned base, and sold on another bounce which went to the same level and retested it

in position trading only first bounce is guaranteed

if u are daytrading use 5min or 15min candles and draw bases off there if you wish to use the method

Thanks nbiroz, so your saying Luc's method is really only valid on the most recent base in regards to a safe bet...when using previous bases and the retesting of those bases there is less predictability of the chart direction...correct?

the theory tells yo to care only about 1 or 2 last bases(unbroken i assume) in 2 months zoom out, and to trade panic sells. But it is your choice to trade any crack or drop you see sufficient. I am not sure how you would go about calculating your probababilities.

smaller bases are useful for daytrading where u can zoom in on 2 weeks or less chart and use 5 or 15 min candles for buying dips below these bases.

position trading relies on buying below major breaks and waiting for first bounce that almost retouches the previous base/level.

I think best to illustrate from a higher level of view shown on my pic. the yellow are better bases, and blue arrows are panic drops. Your bases you drew are ok to use, but I prefer bases with MULTIPLE TESTS. As you can see there were two tests on each of my yellow line. Your entry point (buy) seems wrong and should be on these panics where the blue arrows are, THEN sell close to the base.

The crux of this analysis tho is that these are still small percentage trades like 2-3%. I would take an even higher overview if you want the 10%+ trades.

I know this is isn't coming from Luc himself, but hope this helps

Yes thanks for the input..always helpful!

wow great info! thanks for posting this

It is a shame that dtube does not have subtitles, English is not my native language and with subtitles (although they are in English) I find it much easier.

Will you do a video on taxes someday? I find it hard to track all those small trades. Is there a software you use?

THANK YOU SO MUCH!!! Just got into cryptos this week and luckily found your videos first, watched all of them, and now all of my first 15 trades using your main method have all been significantly profitable! Whenever you get time please keep the posts coming, you're the man! I am definitely interested in learning more about your smaller position quick trade strategies. Thanks again!

Thats great to hear.. Awesome.. thanks for letting me know

Luc, loving these videos, I am not just learning, I feel motivated to keep pushing for more knowledge because of your video's. Thanks so much.

Wow, very interesting, Luc. Thank you so much for the information on D-Tube. Love it. NEO seems like a good long-term investment, as well. I like how it doesn't require developers to learn a new language in Solidity. I like having competitors in the market—makes everyone better.

Never even heard of it until now! Well definitely be signing up for this.

Hello luc

I wanted to ask you where are you making your big position trades with USD instead of USDT (i mean in which exchange)?

thanks for your time

kind regards

Hi @quickfingersluc, I am new to the trading zone, like a lot of others. I started with your videos and working through them. I am busy with the pay trade & how to use volumes on a chart video.

Quick question, might be simple, so excuse. If you work on the ETH/USDT chart, I presume you must buy ETH with USDT and not with BTC? As ETH/BTC has a different chart and thus the payout/results/gains should be different?

Great stuff Luc, and Oh man, you make it look so simple ;-).

You asked for drawings, so here mine. Been trying to score some Luc's this afternoon, but do you agree that things are kinda slow currently.

Look at this: https://www.coinigy.com/s/i/599c3805392a7/.

Are my bases correct?

Unfortunately all the buying periods were during the night, so I missed them. And this afternoon, well, look at the purple line (at the end, bit small), is A a buying spot, or should I stay up late and go for B.

PS: I do notice that it can take days to find a good spot to buy... You agree?

PPS: I have to ask, what's with the profile photograph...

Again, thanks for giving this newbie a safe way to get into this exiting new world!

Well, because it is so slow I looked at some of your older video's and picked up that I should be looking at a 2 month period and a 1h interval. So this is my new base: https://www.coinigy.com/s/i/599c582046ce1/.

I assume that one is better...

I've been trying to trade NEO for a few weeks now. I haven't really been unsuccessful, but I don't think I'm getting too far. I have about $500 worth of it because I bought it when it was only like $12. Should I just take my money out of there and try trading with Ethereum the next time it cracks its base?

What do you guys think of something like BAY as something like a small account builder? I got rid of one of my NEOs to buy some because it seems to spike up out of nowhere. I set the sell for it pretty high. I did this once before on another coin that had similar behavior and made like $40 off of it.

Another drawing. So the yellow line is - I think - the base (https://www.coinigy.com/s/i/599c7d8c2c0dd/).

Do the three fine lines at 22h20 matter? Or they lowering the base to 0.00025500, or should you ignore them?

Hey Luc. Thank you for your efforts, you have a large magnanimous heart.

Please explain the different colors in the volume area:

The Green bars mean that the buyers are accepting the price that the seller has quoted and purchasing the units that are being offered. The Red bars are the exact opposite. The size of the bars denote the total amount (volume) of such trades have taken place within that time interval.

Thanks psycho (I mean not a psycho). And the blue is average volume right?

I heard about dtube first today from you.

I can't find info on google results...are outbound links from dtube follow or nofollow?

I hope it's not like steemit where you only get 7 days of upvoting earning on articles/videos.

I really have not played with DTUBE too much yet, so I cant answer questions.. I uploaded 2 videos and havn't visited again yet.. Im just too busy

Hi Luc, great videos, very interesting! Im just in the info gathering phase before taking the plunge.

I do have one question (apologies if it seems stupid) though - I understand its generally frowned upon to leave funds in the exchange, but with some of these currencies not supported even by the likes of coinomi do you leave them in there if they haven't yet bounced back?

Or is it a question of having a bunch of different wallets to cover most of the currencies? Many thanks - once again apologies if this is a stupid question.

most of my funds are on exchanges.. thats the only way to keep up and trade them.. So I use a bunch of different exchanges to split up the risk and then I also have off exchanges in cold storage as investments..

Thanks Luc. Much appreciated. :)

I am in the same boat... I'm anxious to get started but I'm having to slog through what tools I need to even start! Heck, I'm still getting into basic things like wallets and exchanges. Luc's strategies seem easier to me than just getting in...help!!!

Oh Wow - Look at XRP/USDT on Bittrex. It has tanked and looking good to get in low... Luc, thoughts? Thanks so much!

you have to look at a 1-2 month view.. that will give you a clearer picture of where bases are

Looking at the chart, I don't think it has broken the base yet... Hopefully it continues to tank...

...and here is the chart of the trade I made - PROFIT! I'm also still holding some 'free' Ripple coins from this trade.

https://www.coinigy.com/s/i/599eed81bfb31/

Luc - Any thoughts on the best way to 'time' the top of a run up? I noticed that it a bit tricky to know where the top is and often I sell for less profit than I can. Any tips or strategy on this? Thanks so much!

Luc,

are the trading pairs important? I mean, if you see ETH dropping, I guess it drops on USD and on BTC and on EUR, and so on. Does the pair you choose to trade with matter?

I guess you should choose a "stable" currency to buy with, to avoid a crash on that one...

Regards,

—Roger

Hi Luc, wondering...What coin or Fiat do you keep your money in whilst between trades? Do you keep in BTC or transfer to USDT or..?

Thanks

Thank you for showing us a safe way to trade. I did a 20% on LSK's dip yesterday! It works!!!

thats the best way to think about trading.. keeping an eye on percentages, and not on the money.. that will help you out alot in the future when the numbers are stupid big.. its much easier to say "hey i just made 20%" than to say "i just made $10,000 off $50,000" ... the latter can be nerve racking, but 20% is just 20% and who cares about the zeros on the end of the balance..

@quickfingersluc

Thanks for the tips! Got this one at the bottom of the dip. Not sure what I am going to do. I may hold it since I have been thinking about buying this for a little while. Great videos...have watched almost all of them. Keep them coming! Link below to coinigy graph.

Matt

My Neo Position

Hi Luc, are you going to use d-tube instead of yt from now on?

Because yt has closed caption voice recognition system and d-tube not.

English is not my native language and than helps a lot, so it would be a tragedy for my if you completely swap platform.