Ill be gone for the next few days, but heres a video to answer a few questions and discuss some trades, before I leave. Thanks for watching and posting your questions and comments.

I hope you find some great trades while im gone, and I can read about them in the comments, when I get back.

Luc

► Watch on DTube

► Watch Source (IPFS)

Hi Luc,

First of all, thank you so much for teaching us your ways of trading.

I'm studying it very thouroughly and have tested it without money first and found that it is indeed an effective strategy. I've had a little experience with trading in the past but wasn't succesful, your way of trading really makes sense to me. I'm very grateful for you that you're sharing this with us.

Before I really begin this journey though, I would like to focus on the security part of it all. I've got the security part covered on my end, although I still worry about exchanges. It seems normal that once in a while an exchange gets hacked and that you can lose your funds, even though you had all the security measures in place, like for example two-factor-authentication.

Do you or anyone in this great community has any tips on how to reduce the risk of losing your funds on an exhange? I was thinking about spreading my funds over 5 or even 10 exhanges, because the change is a lot smaller that they all get hacked. I know about the security features that exchanges offer for your account, I'm just wondering if there's any particular strategy that can reduce this risk of losing your earnings on exchanges.

Btw, do you leave your funds on the exchanges? Or just a portion of it? Because I know you generally don't put more than 10 or 20% of your total holdings in one single trade. Thanks a lot!

Hi mate, I used to have the same thoughts, My way of doing it, money spread thru exchanges and plus get a wallet like ( trezor, ledger) keep money for trading in exchanges and transfer some profits to the offline wallet when you want to trade from offline wallet to exchange after profit back to offline wallet

Hi man, thanks for replying. So every time you begin your day with trading, you transfer all of your funds from offline wallet to exchange? And after you're done for the day you transfer it back to the offline wallet? That seems like a lot of hassle if you trade everyday, not sure if I understand it right tho.

Which exchange you thinking about moving over too from HitBTC?

bittrex/kraken/liqui

Dear Luc,

Another newby here finding your video very generous and seemingly a rational thing to do to make a few extra bucks - thank you!

I missed the bounce now this weekend after a long fall, and I am stuck with quite a lot of Ethers in my pocket. I did not sell off any in panic yet and have my hopes that the all the crypts are going to recover.

Or am I wrong, should we sell off some of the coins after missing the bounce, and just start anew?

Apparently everything fell (more) due to China new policies. Well, my crypto budget is blocked until the next big wave of investors appear :P

Hi Luc, you have probably heard it a thousand times. But thank you so much for your videos, I really enjoy the content and information that you are helping the community out with. Kudos to you! Just wanted to ask a quick question, I purchased (at the blue arrow) some ETH with the recent down turn and I think I miss read the top yellow base line. Or is this just an abnormal situation? https://www.coinigy.com/s/i/59ae6436a7507/

I know it was tricky, and if you were calling that 320 a base than you bought very very close to that base.. you have to refer to previous base drops and figure out what is a normal length panic.. But this was a tricky one, and I didn't trade it that well either.. I bought the 300s myself (on kraken) and sold the 320s.. not my best trade .. heres a chart

It would be great to see your video with comments on these past few days of the big fall of cryptos, especially the ETH. I trust the ETH (and everything else) will go back to a rise, but I don't trust it enough o upload extra funds and play around more after having bought 45 ETH too early :)

Thanks Luc, looking forward to more videos/content :) Cheers

It was indeed a tricky one and thanks Luc for all your content and insight. You also launched me on crypto's trading.

You said you traded on Kraken. Do you have (or anyone else in this great comunity) problems setting trade orders? I just cant get a order placed without getting somekind of error. And this already made me lose good trades...

What do you guys recommend? Im thinking of using Kraken only to make deposits, withdrawals and buy a base coin (ETH for instance) to transfer to another Exchange. Bittrex for example...

I am curious what Luc has to say as well. What I have noticed the last time things started diving begin august, is that when things are going down as rapidly as the have been in the last 24hrs, that they usually do not jump up right to the last base, you will see that in the history as well. I learned that the hard way and give myself a bigger buffer when it turns bearish like this. at least 4%. You bought at at about 3 1/2 % below. The even worse mistake I made was toughing it out, when I missed the first bounce and the second..... He does always say take the first bounce and I have also heard him say he tends to get out early. I love it when he speaks of his thought process on specific examples like this.

Thanks for the updates Luc, you're the man!

Can anyone point me in the direction of joining that slack channel please? I would love to be able to participate there as well. I've been following QuickfingersLuc for a few months now and really absorbing the base cracking method. So far I've been successful with testing my small trades and am ready to start ramping it up a bit. Thanks!

@owlien quickfingerstraders.slack.com

Would love an invite as well if you don't mind sharing. Been following the other threads but none of those links seem to work anymore. Thanks!

Follow @tizzle for updates on the slack channel invite

thank you @upsman Looks like I need an invitation, unless I'm doing something wrong. Can you provide that?

same here. my email is rick@pointlending.com

Could you add me please? novatin.laurent@gmail.com

Thank you :)

Luc, I hope your trip went well. Please invite me to your group as well. pstrzelec@comcast.net

add me too pls, watched all the videos two times over and want to keep on learning with you guys!

wedinko@gmail.com

can you add me to the slack group too please? gjohncock@gmail.com

cheers

greg j

There are no new invites at this time, we will re-open the Slack to the public soon. Sorry!

To further clarify, when we re-open the slack it will be opened to everyone. You will not need to request an invite, we will post the public link once it becomes available again. Just be patient, I'm on vacation - we will address the new public gateway sometime after I return. :-)

Good to know, thanks tizzle!

Shot dude

Looking forward joining the Slack channel...

Thanks @tizzle, I'll look out for that.

I'd like an invite as well. cryptoidloooker@gmail.com

thanks @tizzle i would love get an invite when it reopens! thank you

@tizzle I would love also to join Slack when you open it again! Love all the videos. Thanks! Been following Luc for awhile.

Hello, would also like to join, thank you

Thanks @tizzle looking forward to joining

Please allow me to join as well! Thanks for your work! nick.b.cummings@gmail.com

Thanks tizzle

Count me in, too, please! I'd love to have an invite to the channel!

@tizzle - amazing work, would love an invite once the slack is re-opened !

@tizzle would love an invite as well! matt@aatrix.com

I would love an invite when they reopen thanks!

Hi Tizzle can you add me to your list - dk@awakenewmedia.com

much appreciated

@tizzle could you please paste here your post on exchanges,which appears in top video at 16min40s please im really curious what you were saying because im from europe,thank you very much.

Luc how do u still feel about bas? its looking pretty weak today with btc and eth going up. I bought some at 44 and 38

I've made 2-3 time more than 20% and few times more than 10%

Twitch for trading. Nice!!! It always surprises me how high bitcoin has gone. Though there is a ceiling for bitcoin and if it keeps accelerating at this pace, it will reach it soon. Which is where all the other crypto currencies come into play. Can't wait for this market to evolve further.

i have been trying to get into the slack channel but need an invite to do so. please let me know who can send that invite

You really do have some excellent info on trading, thank you so much. Is there any chance I can join your slack group please? Thanks again for all your talent, amazing!

I would like to join the Slack Quick Fingers Traders too, when it reopens. Thanks. Great information, Luc! david.sunfellow@gmail.com

Thank you for your generous knowledge Quickfingersluc! Cheers!

Thank you Luc for the recent video! I am learning so much from your content. I am a nurse with no background in trading- your content is easy to learn and explanations are well worded. I am going slowly- small trades and learning "the story" on the charts. Thank you so much!

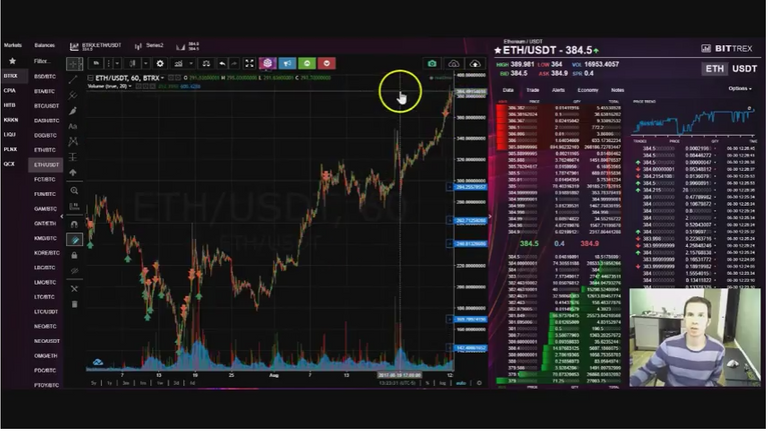

Can anyone tell me what software that was he was using for his stock trading?

https://www.coinigy.com

I believe it is the Interactive Brokers desktop trading platform (https://www.interactivebrokers.com/en/index.php?f=14099#tws-software). Assuming you did in fact mean stocks. akpme1 is right about the crypto platform.

Luc I just really wanted to thank you for everything that you have taught me, in the past 6 weeks since I started watching your videos I have generated 30 NEO coin from thin air and then bought XVG at 0.00000047 and was astute enough to read the chart and sell it at 0.00000120 - between that and buying in with my first $500 at $8 a share on Antshares (now NEO) I am sitting at close to $7,000 - I cannot thank you enough for your videos and chart analysis. All of my friends are here with me watching and playing along and I really don't know how to thank you enough. I am hopeful that XVG (that just now today hit 1 cent) will be at 1 dollar per coin by the end of the year and I will be able to trade every day for a living and it's all thanks to you!

Thank you for sharing your experiences.. That encourages me to continue making videos.. I applaud your success.. that was great start :)

they're impressive gains. I've been following along for two weeks and have won on nearly all my trades, but they're small so I haven't improved my position all that much. Hope I grab some bigger %% trades over time.

Good Afternoon Everyone. I am looking for some help. I recently started trading Crypto and thanks to Luc I am definitely learning a lot. The problem I am having is that I don't have a problem identifying "obvious" bases but I get confused when there are multiple jumps (not super significant as the base I originally found. I am including an example if someone could help I would greatly appreciate it.

The green line at the bottom is my original base but then the chart starts jumping....what is the next base? It seems like it would take a couple of days to crack my original base?

To me, the big drop and bounce on the left is an obvious solid base and as you see it drops later and rebounds to that base. Then the chart is generally going up, which we can't really trade with this method. Where your green line is a new solid base, it drops a lot but rebounds beautifully... the following drops and bounces can be bases too, but as I said it's going upwards.

So its better to trade in a downward or leveling trend versus and upward? With the exceptions of obvious large back and forth arguments.

Just to illustrate, Bitcoin has risen as you know over the last few weeks. There may be an opportunity to trade, but not as many as when it's on a downer.

Thank you very much for your responses. You have really brought it to light for me. I’m excited to go back to the charts and start anylizing. This community is great and I am glad I found it (it’s like the golden egg of information).

On a downward trend you'll see it breaking bases (support) more often, which are excellent opportunities to trade. When the trend is upwards the bases tend to not crack as often or as deep as they do when the market is going down.

Hopefully you can see what I mean there. You could squeeze a trade in if it drops below a good base with it going upwards but you're less likely to find them from what I can see...

Hello Luc

Me and one of my friends are working on a scanner and we are also programming a window to take fast trades through the API keys to be faster..

since we know almost nothing about the trading platforms and all the tools that can be used to trade, could you by any chance illustrate us through a video which tools you use on the stock market?

examples apreciated!

Thanks in advance and anyway

Frank

Hey, does anyone know how I can get an invite to the Slack channel? Thanks in advance.

Slack invites are currently on hold. The Slack guys will get back to us via this channel when it opens up again.

Hey Guys,

Luc mentioned some favorite coins in one of his videos, but I can't find it. Can someone point me in the right direction?

Hi Luc, big Fan follow you from a long time, If you have time I want to know how to join the slack channel, and please keep us up to date with your videos and thoughts all the best

Luc, good sir, I've joined Steemit to follow you. That would be a first. But your approach expresses an ideal level of risk tolerance. I admire both your discipline and experience.

I'd love to see you walk your fans through a red day. I suspect you are human. Would be nice to see evidence of this. ^.^

Not to be rude. But I'd love to see the kind of trades that would leave even Quickfingers holding the bag.

Also curious what charts you're looking closely at in this wild bull run this week.

A red day :) I really don't get those often. But yeah, it happens to me, on the stock market a few times a year.. So as soon as I have a red day again, I will mention it in a video. You may be waiting a while tho, sorry.

Hi Luc,

Thanks for all the great videos. Can you please take a look at this Coinigy chart (Kraken-XMR/USD(60).

https://www.coinigy.com/s/i/59aa0b5aea546/

I set the base and I am currently watching it to drop a bit below the base I set. Is this base set correctly?(big volume spike and a nice runup). I'm a newbie, so I have no idea if this is a great currency to trade, but the chart looks good to me .

Thanks again for the informative videos.

you have to scroll out to a 1-2month chart to spot the bases.. $125ish is a clear base, if you scroll out.. and your 138 is not a base in my opinion, therefor if you were to take a drop off that level, you would need to react very fast to the bounce, because it would be more of a quick daytrade and not a position type trade.

Hi Luc,

Thank you for the info. Based on your input, I marked up another chart (Kraken-XRP/USD(60)). I placed the questions in the chart. I know you are super busy, but if you have a minute could you critique this chart?

https://www.coinigy.com/s/i/59acdb487298a/

Thanks again.

hi velome,

I draw the lines. These are the bases in my perspective: https://www.coinigy.com/s/i/59ad32b6f2ca2/

Hi realviking,

Thanks for your input concerning the baselines. I'll take a look at your chart.

Does it Get Better, Can’t Get Any Worse

Hi Luc,

General question to all to ask if other crypto traders made stupid mistakes when first starting?

Classic newb move here. Thought I was ready; 1) Listened to the latest quickfingersluc video, 2) Read and marked up the bases on selected charts, 3) setup my alerts on Coinigy.

I decided on a stock, and set my trade. Unfortunately, the exchange was at capacity and I received error messages. Anxiously, I tried again the next day and entered my buy order. It worked. Then I realized my buy order was wrong (~20 points hire than my alert). I watched as the price dropped. Decided to sell my position since I started out wrong anyway. Took a miniscule loss since I only bought a small amount to trade. The price ended up going well above my buy price too…. go figure.

A friend told me I should take up hang gliding or parachute jumping…something less stressful. Anyway, it was fun, but time to settle down and implement what you have been saying in the videos. I know there is hope for a classic newb here.

The exchange was a capacity?? Im not sure what you mean.. You should always be able to put in your order. If you are having trouble routing your order using Coinigy A.P.I. then you can simply sign in to the exchange and submit your order that way.

Hi Luc,

"The exchange was at capacity" means that the coin Exchange support team told me that I was receiving the error message preventing me from trading because "they were at capacity". Seems odd to me too. I was not using the Coinigy API at the time. I was trading directly with my coin Exchange (ie. HitBC, Bittrex, Kraken,etc).

Can't thank you enough for making these videos. Clear, concise, and you have some great stories as well. Thanks again.

Is there anyone else having trouble playing the dtube videos?

they are all on YouTube also

Thanks for your information I've been learning a lot.

Hi Luke or maybe someone with Bot experience,

I was wondering if you or anyone else has tried an "Order bot". I am just learning about bot's myself and I dont know if a "Trading Bot" is of that much use for the way you trade, if so it would probably need some custom programming, because most of what I have seen is that they use them to trade traditional indicators and I suppose you could reverse the protections on the insurance features to purchase in panics instead of sell, but I was thinking the use of "Order bot's" could be of great value if it had features that would speed up purchasing and selling. Any thoughts?

personally I wouldn't want a computer making trades for me.. I much rather make my own decisions... I like to simply trading, so I do set alerts and wait for the chart to tell me thats its a good time to buy. But when it comes to pulling the trigger, thats me.

I understand the desire to make a program that would just generate money, and while it seems fine to let a program run with perhaps $500 in capital and see how it does, what happens when your account is $100,000 or $500,000? would you let a program buy and sell for you then?

I could have worded that better. That's not what I am looking for either.

What I am looking for is something that is more of an extended stop limit and an enhanced alert system. for example, sometimes I have orders set when I think something is going to drop, but I know I will likely not be there when it goes and dont trust that it I will be back in time for the spike, so either I risk it, or skip it, and both have cost me. In this instance it would be nice for an order bot to place a sell order, (of my choosing), for me as soon as a purchase happens. A limit stop would not help me as the current price is to high and would just trigger on the way down. I need it to trigger on the way up. I have also found stop limits to be inconsistent anyway. Sometimes there are order errors and a bot could be programmed to check if the order was actually made. Maybe there is another way to do this, but I am not experienced enough to know what it is.

I have also noticed that when I place an sizeable order for a coin, sometimes the order I placed mine just in front of, because it was also a sizeable order, jumps in front of me. This could also be a usable feature, if not just in the smaller markets. So something that can adjust orders based on order book information.

And lastly of course it would also be nice to have something scanning the market for panics and alerting me so I can make a decision on it. This is not my day job and I don't have that much time to set alerts on as many things as I would like to.

These abilities I think would allow me to be more successful with a limited amount of time, these points may be irrelevant when I am able to quit my day job, but I have not reached that point yet and I think even if were doing this full time it would be nice to have some of these features, if they worked consistently of course.

Luc,

I feel I have been spinning my wheels and getting impatient. Perhaps paralysis by analysis. I have been reading and watching everything here to learn more. I understand the ideas of finding broken bases and finding good account building charts.

My question is, if you were me, with a $350 balance (hoping to add $1300 of funds to that soon) what would you do to build up your account? Stick to just 'account' building charts with big swings? Also how would you split your bank doing that, 10% per trade and hit 10 different charts (that are good)? Or 20% and do 5 charts?

It's funny... I've done a number of trades, some successful and some I got impatient and exited. Then not too long after, POP, hits the base... I need to be more patient!! I think it's difficult with low funds as it all gets tied up and then you spot nice opportunities...

What Exchanges do you trust?

I love Bittrex, Kraken, Hitbtc, and Cryptopia, those are my favorites.. As far as trust, I dont trust any of them.

https://themerkle.com/tether-issues-an-additional-20-million-usdt-unexpectedly/

yeah, I noticed that news.. I'm glad I got rid of most of my Tether already.. Fishy business..

If your not using Tether now, which base coin are you using to trade in and out of ETH and BTC for the bigger trades?

Im still using Tether.. but not as big, I have other accounts where they use actual Fiat, instead of Tether (kraken for example) but in the exchanges that use Tether (bittrex for example) I dont keep very much funds, to limit my exposure.

Hi Luc,Thank you for all the great content,that you put out! I have one question,something that you didn't mention in any of yours videos,how do you keep your coins safe,and what is the way you are using to buy Bitcoin,Etherium,i know that is a rookie question but if you can answer that would be awesome.Thank you!

keep my coins safe?? I have many different exchanges, so that no one exchange fail will hurt me too bad.. and when I can I send some coins to wallets.. But you cannot really ever be totally safe.. Its risky here in crypto, but with high risk comes high reward.

Hello, I understand the principle of looking at charts with 1hr candles, and that make perfect sense to me. What I am wondering is when placing a buy on the down move , do you look at a shorter interval candle so that you have a better chance at buying at a lower level within the hour?

Hi! What is the order of videos to watch?

Bottoms up! They are chronological by date. I would just work your way up from the bottom (at least one per day) and keep an eye out for new content up top. They are all very rich in content and so are the comments.

Couple questions for you @quickfingersluc ... Do you adjust your approach at all depending on uptrend/downtrend?...as cracks are much more likely to happen in a downtrend...but it's a downtrend...do you play it tighter? Do you use fibs at all to gauge a likely target for a crack? I've been playing around with fib-trend extension, and it's been surprisingly useful in combination with your trading style....particularly the .272 and .414 extensions. On a respectful chart they've been incredibly reliable for setting my buys before the crack even happens. Uptrends I find more difficult to apply your style. I find that many times I miss out on tasty profits because the crack just doesn't happen. It continues to build new support on previous resistance levels as it uptrends. Sorry for the wall of text. Thanks so much for your time. One of my favorite follows out there.

Just found you, since im started to trade manually (although considering buying a bot), followed :)