With the blockchain technology that is one of the biggest innovations that have given us technological advances and the Internet, cryptocurrencies have begun to enter our lives. In this article I will try to introduce the Distributed Credit Chain project.This project, in short, is to create an ecosystem on blockchain with the entire services of the sector finances. The main objective of the DCC project is to provide a decentralized banking platform for financial service providers. For most more detailed information, visit its official website: http://dcc.finance/

The current system of financing is not so effective because of its structure that depends a lot on the supports of the very large institutions with very high commissions . This does not allow the system to develop or allow very small transactions.The DCC project, in contrast to the quite centralized systems, provides the services with many advantages for the aspects of cost, efficiency and profit. When you see the closest project to understand the main ones to solve problems of the financial world by blockchain, six major pillars increase the standing project.

Six pillars are;

- Those who give loans;

- register the system with certain conditions to comply with the authorization of the data service provider.

- The data service provider;

- saves all the personal data that is integrated, on blocks within blockchain.

- The algorithm and computing service provider;

- to extract characteristic information from the data so as not to be deceived.

- The credit history information;

- to evaluate those who ask for loans.

- The providers of the fund;

- who provide loans through the system.

- The institutions take the risk;

- for the operation of the credit unit.

Consider the main problems of this field:

- High interest rates.

- Collect documents that do not guarantee your crediting.

- Hidden items in the contract, under which the payment for a loan goes more than it is supposed to. T

- ime to review and approve the issue of a loan to you.

- Additional items that artificially overstate the amount claimed. The solution of this problem is the Distributed Credit Chain (DCC) project.

The solution of this problem is the Distributed Credit Chain (DCC) project.

The Distributed Credit Chain (DCC) project is a fully decentralized platform, whose team has set a goal to lower lending rates and drive out the traditional lending system. The application of blockchain technology will give the project complete security, the confidentiality of all data and the speed of all processes.

Smart contracts play an important and fundamental role in the project. Thanks to them, there is no need to collect a package of documents and go to banks to apply for a loan, everything will be automated. Regulating all processes, blockchain will process all data. This will give a full guarantee of the safety of personal data and the inability to change them. The main payment tool of the project is the DCC token, thanks to which all operations within the platform will be performed. 1.png What problems in the sphere of lending are solved by the project Distributed Credit Chain: The problem of centralization and monopoly in the traditional financial industry. Pricing policy will be determined directly by the market, and not by intermediaries and speculators.

A complete guarantee of the safety and storage of personal data that only the client of the project will be able to view. The introduction of blockchain technology and AI organizations that issue loans will be able to better control risks. The credit rating will be available for all market participants, and a credit history for borrowers. The user account authentication system will be implemented using DCCID.

This identifier connects the DCC account (loan request, loan, repurchase information) to the client's real capabilities (name authenticity, bank cards and property).

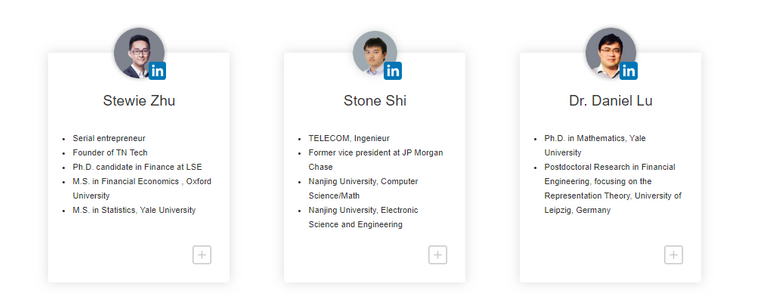

The Project Team:

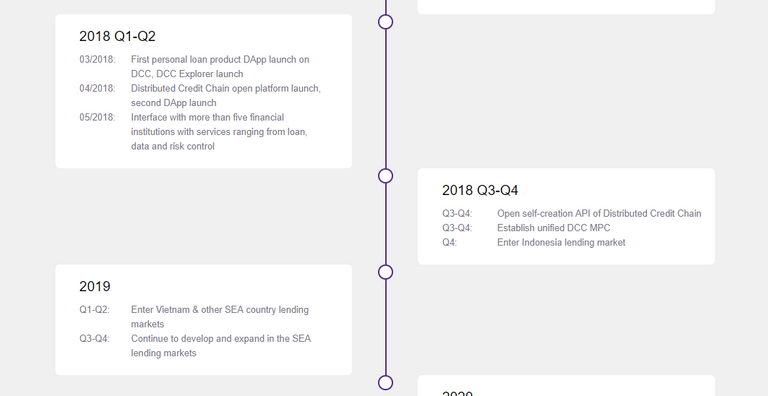

The Road Map:

The conclusion

Of course, the project has a good future. To date, it is very difficult to obtain a loan and overpayment for the period of its repayment is in most cases from 80 to 100% of the loan amount. The Distributed Credit Chain project completely changes the traditional financial industry, and I wish them great success in this.

References:

https://www.facebook.com/Distributed-Credit-Chain-425721787866299/

https://medium.com/@dcc.finance2018

https://www.reddit.com/r/dccofficial/

https://twitter.com/DccOfficial2018/

https://github.com/DistributedBanking/DCC

https://bitcointalk.org/index.php?topic=4185316.0

http://dcc.finance/file/DCCwhitepaper.pdf

Author :

rajee89

https://bitcointalk.org/index.php?action=profile;u=1540706