5 minute read

A Game of Disruption: Blockchain and the World of Accounting

This will be the first installment in a series of discussions surrounding readily disrupt-able industries and the coming advent of blockchain technology. If you would like to see posts about a specific industry please let me know in the comments below.

When one thinks of the strong suits of a technology like blockchain and the applications that will be developed on top of it, the most broadly recognizable paradigm shift appears and can be defined simply: transactions.

According to Visa over 150 million transactions occur a day on VisaNet. When taking into account the number of card providers that exist and the number of unbanked individuals around the world today (transacting in cash), it can be estimated that there are easily more than 1 billion transactions occurring worldwide on an average daily basis. I’ll let that sink in for a moment while you consider the sheer number of daily transaction that might occur in 10 years, or in 100 years, as our world population continues to grows.

It becomes even more daunting when we realize that our current methods of transacting are outdated, archaic. In fact Double Entry Bookkeeping was first used in 1340 in The Republic of Genoa and not much (save electronic records) has changed since. Credits and debits are still done as an ‘after the fact’ recording of the happenings in a transaction.

Enter Blockchain

When discussing blockchain technology you will often hear people say it is the biggest advent in technology since the dawn of the internet. While I believe this is true I also believe it goes further than that, in fact I believe it goes all the way back to 1340’s Genoa and the first use of the aforementioned Double Entry Bookkeeping. Let me explain.

Not only does blockchain provide us a cheap method of moving money, it changes the process of transactional bookkeeping from ex post facto into a concomitant component of the transaction itself. More simply put, it brings the business layer and the financial layer onto the same floor of the metaphorical building.

The Old Way of Doing Transactions

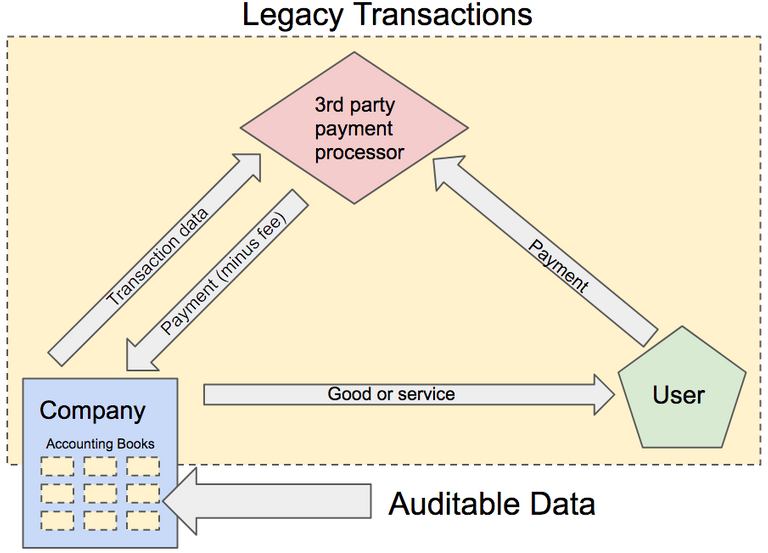

Current ‘legacy’ transaction systems require the use of a third party payment processor in order to complete your business. This third party takes a small fee and in return handles the payments of customers. All of the related data from the transaction is recorded by the company into their accounting ledger and at some later date accountants go through everything in order to determine taxes that need to be paid, ratio calculations pertinent to company projections, and more. The company may also perform an internal, or bring in outsiders to do an external, audit or the process of making sure everything on the books lines up with the way the company is supposed to operate. The sheer number of intermediaries needed for this process increases cost and decreases security of each and every transaction.

The New Way of Doing Transactions

Transactions in the blockchain on the other hand are more efficient, and more secure. A contract is created upfront that lays out the way the transaction will take place going forward. A trustworthy company will have had someone audit this contract before its deployment in order to fix any security or logical flaws. The contract will be viewable by any party about to enter into it, and if on a public blockchain, by anyone exploring the chain. Information in this system will be verifiably correct (as entered) and unalterable.

Inherent Issues

When it is brought up that the blockchain is verifiably correct some people will take issue. Points about human untrustworthiness will be thrown into the mix, and they are valid. However, valid as they may be in relation to blockchain they are equally as valid in our current systems. Blockchains strength is in the fact that once something is said, it cannot be unsaid. Books have always been cooked and they will continue to be, blockchain just guarantees that books cannot be cooked after the fact.

____________________________________________________________________________

As always please vote comment and share if you found this post useful or interesting. I'm always open to criticism and discussion and love a good discourse.

Links to some of my other writing:

Blockonomics: Real World Value in a Virtual Environment

Are You an Investor or a Speculator?

Keep an eye out for future posts by hitting the follow button or signing up for my email list at Aloa.io

Both the Blockonomics and Game of Disruption posts will be serial in nature and I am planning a number of other series posts that will be starting soon.

Best Wishes and Happy Steeming,

Mason

Congratulations @crypto-mason! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGreat article! One thing I didn’t quite understand though was what you were implying about the “inherent issues” of “human untrustworthiness”. What’s an example of how someone could abuse the system you described?

I appreciate the question! An example of abuse would be an incorrect accounting. For example if someone recorded that they had mailed 5 physical units of a product when in fact they had mailed none this would be an abuse of the system, but an abuse that could happen in our current systems also. Best,

Mason