Image Source

Due to the many risks associated with using centralized cryptocurrency exchanges (CEX) one would wonder what steps have been done by CEX operators to mitigate them. Truth be told many CEX operators have been seeking ways to ensure that the funds that have been entrusted to them are safe.

One simple but effective way of securing customer’s funds is putting them into Cold wallets and leaving only a small portion of the digital assets online. It has been described as the most secure way to store cryptocurrency.

In fact, one of the largest exchanges in the world, Coinbase, use a large quantity of cold wallet to safeguard user’s assets. But what actually are cold wallets and how does it work?

Cold Wallets

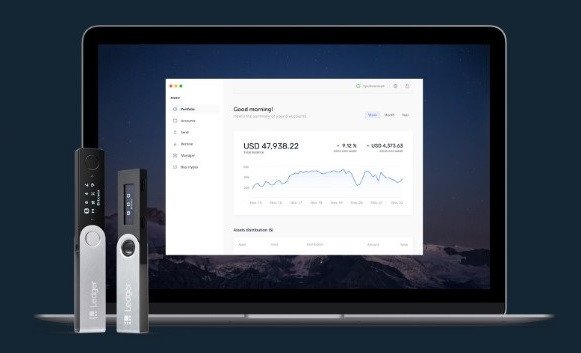

To simply put, cold wallets are wallets that are offline. In most cases, they take the form of hardware wallets. The most popular brands are Trezor and Ledger.

Hardware wallets have become a necessary security measure, especially when dealing with large amounts of cryptocurrencies. The act of moving cryptocurrencies offline means that there is no way to access them online.

In the case of hardware cold wallets, transactions are usually triggered and authorized with a button found on the physical hardware wallet itself. This means the only way to trigger a transaction is to have physical access to the hardware cold wallet.

Generally speaking, any wallet that has their private keys stored offline are called cold wallets or cold storage wallet.

Hence a better definition of cold wallets are wallets or accounts whose private keys are stored offline and cannot be opened without the access of these private keys which in turn, might be stored in different mediums.

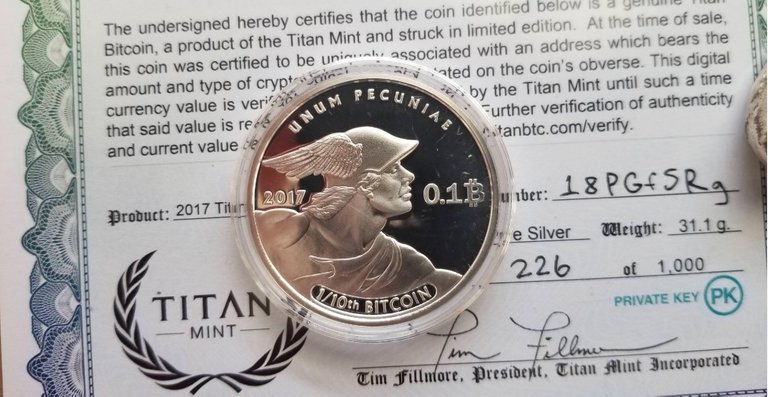

These include hardware wallets like the one we have said earlier, specialized USB drives, paper wallets, NFC chips or even real coins with embedded private keys.

Image Source

Hardware wallets have additional security features such as pin codes and specialized chipsets that ensure data cannot be easily hacked.

Special types of USB drives are also used in combination with strong encryption such as FIPS-140 USB drives with AES-256 encryption technology, they are in turn stored in safety deposit boxes or bank-grade vaults.

A paper wallet is another cold storage wallet solution, private keys are printed on paper or any printable, stampable, etchable or engravable medium.

NFC chips have been used to store private keys as well embedded in various devices even real coins.

Insurance

Aside from keeping users funds in cold wallets, some CEXs have started ensuring funds of their customers. Some of them self-insure like Binance’s much-touted SAFU program which allocates 10% of all trading fees in the platform only to be used when user funds are in trouble.

Coinbase and Bittrex also started to insure the funds of their customers. According to Coinbase, the insurance policy covers any losses resulting from a breach of Coinbase’s physical security, cybersecurity or employee theft.

Bittrex, on the other hand, obtained $300 million in digital asset insurance against theft or collusion for cryptocurrencies in cold storage.

Image Source

The point of having private keys offline is to ensure that no other person or any entity has access to them except for their rightful owners. While it is true that the use of hardware wallets increases security from outside risks but it does not remove the fact that if they are on Centralized Exchanges there is still the custody issue.

CEXs will have complete control of their client’s assets and will have the capacity to even restrict access to users of their own digital assets. Moreover, Insurance will not cover risk brought about by the CEXs themselves such as opportunity cost or price volatility due to down-time or technical difficulties

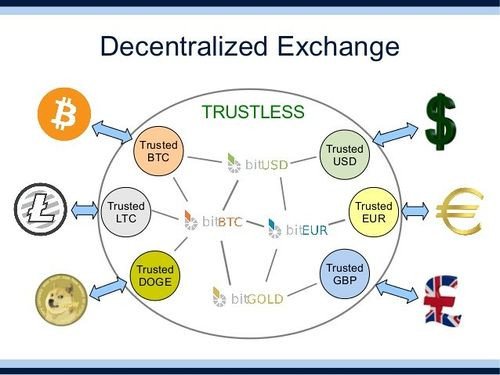

Fortunately, there is a better way to trade, one that does not involve losing custody of digital assets which aligns better with the ideals of decentralization.

Image Source

Decentralized Trading

Throughout cryptocurrency’s first decade of existence, centralized exchanges have been the weakest link in terms of security as they serve in many instances as the main conduits of attacks and risks.

Decentralized Exchanges (DEX) have become a viable alternative to centralized exchanges where users have full control of their digital assets. This was made possible by allowing users to directly trade from their wallets.

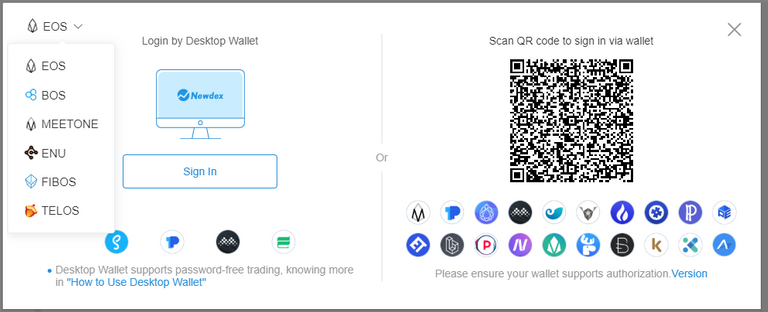

DEXs like Newdex do not require a user account system which means customers are not required to deposit or withdraw their assets to trade.

Most wallets used to login Newdex have hardware wallet connectivity function. This means that you can connect these wallets to a hardware wallet like Ledger and be able to use them to interact with the desired blockchain.

Image Source

One such wallet is Scatter which allows users to interact with the EOS blockchain. Another wallet is Tronlink which does the same.

By using these wallets, traders can enjoy the inherent advantages of using decentralized exchanges and leverage the additional layer of security of using hardware wallets.

Risks on Centralized Exchanges

Centralized Exchanges will not go away anytime time soon, they do play a major part in the whole cryptocurrency ecosystem. Moreover, they have also been looking for ways how to secure their customer’s funds while navigating the regulatory environment where they operate.

However, while CEXs increase their security measures, bad actors have been increasing their level of sophistication on how to exploit security gaps in these exchanges. Furthermore, none of the discussed CEX security solutions guarantees against itself if it acts against the interest of crypto holders.

Image credit: LuckyStep48 | Getty Images

The only way to circumvent exchange operators from acting against the interest of its users is if they are not given the chance to do so. The best way to do this is if we don’t allow exchange operators to take custody of our funds.

Decentralized Exchanges

This is only possible in a decentralized exchange setting where digital currencies never leave the custody of the customer. In this way, traders need not trust the exchange operator and are ensured that the transaction will push through, be confirmed and finalized guaranteed by the blockchain itself.

If you are a new trader or new to the cryptocurrency trading it is in your best interest to look into decentralized exchanges (DEX) and learn how to use them. There are many decentralized exchanges out there and they support a wide range of blockchains.

I have previously written an article in Hackernoon about non-custodial exchanges discussing how it works as well as a step-by-step tutorial on how to create a wallet/account for free and how to connect it to a DEX.

For demonstration purposes I used Newdex as an example as it is the biggest DEX in EOS and allows CPU resource free transactions. It is also perfect for new traders as it provides limited resource free transactions.

Choosing which DEX to use is primarily the choice of the user. The biggest DEX market right now is the ETH ecosystem. However, it is hounded by scalability issues and expensive transaction fees especially when its network is congested.

EOS, on the other hand, has feeless transactions and a highly scalable blockchain. This means there are lesser risks associated with transaction fees and latency issues, enabling better trading opportunities for traders.

The feeless transaction mode of EOS is a perfect match for new traders who want to gain experience decentralized trading without too much expense.

So are Centralized Exchanges (CEX) doing enough to safeguard customer assets? The short answer is no, not yet. Despite their best efforts, there are simply inherent risks associated when using centralized structures. Decentralized trading is widely considered as the future of crypto exchanges and DEXs are leading the way in realizing this.

This is perhaps why some of the biggest and most established exchanges in the crypto industry have begun exploring decentralized exchange services for their customers, which is a clear indication that DEXs are indeed the natural evolution of cryptocurrency exchanges.

The above article is a commissioned work for Newdex. I was tasked to write a comparative article between Centralized Exchanges and Decentralized Exchanges. Total creative freedom was given to me. All the information stated above came from my own research and statements are of my own opinion based on my experience and knowledge. It has not been edited by Newdex or any of the aforementioned projects in the article

Originally published in Hackernoon.