| Dear Hiveans | Liebe Hiver | Queridos Hiveanos |

|---|---|---|

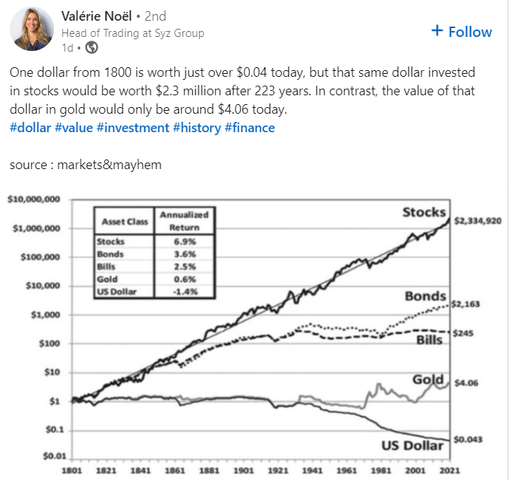

| Some days ago I saw the following tweet with a comparison of the price development of different asset classes. | Vor einigen Tagen sah ich den folgenden Tweet mit einem Vergleich der Kursentwicklung verschiedener Anlageklassen. | Hace unos días vi el siguiente tuit con una comparación de la evolución de los precios de distintas clases de activos. |

| In my opinion the simplistic message that over the long term stocks are the best investment and better than gold is wrong, on multiple fronts. | Meiner Meinung nach ist die vereinfachende Botschaft, dass Aktien langfristig die beste Anlage sind und besser als Gold, in mehrfacher Hinsicht falsch. | En mi opinión, el mensaje simplista de que a largo plazo las acciones son la mejor inversión y mejor que el oro es erróneo, en múltiples frentes. |

| First, which stock did you buy in 1800 that is still around? Right, none. If you did that (and would still be alive to witness it), the company would be gone and your stock would be worthless. | Erstens: Welche Aktie konnte man im Jahr 1800 kaufen, die es heute noch gibt? Richtig, keine. Wenn Du das getan hättest (und heute noch am Leben wärest, um es zu erleben), wäre das Unternehmen verschwunden und Deine Aktien wären wertlos. | En primer lugar, ¿qué acción compró en 1800 que aún exista? Exacto, ninguna. Si lo hicieras (y aún estuvieras vivo para presenciarlo), la empresa habría desaparecido y tus acciones no valdrían nada. |

| Second, well-diversified funds (e.g. ETFs) didn't exist back then, and the variety of stocks was very limited. | Zweitens gab es damals noch keine gut diversifizierten Fonds (z.B. ETFs), und die Auswahl an Aktien war sehr begrenzt. | En segundo lugar, los fondos bien diversificados (por ejemplo, los ETF) no existían entonces, y la variedad de valores era muy limitada. |

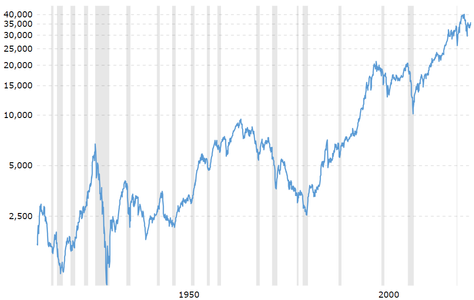

| Third, how much does this ultra-long-term view help a person that invested at the end of the 1920s, after which it took the stock market 30 years to recover (see chart below)? | Drittens: Wie sehr hilft diese ultralangfristige Sichtweise einer Person, die Ende der 1920er Jahre investiert hat, wonach der Aktienmarkt 30 Jahre brauchte, um sich zu erholen (siehe Grafik unten)? | En tercer lugar, ¿en qué medida ayuda esta visión a muy largo plazo a una persona que invirtió a finales de la década de 1920, tras lo cual el mercado bursátil tardó 30 años en recuperarse (véase el gráfico siguiente)? |

Dow Jones - DJIA - 100 Year Historical Chart  source

source

| Every stock, bond or bill that existed in 1800 is worthless today. Real assets like gold or real estate, however, increased in value (though with ups and downs, e.g. gold strongly down between 1980 and 2000). | Jede Aktie und jede Anleihe, die im Jahr 1800 existierten, sind heute wertlos. Reale Vermögenswerte wie Gold oder Immobilien haben dagegen an Wert gewonnen (wenn auch mit Höhen und Tiefen, z.B. Gold zwischen 1980 und 2000). | Todas las acciones y bonos que existían en 1800 carecen hoy de valor. Los activos reales como el oro o los bienes inmuebles, sin embargo, aumentaron de valor (aunque con altibajos, por ejemplo, el oro bajó fuertemente entre 1980 y 2000). |

| This is not investment advice, neither against stocks nor for gold, but a reminder that markets can be very volatile and nobody can foresee the future. | Dies ist keine Anlageberatung, weder gegen Aktien noch für Gold, sondern eine Erinnerung daran, dass die Märkte sehr volatil sein können und niemand die Zukunft vorhersehen kann. | Esto no es un consejo de inversión, ni contra las acciones ni a favor del oro, sino un recordatorio de que los mercados pueden ser muy volátiles y nadie puede prever el futuro. |

Have a great day,

zuerich

So it's all the better that today and in the future there is the opportunity to invest in the stock market in a broadly diversified way and benefit from the long-term growth of the best asset class. 😉

And you also have to keep investing in real estate to maintain its value. Hardly any property (apart from just the land) from the 1800s is worth the same today without maintenance.

Indeed, just owning land without managing and taking good care of it is practically worth nothing. All the best! Very well pointed!

Yes, land is scarce, buildings are not.

Concerning your first statement, I would still not fully agree. But I'll write a second post about that. Have a great day, and thanks for your comment!

Of course, you are right @zuerich

As humans we can never truly predict the future. So when we make investment decisions, we should always remember this.

Luck and risk has to be taken into consideration when dealing with something as volatile as the market.

Thank you for sharing.

I don't know much in this area, but for me there is so much wealth accumulated in a few hands that it is always easy for them to manipulate it.

That is also true!

They say it themselves, you just have to look at The Economist magazine, 90% of the accumulated wealth is owned by less than 1% of the population, they have more money than nations.

That's very sad... Yes, I heard this before... And very unfair at the same time. What I heard was something like 1 or 2%, but, regardless, it's still approximately the same. That's shocking, actually...

That's right, number more numbers less!!

I wouldn't care if all that wealth had been created with one's own and legal efforts, that would most likely be done maliciously.

greetings

Indeed, something is very fishy about that 1% and their enormous amount of wealth. Greetings!

Indeed 😇

I bought Decode Genetics in the early 2000s. I invested more than $1,000. I thought, what a great idea. And, Iceland. That seems safe. I like Iceland. In 2009 Decode went bankrupt. My stock was worth $0.00. Today, Decode is operational, and the founder of the company is at its head. Somehow, I lost my money but he came out of it fine.

Taught me a lesson. I don't understand anything about stocks or investments and I can't play with the 'big boys'. They will always come out on top.

That wasn't my only disastrous venture in investments, but one that is tinged with a certain irony (i.e., they are in business and doing fine)

Oh, that's very unfortunate.

I had some bad experiences with crypto, e.g. I took part in an ICO, send some money there, but the ICO never took place, and there were no coins to be distributed.

I wouldn't have expected this regarding Iceland or deCode Genetics. Aren't they quite reputable there? Their studies are very interesting and fascinating with respect to the Gaelic origins of the Icelanders. I know because I blogged about this in one post on one of my websites. I am very sorry for your loss, that was not nice at all... And it's even more nastier that nothing was done about it and that the founder of the company who is at its head is pretty much unscathed. That's not fair... But then again, stocks and this sort of global economy with many ups and downs and various financial crises is not fair at all! All the best and plenty of success both here on HIVE and outside of it!

I wouldn't have expected it either. That's why I invested :) I liked the idea, thought it was quite good. Apparently it is. But, when it comes to investing there is more involved and I don't know enough to play that game. Could have been worse. I only invested what I could lose (although that always stings).

I still love Iceland 🌼 Thanks for the comment.

Yes, nasty economic things can happen... Way too bad, all the more from a rather reputable company involved in genetics. I also love Iceland! It's a great country with wonderful people! A cradle of literature and art, unique and very beautiful in its own way! Great sportsmen from there as well! Additionally, stunning landscapes! All the best once more!

The best is to have all (Real state, gold, bonds, Bitcoins and cash)

Yes, that's a reasonable approach.

That's a very good and reliable combination. I'd also add Ethereum or another powerful cryptocurrency out there. All the best!

Da ist was dran, die Betrachtung ist zwar theoretisch richtig aber praktisch ergeben sie gewisse Probleme.

Das ist so, ich denke auch. Immobilien und Bargeld oder Gold sind weitaus wichtiger als Aktien. Alles Gute!

Very well and wisely said indeed! Gold and real estate will always value more because they are there, they are physical. Stocks are very volatile and so are both fiat and crypto currencies, especially in rather foggy economic times as the ones we have been living since late 2019 onwards.

I feel the best approach would not be straightforward investment but rather a thorough analysis of all markets beforehand as stocks fluctuate drastically from day to day. And if you really want to invest, always start small in the beginning. This is a great economic strategy to try out the terrain, so to put it. Or, in other words, to basically see where we are at economically, i.e. if it's even well worth investing in the long run even with a small sum of money. The very same goes for stacking, in my humble opinion.

Thank you for writing and sharing this post as well as for your constant support! It means enormously to me! All the best and plenty of success here on HIVE and outside it! Alles Gute!

Have a great day too.

!LOL

lolztoken.com

When I see food I eat it.

Credit: happyme

@zuerich, I sent you an $LOLZ on behalf of holovision.cash

(1/10)