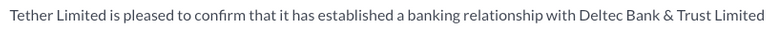

Tether Unlimited has struggled for weeks with their banking relations. But on the November 1, they announced the establishment of new banking relationship with Deltec Bank & Trust Limited from the Bahamas.

Even though Deltec is a 72-year-old financial institution, rumors started circulating about it being on the warning list of Central Bank of the Bahamas.

Central Bank occasionally updates its “blacklist” in order to alert the public. Those listed are operating in breach of the laws of the Bahamas since they are not listed under the Banks and Trust Companies Regulation Act.

So, Is Tether’s Deltec Bank on the Warning List?

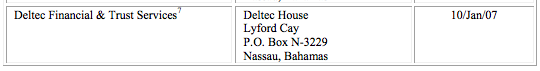

The entity called Deltec Financial & Trust Services has been on this list since January 10, 2007.

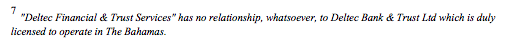

However, if we take a closer look at the footnote it becomes clear that Deltec Financial & Trust Services and Deltec Bank & Trust Limited are not the same entity.

To further address the possible confusion caused by the similar name, Central Bank notes that Deltec Bank & Trust Limited is licensed to work in the Bahamas.

Nevertheless, both of the entities seem to reside at the same address in Nassau. This makes Central Bank’s statement: “has no relationship, whatsoever” a bit too strong.

Are There Other Issues?

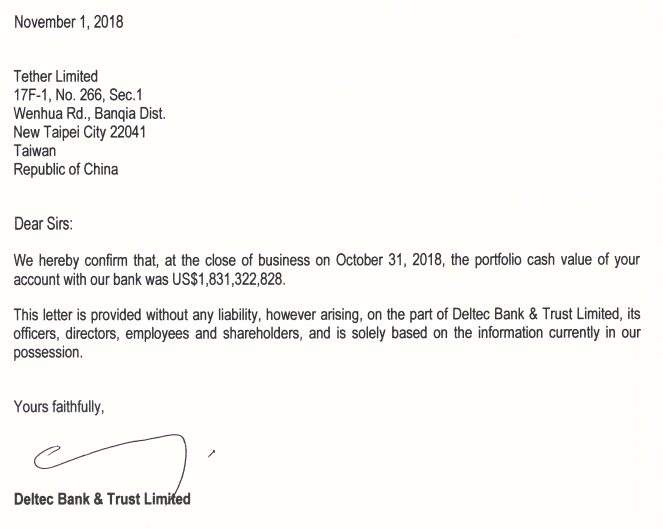

Together with an announcement, Tether Unlimited shared the letter from Deltec Bank. In the letter, Deltec states that Tether Unlimited holds over $1.8 billion at their bank, which covers the current balance of USDT.

However, it is noticeable that the signature on the letter is not attributed to any particular employee of the bank. Usually, letters of this kind have a printed name and the position of the employee who signed it.

Coined Times has sent an email to Deltec Bank, asking them to confirm the authenticity of this letter. They’ve also asked them to clarify their standard procedure for signatures. However, Deltec Bank has not answered before the publishing of this article.

The article https://coinedtimes.com/is-tethers-new-bank-blacklisted-by-central-bank-of-bahamas/ will be updated when Deltec Bank answers.