Daily Technical Analysis Summary for Decred — 3rd September 2018

Welcome to the Technical Analysis Summary for Decred — 3rd September 2018.

This report investigates 4 popular technical analysis indicators:

- Moving Average Convergence Divergence

- Relative Strength Index

- Aroon Indicator

- On-Balance Volume

The above indicators are used in technical analysis as tools for forecasting the direction of prices through the study of past market data, primarily price and volume.

They are based on the idea that the market for buying and selling digital currencies is not efficient and historic prices can be used to predict future price movements, and using these tools can be advantageous to investors and traders.

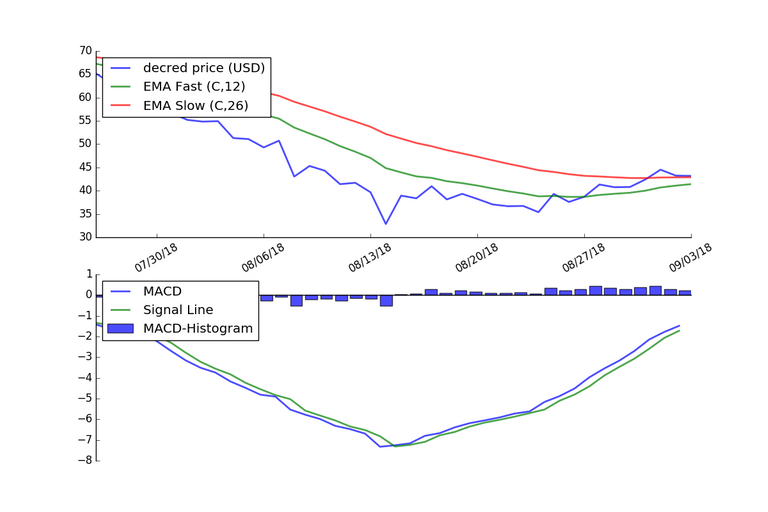

Moving Average Convergence Divergence (MACD)

The graph below shows the MACD applied to the price of Decred using daily price data for the last 40 days.

As shown in the chart above, the MACD is currently above the signal line, implying a bullish signal, indicating that it may be an optimal time to buy.

According to the MACD, a bullish signal suggests that the price of the asset is likely to experience upward momentum.

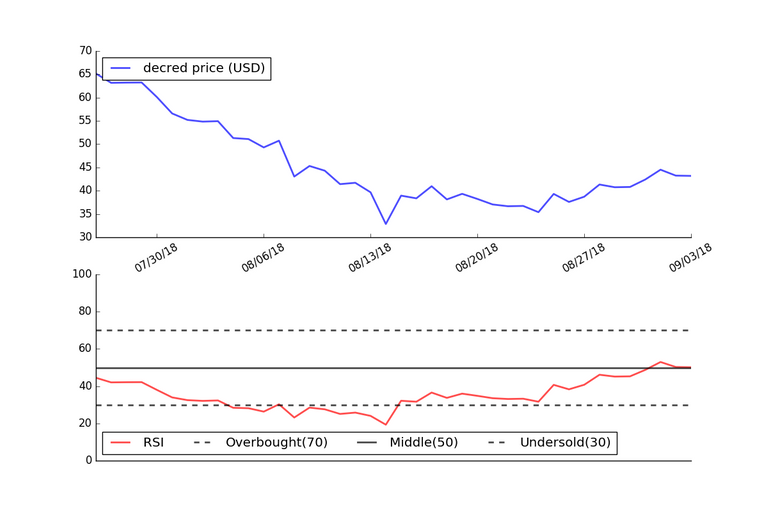

Relative Strength Index (RSI)

The graph below shows the RSI applied to the price of Steem based on daily price data for the last 40 days.

Since the RSI is currently between 30 and 70, this would indicate that Decred is neither overbought or oversold and that no material price change is expected.

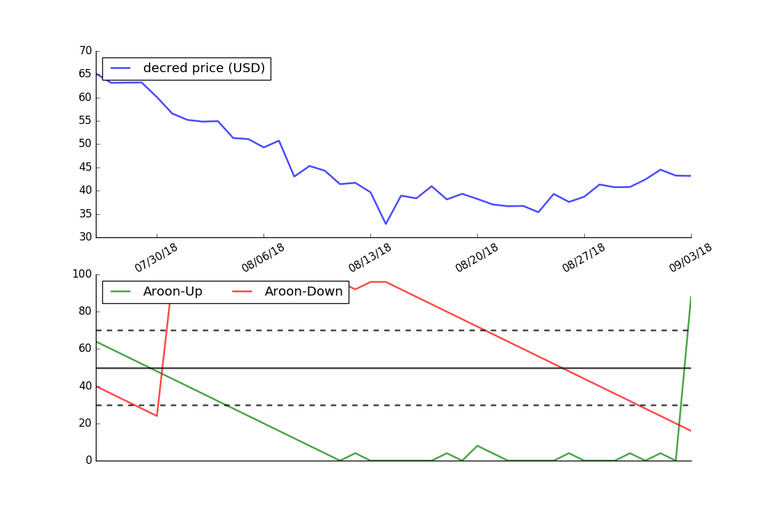

Aroon Indicator

The graph below shows the Aroon Indicator using the price of Decred over the last 40 days.

The Aroon indicators move above and below the centerline (50) and are bound between 0 and 100. These three levels can be explained as follows: When the Aroon-Up is above 50 and the Aroon-Down is below 50, the bulls have an edge. This indicates a greater propensity for new x-day highs than lows. The opposite is true for a downtrend. The bears have an edge when Aroon-Up is below 50 and Aroon-Down is above 50.

In the graph below, the Aroon-Up is above 50 and the Aroon-Down is below 50 indicating a bullish signal.

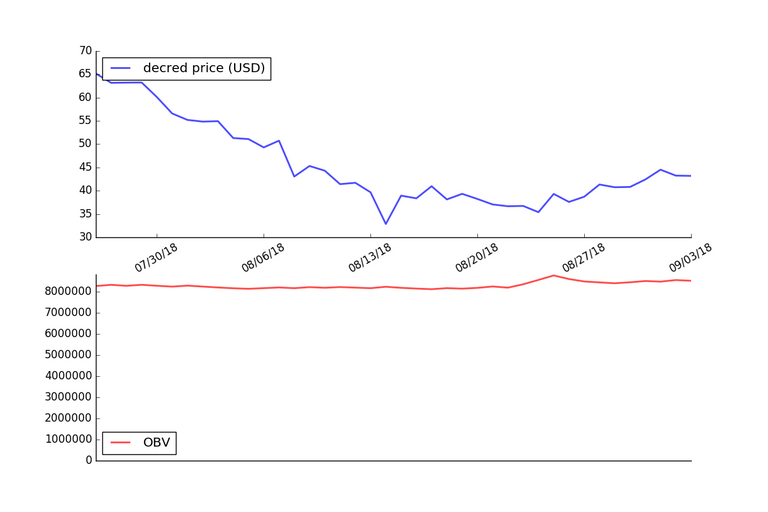

On-Balance Volume (OBV)

The graph below shows the OBV applied to the price of Decred using daily price data for the last 40 days.

Please note that the above indicators can give false trade signals and use of such tools should be treated with caution. Blindly using technical pricing indicators without a general knowledge of fundamentals or an understanding of the currency being analysed is not advisable.

Thank you for reading

Source of data: www.coinmarketcap.com

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

base on what you say or should I say all this post is misleading don't give a people a high hope stop doing this in order to make everyone hype for investing decred make us more aware on what we should see the facts and reliable for us to keep hodling hodling stop wasting our time.

What do you mean that it is misleading? Care to elaborate?

This is a reliable fact because I know that Decred have the tendency to do this kind of thing in the market. People can still hope for some huge pumps in the market but it can also cause some major dip. If the author is blacklisted then you can find some more reliable source online to see if Decred is doing great or not

I rather choose to high hope than to miss the chance when the project reach it's success and for me there is no misleading with this article all written in the post it true.