INTRODUCTION

Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance.

Distributed Credit Chain (DCC) empower credit and enable finances.

PROBLEMS SOLVED BY DISTRIBUTED CREDIT CHAIN

The traditional financial industry is highly centralized. Financial transactions rely heavily on the endorsement and support of large financial institutions, with substantial transaction fees paid out to these institutions. Monopolistic financial institutions have in fact raised lending rates for borrowers and reduced the interest income for lenders.

- Cost

The core model of a credit agency is to share the costs of non interest-earning elements and bad debts by charging the "good guys" who can pay back the money. For borrowers, it brings an additional cost. - Efficiency

From the credit agency's perspective, a lot of time and efforts are wasted in verifying the credit of borrowers who do not meet the agencies’ risk criteria, which leads to wasting resources and decreasing efficiency. - Profiteering

A centralized credit model entices many financial institutions to deviate from their primary purpose— serving customers. Aiming for profitability, they deduct lenders while squeezing borrowers, and expand their profits by extending their customer base.

METHODS USED IN SOLVING THE PROBLEMS

- Borrowers

Individuals with specific borrowing demand establish blockchain account to authorize data service provider and Initiate borrowing request - Data Service Provider

Integrate individual data and store them on the chain, clean dirty data, and provide data standards - Algorithm & Computation Service Providers

Extract characteristics from data, make judgments based on policies and quantify judgment based on characteristics - Credit History Feedback

The approved credit history reports generated on blockchains prevent problems such as long-term borrowing and repeated test borrowing. - Funding Providers

Not directly involved in lending but provide funding (such as ABS-purchasing institutions). - Risk Assuming Institutions

Operate a credit business by earning income from bearing specific risks, manage loans in progress and collect after loan

BENEFITS OF DISTRIBUTED CREDIT CHAIN

- Break the Monopoly

With a global distributed banking ecosystem, DCC aims to break the monopoly of traditional financial institutions and to return earnings from financial services to all providers and users involved in such services so that each participant may share the return of ecological growth. distributed banking will ultimately be a way to truly achieve an inclusive system of finance. - Decentralized Thinking

Through decentralized thinking, distributed banking will be able to change the cooperation model in traditional financial services, building a new peer-to-peer and all-communications model of cooperation across all regions, sectors, subjects and accounts. - Transform Business Structure

As it pertains to business, distributed banking will completely transform traditional banking's debt, asset, and intermediary business structure. The tree-like management structure of the traditional bank will thus evolve into the flat structure of a decentralized bank, establishing distributed standards for various businesses and improving overall business efficiency. - Government Regulation

As it pertains to regulation, the fact that all records registered in the blockchain cannot be tampered with will enable regulators to penetrate the underlying assets in real time. Big data analysis institutions will also be able to help the regulatory bodies understand and respond to industry risks more quickly based on blockchain data analysis.

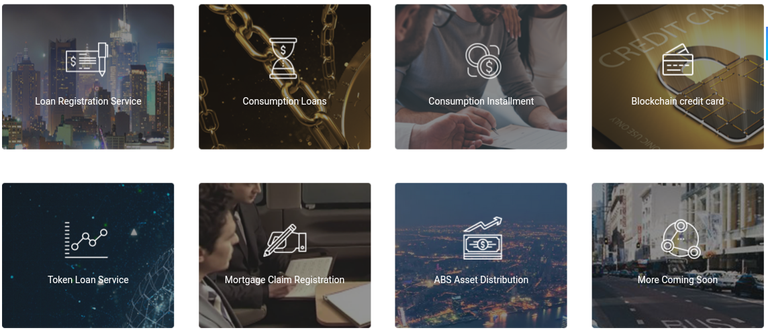

DIVERSITY OF DCC IN FINANCES

The distributed credit chain can be applied in many scenes in financial area, among which a DApp serving the personal loan market has been launched and in use, the others are under developing and will come soon. The diversity includes:

• Loan Registration Service

• Consumption Loans

• Consumption Installment

• Blockchain credit card

• Token Loan Service

• Mortgage Claim Registration

• ABS Asset Distribution

DISTRIBUTED CREDIT CHAIN'S INVESTORS

DCC’s investors include JRR Capital and numerous founders of top-tier fintech companies as well as anonymous investors who are chairpersons of publicly traded companies or CEO of top internet companies. They support DCC with capital and profound resources.

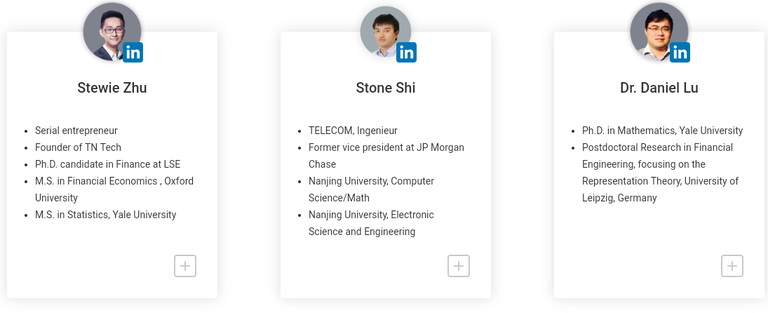

TEAM

CONCLUSION

Distributed Credit Chain (DCC) empower credit and enable finances. For details information about Distributed credit chain, it is important to check their various links and channels indicated below:

Website: https://www.dcc.finance

Whitepaper: https://dcc.finance/file/DCCwhitepaper.pdf

Join on Telegram: https://t.me/DccOfficial 2. https://t.me/dcc_official2

Follow on Twitter: https://twitter.com/DccOfficial2018/

Follow on Facebook: https://www.facebook.com/Distributed-Credit-Chain-425721787866299/

Follow on Github: https://github.com/DistributedBanking/DCC

Follow on Medium: https://medium.com/@dcc.finance2018

Follow on YouTube: https://www.youtube.com/channel/UCcMkIrVUJoILdEpA4An0Sog

Follow on mail: contact@dcc.finance

Follow on Reddit: https://www.reddit.com/r/dccofficial/

NB: Most of the picture diagrams and table displayed in this write up are obtained from official site of Distributed credit chain.

Username: Akinseye118

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://dcc.finance/index.html