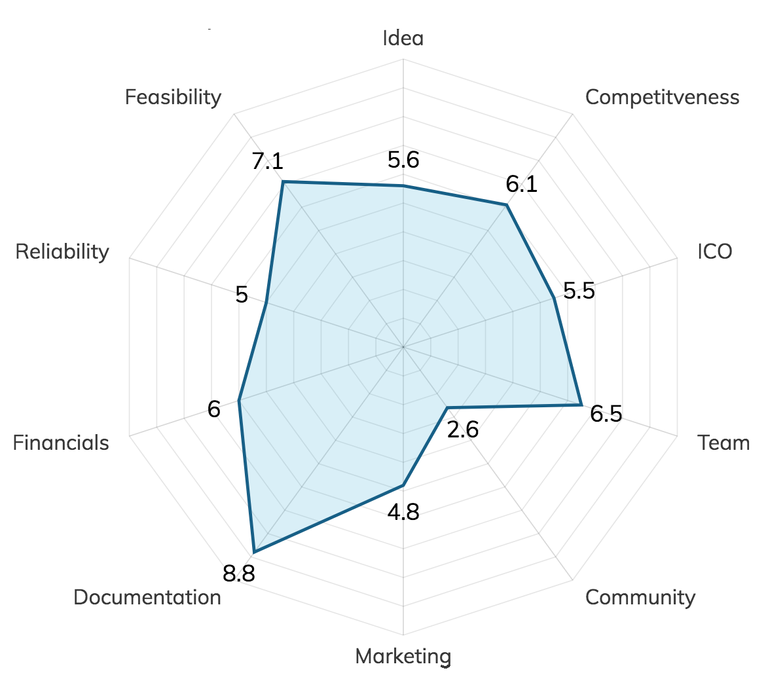

A CryptoStandard Score of 5.6 and a Negative+ outlook are assigned to CRYX (Pre-ICO starts on 9 April, 2018)

CRYX provides crypto market indexes and it aims at helping investors build better cryptocurrency portfolios under the challenges in the market which include the high standard deviation of prices, volume volatility and a large number of new entries of cryptocurrency. However, CRYX has to make more effort in getting attention from investors in order to scale in the high level of competition in this market. Besides, whether CRYX can achieve what it has mentioned in the white paper is still not proven due to the lack of technical details provided. Hence, a Negative+ is assigned to CRYX.

CRYX is a crypto market index provider defining how the cryptocurrency market evolves through time. Its purpose is to provide a wide range of indexes applied to the cryptocurrency market and help investors in their investment decisions. The cryptocurrency market has a number of particular characteristics such as a high standard deviation of prices, volume volatility and a high number of new entries hitting the market regularly. CRYX proposes a methodology that quickly reacts to market changes and therefore better represents the cryptocurrency market.

The analysis is based on our rigorous CryptoStandard Score model which is supported by over 80 parameters. The distribution of the score and the explanation are shown below:

Idea

The idea of CRYX is clearly explained in their white paper and it could potentially help investors in the crypto market in conducting their research. This is essentially important in the market full of uncertainties.

Competitiveness

There are a number of players in the industry, including CCi30 and WorldCoinIndex. CRYX tries to differentiate itself with machine learning backtesting and data visualization tools. However, these are not new ideas in the market.

ICO

Some ICO details should be presented clearly but are found missing in the white paper or the website of the company, such as whether tokens would be issued in major exchanges.

Team

The team lacks major blockchain or ICO experiences. A more diverse team is needed to better convince investors of their capability.

Community

The reaction from the community to CRYX is poor. The number of Telegram group members and followers on Facebook and Twitter is very limited.

Marketing

CRYX should improve its marketing through filming an introduction video, as well as increasing its exposure on quality media press.

Documentation

Our team appreciates the largely sufficient information on the description of each product from CRYX as well as the roadmap. However, the information of the team is missing in the white paper.

Financials

No past nor projected financials are available on the whitepaper and website.

Reliability

The alpha prototype with limited functions is available on its website. However, the beta prototype supporting all the other functions will not be available until the fourth quarter of 2018, making it difficult to convince investors.

Feasibility

The potential limitation to the feasibility of the project would be whether they can provide a reliable index that could tract accurately the market with a high volatility. In addition, though CRYX stresses its feature of using a machine learning backtesting tool to track portfolio performance, the details of machine learning in the backtesting tool are not provided in the white paper.

See their profile: https://cryptostandard.io/ico/cryx/

#cryptostandard #crypto #cryptocurrency #ditigalcurrency #cryptonews #ico #bitcoin #btc #ethereum #eth #ripple #xrp #blockchain #review #reviewpaper #whitepaper #ratings #professional #money #binance #fintech #newcoin #coinmarketcap #initialcoinoffering #icomarketing #coinmarket #coinmarketing

Good afternoon. I have a request for you.Could you sign for me, and in return, I'll sign for you.