Hello this is the first of my series of posts on crypto currencies insights using data science. As an introduction, I am a Computer Engineering graduate major in Data Science and have been using Data to come up with predictive models and insights since the past 5 years now. I have worked across multiple domains including Finance, healthcare and social networks.

Since April, 2017 during a discussion with my friends on investment options crypto-currencies caught my eye and since then I have been actively investing and learning about crypto-currencies and ofcourse the phenomenal rise of Bitcoin. I had my share of fun during the bull market but as a Finance guy I was looking for a correction in the hind-sight and now when we see a bear(ish) market I am looking to share some insights using some of the cool stuff I have learnt in data mining.

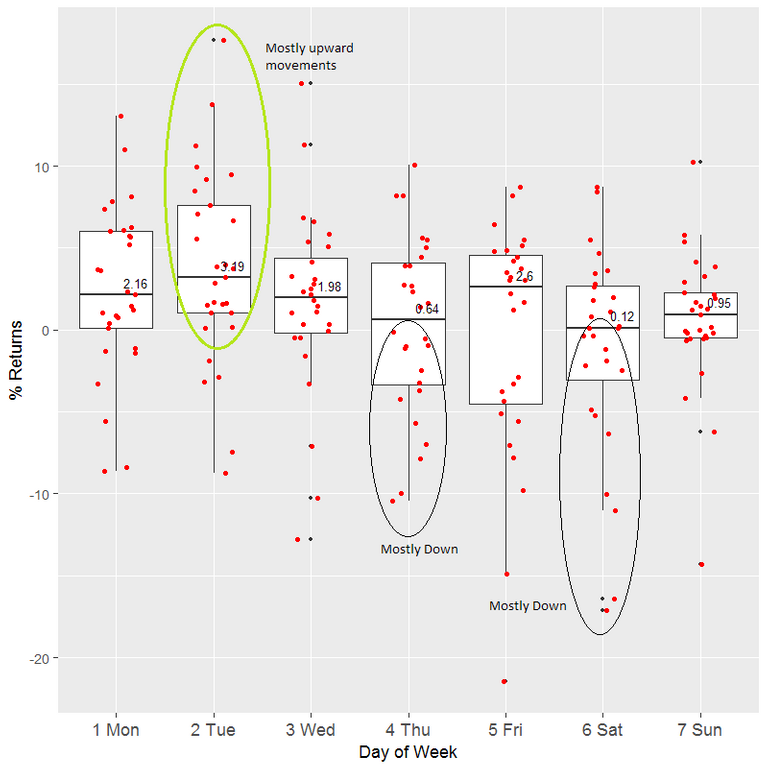

To begin with lets look at the distribution of the gains (current close / previous day's close) across days of the week in 2017.

What do we see here - on Thursdays and Saturdays we almost always see a dip in the bitcoin price ( 0.64 and 0.12 median values)

And in contrast on Tuesdays we almost always observe solid gains.

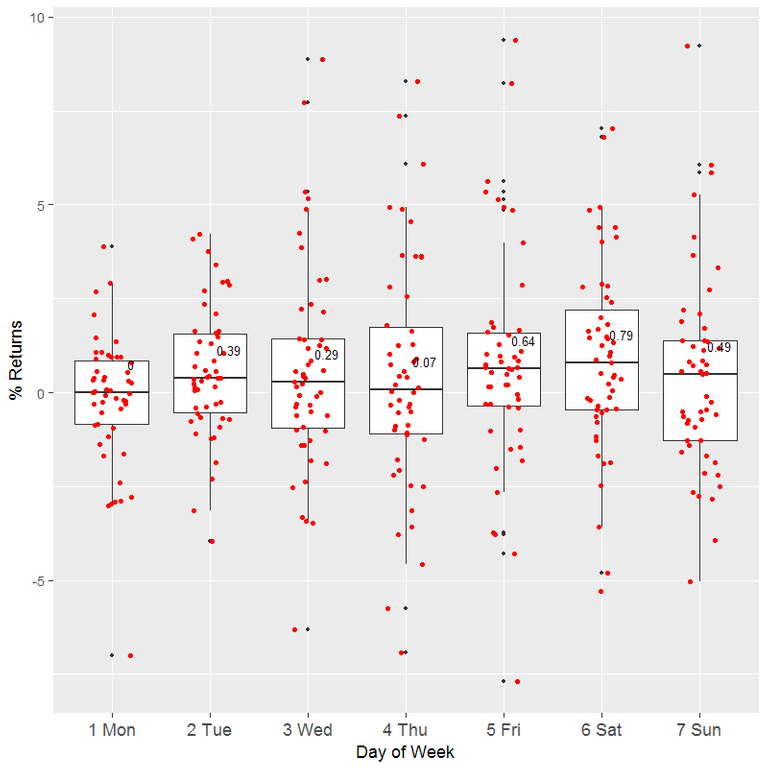

Lets look at a similar chart with data from 2016.

We observe lower volatility in 2016 with almost no dips during weekends (the market has become more notorious) but another interesting observation is the Thursday dip again. I wonder what is happening on Thursdays

So basis the above 2 chars let us define a crypto week which starts on a Thursday and ends on a Wednesday. An important information for investors here will be to know about cryptos which have negative correlation with BTC.

As a part of my crypto analysis series I will be posting the correlation charts to help investors make informed decisions an not fall for FOMO or FUD ( Pretty standard terms in cryptoverse if you don't know about these do read)

So coming to this weeks chart (06- 12th July)

The chart shows correlation across crypto-currencies. I am looking at top 15 only since the rest is just noise and Pump and Dump) Pairs which are negatively correlated are colored "red" and positive correlation is colored "blue" with the darker shades indicating the scale.

![[Jul6-12].png](https://images.hive.blog/768x0/https://steemitimages.com/DQmNPXckGxnjKzZYA2muZoqwVFXDL7tzWvQCjAAbXik1z3V/%5BJul6-12%5D.png)

If we look at the current weak BCC ( BitConnect Coin) is negatively correlated with Bitcoin which makes it a research candidate for me. Among the higher market cap coins Litecoin is loosely correlated with Bitcoin price followed by ETC,XEM and XMR). Investing in these currencies can be a good hedge against bitcoin price when it is falling. On the other side of the spectrum ETH , XRP ,Waves, STEEM and ANS are almost 90% correlated with Bitcoin price and it won't be a good idea to invest into these when the price is falling. The LTC-BTC , ETC-BTC Charts also support this observations.

Look at how the ETC-USD pair held value when ETC-BTC was falling

And so did the LTC-USD pair

As a concluding remark I'd say there is a lot of interesting stuff to be unveiled in the cryptoverse and the correlations are too statistically significant to be attributed to noise. Please share your views on my analysis and feel free to upvote/subscribe my post if you gained anything from this. Also comment on the elements which require more clarity or something which you would like me to cover in the next edition.

Feel free to refer to my standard Technical Analysis(TA) ideas on trading view

NOTE: The contents of the post are in no way to be considered as investment signals. Please do you own due diligence before investing in crypto and never invest more than you can afford to lose. Remember its not a lottery but investment.

Have you played with machine learning on the crypto data much? SVR regression is un cannaly good at predicting trends on litecoin data.

That is there in my pipeline. Currently I am focusing on EDA to explore trends and educate investors. Fee free to add more suggestions which I can include subsequently.

Thank you for taking the time to do this research, very informative study. I think you can start creating betas, can start creating some CAPM model for crypto would be awesome!

BitConnect is a scam

Quality post, I always like to look for patterns on the charts:) But be carefull with bitcoin connect, it's probably a one big ponzi scam.

Anyway following :)

Thanks mate. I hope you learned something new here. Please suggest topics in should include in the subsequent posts

Interesting post. I do believe that with the right tools and information, you can take better decision. Looking forward to more post like this.

Great read. Keep sharing.

Very interesting post. Looking forward to the rest of this series.

Congratulations @saurabhbansal123! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPInteresting article, I'm hoping for more and upvoted it! ;)

Interesting take on this topic. Have you considered non-linear relationships among the variables examined? Also, what programming framework did you use?

Thanks

Congratulations @saurabhbansal123! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

follow me

This isn't how steemit works. Create good content and stop begging. And you're probably just a bot anyway :(

I how do i remove this as spam. Stuff like this is annoying

Use the flag option (downvote) but you can not remove it, it's blockchain(ed:)

I only see an upvote icon, how can I downvote or flag it?