First, I do get asked a lot on this and I often tell them to do their own research on how to value a new crypto. People would then scratch their heads like they had lice and tell me they do not know where to start. As a former market intelligence analyst I can't understand why or how they can't do this.

Fine. Then first consider the usage of a new crypto.

All new cryptos are finding a niche and if they don't have one to differentiate them from the rest, then it is a scam.

What is Usage?

Every new crypto invented has a use. Some have limited usage potential, others like Ethereum and NEO blockchain with their smart contracts will have a perpetual use for it since the a virtual currency is required to transacting a data block.

Crypto or virtual currencies that do not offer any unique usage potential may have no value. So this is not to say that Bitcoin has no real value but as the grand daddy of the crypto space its place is there, but its potential for upside growth will be limited. This also means John McAfee will have to eat his testis soon enough. Folks out there might do him a favor by sending him some crafty recipes.

So using the next three criteria is important for any evaluation.

1. Traded on Numerous Exchanges Globally

Crypto and token exchanges are privately run enterprises. They have their own vested interest in featuring a token or crypto currency on their exchanges. Unlike tokens, which in many cases the token owners will have to make arrangement to PAY a crypto exchange to get it listed, crypto currencies are instead judged by their investor appeal and adoption before they get listed for free.

When more of these Crypto Exchanges list them, the easier it would be for people to trade them. It's like going out to buy a Big Mac, if there isn't a McDonalds in your area, you can't buy a Big Mac.

Crypto exchanges will do their due diligence on their part on whether to list a virtual currency or not. They will study the demand and market trends so if they all hop on the same bandwagon, you can be assured that a any particular crypto currency has global or widespread appeal.

Have numerous Traded Pairs

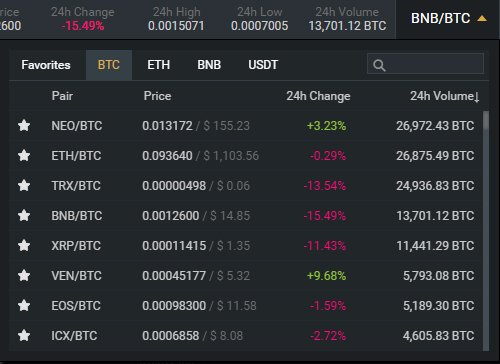

A traded pair is linked directly to the convertibility of a crypto currency. For example, people will trade BTC/ETH or vice

versa. So to evaluate a relatively new crypto currency, you just have to see how it is traded on crypto exchanges.

There are many exchanges that trade USD/BTC, Euro/ETH, JPY/ETH etc. But the best or most valued cryptos can be traded directly to a currency like for example in SGD/ETH or HKD/LTC.

With more traded pairs you have, the better its acceptance it is as a virtual currency internationally.

The direct conversion to a national currency is a important factor for investors and speculators. It means having to bypass the forex commission trap imposed by banks.

All banks charge you a fee for converting forex. It might not seem like a lot but when you are converting many thousands at a time, you risk having to lose a substantial margins in your crypto trades. It is the small margins that eventually takes the fun out of your trades. When you want to convert it back to your own holding or national currency, you could be losing twice as your local bank account won't let you hold USD or Euro when you have the currency converted back to deposit in you bank account. So imagine for a moment if your holding currency is the Indonesian Rupiah, you would have to convert Rupiah to USD to buy Ether and once you sell the Ether, you are going to be paid in USD and to take the money back to your local bank account, you have to convert USD to Rupiah once again.

This porous exchange system means you have to keep track of your trades carefully, and this is why I don't believe in buying crypto currencies with a debit card. I did my research on one of such debit cards and found out that you pay up to 18 percent more for the spot price for a crypto currency. The whole deal makes loan sharks look like petulant Sunday school kids.

Spending your Cryptos Directly from a Debit Card

This is another criteria for a successful crypto currency. When Litecoin partnered with VISA, the value of LTC shot up.

Now there are many crypto based debit cards, some convert your purchases instantly while others converts your crypto to fiat and uses a prepaid transaction method. Both ways can work for you or against you.

But both types of debit cards have transaction charges. Some use a flat fee while others charge a percentage or less than 2 percent for each purchase transaction.

What is important in the evaluation process is how many crypto debit cards you have direct access. In many cases, many crypto debit cards are subject to your place of abode. So if you reside in Asia, you may not be able to apply for a European crypto debit card.

There are heaps of BTC and ETH debit cards but few LTC or BCH ones.

This is where the issue of trading pairs in a crypto exchange will help sort you out by converting your holdings from say LTC to ETH or BTC for you to use with a debit card.

My evaluating criteria is not applicable to new cryptos that are being launched. For me I think there are too many of the same and there should be more differentiation.

I also hate hard forks proposed by miners, like in the case of BCH or Bitcoin Gold. These are just another way for miners to print virtual money. If these guys are sincere, they could create a new virtual currency to fill a void that the old one doesn't do. Instead, they chose to ride on the Bitcoin name and do a hard fork for whatever reason they claim.

Those of you who are speculating in the virtual currency market should NOT use this as a guide (even though technically you can use this a real world barometer or sorts).

Speculation parameters are a bit different but I won't go into here. Like all analyst I like to be paid for my time dissecting information and there are tomes of it. As a rule I do not invest in crypto currencies since by investing in them will affect my judgement of each on its market performance and my holdings in BTC and ETH are payment for services rendered.

I am quite sick of those ivory tower bloggers on YouTube who tell people to invest in tokens and cryptos to encourage herd investing in a crypto or token they are riding on.

If you have questions, I would be most happy to answer them on Quora if it is worth my while.