After Bitcoin, Ethereum has become the second most popular cryptocurrency program. The market capitalization of digital token ether (ETH) exceeds US$50 billion, and the number of financial institutions and companies that run distributed ledger technology experiments is evident.

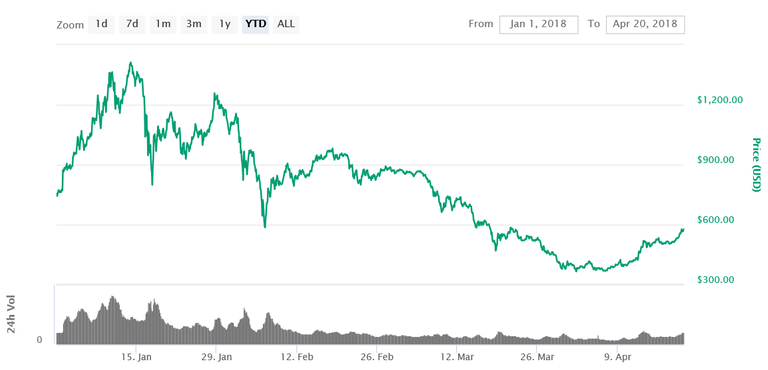

However, so far, the value of ether has been a bumpy year since 2018, because the value of the tokens of Ethereum has fallen sharply since mid-January.

On January 14, 2018, the price of ETH hit a record high of US$1,412. Since then, ETH prices have fallen sharply compared to other cryptocurrency asset markets, and the current transaction price is about $500. In March, ETH was even the worst performing digital coin in the top cryptocurrency.

Although Ethereum faces competition from other smart contract platforms such as NEO, Stellar, Cardano, NEM, and EOS, and these platforms claim to be excellent platforms, the price of Ethereum has also suffered from blockchain initiation due to initial investment products. Companies (ICOs) need to sell the ether they raised to pay bills in fiat currencies.

Tim Enneking, founder and managing director of Crypto Asset Management, told MarketWatch:

"These companies holding ICOs have statutory fees and have to sell Ether to pay for them. They are not great traders and selling them to the already falling market is irritating a lot of investors.

Bitmain's New Ethash ASIC Miner:

On April 3, Bitmain, the largest cryptocurrency mining hardware manufacturer, announced the release of its new Antminer E3 Ethash ASIC Miner. This is the first ASIC (Application Specific Integrated Circuit) miner to mine ethereum and other cryptocurrencies using the Ethash algorithm. So far, Ethash-based cryptocurrencies are ASIC-resistant and can only be mined using GPUs (Graphics Processing Units) or CPUs (Central Processing Units).

The mining of ASIC has raised concerns about increased levels of concentration, which can be found in the distribution of bitcoin and bitcoin cash mining pools. This is why the digital currency project Monero announced a problem after Bitmaster released the Monero ASIC mining machine to ensure that the digital currency maintains ASIC resistance and maintains a high degree of decentralization.

However, Vitalik Buterin, the founder of Ethereum, is not worried that the new ASIC miner may threaten the dispersion of "his" networks. At every bi-weekly developer conference, he said: "Let everyone upgrade can be quite confusing, and it will hurt more important things. So, at this point, I personally very much prefer not to act."

In addition, Buterin plans to convert the network in the future to convert its proof-of-work (PoW) consensus algorithm into proof of equity (PoS), called Caspar Escalation, which will eventually make all ethereum hardware mined obsolete.

Although Buterin is optimistic that the Ethereum network will be converted from a job proof to a stock certificate, BitMex's report from the Bitcoin derivatives exchange shows that the possibility of such a conversion is rather small.

The BitMex Research team wrote in its report:

“Ether Ethere’s latest PoS proposal is by far the best proposal. We think it can make a positive contribution to the security of the system. However, the system still relies on PoW mining, at least in the medium term. Although the plan will use this proposal as a stepping stone as part of a gradual transition to a comprehensive PoS system, this may be more difficult to achieve than some in the Ethereum community believe.

Limited supply:

On April 1st, Buterin released a new Ethereum Improvement Program (EIP), which was designed to be "a joke" for April Fool's Day, but later he said he believed the idea was "worthy to consider."

In either case, in the EIP, Buterin stated that he could conceive that the total supply of tokens for ether will be limited to around 120 million in the next software update of the project.

More specifically, he wrote:

"To ensure that the platform is economically sustainable in as wide a range of circumstances as possible, and that the issuance of new coins to miners who prove themselves to work is no longer an effective way to promote the distribution of egalitarian coins or any other important policy objective, I suggest that we reach a hard limit on the total amount of ETH. "

Buterin recommends setting the maximum supply of ether at 120,204,432, which is twice the amount of token sales in 2014.

Given that this proposed monetary policy change will result in limited supply, it may meet demand without limit. If this proposal is implemented, we can expect ETH prices to rebound.

Please leave a comment in the comment section as I would love to hear your take on this. And if you enjoyed this, please consider offering me a resteem.