EOS has been somewhat disappointing over the last week. Has it simply been correcting from it's run above $22, or is it now officially down-trending? There's mixed signals throughout the entire market. Like bitcoin, there are valid counts to support bullish and bearish scenarios. While there are many theories on how EOS could be counted, let's start by outlining what I see as the 2 most probable paths. Only time will tell which one is correct.

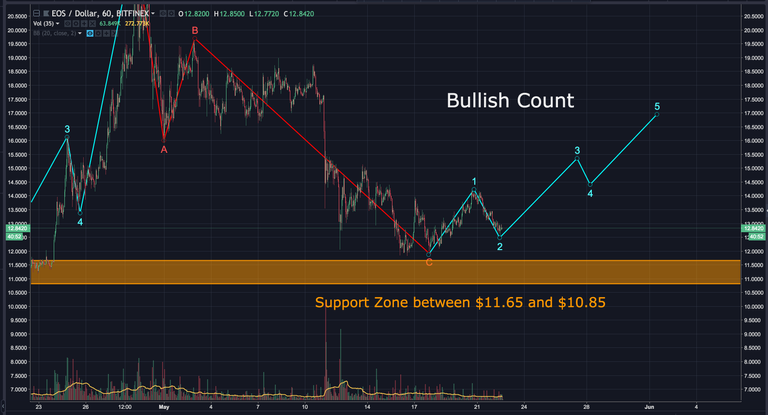

The first count is bullish and has EOS in wave 2 of 5 waves up. There's a strong support zone between $11.65 and $10.85. Here's how this scenario may play out:

Zooming in you can see it bounced off the "golden pocket" (the zone between the 0.618 and 0.65 fib levels). EOS only slightly penetrating below that area with just a wick, then was quickly rejected by the bulls.

Will it drop further? If this scenario is valid, I'd be surprised to see it drop below the golden pocket by more than a wick. However, if it does, there's strong support at the 0.786 fib level ($12.38). Should it drop below that, it would suggest we may be in a more bearish situation. Let's see how that might look.

The bearish count has EOS in an overall down trend. It assumes EOS previously finished 5 waves down followed by an ABC correction. If this is correct, we'd be on the first of 5 waves down. Here's how that scenario might play out:

Looking at the 1 hour RSI, we can see a strong ascending support line has formed. If this support holds, that would be a good indication we're in the bullish scenario.

Looking at the 1 hour MACD, we can see bullish divergence. This indicates a rise in price may be coming, at least in the short term. However, the RSI does not show the same bullish divergence. I also only find it on the 1 hour, not on the higher time frames.

Let's keep an eye on these indicators, particularly the ascending support line on the 1 hour RSI. We also need to remember EOS is still tied to bitcoin...at least for now. If bitcoin drops further, EOS will most likely drop with it. I'll be very interested to see if that remains the case after the main-net launch in 10 days. My hope is EOS will start to break away from bitcoin, rising and falling on its own merit.

BIAS:

Short Term: Neutral

Longterm: Bullish

I hope this has been helpful. I’d be happy to answer any questions in the comment section below. Thanks for stopping by.

If you found this post informative, please:

Disclaimer: I am NOT a financial advisor and this is NOT financial advice. Please always do your own research and invest responsibly. Technical analysis is simply a guide. It doesn’t predict the future. Anyone that claims they know exactly what’s going to happen is foolish, lying or both. Technical Analysis should only be used as a tool to help make better decisions. If you enter a trade, I recommend having a stop loss and sticking to it. You will loose at times. The key is to have more wins than losses. With that in mind, I wish you great success.

If you don’t have an account on Binance, I STRONGLY recommend getting one. They’re usually the first to get reputable coins, have excellent security and second to none customer service. You can sign up here free of charge: https://www.binance.com/?ref=16878853

Hmm.... as you say bitcoin might be of influence, but with the iminent mainnet launch and its insecurities, i guess that what'll determine further movement maybe more than btc. I would rather go for your bearrish scenario short term, there are no relevant news ahead....

We'll see. I think the biggest factor holding back the market is the fear of the SEC classifying certain crypto as a security...which would include EOS. Until there's regulatory clarity, we won't see much new money entering the market.

Has there been any news on that? The fud around eth a few weeks ago turned out unfounded and they repeatedly said they intend not to over regulate

The truth is, the meeting that was supposably scheduled for May 7th was untrue. HOWEVER, the overall story is not just FUD. The SEC is trying to decide whether or not to classify certain coins as a security. Anyone saying this is just FUD hasn't done their research.

The SEC will make a decision on this at some point. Personally, I believe they'll meet in the middle. Maybe giving a pass to coins already in existence, as long as they comply moving forward. I can't see them just keeping their hands off crypto. When has the government EVER left profitable companies alone? But they also can't wipe them out as that would destroy innovation as well as a ton of tax revenue. So we'll see what happens.

If you're interested, this guy does a great job separating fact from fiction, while explaining the current situation with the SEC:

Just to get things into perspective: What i wanted to qualify as FUD was the May 7 story, not your arguments on a general uncertainties about possible SEC ruling.

Having said this i believe that rumours about restrictive regulation in US are still greatly exaggerated. First we know from history that policy makers in the US have a strong tendency to support technical revolutions and disruptions, and carefully look into not to chocking it by regulation even if it is accompanied by fraud and scam. This might be even state reasoning for all US as history, with the internet hype in the late 90ies being the latest example, where regulators explicitly affirmed this policy.

And why should that - of all things - now change under a president trump with his enterpreneur-ethos and anti-institutionalism???

Even more, US regulators are certainly aware of global permeability of technology and will have enough foresight to understand, that crypto-innovation would just happen elsewhere (China/Asia!) if it were outregulated in the US.

So although a negative ruling is not impossible, it's just not very realistic.

And finally - although i would keep it in good memory - i wouldn't really miss Ethereum, being exposed again to ridiculous fee-spikes like those we have been having over the recent weeks. Better positioned projects (EOS!) not only will cease to annoy us with impracticality, a huge effort is put into circumventing any possibility to classify them as securities, so here is just one more reason not be worried too much.

Man i should publish this as an article....

I agree they won't over regulate because, as I said above, it would destroy innovation in the US. That said, I also don't think they're going to keep their hands off crypto...especially coins like ethereum. As I said, when has the government EVER left a successful business model alone?

They will most likely meet somewhere in the middle...and people want to know what the rules will be. It's not a matter of doom and gloom. It's simply a matter of people wanting to know the rules before they play the game. That said, until we have such rules in place, I don't think we'll see any large amounts of new money enter crypto....and I can't blame them. Let's hope this gets resolved very soon.

AMEN to that my friend! ;-)

We do expect announcements upon or shortly after successful launch of new dAPPS that are going to launch on the blockchain. Any holders will benefit from airdrops of course, so there is incentive to buy the dip and hold going forward. The risks on launch can't be ignored but with 110+ block producers cooperating to make the launch smooth, that's what we hope it will be, without issues.

No question the network will run after a while but it might take a week, there might be bugs, chain could get out of sync, tokens frozen, no standard wallet, no voting portal, it will be certainly a very good opportunity for buying the dip if you've the guts....

"I think the biggest factor holding back the market is the fear of the SEC classifying certain crypto as a security...which would include EOS. " Since EOS wasn't selling in the US and how they've carefully crafted their offering, I don't see how SEC could rule on EOS being a security, and ETH having history and being so large, with so many tokens launched, I don't see how they could classify either. Can't debate that here, not a lawyer. That would be very bad if they did. I have thought of holding years, it is difficult to do, so many crosscurrents.

I think chances are it will not be labeled a security, but who knows. The fact that they haven't come out and stated anything yet tells me it may not be that simple.

This work you do is demanding, and complicated as well, gives me reason to deeply respect your skill, with so much detail and precision, outlining the scenarios for both bulls and bears. When oh when will be just be on that bullish scenario? People are making reference to BTC dropping all the way back to 5,000 and other targets. This type of movement will drive away potential investors, it's too volatile. Saw the 1-hour RSI was pierced on EOS chart, does that invalidate the comparative bullish divergence?

The bullish count will be invalidated when the price drops below the start of wave 1.