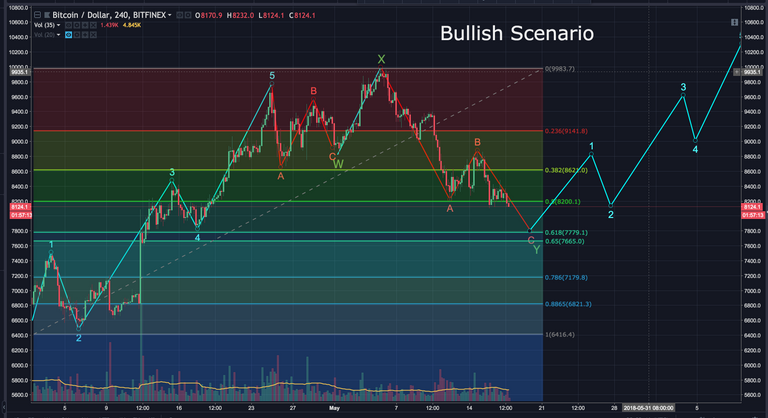

The bears are fighting hard. As pointed out yesterday, there's still 2 scenarios in play. To recap, the first scenario (bullish) has bitcoin in an ABC correction, with wave C still needing to find bottom. The next strong support zone it's likely to land on is between $8,000-$7,900. If that breaks, the 0.618 fib level ($7,780) should provide solid support. An impulse wave up from 1 or those support areas would make sense.

The second scenario (bearish) has bitcoin in an overall downtrend. If this count is correct, it's currently on wave 5. A logical target for this would be the 1.0 fib level ($7,686). We'd then expect an ABC correction followed by another 5 waves down. Here's how this scenario could play out:

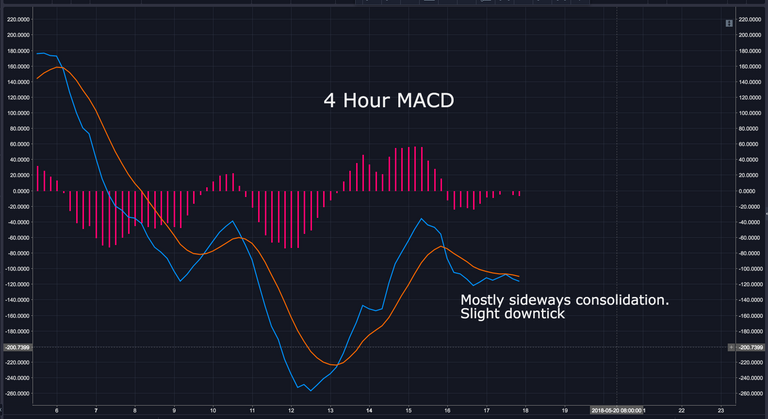

The 4 hour MACD is starting to look bearish as it ticks down slightly.

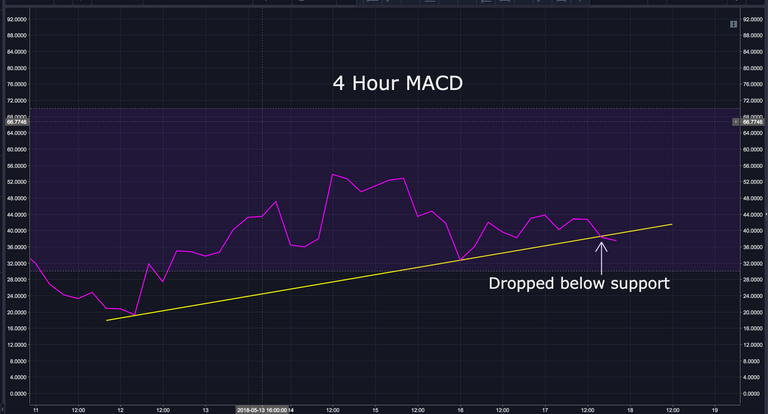

The 4 hour RSI just broke below the support line...also indicating a drop.

The 8 day EMA is acting as resistance on the 4 hour chart. Breaking above this may indicate a change in momentum.

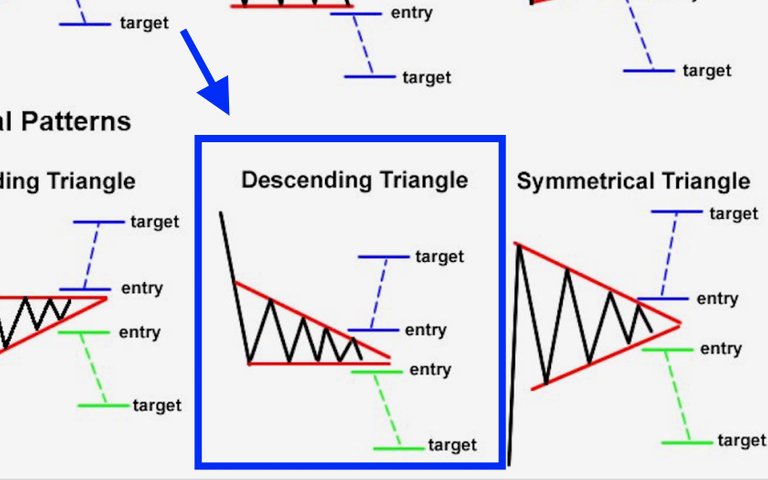

Finally, zooming out, we can see a descending triangle has formed. As bitcoin gets closer to the apex, a breakout up OR down becomes more likely. Let's keep an eye on this over the next week or 2.

BIAS:

Short Term: Neutral to Bearish

Longterm Very Bullish

I hope this has been helpful. I’d be happy to answer any questions in the comment section below. Thanks for stopping by.

If you found this post informative, please:

Disclaimer: I am NOT a financial advisor and this is NOT financial advice. Please always do your own research and invest responsibly.

If you don’t have an account on Binance, I STRONGLY recommend getting one. They’re usually the first to get reputable coins, have excellent security and second to none customer service. You can sign up here for free: https://www.binance.com/?ref=16878853

Excellent work

Thanks my friend

Well done. But poor Bitcoin, never a moment of rest.

Thanks...Until we get some regulatory clarity, I believe the market will continue this volatility. Once there's a clear set of regulations, we should see new ATH's.