During the time you are done reading this article worldwide almost 20 people will die in car crashes only, not even factoring in all other disasters like forces of nature or murders happening every day. Now, I am very very very sure none of them counted on that while waking up in the morning the very same day.

If you are reading this there is a very good chance that you already own some Bitcoin, Ether, Litecoin or other Coins or Tokens. So you have your Bitcoin wallet, your Ethereum wallet, your NEO wallet, etcetera, you have exchange and trading accounts, you even might have a paper wallet or a Ledger Nano. You have your passwords, your 2FA, your Private Keys.

If this information dies with you, all your funds are gone as well. Forever. Everything you accomplished so far was for nothing.

This is an issue you need to adress right now

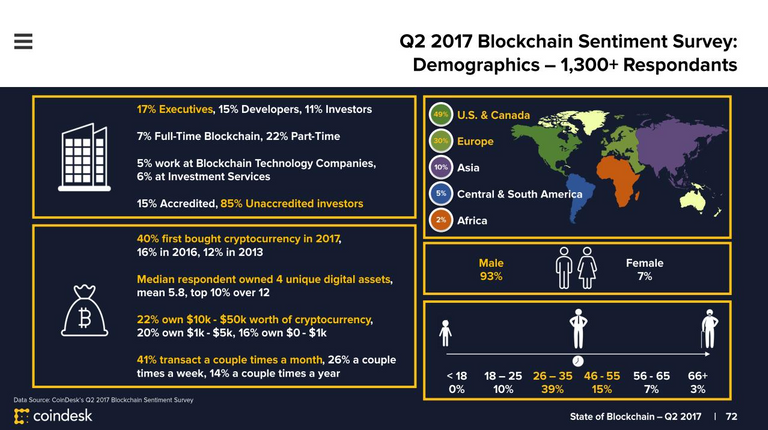

On top of that, over 70% of those car crash fatalities are men aged between 15 and 44. This number is important because according to the State of Blockchain Q2 2017 report as of now over 93% of people involved in Crypto are men aged 26-55. So our wifes who will be left behind - if god forbid something happened to you - will be affected twice. You don't even have to die, what if you suffered a lost of memory or you are in coma for years not able to communicate with your loved ones?

What happened to those 500 BTCs over time?

The Bitcoin Whitepaper was published on Oct 31st 2008. Since then there are about 20 Million wallets out there and estimated 0.3% of world population owning (at least a fraction of) a bitcoin, which would account to around 25 Million individuals. Following the car crash death statistics around 0.02% (~5.000) of those died in car crashes. If every of them owned let's say 0.1BTC - what happened to those 500BTC worth (as of today) $1.9 Million since then?

OK, you are right, this is just a very rough estimation. But it makes my point.

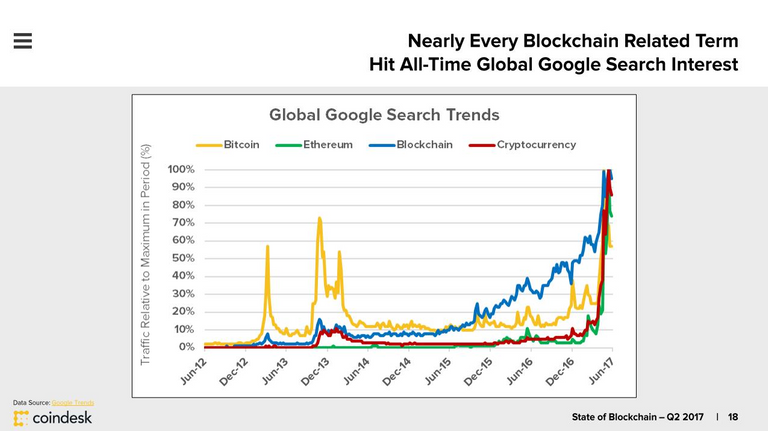

We are part of the Crypto-Revolution

Now see, we are in this Crypto-Revolution. Amazing times to be alive. Every day more and more people start investing their hard earned money into coins and tokens. And if Bitcoin proved anything it is that it's not going anywhere and those coins will raise in value over time.

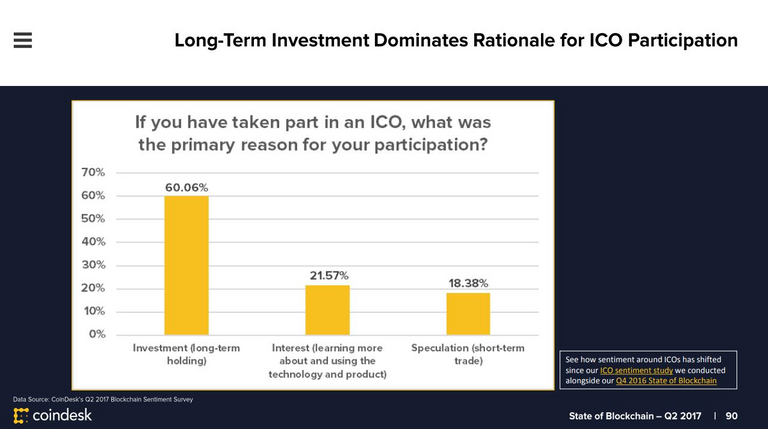

We traders and investors, but mostly HODLers

Most of us are not traders but investors - in there for the long-term profits.

But since the technology is still very young, all those funds are scattered all around the place - on countless exchanges and wallets, both online and offline. For every exchange and every wallet there is an account with credentials and public and private keys. And (hopefully) most of those accounts are even secured by 2FA codes which are in turn secured by one-time recovery codes. And those accounts are tied to our CCs or IBANs.

If I wanted to explain all of my accounts, wallets and holdings to my wife right now it would take me at least a week. And I would need to write down a long list of sites, emails, accounts, usernames, passwords, 2FA apps and recovery codes. And I am still not sure my wife would really get it how to access, sell or withdraw those funds.

And if she wanted to keep the long-term coins (since most of us are HODLers, remember?) how should she decide on which one to keep and which one not? And for how long? I've spent months reading, learning, taking courses, participating in webinars, playing with TA, chatting about Crypto. And I do that every day even more.

How should I transfer all my knowledge to my wife for her to be able to profit from all my work?

Well, there is no way.

There is no way for her to know what to keep and what to sell - when and where? And what if I had no wife or children and would want to do this with my parents? With my mom who still thinks Google is the "Internet"?`They are just NRFC - "Not Ready For Crypto" yet. And this really makes me nervous.

I am not investing all this time, efforts and money to make the exchanges rich at the end.

FODU. The need for a smart all-around Crypto Inheritance Service

I myself call this feeling FODU - the Fear Of Dying Unprepared. While all my other assets like my property, life insurance and my bank accounts can be devoted to a dedicated beneficiary - my Crypto can't. There is no way. What we need is a service that would take care exactly of all of this.

This is a Global Real Life Everyday Use-Case for the Blockchain

I don't know if this use-case is enough for a start-up on itself. Maybe this should be incorporated as another use-case for a privacy project like Civic, or an universal wallet like Bitquence, or maybe a district of the 0x platform, or even one of the services of a decentralized exchange like ICON or Kyber.

The really nice thing about the concept is that it is extensible to other use-cases, like encrypting and storing other sensitive information like your social media profile passwords, your private files, your testament and so on. This might be even - as a nice side effect - sort of a fallback backup for all your passwords, private keys or recovery keys.

Post series: All you need to know about Inheritance of Digital Assets

This is the first part of my journey along the simple question with huge consequences: What happens with your digital assets when you die?

In this post I exemplify the existing issue with digital assets inheritance and the need for a service covering this problem. In my further posts I have reviewed the most promising start-up in this area - DigiPulse, I have gone in detail examining the essentials for a Digital Inheritance Service to be successful and I have explored if MyWillPlatform (MyWish) is a serious competitor in the Digital Inheritance arena.

Here is all you need to know about inheritance of digital assets:

- What happens with your Bitcoins when you die? You need to act on this issue right now.

- DigiPulse ICO Review - The Digital Inheritance Service to make sure your Bitcoins are not lost when you die

- Essential Features for a Digital Inheritance Service like DigiPulse to be successful

- MyWillPlatform ICO Review - Is MyWillPlatform (MyWish) a serious DigiPulse competitor for a Digital Inheritance Service?

Thank you for reading!

The best way to be the first to find out about my follow-up reviews is to subscribe to my blog. Just hit the "Follow" button on my profile.

Stay safe and stay tuned!

Put your private key(s) in your safe, in an envelope with the name of the beneficiary on it. Not perfect, but its better than doing nothing.

Within one or two years the world will be full of Crypto experts. Now crypto is like email in 1992. My wife didn't know what email was in 1992. If you live for a couple more years, she'll figure it out.

I guess I could buy a safe and do it the way you suggested, but it still does not solve the problem with forwarding the safe password / code to the beneficiary in the first place. Neither does it make the regular updating of all the accounts and passwords more convenient.

And there is even the problem, that at the current state of "wild-west-crypto" I can't let my wife know, that I am 'playing around' with our money in this 'big experiment'. If I get a safe, she would want to have access to it from the start and she would find out and worry unnecessarily all the time.

So the only way to really make this work effectively would be depositing this letter at an attorney, notary or a bank box. And that is neither free nor convenient. So I'd still prefer to have a smart contract with an effectively timed trigger to pass on this secret to my inheritors.

Or to put it other way - just because we can ride horses already it does not make the development of cars unnecessary ;)

Before telling my wife that I was already in crypto, I watched a few videos about it with her, and then one day when the price fell heavily, she said “Let’s do it”. Women are much better at timing things than men.

On the deferred Will or deferred letter idea, I am sure the solution will exist very soon. Can you try and live a couple of years?

Thanks for the hint, I might try that out. My biggest fear is that because my wife is a lawyer she can very well figure out the risk hidden in the actual legal consequences of the current state of the regulation-free crypto space, ICOs especially. It might get really hard to get her on board ;))

And yes, I actually do my best to not to be in a need of a DigiPulse service any time soon :D

certainly not something people think about daily, but is something we all have to deal with. Would documenting all your crypto information in your will in some form be the best means of handling it? The best way I have found for explaining crypto is comparing it to a safety deposit box. I can have my will transfer the ownership of the key and all that's inside and couching it that way is generally understandable for the NRFC folks in our lives.

I was thinking about that as well. But it's not very practical for a couple of reasons, but expecially for regular updating. What also is missing is a sort of advisory-service from such a provider who would advise the beneficiary on how to use the existing funds the best way. I will outline my thoughts on such service in my follow-up post.

please do. Ill follow to see what you've got to say. My idea would be based on what I do. I use Encryptr to store my login information and all the relevant information for my crypto biz. I can give my encryption key for the program and give access to all the survivors outlined in my will. It doesn't make up for the lack of financial knowledge others may have.