This is the third part of my journey along the simple question with huge consequences: What happens with your digital assets when you die?

In my previous posts I have explained the existing issue with digital assets inheritance, the need for a service covering this problem and I have reviewed the most promising start-up in this area - DigiPulse.

Here is all you need to know about inheritance of digital assets:

- What happens with your Bitcoins when you die? You need to act on this issue right now.

- DigiPulse ICO Review - The Digital Inheritance Service to make sure your Bitcoins are not lost when you die

- Essential Features for a Digital Inheritance Service like DigiPulse to be successful

- MyWillPlatform ICO Review - Is MyWillPlatform (MyWish) a serious DigiPulse competitor for a Digital Inheritance Service?

As I already said in my previous posts, I have no doubts the issue with inheritance of digital assets has to be addressed as soon as possible. I believe DigiPulse is on the right path trying to solve a real and urgent pain. I am a big fan of the project and want it to be successful.

This is why I have invested even more time into inspecting the DigiPulse approach, exploring and reflecting possible issues and thinking about the next steps for DigiPulse on the road to conquering this market. I have even taken the liberty of extending the roadmap by further steps to maximize the differentiation and USP.

If you guys from DigiPulse are reading this, I'd love to walk you through all these topics and ideas, if you're interested. Just drop me a message.

Issues, Open Questions & Suggestions

Following I am addressing a handful of issues and pitfalls that might arise with a Digital Inheritance Service such as DigiPulse. I am not only pointing out the potential problems, but I am also describing eventual solution approaches to those problems and explaining additional rational and useful use-cases to be covered by such a service.

While not all of the outlined issues below are necessarily direct DigiPulse-problems, they are logical parts of an all-around inheritance service. The very basic idea of a "Smart Vault Service" can be easily copied by competitors in the wallet, exchange or privacy space. The more sophisticated the DigiPulse solution becomes, the more serious efforts would competitors need to copy it and succeed.

ICO tokens which are not yet in any of your wallets

Imagine you have just bought a bulk of tokens of the next promising ICO and it will take a month or two until they actually arrive in your wallet. All that you have right now is a confirmed transaction on the blockchain but not much more. How are these tokens going to be handled? Are they included in your digital inheritance processed by DigiPulse or not? Is there a check made on etherscan to find out about those? How are you going to include this information in your DigiPulse service?

Vesting period for tokens

In many ICOs the tokens issued (especially on the pre-sale) are vested a certain period of time, for example like with Mingo for 3-6 months. And if you're a founder of an ICO startup it is not unusual for your tokens to be vested for 1 to 4 year. They can't be sold right now. How are you going to instruct your inheritor(s) who (more likely than not) has no idea what blockchain, token, ICO, vesting period and so on mean at all?

Assets stored in Exchanges

They don't explicitly mention assets stored in Exchanges. But it might be implicitly meant by "wallets" since you are storing your coins on an Exchange as well in an integrated wallet, which is part of the Exchange service. Nonetheless, I would suggest to DigiPulse to have a closer look on this issue to make sure it is actually possible since the integrated wallets in exchanges might not work the very same way as private wallets. Whereas this service actually grants access to any particular account in a wallet or an exchange this should not be an issue.

Other types of digital assets

This issue does not apply to digital currencies only. How about other digital assets like the ones that services like LAToken Trading Platform are trading? What if you have acquired or are offering a real estate position on a platform like REAL - Real Estate Crowdfunding & Trading Platform? What is to going to happen with those inherent values that can easily be lost or at least substantially diminished if you don't know what you are doing?

I actually have an idea how to solve this and accompanying issues which I describe later in this post. You're gonna love it ;)

Inheritance Law

Issues with Inheritance Law country by country. The blockchain is global and boundless but the inheritance laws vary strongly from continent to continent and country to country and the crypto assets part is neither considered nor regulated whatsoever. With the upcoming mass adoption of digital currencies in the future there might arise disputes and conflicts on this matter. There are couple of issues that need to be addressed. Not necessarily by DigiPulse itself but by governments and lawyers. And DigiPulse needs to consider this in their Terms of Service.

Issue Nr. 1: Imagine you are from Austria. You use an US-based exchange or wallet service. When you die your assets are handed on by DigiPulse to your inheritors in Austria. Which law is used? The US one because the exchange is based in US? The Austrian one because the inheritors are based in Austria? And now think about the mess if you are using (and most of us are) exchanges and wallets from several different countries? Which laws are applied to what assets?

Issue Nr. 2: Imagine you decide to make your girlfriend to be the beneficiary of all your digital assets stored by DigiPulse. When you die DigiPulse hands on your assets to your girlfriend as you decided. Now your statutory heir - depending on the country but it most cases your parents and your siblings - are legally entitled to a portion of your heritage. Your girlfriend is not at all. If your family claims their entitlement - how is it going to be handled?

Issue Nr. 3: Once again, depending on the country but most likely Inheritance Taxes might apply. How is this covered? Does DigiPulse ensure this law compliance? And if not - who does? This is yet another potential sandtrap that needs to be addressed in DigiPulse ToS and the regulators / governments.

(These are the moments I wished I was a lawyer to start specializing in this area immediately - there is massive potential to be exploited! If you're a lawyer yourself drop me a message and let us talk about how to monetize this idea properly 😃 )

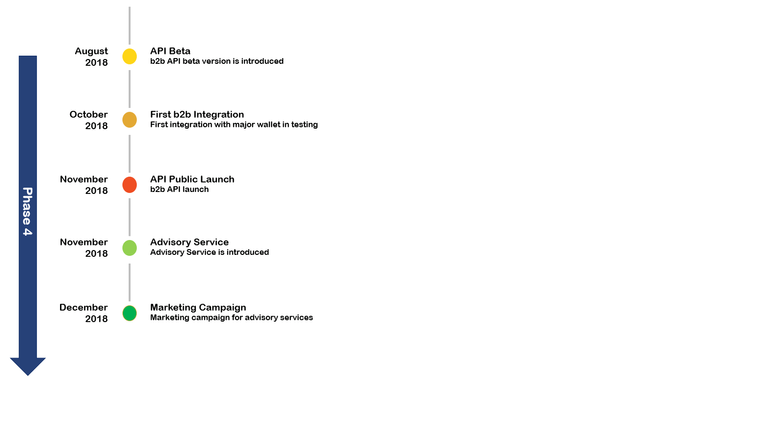

DigiPulse API for b2b services

This is a major suggestion. I like the focus on the end user in the first place. But the very next rational step is to build an open API for services like exchanges and wallets. The DigiPulse service would be a great extension and partnership for any wallet-service like Bitquence for an instance. The same is valid for platforms like LAToken, REAL, DA Powerplay, etc.

Better service, more exposure, additional revenues. Win-win for all involved parties.

DigiPulse Advisory Services

With the planned end user service DigiPulse addresses the journey of the digital assets until they are handed out to the inheritor. But for the inheritor the journey only starts from there. Nevertheless most of them will be completely lost and overhelmed. Even more so if part of the inheritance would be not just digital currencies but various other assets like digital property shares, liquid assets, various tokens and so on.

It would be a smart move not to surrender this monetizable use-case to competition, but to create additional revenue source for DigiPulse.

A service for the inheritors included in the DigiPulse subscription

Create an online best practices compendium and guideline for inheritors. This compendium would include:

- How to use the Smart Vault

- What are the Basic Security Precautions

- How to access the accounts

- How to use the wallets

- How to use exchanges

- How to treat the major coins

- How to approach the tokens

- When and where to sell

- What to keep, for how long

- How to approach other digital assets like property shares, liquid assets, etc.

- How to go about taxes

- Etcetera, etcetera

Let the community contribute. Every DigiPulse user could create and cover topics she would like to have included for her inheritors. Just like a dedicated little Inheritance Wikipedia. With this compendium any inheritor would be adequately instructed how to proceed with his digital heritage.

On demand paid Crypto Advisory Service

Any inheritors who would prefer to maximize the profits form their inheritance would be able to hire a Crypto Expert provided by DigiPulse for counseling. These Advisors would charge a percentage fee of the proceeds gained through their expertise.

Partnerships for better product, more exposure and revenues

Just from the top of my mind:

- Rivetz TEE security solution for the DIgiPulse mobile client

- Bitquence wallet integration

- Specialized heritage consultancy

- Brokering services

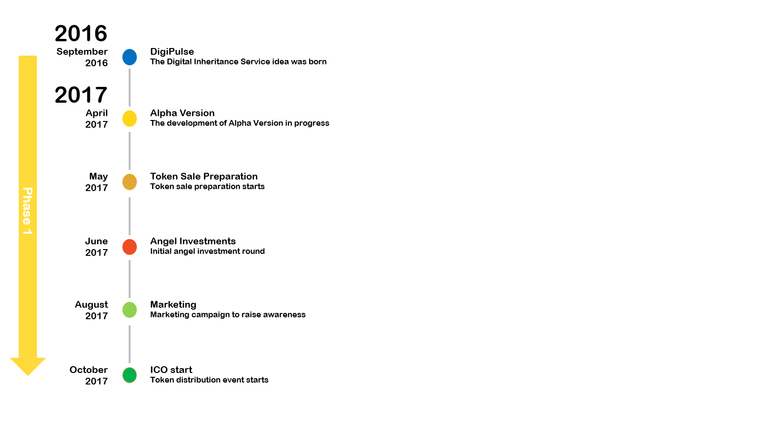

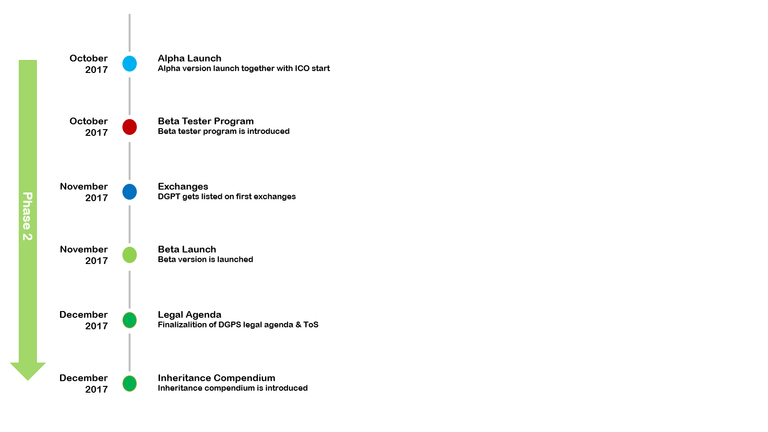

Extended Roadmap for DigiPulse

Here is my take how I would extend the existing DigiPulse roadmap.

Additional small issues to cover

Regular updating of passwords

I force myself to update and change all of my existing passwords at least once a year. This is my own practice to maximize my security. Is there any way to automate this so I don't have to update the data in my Smart Vault every time manually? Any chance to create an API for the most widely used password manager to propagate this update to my Smart Vault without my assitance?

That's it for today.

In my upcoming post I will reviewMyWillPlatform to find out if they are a serious competitor to DigiPulse.

Stay safe & stay tuned!

Disclaimer:

I have invested a lot of time into researching and writing this review. If you want to honor this effort please upvote this post and / or use my referral link to subscribe for DigiPulse. Thank you!

And always remember - my views outlined in this or any other post do not constitute a financial advise whatsoever. DYOR.

There is a need for a service relating to digital assets. It sounds like this one has been cobbled together without much thought on the real issues.

I think I have found a simple and practical solution to inheritance which is contained in my Blog "A bitcoin baby is born". Here are the last few paragraphs:

"There are so many things we are going to do together. I want to teach him to catch a ball, to swim, to ride a bike and so many things.

I want to go to all his birthday parties. I know that when he's a teenager, I will be an embarrassment to him. He won't want me at his parties. Then, I'll stop going.

One day, he will fall in love, maybe marry, and hold a little hand, just like I am holding his now. He will understand what I feel now. He will start inviting me to his birthday parties again.

At 60 years old, half of us are gone. I'm in the lucky half. My odds aren't getting any better. I hope I can live long enough to tell him all I know about life.

But what if I don't? How can I leave him an indelible record of my life and how I loved him?

I will make a sealed envelope. I will lock it my safe. The instruction on the envelop will be “Not to be opened until you have a child of your own”.

The envelope will contain two messages:

“P5JtJMdGrbwpF7djtoCkhvY4DFvjZv9A5ufbZTGUpr79GvSp8qz”

“KzCf8jH9zuwT2vRm9y2fuV16mHrkZqG2JavAJb8RN4dT6nkjq2”

I think he will figure them out."

Thank you for reading my blog and sharing your opinions :)

This is the first try approaching this issue out there and I am totally with you, it is not perfect. But I still see a lot of potential in it. I am absolutely sure your son will have no problems figuring out how to approach his heritage.

But I'd still prefer if anything happened to me today or tomorrow, my wife, my brothers or even my parents would be able to cash out on my work.

It is amazing to read how smart people as you think about the future and how much love and thought you are investing in your son. Happy him!

All the best!