On days like these, it is tough to give tips on indicators and strategies when many people are watching and wondering and hoping and deliberating. I say many because there are a good number of us (many more hopefully due to the fun and conversation we have at the Cryptopub every day - https://steemit.com/cryptocurrency/@vanessav/cryptopub-daily-update) have been watching the setups and indicators which give us warnings about dips like these. More importantly, even when the timing of the dips (which I am refining my analysis so that they don't happen a day earlier or later than I predict!) catch us off guard, we are prepared for them, and are set up for profit.

Today's lesson is liquidity or FIAT balance on exchanges.

I will be the first to admit that, being such a fan of crypto and blockchain, whenever I see a USD balance on my exchange trading stack, my first thought is, "That is sitting there and not growing, what should I buy that will produce a gain?" Legitimate notion depending upon the current state and short term trajectory of the market. When you look at the medium term (which is about all you should consider in active trading not including your core investment,) there is NOTHING like having that balance of USD/EUR/CAD/Zimbabwe$ sitting there as a shock absorber on the bumpy ride that is crypto.

Here are a couple opinions/strategies/advice on 2 extremes of the crypto strategy and a mean between them.

HODLer - You buy/mine and the price that the market will bear today, has little to do with your mindset because you are not about to cash out for a gain at this point, let alone a loss in a dip. "I lost X% of my portfolio value in the last Y days" stop it. Back out and look at the 2-year trend line and realize that this dip is insignificant, recurring, and a small bump in the road that is headed up the mountain. Additionally, the currency that you bought/mined was a good investment because it is headed up the mountain on the value scale (consider Zeke's assessment of Crypto adoption https://steemit.com/cryptocurrency/@zekepickleman/bitcoin-and-crypotocurrency-where-are-we-really , and picture what your core will be worth when the majority eventually enters the market with tier FIAT!!) Example: 5 months ago, you bought/mined ETH when it was struggling to stay at the $300 mark. Now, in a HUGE correction :), every coin you buy/mine is WELL over 3x that amount, AND every coin you bought/mined back then is equally as inflated in value. Dips like this do not even count towards what you are working towards, and the only thing you might consider is (for the next little while) not pay INSANE prices for video cards (PSes, MOBOs etc) and buy the dip. Cash in the profit from the bounce into hardware when Nvidia and AMD catch up with the demand. You may also want to add Nvidia and AMD to your stock portfolio!

Day-traders: It is said that if you are not sitting entirely in FIAT on your trading fund/exchange, it is because you are waiting for the profit target to cash out, you are not very skilled at setting stop-losses and are hoping for a recovery, or you have fallen in love with a coin (which is an extreme no-no.) These fine folks with the iron hands and thinning hair are the BEST prepared for the correctoning because they have cashed out in profit, or set stop-losses to cut and run before the big red knife guts them. These sick bastards love the huge ups and downs because the volatility is the key to profit. I love and respect them!

Scalpers: With the happy medium between the 2 extremes comes the comfort of more control than HODLing but less stress/time consumption of constantly riding the 5-minute charts. It also comes with a bit of the despair during corrections as they often surprise us with the timing, and we can buy in before the bottom and any lost profits can cause some stress.

SO, the lessons of the day for Scalpers are presented so you can hopefully avoid the harder lessons of discovering it yourself:

- 50% in FIAT - As much as it hurts when things go up and you are in fiat, it is good for your peace of mind to sacrifice a percentage of your gains in bull markets, for the greater profits realized when you buy the bottom of bear markets. It can sway up to 20% from that mark based upon your educated assessment of what is to come in the next 24 hours, but that is your personal science to discover.....and hopefully impart to others along the way.

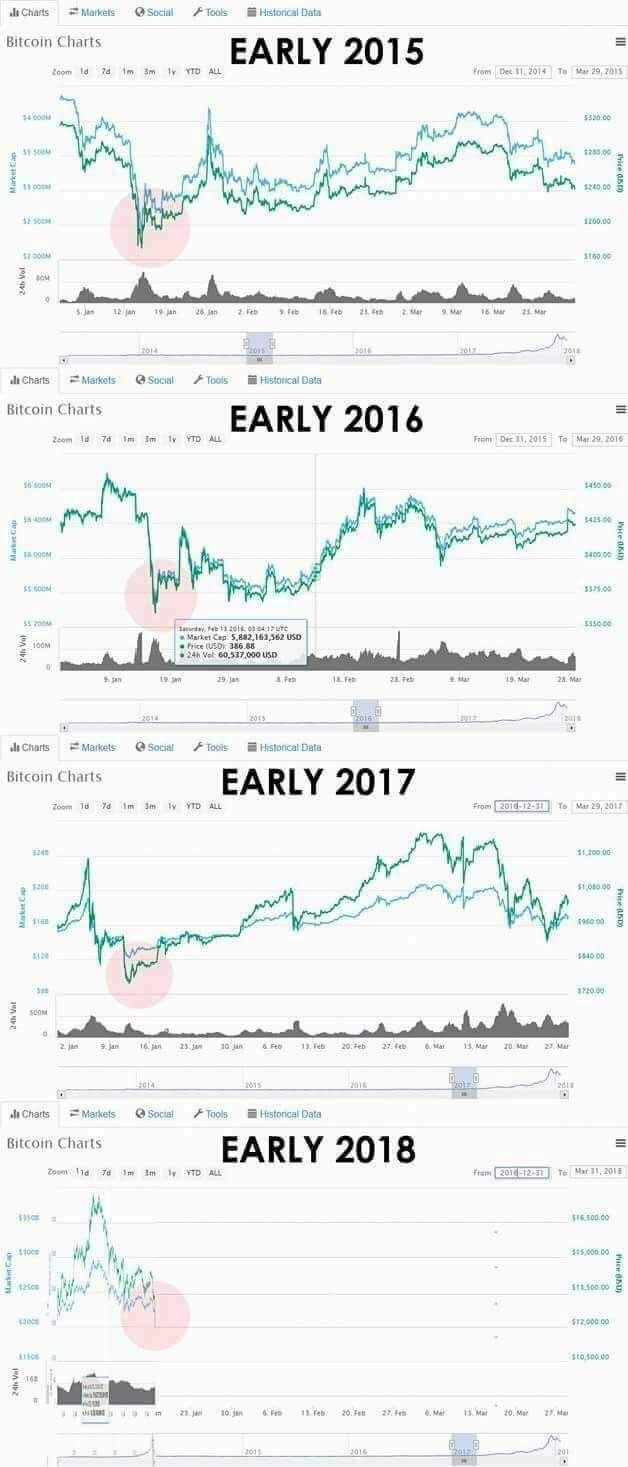

- This happens all the time - Every damn quarter and every damn January this happens. Keep your head on, buy the dip and thank me later (as I have repeatedly thanked those who came before me like @sequentialvibe the visionary, and @evileddy the mining kingpin) Check the evidence:

It is up to the veterans we are or will become to moderate the wild swings that are born of sentiment, emotion and ignorance in Crypto if it is to stabilize to the point where the early majority will confidently come aboard. You can quote me on that as I think it is a pretty heavy statement that your fellow crypto-ambassadors will embrace and personalize as we get there.

Less Hysteria/worry

More rational, prepared, resilient traders

Grab your land now that it is available, forget the market price of the moment, and don't let it impact your day-to-day attitude in a negative way. We are doing this.

Fucking SOLID! Resteemed for the masses.

Thanks!

Playing the long game... Nice!

Long Duk Dong!

Words!