This crypto adventure is a wild ride!

I joined recently and have slowly started to build my crypto portfolio as per my earlier post: https://steemit.com/cryptocurrency/@transptrader/portfolio-management-how-to-build-a-crypto-portfolio-from-scratch

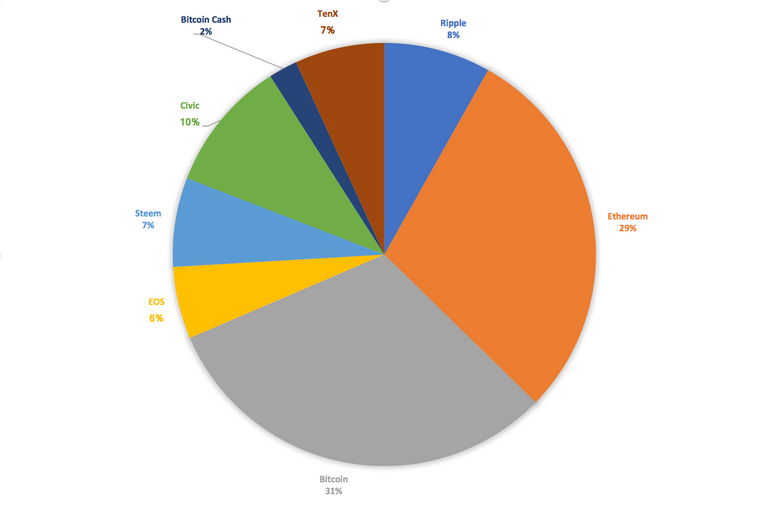

As you can see in the post, my plan was to allocate certain crypto currencies according to my perceived risk profile for them. And I have. My portfolio at the moment looks like this:

Here’s a few observations I have had along the way so far:

- The volatility is CRAZY. I love it. You need a strong stomach though, my portfolio has swung from -40% to +20% within a months time.

- The potential gains are INSANE. Of course, I have heard about the 1000% gains of the past but until you actually realise a massive gain like the 300+% gain on CVC right now, you kind of don’t believe it is true. But it is!

- There are SO MANY SCAMS out there. I can’t tell you how many times I have done research on a coin to shake my head in disbelief.

- Market Cap is a tricky metric. If you would look at the crypto coins as if they were companies then the market cap does not make sense at all (really, EOS which isn’t even a thing yet! is valued at 500 MILLION US??) but then again, if you were to change your perspective and look at it as if it was Forex, it actually isn’t too bad. Changing perspectives helps.

- Everyone is always talking about a bubble, but it never really comes (OK, the hard fork was a bit touch and go...)

- You need to get a grip on the lingo to really understand what’s going on. I.e. hard fork, ICO, exchange, wallet, cold storage, blockchain, off-chain, decentralised apps. And these are just the non-technical terms!

- Stick to your research - I bought into NEO at 17 thinking it could go up more and when it didn’t I sold at 18, only for it to shoot up to 36. When you make a call, don’t react in a panicked way to the market movements. This market moves like crazy, but you have to trust your research.

- Read, read, read, then read some more. Or watch, whatever works better for you. There are so many great channels available to get up to date on crypto land. use them, as it will help you make more informed decisions. One of the best informed guys out there is @boxmining. Follow him, it will help you.

I know, this post is a bit all over the place. I wanted to share some observations and also discuss how to rebalance the portfolio. In my previous post I said this:

And that’s spot on (if I may say so myself). If you would just take a look at the breakdown of my portfolio now you can see that it is already a bit out of whack, but not by much. Here’s what I do to get it back on track:

For example, when I had the massive gains on Civic it exceeded the 10% I allocated to the coin and I had to make a choice. I decided in this instance to transfer my initial investment amount back to bitcoin. Besides bringing the coin back into the 10% mark, this has two advantages:

- What remained of the Civic tokens is PURE PROFIT. How good is that? Stress-free. But also:

- I have a bit more in the bigger coins (Bitcoin in this instance) to allocate to promising other coins. You need some extra in either Bitcoin or Ethereum to buy other new coins (if you don’t want to expand you initial investment).

Now taking this decision doesn’t seem to significant, but the reason I wanted to provide this example is that it is a decision driven off portfolio management rules. Without sticking to the rules of the portfolio management, management of your risk gets harder and harder. And of course - you could argue that at some point Civic warrants a move up into a new category. My main point is: assess, then decide.

Hope this helps some of you out there!

All the best,

Jeroen (aka The Transparent Trader)

Nice article, I'm just starting out in the crypto currency world myself. Thinking about diversifying too.

Very interesting, I'm going to share this with my fiancé he's big into crypto currency. Thanks for sharing.

Great! No worries and good luck to him.

Nice article Jeroen! Interesting experiences you share here :-)

Btw, something that might be interesting to you as well, a tool that gives insights in correlations between crypto's:

https://steemit.com/cryptocurrency/@cryptotem/how-do-the-cryptocurrencies-in-your-portfolio-correlate-a-handy-tool-for-valuable-insights

Keep up the good work!