Since the beginning of 2018, large cap crypto markets have been a bloodbath. Investors have been overwhelmed with #FUD (fear, uncertainty, doubt) as the largest crypto assets have shed nearly 50% from their peek valuations. This piece will touch on our thoughts to the market, what we’ve learned, and how we’ve managed portfolios.

Market Summary: Painful but Necessary...and close to a turnaround

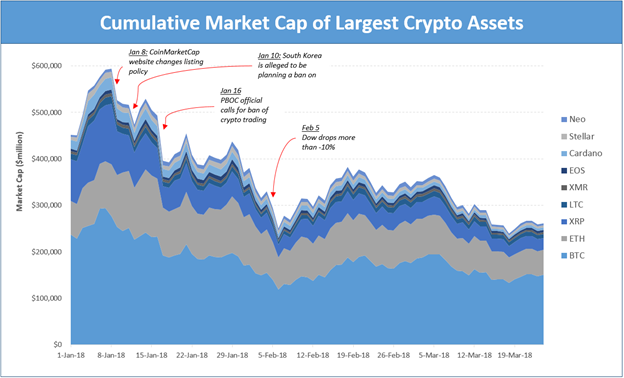

The cumulative market cap of the largest crypto assets (see footnote for our sample set for this study) has declined by 42% from January first through March 26th, with XRP declining -72%.

While the losses sustained this year have been painful, we and the fund managers we interact with have felt a bit of relief. Valuations of early January reflected extraordinarily optimistic expectations for the regulation and adoption of crypto.

As the regulators (both US & international) continue to roll out a framework for understanding the space, a lot of air has come out of the tires, bringing crypto much closer to reflect a more realistic outlook. We view this as positive.

Another positive is that we think the blind speculators have all exited the market for good – though I must admit my claim here is based on somewhat anecdotal evidence; I was told yesterday by a Supreme-wearing Brooklynite that he “used to invest in crypto back when that was cool.” As he and his kin have dumped crypto, we happily await lower entry point to invest in interesting projects and are optimistic that the market is becoming more intelligent.

A lesson that has been reinforced

“We Will All Go Down Together” – Billy Joel, Goodnight Saigon

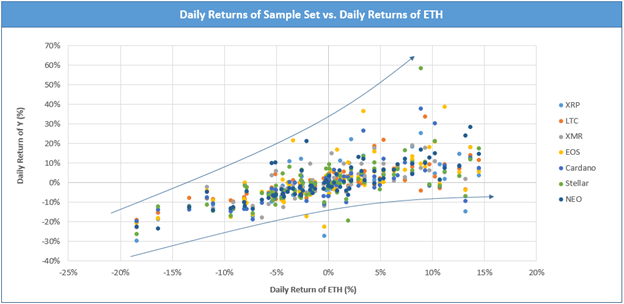

We touched on this in a previous piece, but we have been very surprised by the correlation between crypto assets – particularly on down days. On days like those indicated on the chart above, cryptos have behaved remarkably similarly. This makes sense when trading is driven by regulatory guidance on exchanges, which impacts all crypto assets. It makes less sense when the regulatory guidance is directed at ICOs; in those instances, one might expect ETH, NEO and other dApp hosting platforms to be impacted far more than crypto currencies (assuming that the value of these assets is driven by their supply and demand). We’ve been frustrated to see that that hasn’t been the case.

Contrastingly, on the way up, there is more differentiation in returns. Therefore, while we remain diversified, we no longer to expect to benefit from diversification in a selloff. We hope that the crypto assets to which we diversify our capital will have outsized upside and similar downside to alternatives.

Implications for Portfolio Management

Turbulence in the markets and the growing legitimacy and availability of fiat-pegged tokens (Tether, bitUSD, USDT, et al) has led us to increase our allocation to cash. We have also looked to new event-driven trading strategies that are market-neutral to generate returns. As an example, we decided to make a sizable bet on the zClassic fork to Bitcoin Private. Unlike previous forks, zClassic’s core developer team was explicit in stating that they would be abandoning the zClassic fork for Bitcoin Private, largely to benefit from the “Bitcoin” brand. They gave guidance on when holders of zClassic could expect to receive a “free” Bitcoin Private coin.

We invested in zClassic expecting:

- zClassic’s price to get bid up due to the excitement around the Bitcoin Private project

- We would receive an equivalent amount of Bitcoin Private

- We would sell the zClassic we held immediately after the “snapshot” used by the developer team to determine who deserved the new Bitcoin Private coins. Since its developer team would migrate to Bitcoin Private, we would sell for any price we could get before the coin plummeted to $0.

- We would then liquidate the hotly anticipated Bitcoin Private when it became tradable on exchanges.

We managed to average in to zClassic at $70 – admittedly, somewhat late as the fork had been announced when it was trading below $20. zClassic then rose to $130 before plummeting to $60 immediately before the fork. Confident in our investment thesis, we used the opportunity to buy more, bringing our average cost down to $65. After the snapshot we sold all of our zClassic for $30, meaning we would need to sell Bitcoin Private for >$35 to generate a return. While our execution could have been better, we managed to sell BTCP for $95.

Our per-coin investment was $65 and we were able to get $130 without subjecting our capital to the general direction of crypto markets.

We eagerly anticipate the next series of forks in our favorite coins, e.g., the Bitcoin Cash Fork scheduled for mid-May. In the meantime, we will be holding more in cash waiting for similar opportunities.