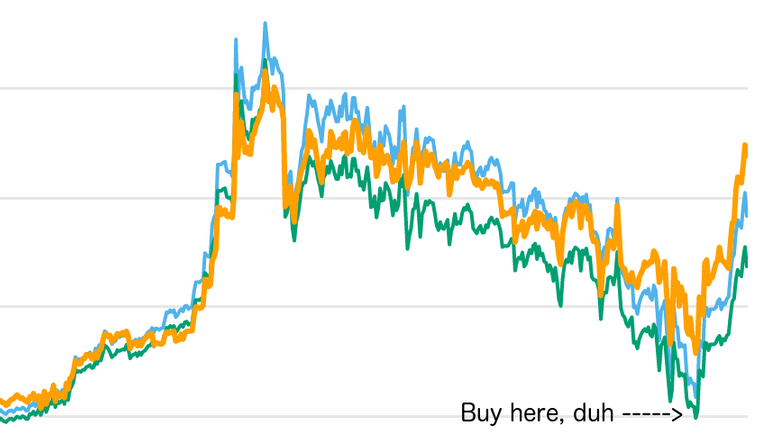

It’s a simple concept, buy things when the market is at its lowest. Then when it rebounds, you’ve made some easy gains! In practice, it’s not so simple to do.

After the most recent Janurary dip, I stopped to reflect on what I could have done better when trading. When I say trading, that doesn’t mean I don’t try and HODL on for dear life. That’s not always the best course though. When is your exit point? When do you buy more? When do take profits? These all factor into the decision to sell.

But wait! This article is on buying the dip. Why does knowing when to sell come into it? I’ll get to that, but first we start with the first lesson I learned.

Lesson #1: Plan for the dip

It will happen. A dip doesn’t mean the bubble burst (regardless of what the media will tell you), and there are market corrections all the time (even after the longest of bull runs).

What did I do wrong? I bought all my new altcoins as soon as I could. I was excited about them, and the market had been going nowhere but up. “Get them quick before they spike another 10x!” I thought.

What I should have been doing is adding those coins to a list, along with how much of my portfolio I wanted to invest in them. This would be planning for the dip, or buying them all at a HEFTY discount. This brings us to….

Lesson #2: Take profits when the market is booming and leave some as liquid fiat

I got the first part right! The market was surging and I decided to finally recoup 2x my principle. My mistake was transferring the whole 2x to a bank account, a slowwwww process.

What I should have done is left half as liquid fiat on the exchange. Then, when the dip comes around (PLAN FOR THE DIP) you use that liquid fiat to buy all those shiny new altcoins at the perfect moment.

Why do it this way? You get to buy your pairing coin (BTC/ETH/LTC) at a hefty discount as well! It’s like double coupon days, rather than trading any BTC/ETH/LTC that you’re holding while it’s ALSO at an all time low.

Lesson #3: Good low market cap coins don’t dip as far as you think

Often because they’re only on crappier exchanges without the volume. Or maybe people dedicated to the technology are more likely to hold those coins. Or Coinmarketcap will SAY the price is much lower than it is because of a couple small orders, but no one is selling at that price and there is a huge spread between buy/sell orders. I noticed this when I frantically was trying to reup on some coins with my super-devalued ETH.

Bonus lesson: Plan for the peak too. I’m going to start keeping a list of what I want to sell so that when I know the market is surging, I can refer to it and prune the coins I no longer want at the right time.

I think the best way it keeps spare cash accessible ahead before the dip is available.

Hell yeah man!

Congratulations @tinyhousevan! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @tinyhousevan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!