Hey Guys,

I posted this on my own site in early March. I wanted to share it here since I think it will be better received. If this is somehow violating Steemit policy or otherwise being spammy, please let me know and I'll delete it at once. Google recommends a backlink to the original source to avoid being penalized for plagiarism. As I am the original author, I would very much like to avoid such charges. :-)

You can see the original article here: http://bitcoinbuildify.com/index.php/2018/03/02/why-the-wolf-of-wall-street-is-wrong-about-bitcoin/

And my YouTube video commentary on it here:

Please let me know what you think of this post. Would love to hear your thoughts, insights and opinions and am generally looking forward to starting discussion with this community. Really happy to be here.

That said, enjoy:

Jordan Belfort, AKA “The Wolf of Wall Street” has come out publicly speaking against Bitcoin calling it things like a “huge danger” and a “bubble for sure”. Click here to see the article. For those who haven’t seen the movie or aren’t familiar with his sordid history in finance, I would highly recommend watching it. It’s good for a laugh and, more soberingly, a trip into a fine example of the types of minds Wall Street tends to attract. Nothing against the guy but suffice to say he has a rather interesting position to speak from. As one who has stood on the other side of scam after scam and lived to profit from it, why should we take his opinion on the world’s oldest and most highly valued cryptocurrency? The answer is this: you probably shouldn’t.

Yes, “The Wolf” knows his way around the stock market. He knows how to find an angle and reel in the profits. He knows sales and he knows money. But, here’s a surprising thing: comparing Bitcoin to the many ludicrous schemes churned out by Wall Street in the past is a bit like comparing an abacus to a smartphone. Just because someone has been in traditional finance doesn’t mean they know what they’re talking about when it comes to Bitcoin. Like, at all.And that’s especially true when you consider that Bitcoin has almost nothing to do with traditional finance whatsoever at all.

In fact, it could hardly be more different. This general lack of understanding of Bitcoin (and its ever growing cohort of similar technologies) has not served its reputation well. And it has probably delayed its rised to the mainstream for the majority of its short existence (9 years of as of January 2018). Thankfully, things are changing. And as Bitcoin continues its rise into the mainstream such terms as “blockchain” and “cryptocurrency” will inevitably become more common as will an understanding of what they are and how they work.

For the time being, however, Bitcoin and cryptocurrencies exist in a kind of grayzone. They are, however, slowly but surely coming into the limelight. Be that as it may, when someone comes out and blatantly calls the entire movement “a bubble” we should really question what their rationale behind saying so is. Especially when you consider that, by the same criteria, the entire world economy could just as easily be called a bubble. Didn’t hear that one on CNN? Yeah, me neither. The thing is, the term “bubble” can be a rather misleading term and, in cases concerning a new technology and its rise in popularity, can be thrown around all too easily.

However, could Mr. Belfort be right? Could Bitcoin really be a bubble that’s going to pop and leave “all those suckers who should’ve known better” holding the bag? Will all the Jamie Dimons and Jordan Belforts of the world get to puff out their chests and say “I told you so” right there on the TV?

Methinks not. Ok. To be fair. Probably not. Yes, the waters of the cryptocurrency world stretch as yet untested. The technology is new, little understood by the majority and the whole thing can come off as something out of a video game that got taken way too seriously. Digital money?

But the truth is cryptocurrency technologies, most notably Bitcoin with its seniority as the first successful endeavor of its kind, are showing enormous promise and all of the signs of not being a fad. If anything, they could very well be a revolution. On top of that, there are a lot of people making a lot of money with them. A LOT of money.

First, can Jordan Belfort make any accurate statement about Bitcoin without comparing it to some sleazy, closet Ponzi scheme based on fiat currency? It is extremely doubtful he can. And, frankly, making a comparison between Bitcoin and basically anything Wall Street touches is, well, a bit of a stretch. And that is because, presently, all of Wall Street and the global finance markets as well are tied up in what basically boils down to Monopoly money.

By that I mean the money can be printed at will and is controlled 100% by institutions with vested interest in controlling and profiting from the people who use it. Bitcoin doesn’t follow this pattern at all. Bitcoin is not controlled by any institutions and it cannot be created at will. So this throws a very different light on the subject.

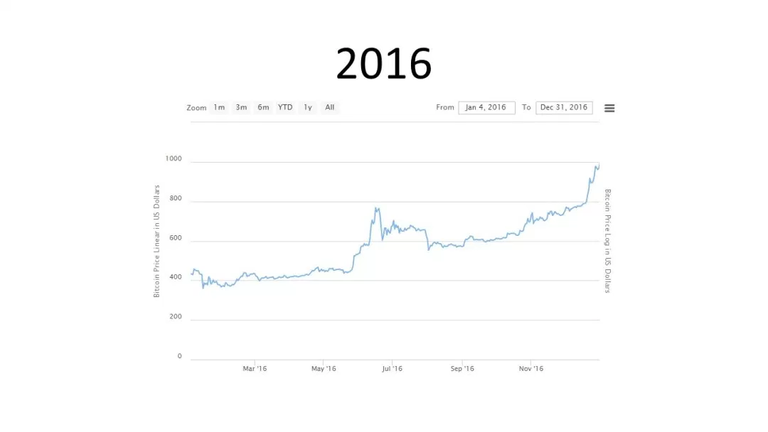

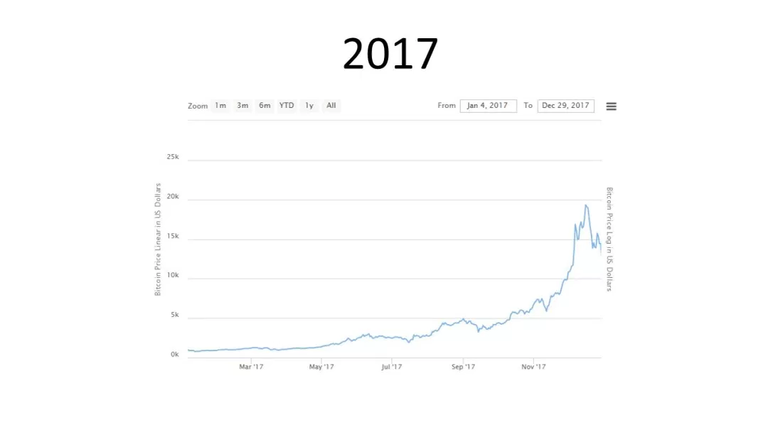

Viewed from the outside, it’s rather easy to doubt the skyrocketing value of Bitcoin or the huge number of both individuals and companies alike getting behind it. In 2017 alone Bitcoin went from an average of $967 in January to an average of $13,860 by December. That’s an increase of %1400 in 12 months.

Looking at data like that it’s very easy to think “tulip bubble” or something along the lines of “The Empror’s New Clothes”. And there’s nothing wrong with that, again, if you’re strictly looking at it from the outside. And the question of why are all these people going so crazy about Bitcoin is a perfectly normal thing to ask. So…

WHAT IS GOING ON WITH BITCOIN?

First let’s talk about the data. Yes, 2017, especially the latter half, did see a remarkable rise in the price of Bitcoin. It was crazy. And the world had never seen anything like it. It was also followed in early 2018 by a remarkable drop in value as the last section on the graph shows. Here’s the thing you probably haven’t heard on the news: This is a historic pattern with Bitcoin.

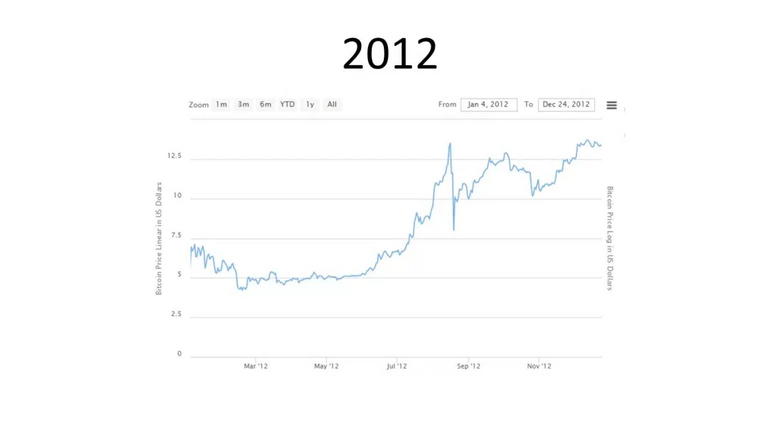

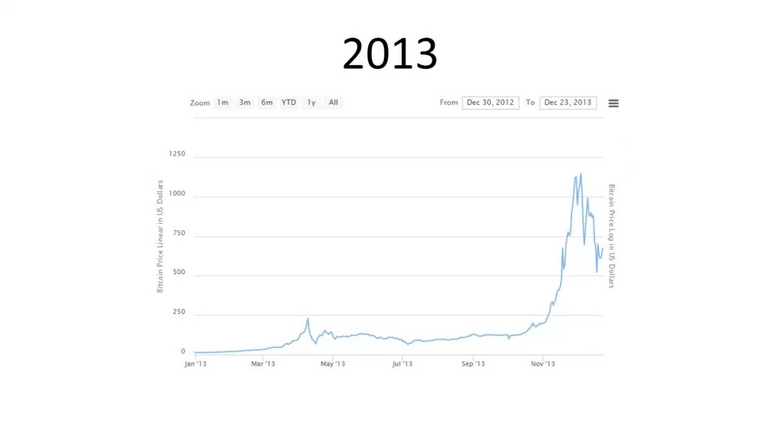

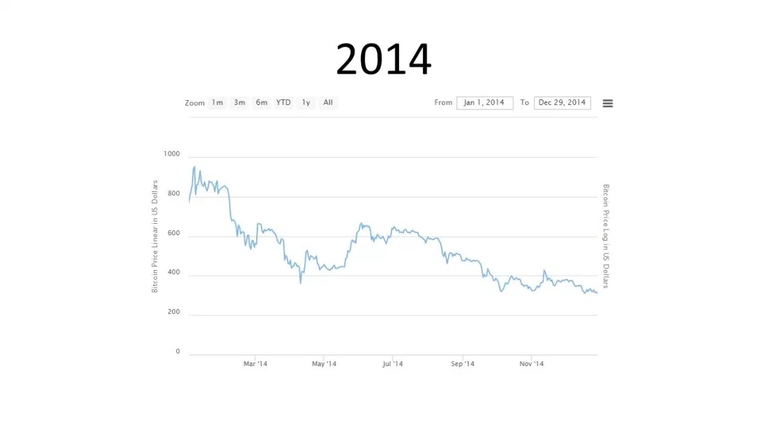

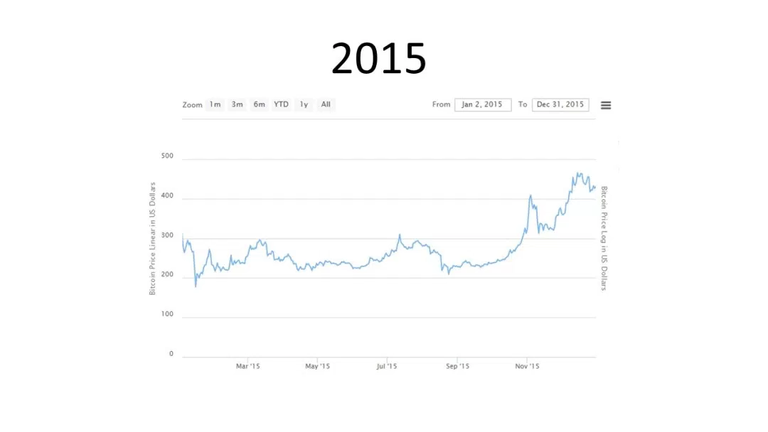

Yes, nearly every year since its inception Bitcoin has started the year small and finished big. There have been exceptions, of course. Most notably 2014. But the general trend of Bitcoin has been, well, up. Take a look below to see the fluctuations in Bitcoin prices from 2012 to 2017 to see for yourself.

What made 2017 unique was that the typical annual rise in price finally broke through a level of magnitude that got A LOT of people’s attention. Look at it this way: if Bitcoin (or any other cryptocurrency for that matter) sees a %1400 percent rise in value when it’s only selling for $0.02 it will end up being (wait for it) $0.28. That is still an incredible rise in value percentage-wise but, let’s face it, something being worth 28 cents isn’t exactly going to knock anyone’s socks off. It’s only when the value really starts taking off that people begin to notice. I would agree that the classic phenomenon of “buying the rumor and selling the news” had a hand in 2017’s massive gains but not altogether. Not at all. Bitcoin, despite sometimes massive drops in value, has consistently and relentlessly been on the rise. It doesn’t have anything to do with some kind of scam being suddenly launched on the unsuspecting public. It doesn’t have anything to do with any institutions or governments inflating yet another ridiculous profit making scheme bound to fatten CEOs and those less endowed with humanity on Wall Street while eventually screwing everyone else. Bitcoin’s rise in value has to do with one thing and one thing only: Bitcoin. Which brings us to the next question: WHY?

Yes, indeed, why are people going so crazy about Bitcoin? Aside from the hype. Aside from the FUD (Fear And Doubt). And aside from the FOMO (Fear Of Missing Out). Bitcoin actualy represents significant opportunities. It is also a forerunner in what is proving to be an entirely new type of technology.

Let me explain further. And to do that, we have to define what Bitcoin is. Bitcoin is a new type of technology, not just a new currency. And anyone who wants to know what makes it so unique and promising will have to put some serous time and effort into learning about it. For all of its simplicity, it is a completely revolutionary platform. So it does not fit any existing definition for other technologies. It is also somewhat difficult to make an accurate comparison between Bitcoin and other technologies. So, to keep this article moving, let’s use the most basic definition:

Bitcoin is the first successful decentralized digital currency.

As such, it allows peer to peer, instead of the more traditional peer to institution to peer, transactions that we’re used to. It is also based on a trustless system. A “trustless system” is one where you don’t have to blindly entrust any information or funds to any one entity hoping they will do their job but not having a 100% guarantee they will. This is an ancient problem sometimes called the “Byzantine General’s Problem” and one no financial, government or commercial system in the history of the world has been able to completely eliminate it; until now.

With the Bitcoin blockchain, one individual can send funds to another individual anywhere on the planet without a trusted 3rd party. And the transaction will be totally secure and verified. This means you don’t need a bank or bank account, you don’t need fees, you don’t have to entrust your money to anyone and you don’t have to leave a record of what you are spending it on. This actually has amazing implications that people and companies alike are just beginning to realize.

Actually, Bitcoin is not the first attempt at a purely digital currency. There were attempts at creating such a thing as far back as the 1960’s and 1970’s. But there was a really big problem called “the double spending problem” that constantly defeated all efforts. The double spending problem refers to the difficulty of creating a digital file which cannot be successfully duplicated. Being able to duplicate a file is great for being able to share information and make access easier but it creates some really big problems when it comes to money. The way Bitcoin solved this was by using what has come to be known as the “blockchain”. The Blockchain is a decentralized ledger with both verifies and records all transactions. It sounds complicated but the principles are actually very elegant and simple. This is part of what makes it so secure and efficient.

WHY ARE WE HEARING MORE AND MORE ABOUT BITCOIN?

So far, Bitcoin’s performance has been flawless. And the more this continues to be the case, the more people are going to take notice. All new technologies go through a few general phases:

inception: the idea of the technology. A good example is the airplane. The idea is ancient but very few ever acted on it and far, far fewer were successful. For a very long time, the best people could do were hot air balloons or simple gliders that were often death traps.

creation: the implementation of the technology. The first successful flight of an engine powered airplane was December 17, 1903. It was a bit rickety and not very long but proved that manmade machines could fly under their own power. It wasn’t just an idea anymore.

use/pioneer stage: people using the technology. For about 10 years after the Wright Brothers, powered flight remained in the “pioneer stage”.

adoption: the spread of the technology. The years during and following WWI saw a massive increase in the technology of flight and it’s use up to and including the rocket technology of the 50’s and 60’s.

mass adoption: the spread of the use of the technology to a level where it reaches a critical mass and becomes mainstream to the point of entering daily language and everday use. The first commercial jet flight happened in 1952. It was the beginning of a new phase in technology where people, for the first time were able to cross oceans in relative safety within hours instead of weeks.

normalization: the point where the technology becomes so common place that people don’t think about it and may actually have trouble imagining life without it. As of 2014, there were an average of 102,465 commercial jet flights per day or roughly 37.4 million per year.

Personally, I believe Bitcoin is at the point of adoption. Many of the pioneers of the use of the technology (the luckiest computer nerds in the history of the world) are now multi-millionaires. And the price, while sometimes falling, has shown consistent upward trends. With each passing day, more people and institutions are getting on board with this new type of technology. And so there must be reasons for this. What are they? Well, for the long answer click here to our “What I Is Crypto Currency?” page. For the short answer, read the list below:

convenience:

Bitcoin offers extreme convenience. With the blockchain technology, you can make a transfer to anyone anywhere anytime – in about 10 minutes. Actual times may vary but it is still far less time than any bank could do it in.

security:

the nature of the blockchain is about secuirty and verifiability. Some refer to the blockchain as “triple entry book keeping” ( one entry for deposit, one entry for withdrawal and a third via distributed verification across the block chain) and consider it a vast improvement over the standard double entry book keeping still used by every institution in the world since it was first devised in 1494. Yes, 524 years ago.

anonymity:

although not 100% absolutely anonymous, the Bitcoin block chain offers a much higher degree of privacy than any 3rd party ever could.

opportunity:

there is a lot of opportunity in Bitcoin and block chain technology. More than most people realize. Be it opportunity for investment, development or simply a better way of doing things this technology shows incredible promise.

independence:

with its trustless network and no need for a 3rd party, Bitcoin delivers an unprecedented amount of independence to its users. This is great not only for your average Jane or Joe in the developed world but also carries huge potential for the over 3 billion people living in the undeveloped world where lack of infrastructure and the fees involved in banking simply make modern life impossible.

WHY BITCOIN IS NOT A BUBBLE

A bubble, by definition, is a sudden surge of activity or force to a degree that is unsustainable and eventually makes whatever is being strained go “pop”. In the case of a financial bubble it is usually a trend in lending or some kind of bizarre financial product that lets people make money out of thin air. It is a house of cards. People and institutions will run with it like a herd of proverbial lemmings right off of a cliff. We’ve seen it again and again.

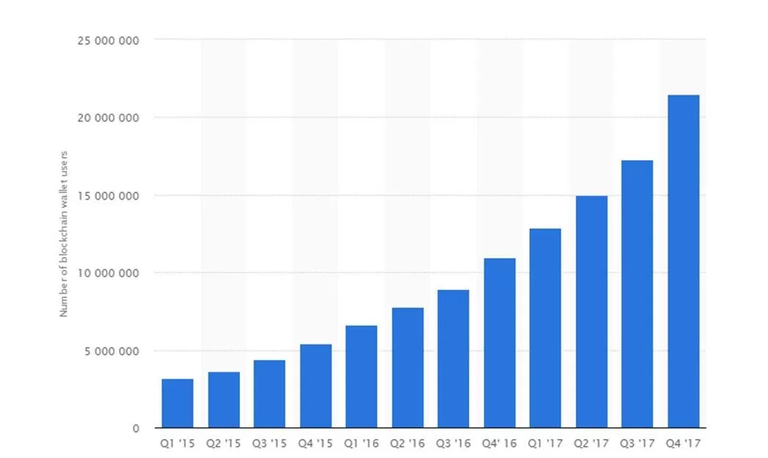

With Bitcoin, we are not seeing anything unsustainable. We are seeing, instead, an increased rate of adoption and use of a relatively new technology. There is a very, very big difference here. If we are willing to accept that Bitcoin is a bubble then, by the same rationale, we would also have to accept that other technologies like cars, airplanes, smartphones and just about every invention of the past 5000+ years are also bubbles. This obviously doesn’t make any sense which is why I believe the Wolf of Wall Street is mistaken.

Take a look at the image below showing the increase in the number of active Bitcoin wallet users over the course of 2015-2017.

The reasons why there are so many more active wallet users may be debatable but the data regarding their numbers is not. One thing is clear, more and more people are becoming involved with using Bitcoin every year. For more facts and statistics outlining the growth of Bitcoin demand, we recommend the article, “Bitcoin by Numbers: 21 Statistics That Reveal Growing Demand for the Cryptocurrency” written Nov 11, 2017 by Kai Sedgwick. You can read it by clicking here.

FINAL THOUGHTS: WHY BITCOIN MAY POSSIBLY BE UNDERVALUED. NOT OVERVALUED

This topic is going to be expanded on in another article but I’d like to share the basic idea here. And that’s because it sheds some light on one more reason why Bitcoin (and other cryptocurrencies) is not a bubble.

Yes, my personal opinion is that Bitcoin may actually be undervalued. Not overvalued. And my reasons are the same reasons that have ever made any currency valuable: scarcity and use.

Scarcity: the total amount of Bitcoin is limited. There will only ever be 21,000,000 Bitcoin in the world and no new Bitcoin will ever be made. Actually, no new Bitcoin can be made becausse they would not be verifiable on the blockchain. There are currently 16,896,925 Bitcoin on the market. Of those, some 5 million are estimated to have been lost because of lost keys and hardware or destruction of the computers the Bitcoin were on. Sad but true and there are quite a few stories about these types of incidents.

Further, the total supply of Bitcoin is capped at 21,000,000. And the last Bitcoin will not be available until 2040. Scarcity constricts the supply side of the supply and demand equation which means it will always have value for those demanding it. And increasingly more people are.

Use: this is the demand part of the supply and demand equation. If something is being used by a lot of people it gives it something called “liquidity” meaning basically that it can be used very easily and very quickly. Think buying something with cash vs. buying something with a kitchen table: far more people will take the cash than the kitchen table in exchange for whatever goods or service you are buying.

Because the technological advantage of Bitcoin offers so much over the traditional finance system, use will likely continue to grow and grow at the same rate and to the same degree as other revolutionary technologies have on their road to mainstream adoption. Think laptop or smartphone. 20 years ago, no one had them. Now just about everybody does.