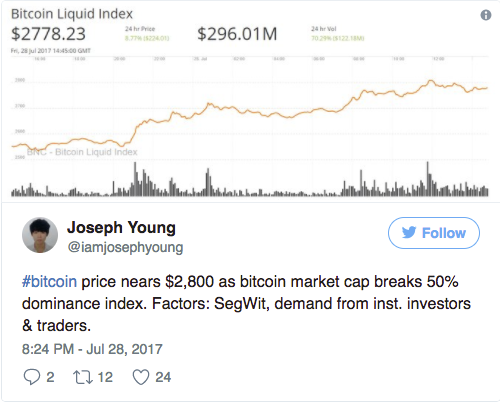

On July 28, Tuur Demeester, Bitcoin analyst and Research Worker disclosed that Bitcoin dominance index recovered on the far side its 50% mark for the first time since May.

Although the market cap of cryptocurrency market fell from $115 Billion to $89 Billion, the dominance of Bitcoin on the market has raised, as Bitcoin moved close to a market cap of $46 Billion.

As a result, Bitcoin’s value has moved close to $2,800, because of the optimism surrounding the activation of SegWit

Some of the largest Bitcoin exchanges and commerce platforms together with Coinbase, Bitfinex and Bitstamp have already processed their stance on Bitcoin cash, the hardfork proposal that is being developed by ViaBTC.

Initially, Bitmain developed Bitcoin abc as a contingency set up towards BIP 148, user-activated softfork. But, because the mining community came to an agreement to activate SegWit via BIP 141 i.e. the first SegWit proposal, the chances of the activation of Bitcoin abc or Bitcoin cash, considerably reduced.

Still, ViaBTC formally declared earlier in the week that it plans on following the Bitcoin cash hardfork, to form a separate version of the initial Bitcoin Blockchain. The abrupt announcement of ViaBTC came as a surprise to Bitmain additionally, that led the corporate to release yet one more announcement clarifying that Bitcoin abc was just a contingency set up against BIP 148.

Despite the rejection of Bitcoin cash by many exchanges, mining pools and businesses, its creation to the market can mean a chain split. Before the finalisation of SegWit activation, the market remained unstable because of the possibility of a hardfork execution and currently, the market is more assured in Bitcoin than ever before.

For the most part, that's as a result of Bitcoin has proved its ability to scale through the finalisation of SegWit and also the overwhelming majority of the business has proclaimed that they don’t intend to acknowledge Bitcoin cash as a legitimate fork of Bitcoin. As leading businesses like Coinbase and GDAX can think about Bitcoin cash as an alternate cryptocurrency or altcoin.

Hence, because of the finalisation of SegWit and also the clarification of the Bitcoin business on the Bitcoin cash Hardfork, the market and investors have a lot of confidence in Bitcoin. In addition, according to analysts from Goldman Sachs and alternative leading monetary institutions, Bitcoin’s upward momentum can probably be sustained.

Source: COINTELEGRAPH

This just reaffirms what I knew all along. The future is bright. Thanks for the information.

I'm glad you liked my post :)

This past week, I watch BTC dominance grow from 47% to over 51% yesterday. I think it had dropped to 38% a month ago.

Yes soon it will cross $3600 Mark as well

Gud one

Thank you :)

If Bitcoin goes up, pretty much all other Cryptos go up too. Looking forward to the rise of Ethereum and Steem! I'm ready!

Be ready it will be UP in no Time

The long-term future for Bitcoin looks even brighter.

Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Tech Trends from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

This post got a

6.01% upvote thanks to @tech-trends - Hail Eris !