Bitcoin Bounces Back From Lowest In More Than 1 Month

Bitcoin prices have recovered recently, climbing close to $9,000 after reaching their lowest in more than a month yesterday.

The world's largest cryptocurrency by market value reached $8,702.47 earlier today, according to the CoinDesk Bitcoin Price Index (BPI).

The digital currency rose to this level after falling to as little as $7,335.57, a more-than five-week low, the day before, additional BPI figures show.

By generating these gains, Bitcoin climbed roughly 18.6% in less than 24 hours.

Full story HERE

Source: Forbes

Trump bans purchases of Venezuela’s new national cryptocurrency

President Donald Trump has issued an executive order to ban Venezuela’s new national cryptocurrency, the petro, from being purchased by Americans or by anyone inside a US territory. It’s the first cryptocurrency-related executive order a president has issued and another blow to an already dubious virtual token that’s supposedly backed by oil reserves, as Venezuela’s president Nicolás Maduro has said.

Trump’s order describes the petro’s initial coin offering as “recent actions taken by the Maduro regime to attempt to circumvent US sanctions,” and declares all related transactions unlawful. His order also makes reference to Venezuela’s National Assembly being in opposition to the launch of the petro. One legislator from the assembly called it “illegal and unconstitutional” on Twitter.

In February, Venezuela launched the petro, allegedly raising $735 million, according to Maduro’s tweet. Many experts have expressed doubt over the digital currency, which Maduro has proposed as a means for Venezuela to “overcome the financial blockade,” likely in reference to sanctions imposed by the US and the EU. Venezuela’s actual national currency, the bolivar, suffers from quadruple-figure inflation, and one bolivar is currently worth 0.00003 USD.

The executive order to ban the petro isn’t that surprising, considering the US’s current sanctions on Venezuela. The US Treasury warned domestic investors back in February not to touch petro in case it violated sanctions, saying “the petro digital currency would appear to be an extension of credit to the Venezuelan government” and “could therefore expose US persons to legal risk.”

Full story HERE

Source: The Verge

Mt Gox Trustee: $400 Million Sale Didn't Drop Bitcoin Price

The trustee overseeing the bankruptcy of the defunct Mt. Gox cryptocurrency exchange has denied being the cause of the decline in bitcoin prices since December 2017.

In a Q&A report with creditors released on Mar. 17, Nobuaki Kobayashi discussed the recent sale of some $400 million-worth of bitcoin and bitcoin cash belonging to the Mt. Gox bankruptcy estate.

"Following consultation with cryptocurrency experts, I sold BTC and BCC, not by an ordinary sale through the BTC/BCC exchange, but in a manner that would avoid affecting the market price, while ensuring the security of the transaction to the [greatest] extent possible," Kobayashi said, using the alternate ticker symbol BCC for bitcoin cash, which is more normally assigned the symbol BCH.

However, Kobayashi refrained from disclosing precise details of how the funds were sold.

Full story HERE

Source: CoinDesk

Making Sense of the World's Cryptocurrency Rules

Getting your head around cryptocurrencies was hard enough before governments got involved. But now that policy makers around the world are drawing up fresh regulations on everything from exchanges to initial coin offerings, keeping track of what’s legal has become just as daunting as figuring out which newfangled token might turn into the next Bitcoin.

The rules can vary wildly by country, given a lack of global coordination among authorities. And while that may change after finance chiefs discuss digital assets at the Group of 20 meeting in Buenos Aires this week, for the time being there’s a wide range of opinions on how best to regulate the space. Below is a rundown of what major countries are doing now.

Full story HERE

Source: Bloomberg

Chart Shows Bitcoin Hitting $91,000 By March 2020

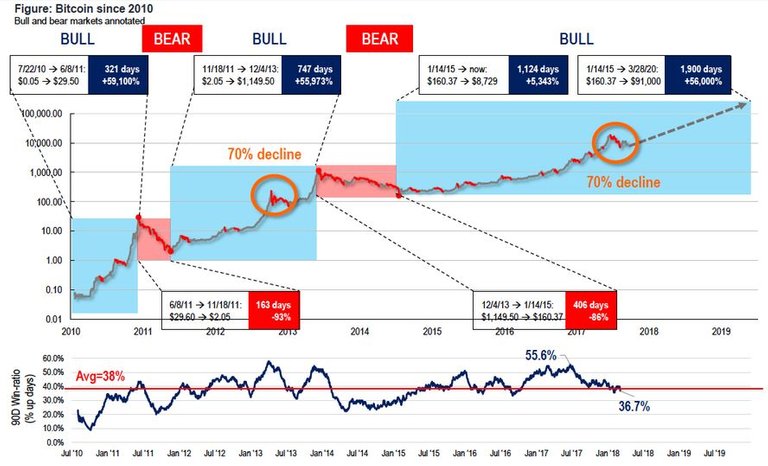

Warren Buffett has concerns about Bitcoin and Allianz’s Head of Global Economics & Strategy thinks it could fall to $0. But Tom Lee, Fundstrat Global Advisors’ head of research, thinks it could rise to $91,000 by March 2020. Fundstrat and Lee have compiled an impressive database, statistics and graphs on Bitcoin that helps to visualize short-term and long-term trends. They include the cost of mining Bitcoins, hourly, daily and monthly trading trends and technical analysis.

Lee also introduced the Bitcoin Misery Index, or BMI, just over a week ago that is at the second lowest point of the past eight years. It is a contrarian indicator, meaning the lower it is, the more positive the outlook for Bitcoin to move up in price.

Lee and his team have produced a new graph that shows Bitcoin’s four declines of 70% or greater since 2010 . After the previous three drops it has experienced significant gains, probably eclipsing the returns of any other asset over the same time period.

Because the chart has a logarithmic scale, Bitcoin’s price movements don’t look as pronounced as they would be if charted on a linear basis (how most graphs are depicted).

Full story HERE

Source: Forbes

Venezuela Wants to Boost Cryptocurrency Mining Activity

Venezuela is a very peculiar country for many reasons. Ever since the Petro was issued, people have been wondering how it would affect actual cryptocurrencies in the country. It now seems the government has launched a crypto mining program meant to attract up to 1 million people. It’s a rather intriguing development, especially because this has seemingly nothing to do with the Petro.

There is never a boring day in Venezuela, by the look of things. Ever since the Petro cryptocurrency was announced, the country has received a high amount of international press coverage. As of right now, the question still remains whether or not the Petro is even a legal currency, as opinions are rather divided on this front. That conundrum is not stifling interest in other cryptocurrencies such as Bitcoin, though.

In fact, the Venezuelan government wants to support these “legitimate” cryptocurrencies in a surprising manner. President Maduro has launched a new crypto mining initiative designed to attract students, unemployed people, homeless individuals, and even single mothers. With this new program, Maduro wants to encourage citizens to begin mining cryptocurrency in the country.

This sudden change of heart is a big surprise, all things considered. When the Petro was put up for sale, most people assumed it would be the only cryptocurrency to make a big impact in Venezuela. It now seems the government is open to competing currencies as a way to attract international firms. Setting up a mining farm in this country is certainly appealing due to lower electricity costs.

Full story HERE

Source: The Merkle

Thanks.

Informative

So mich exciting news! Let hope more positive news comes and prods the sheep into som fomo that pushes the price up.

Daily price of Bitcoin, SBD, STEEM and SuperiorCoin for 22nd March 2018

Good artical

Very informative, thanks for sharing these.

You blog is the best sir

Nice news, keep it up.

Thanks for all your informative updates

Thanks for all your informative updates

thanks for these

hope everything goes well with btc, I just bought some

Will it be count a good news?

WARNING - The message you received from @dzordyja is a CONFIRMED SCAM!

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment!

For more information, read this post: https://steemit.com/steemit/@arcange/phishing-site-reported-www-steemitfollowup-dot-cf

Ese petro como que no va a llegar a ningún lado!

Thanks for the information, it's very interesting.

It's good that the value of the currency is rising. With respect to Venezuela, I hope that all this will end soon for the benefit of all Venezuelans.

thanks for the information

Coins mentioned in post:

Thank you for sharing :)