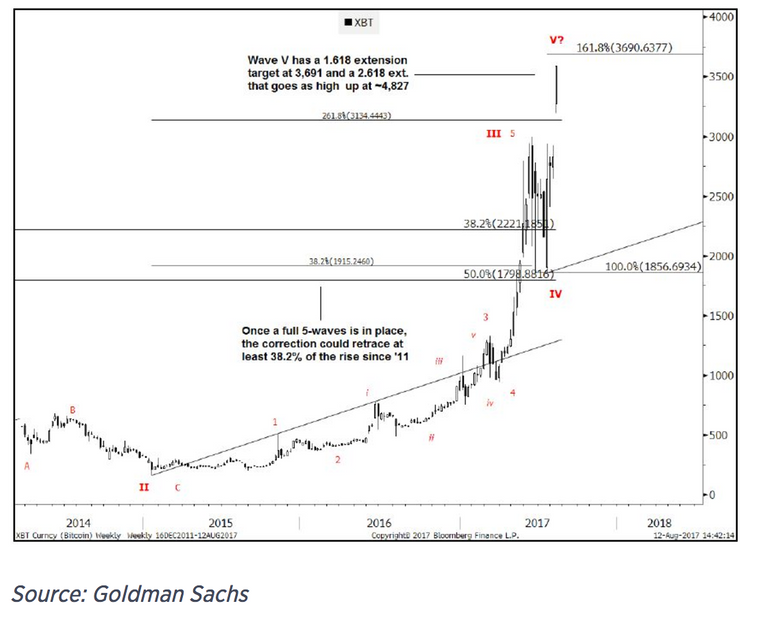

I’m a bartender at a restaurant on the ground floor of a building which is home to the offices of lots of hedge funds, so I overhear a lot of interesting financial conversations. Lately, a lot of these traditional traders have been discussing crypto assets. I was speaking to a guest about the recent spike in the price of bitcoin and the current price projections. For example, Goldman Sach’s analyst Sheba Jafari’s fibonacci arc puts bitcoin peaking at $4,827, then losing up to half its value in a market correction.* Standpoint’s Ronnie Moas just adjusted his $5,000 projections to $7,500. He also sees a $50,000 bitcoin in 2027.* There are of course many who think we’re in a bitcoin bubble that will burst soon, sending the price crashing back down.

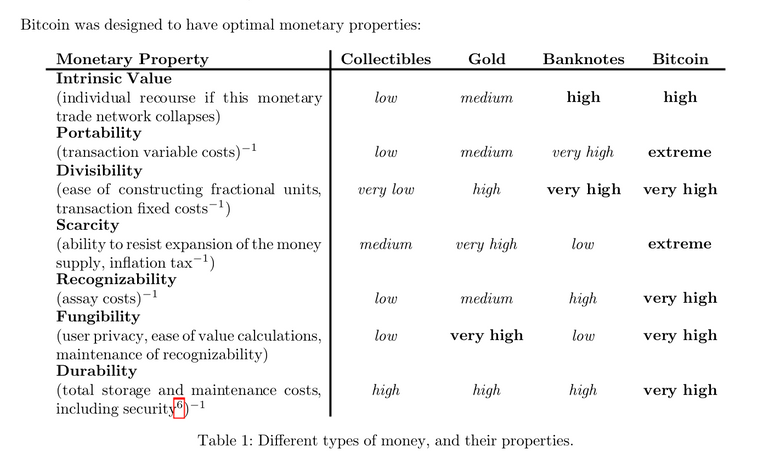

He questioned what would happen to the price of bitcoin in a Great Recession scenario, suggesting it would send the price through the floor. This got me pondering the subject. A recent paper published under the pseudonym “Mr. Game and Watch” argued that in addition to being a technology, bitcoin is a digital collectible, saying “the collectible has a market price and individual owners, and in this way it is similar to physical collectibles such as gold, baseball cards, or oil.”* Like gold, bitcoin has a fixed supply, although bitcoin doesn’t currently have as much practical use. Gold is used to produce jewelry and is used to manufacture some electronics. Bitcoin is harder to use for transactional purposes in a traditional market. Mr. Game and Watch argues:

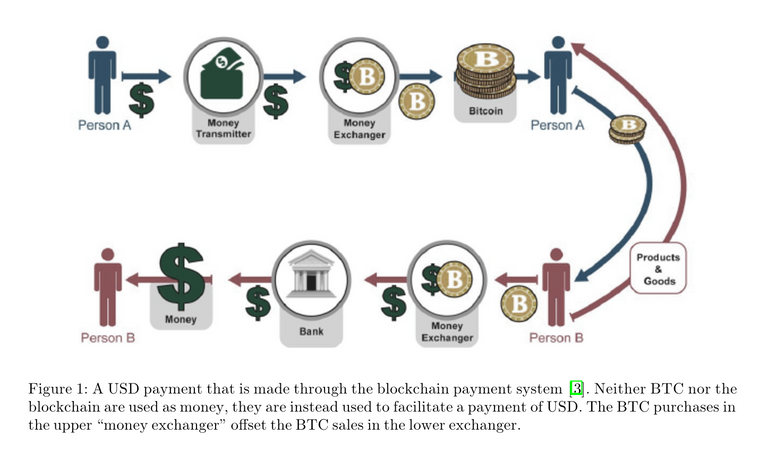

“BTC’s intrinsic value is that it alone will allow the wielder to access the network’s blockspace. In turn,the intrinsic value of blockspace is that it, together with BTC, enables special USD transactions – we will call these “Peer-to-Peer Digital USD Payments”, or “PDUPs”*

Essentially, the user rents bitcoin in order to complete a USD transaction. The bitcoin is just an intermediary, but it is required for the PDUP. The author acknowledge some disadvantages such as fees, learning curve, and speed; but that they have the benefit of anonymity and self-preservation (the chain cannot be shut down). Other authors note that bitcoin and other digital assets can hedge against the volatility of their local fiat. Westerners generally view cryptos as highly volatile, but compared to some fiat currencies, it appears stable.

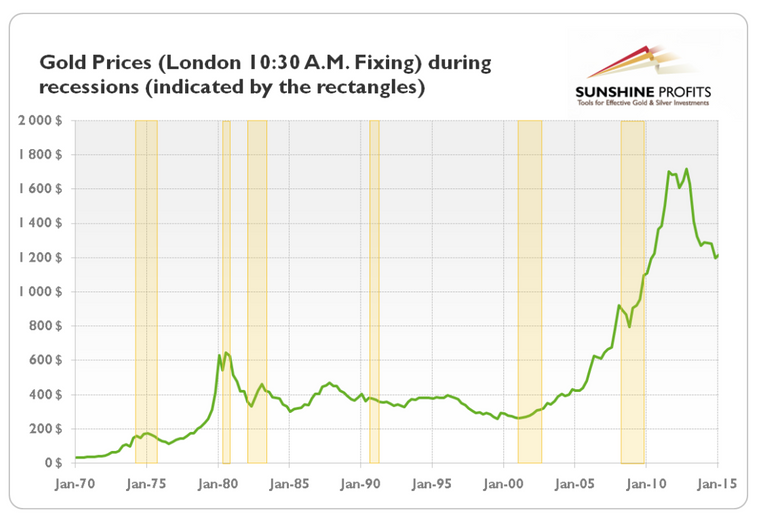

Therefore, my speculation is based off of assuming that bitcoin’s value will somewhat resemble gold in a recession — with its own nuances of course. We must acknowledge that although there are many similarities between bitcoin and gold, there are some differences, both in the asset itself and its traders. Gold’s traders are more traditional, bitcoin has a fringe following. If a recession occurs before more traditional and institutional traders get involved, I’d expect the price of bitcoin to increase more sharply. This is because crypto tends to attract libertarian minded thinkers whom might hedge against weakness in their fiat by holding bitcoin instead. This is pure speculation with no data to back it up.

Once bitcoin attracts a wider market, the gold comparison becomes more relevant. Common wisdom holds that gold always performs extremely well in recessions, but what does the data say? According to a research paper aptly titled “Gold During Recessions,”

“The combination of an index portfolio and gold has been shown to be profitable in the majority of the recessions. Due to the low correlation between DJIA and gold, it has been shown to improve stability to the portfolio…

Gold had positive returns during all recessions, and could thus be concluded to be a good performer during recessions. Gold performed best in recessions caused by un- certainty [sic] and inflation, however, it could not be concluded that gold outperformed the market just because it was in a recession. “*

As with most epistemological inquiries, the data is somewhat mixed, but it suggests that gold performs well during recessions relative to other assets. Therefore I conclude that during another 2008 like Great Recession, that investors will flock to bitcoin as a safe-haven.

Markets generally hate uncertainty and we can see that reflected in some of bitcoin’s recent price jumps. The smooth implementation of SegWit probably impacted it the most, because the price has risen steadily since August 1st (the implementation date), save the last 48 hours at the time of writing. This makes sense, because a huge amount of uncertainty over the implementation was gone and there was less of a chokehold on the network. Perhaps a small amount of the price moves are in response to the escalating rhetoric between the United States and North Korea. I say a small amount, because price jumps are not immediately apparent when lining up rhetoric with price. No price jump occurred on August 8th when Trump delivered his “fire and fury” remarks. However, the stock market took a dip.

(source Coinmarketcap.com)

I conclude that bitcoin’s value will most likely rise during a recession that is caused by uncertainty and inflation, both before the market attracts a wider audience and before. But, as always, hindsight is 20/20, so we’ll just have to wait and see.

- https://www.cnbc.com/2017/08/14/goldman-sachs-says-bitcoin-may-rise-about-500-more.html

https://www.cnbc.com/2017/08/14/standpoints-ronnie-moas-raises-bitcoin-price-target-to-7500.html *https://www.scribd.com/document/354688866/Bitcoin-A-5-8-Million-Valuation-Crypto-Currency-and-A-New-Era-of-Human-Cooperation- http://www.diva-portal.org/smash/get/diva2:158721/FULLTEXT01.pdf (Page 60 and 61)

UPDATE: Formatting error.

My humble opinion: Bitcoin is still undervalued due to its limited supply and although the short term volatility is very high, in long run it will still go up. Therefore recession on boom, bitcoin price will still rise.

Hi. I am a volunteer bot for @resteembot that upvoted you. Your post was chosen at random, as part of the advertisment campaign for @resteembot. @resteembot is meant to help minnows get noticed by re-steeming their posts

To use the bot, one must follow it for at least 3 hours, and then make a transaction where the memo is the url of the post.

If you want to learn more - read the introduction post of @resteembot.

If you want help spread the word - read the advertisment program post.

Steem ON!

Excellent post I think bitcoin will be the reason the economy could continue in a depression market. That's the whole point right? @extramoney

Thank you! Much appreciated. I'm just waiting for that retracement dip to invest, then I'm hoping to ride it all the way to the top. I hope the government doesn't fuck us with overregulation though.

Congratulations @surfingsnowman! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @surfingsnowman! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP