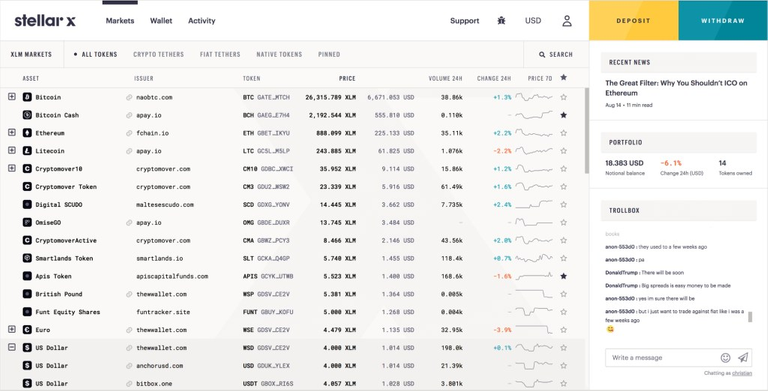

We’re happy to say that StellarX is fully open (9/28/2018). There’s a lot we still need to do (and I’ve listed some of that at the end of this post.) But we’re excited about what we’ve built— DonaldTrump is talking to SatoshiNakamoto in the trollbox, why not, and JesseLivermore shrewdly came back from the dead to trade our fat spreads. Bullish!

So we’ve got this thing started. We’re methodically positioning StellarX to be the most popular place to trade in the world. We know it’s a big, dumb goal. But we think it’s achievable, starting with a few basic values:

StellarX is free

We’re a totally free trading platform, almost certainly the only one.

Legacy exchanges charge per trade. A “free” custodial platform, like Robinhood, profits from its customers’ idle funds. Decentralization offers a more user-friendly experience, but users of any Ethereum DEX—IDEX, EtherDelta, and so on—have to pay for gas, which, as we’ve already shown, is too expensive today and will be even more expensive in the future.

Using StellarX, on the other hand, costs you nothing. We take no fees and, even above that, we refund all network costs, something no other decentralized exchange can match. All the while, you have sole control over your assets, so whenever there’s interest, it’s yours. We’ve even written our own fee out of our agreements with deposit partners, who, we’ve found, often put in a percentage by default. We aren’t here for a cut. We’re here to redefine how assets move around the world.

How can we afford to do this? In short, we chose the right tech. Trades and orders are native to Stellar, not a layer that has to be superimposed via relayers and smart contracts. And Stellar’s consensus mechanism requires neither “work” nor “stake” — that is, it doesn’t use your capital to function. We don’t need your capital to function either.

We let you trade anything

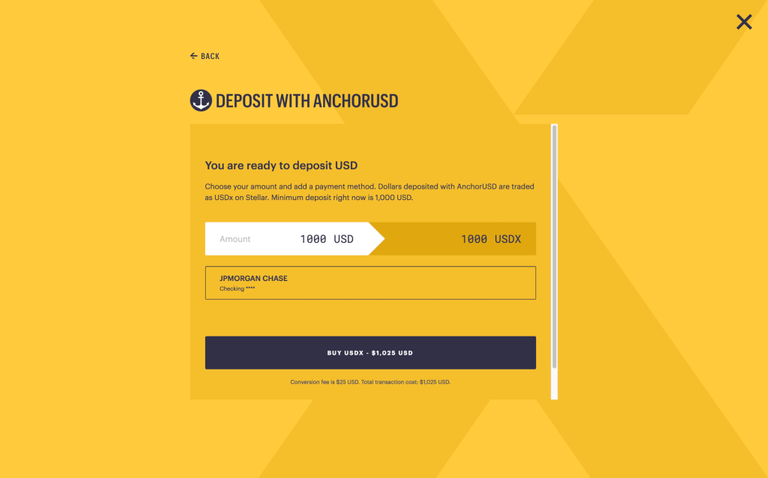

Today, StellarX has a real fiat onramp, a first for a decentralized platform. If you have a U.S. bank account, you can deposit dollars directly, via ACH, right inside our app.

We also, today, show tokens for Euros, Philippine Pesos, Nigerian Naira, Chinese Yuan, Hong Kong Dollar, and the British Pound, and we’ll add in-app deposits/withdrawals for these as soon as their issuers support our standards. We anticipate a full suite of forex stablecoins in the coming months: we will be a “local” exchange for many countries that currently have nothing.

On the crypto side, the most important coins are already in place, BTC, ETH, and so on, and we’ll be adding deep into the coinmarketcap top n very soon. We have listings comparable to many legacy exchanges, and we’ll far exceed them in the near future. The “X” in StellarX might seem like a nod to “exchange”, but we see it as the algebraic x. Anything. Anyone. Anywhere. That’s the platform we’ve got.

Our full potential, however, is so far unrealized: StellarX will one day have bonds, stocks, real estate, commodities, and so on all side by side with essential currencies, but these new assets take time and the right tech to digitize. This leads me to our final founding value, a subtle and little-understood one, but really the most important thing that StellarX offers, because without it no exchange can become the world’s marketplace:

Our market is transparent

Everything meaningful that happens on StellarX is on-chain, and so yeah the world can see it. But here I mean “transparent” in a larger sense, both for users and, crucially, for token issuers. Because both must be informed for a market to flourish.

transparency for traders: Our tokens behave in an expected manner. There are no smart contracts to unravel ownership, or to catastrophically fail. Tokenization is handled at the protocol layer from simple templates. Important features are set as flags, not in custom code.

transparency for issuers: if you so choose, you can see who your customers are and confirm their identity before they interact with your token.

We realize nobody really wants to think about compliance—it’s probably blockchain’s least sexy word—but how a platform enables or discourages it has massive effects, especially as newer and more interesting types of assets get digitized. Whether you find it wrong or not, it’s just a legal fact that banks, corporations, and municipalities have to know who holds their credit, their stock, and their bonds.

Yet almost every other platform defies this basic truth. Thus Gemini, in order to launch their big dollar stablecoin, had to write the underlying Ethereum contract to allow them to:

generate an infinite amount of tokens, and every 48 hours…totally change the implementation, making all tokens non-transferable or pretty much anything else

This is blockchain fine-print that hurts both the token holders and the issuer. It’s unfair to traders to have to sort out ownership risk via a code review. And it’s sad that Gemini had no alternative but the NSA approach to law enforcement—we can’t tell who the bad guys are, so we’ll have to make everybody insecure.

Stellar has a better way. We get that KYC is a thing in the world. We also understand that smart contracts are the wrong place to bury fundamental information. We allow issuers—if they so require—to impose KYC requirements before a person can trade their token. And we give holders human-readable information about what they own, so they can make decisions for themselves.

To fulfill the promise of a universal platform, we must be transparent. No one is going to issue stock or whatever to the blockchain otherwise.

So…yeah: free, flexible, functional. That’s why we think we’ll win. Like I said, we have a long way to go, but we’re off to a running start. To the Stellar community: thank you so much for all your feedback over the summer. You’ve made StellarX so much better already.

Here’s a summary of our product priorities over the next few months. And as new assets and new deposit partners come online, we’ll let you know.

Coming soon to StellarX, in no particular order:

- Night mode

- A mobile site, for great justice

- Continued improvement to signup, onboarding, and visual design

- Improved token stats and info

- Portfolio performance reporting & summaries

- Improved charting library

- Fungible path-payment support (i.e. allowing a sender to send token A and specify that the recipient receives it as token B)

- A market maker rewards program

- Multi-sig support

- SEP 0007 support for airdrops, etc.

- Non-XLM markets support

- In-app deposit/withdrawal support for all tokens via SEP 0006

- Universal (optional) KYC via SEP 0009 & 0010

- Self-serve platform for issuers to submit more token detail

- Bitcoin.tax support for Stellar trades

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.stellarx.com/how-stellarx-will-take-over-the-world/

Yeah - Exactly. Good eye @cheetah