In 2017, we witnessed a spectacular Cambrian explosion in the crypto space. The number of Coinmarketcap listings grew from 617 to 1335 within the twelve months. At the same time, Bitcoin lost its market cap dominance (falling from 88% to 38%) as new cryptoassets soared in value.

As new applications of blockchain technology emerged, the cryptoasset space became increasingly more fragmented. Yet, to this day, when we look at the changes on the market, we talk about Bitcoin market cap dominance and lump all Altcoins together. This simplistic approach fails to recognize the vast differences among cryptoassets and it fails to provide us with the required level of detail.

Imagine that instead of Bitcoin Dominance we could talk about Smart Contract Platform Dominance, Store of Value Dominance or Blockchain Interoperability Dominance. We could then compare these sectors, find out which ones are growing fastest and place our investments accordingly. Looking at most attractive sectors of the economy and then picking the companies to invest in is a standard practice on the stock market, why should this approach be different for cryptoassets?

In order to make sense of the highly fragmented crypto space, I have pulled historical market cap data (Jun-2015 to Jun-2018) and generated a list of major cryptos. I defined “major” as a listing that appeared in the 95th percentile of total market cap on any given day. This way I could focus only on those blockchain projects that have received wide recognition from crypto investors while filtering out all the minor long-tail cryptoassets, which make up the remaining 5% of the total market cap.

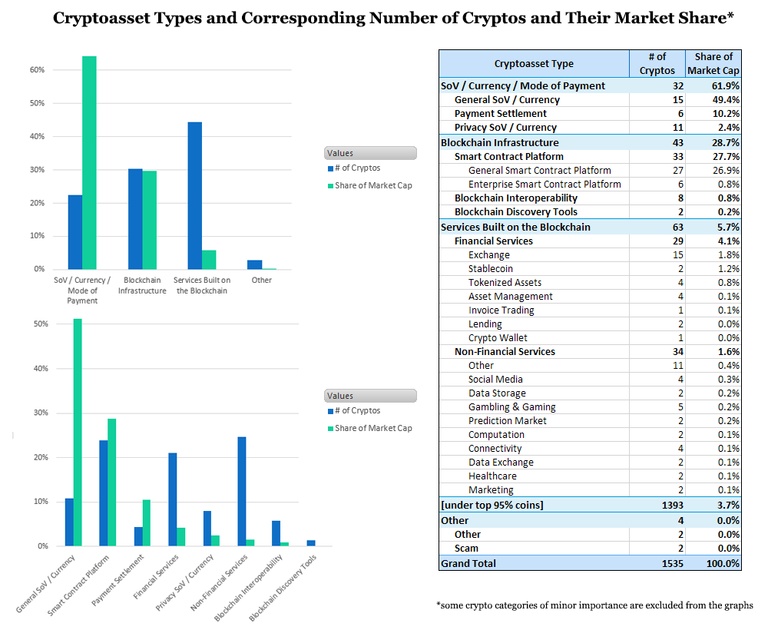

142 cryptoassets have satisfied the above-mentioned criteria. After several iterations, I have created the following categorization:

Cryptoasset Types and Corresponding Number of Cryptos and Their Market Share (as of 24.06.2018)

I am currently working on an in-depths analysis of the historical changes in market cap dominance of different cryptoasset types and will be sharing this analysis with you in about two weeks. Please follow me on steemit so that you don’t miss the upcoming article.

Great representation. One thing that has always bugged me is the bundling of all cryptoassets into one market cap value, when in reality the difference between bitcoin and a random altcoin in social media is as big as would be for stocks in different sectors and countries. This is a better way of showing it

Yes sir :)

Thank you for this post amazing info... :)

Yeah:)