In order to understand cryptocurrencies, one must first understand what money is. What do we need money for anyway?

- It's light enough to carry around

- We can use it to exchange for goods and services that bring value to our lives

- We save it in the hopes of accumulating more and spending it on a big ticket item in the future

We use money because it's universally identical. My $1 bill is no better or worse than your $1 bill. It is worth the same.

We also use money in the hoped that our $1,000 in the bank will be equivalent to $1,000 in a year or two's time as well. Assuming that the centralized government that issues the currency doesn't raise or lower interest rates too drastically, affecting what $1,000 can buy you.

Since money has had to perform so mnay different functions, it's taken on many different forms, be it salt, seashells, camels, gold, or credit cards.

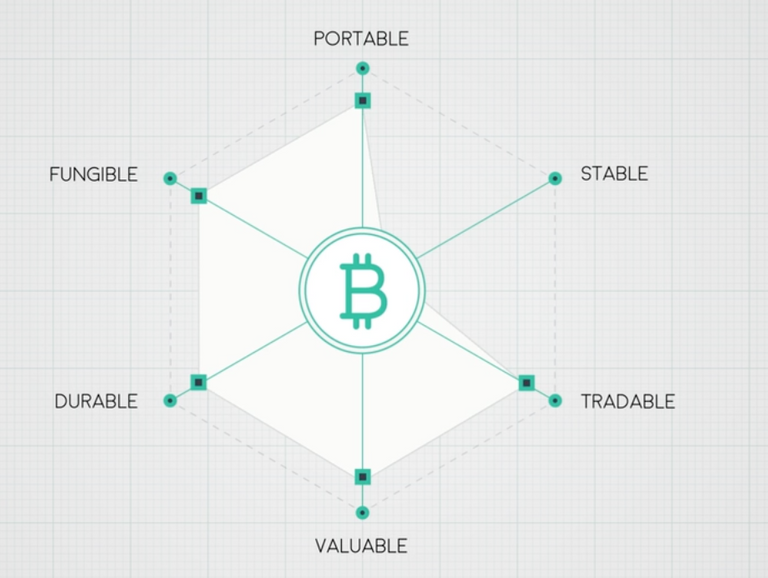

Eventually, money evolved into Bitcoin

Created without a central authority , Bitcoin is less vulnerable to issuance corruption than standard fiat currency.

This means that the value of your $1,000 will still be worth one MacBook, instead of half a MacBook (assuming that, in some Utopian world, Apple keeps its prices the same for its machines).

When Bitcoin was lesser known (and less centralized by the miners with expensive equipment that extract this digital gold from the digital goldmines with super-computers that solve complex math problems), we could rely on it as a storage of value and a mode of exchange.

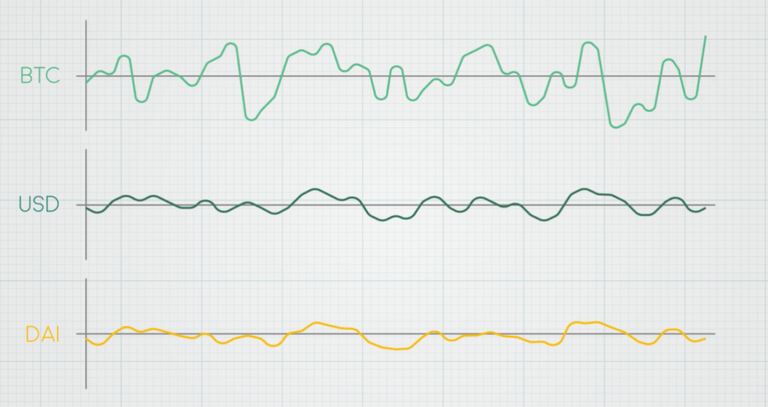

But now, $1,000 of Bitcoin, or currently 0.12 BTC could become $700, or $1,500 due to the volatility of the belief-backed nature of the crypto-markets.

Bitcoin's fixed supply creates speculative investment, and with that, high volatility and instability.

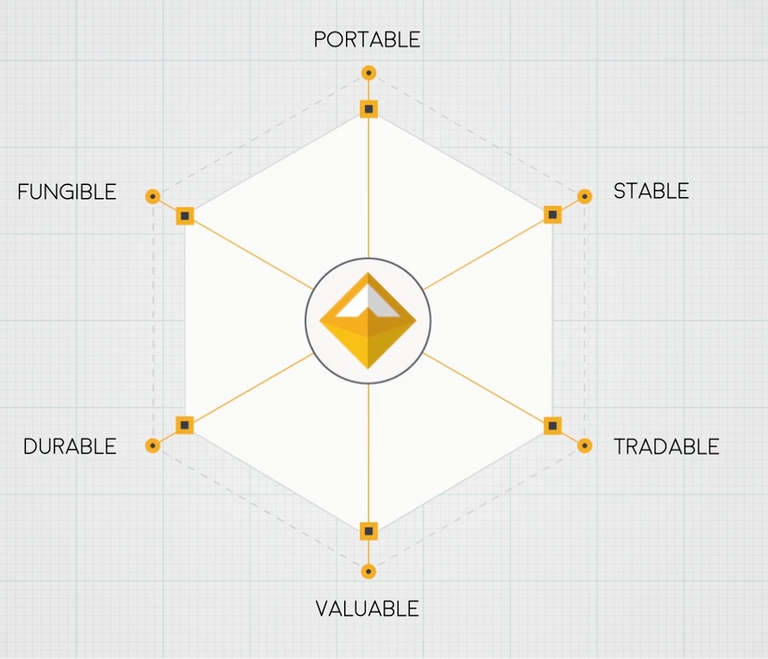

Enter DAI: the Solution to Crypto Volatility

DAI is a cryptocurrency that uses collateral to back it's value and interest rate mechanisms to stabilize its price. 1 DAI = 1 USD

- Collateral is...a security pledged for the repayment of a loan.

Say you spend your $1,000 on a shiny new MacBook. 2 days later your friend Jake goes to jail for robbing a candy store.

His bail is set at $1,000.

You no longer have $1,000, but you decide to give the MacBook to the jail as collateral for the bail. Jake is set free and never robs Jolly Ranchers from a candy store again.

DAI is created by locking collateral with Maker - a decentralized platform on the Ethereum blockchain

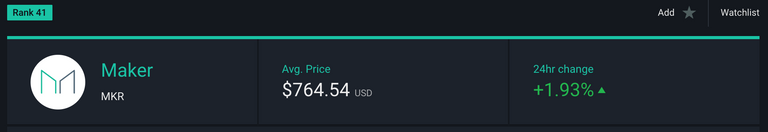

Maker (MKR) is a smart contract platform built onto the Ethereum blockchain, which allows Smart contracts to act kind alike an automated robot lawyer.

A holder of the MKR token (currently priced at $764 as of 13:38 EST April 17th, 2018) basically acts as the Federal Reserve of DAI, meaning that the money (presented in ETH on the Ethereum blockchain) is converted into CDP (Collateral Debt Position) and serves as the interest rate mechanism that keeps 1 DAI = to 1 USD

1 DAI will always = 1 USD, thanks to the collateral provided by MKR Coin holders

Below is a great analogy provided by Medium writer Gregory DiPrisco:

The much-more-in-depth-source: https://medium.com/cryptolinks/maker-for-dummies-a-plain-english-explanation-of-the-dai-stablecoin-e4481d79b90

The core smart contract at Maker is the CDP. Let’s use an analogy to describe these. Pretend you are at the bank asking for a home equity loan. You put up your house as collateral and they give you cash as a loan in return.

If the value of your house decreases, they’re going to ask you to pay the loan back. If you can’t pay the loan back, they’re going to take your house.

To bring this back to Maker... just replace your house with ether...the bank with a smart contract....and the loan with Dai.

That’s all there is to it. You give the Maker CDP smart contract your ether and it lets you take out a loan in Dai. If the value of your ether goes below a certain threshold, you either have to pay back the smart contract as you would a bank or it will auction off your ether to the highest bidder.

Source: snapshot at April 17, 2018 14:28 EST from apogeecrypto.com

Using a smart contract, the automated robot lawyer triggered by price fluctuations, Maker CDP is liquidated into ether and sold to assure that DAI is always = to 1 USD.

This is the interest rate mechanism applied to the blockchain in the form of a smart contract, assuring price stability, so that your $1,000 of DAI will always be equal to 1 MacBook, or at least $1,000 USD if Apple decides to raise the price of their machines.

If anything, DAI provides peaces of mind and a functional coin amidst a sea of hundreds of coins with ever-changing values. This is a true exchange of value, similar to the USD in that it's transportable, used to exchange value, and can be saved for a rainy day.

Better yet, it doesn't come with the constrictive inflationary nature of centralized fiat currencies, and flawlessly executes its purpose thanks to the Ethereum blockchain.

If you enjoyed or found this article useful, ETH donations are always appreciated

0x7E53F91FdFa479CAbB991C845De6A07D2b5ae7D0

How is this different/the same as tether?

Coins mentioned in post: