Overview

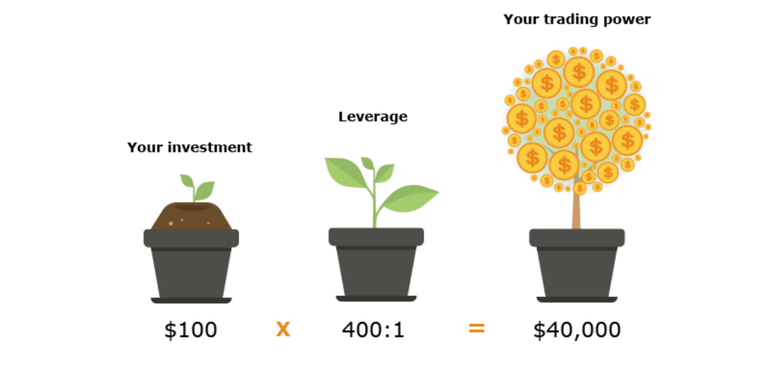

Margin trading in cryptocurrency is a concept which gives you the financial power to buy more crypto assets than what you can buy with capital in hand. It’s like a loan that the cryptocurrency exchange lends to you. For instance, in a broad sense and put very simply, with a capital of 200 USD you can buy securities worth 1000 USD. Now let’s get into the details.

Why is margin trading useful?

Let’s look at a person who has capital of 200 USD which he feels is not adequate for trading. Now, if he trades on margin, he can trade for as much as 10 times with this margin. Even if he earns 4% profit in this trade, his total profit would be 80 USD or 40% of his initial investment which is much greater than the returns he would get if he does not trade on margin. However, it is important to understand that with great rewards come great risk, too.

Margin Trading on Huobi Pro

Huobi Pro is one of the top 3 cryptocurrency exchanges by volume in the volume with a diverse trading offering. They also offer a Margin Trading option which I’ve personally found very useful because of its great interface, easy to understand functions and highly intuitive process.

To begin Margin Trading on Huboi Pro you'll firstly need to sign up for an account if you don’t have one already. Then all you need to do is follow this easy step by step guide.

Advantages of Margin Trading

Amplifying Profits

Buying on margin increases your purchasing power, which can lead to greater profit. If you understand how the process works and know the risks, the rewards can be quite great. But again, a word of caution… no high rewards come risk-free and margin trading does come with a high degree of risk attached, so tread carefully.

Margin trading allows you to maximize your exposure and magnify your returns when your investments pan out in your favour, For example, an investor with a very small amount of money invested can have more money on a cryptocurrency trading account and dramatically increase their returns.

The Ability To “Go Short”

Shorting or Going Short means exercising your right or ability to sell a cryptocurrency. On the flipside, buying is known as Going Long. Going short on an instrument is when an investor opens a selling position on the platform. This means that traders can make a profit during market downturns as well. This allows him to minimise his overall risk in certain situations.

Remember To Be Safe and Responsible

There are numerous ways to keep you away from trading on margins with such high risks. Firstly, use leverage times reasonably, and control your positions. This means monitoring your trades actively and setting up parameters for yourself. Secondly, keep the loss and profit in a reasonable range, and close your positions spontaneously. Do not go to either extreme ends. Lastly, add margin in time and make sure that the rate of Margin Balance and Wallet Balance is over 110%, otherwise your account will be forced into liquidation and Huobi Pro will notify you via SMS and email.

NOTE: Margin trading can amplify gains as well as losses. If the cryptocurrency you bought suddenly has a sharp decline, you will face the risks of larger losses. So, ordinary investors should avoid high leverage trading to avoid liquidation or debt.

5 Important Tips For Margin Trading in Digital Assets:

1

Have some cash on hand to back you up

Balance is the key to every investing and trading strategy. To avoid getting burnt, never go all in or take up a large position. This means having some extra cash you could use as ammo in case things don’t go as planned and you need to take advantage of another opportunity that presents itself. When it comes to trading cash is king and the more you have to back you up the better. Also, in addition to firepower, leaving some cash behind also gives you some emotional and mental security and acts as your personal safety net. So trade wisely and remember to have a backup plan in the form of cash.

2

Stay away from speculation

Although a lot of trading is based on news, speculation, promises and what-ifs, it is important not to get too caught up in it. From my personal experience starting out as a trader, I admittedly got engrossed in hype and speculation that only served to cloud my judgement and make rash decisions. The stories of people falling to the perils of speculation are far too many, so I advise you to use a level head and steer clear from speculative trades that could cause a fair deal of damage if they go wrong in Margin Trading.

3

Knowing what the margin maintenance level is

It is important to understand what margin maintenance level is. This is critical to Margin Trading because the amount of currency that users can loan depends on the margin maintenance level and leverage times.

Let’s take a look at how Margin Maintenance is calculated:

Margin Maintenance level is basically your current wallet balance/loaned amount *100%

Note that your current wallet balance is calculated as your existing holdings in the particular coin.

Now, say you bought 3 BTC with a capital of 8,000 USDT while taking a loan of 16,000 USDT. The current price of BTC then becomes 7,569.28 USDT. Since you have 3 BTC, your current wallet balance is 22,707.84 USDT. Since margin maintenance is calculated based on this amount and your loan amount of 16000 USDT. It will, therefore, be 22,707.84/16000 * 100 which gives you a Margin maintenance level of 141.9% in this instance.

4

What is the interest rate of a specific coin?

When it comes to Margin Trading, the rate of interest is an important factor to keep in mind. The rate of interest in loaning USDT varies from other coins. For instance, the daily rate of loaning USDT is 0.1% on Huobi.Pro. Daily rate of loaning BCC, ETH, LTC, ETC, DASH, XRP, EOS, OMG, ZEC is 0.02%. This interest starts from the moment you loan. One day/24 hours is considered as a unit. Any time less than 24 hours will be considered as 24 hours. When you repay the loan, you also need to repay the interest. To learn more about the rates, click here.

5

Sticking To Your Strategy And Not Going ‘All In’

As I’ve mentioned time and time again, having a balanced investment or trading strategy is the key to success. The only thing more important than having a balanced strategy is sticking to it. It sounds easy but this is easier said than done. Starting out, I found it quite easy to come up with a strategy but sticking to it was the challenge. It is easier said than done, but with time I am sure you will build up discipline and be able to follow an approach with a level head. Another great tip is to not go “all in” and get greedy but to buy over time. This means resisting the temptation to open a position with one large order only to see your plan fail. Remember, slow and steady, wins the race.

You can use all the tips and advice you’ve learned about Margin Trading on Huobi.Pro simply by signing up here. Do remember that Margin Trading is far riskier as I’ve stated many times in this article, so remember to invest only what you can afford to lose, always. Click here to read all about Margin Trading on Huboi Pro.

Disclaimer: The material provided herein is general in nature and does not take into account your objectives, financial situation or needs. While every care has been taken in preparing this material, we do not provide any representation or warranty (express or implied) with respect to its completeness or accuracy. For the avoidance of doubt, this article is solely intended to be for general information only and does not in any way constitute as professional advice or financial advice. This is not an invitation or an offer to buy or sell cryptocurrencies, nor is it a recommendation to buy or sell specific types of cryptocurrencies. Trading cryptocurrencies carry a high level of risk that may not be suitable for some. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice.

If you liked this article do share and resteem.

Cheers!

Follow me on twitter: https://twitter.com/SomePokerGuy

Huobi Pro Official Community and Social Media Channels:

Website: huobi.pro

Facebook: https://www.facebook.com/huobipro/

Twitter: https://www.twitter.com/Huobi_Pro

Instagram: https://www.instagram.com/huobipro/

YouTube: https://www.youtube.com/Huobipro

Medium: https://medium.com/@huobipro