The Best of Times, the Worst of Times

As with any disruptive new tech, cryptocurrency is being met with more skepticism than adoption. It’s difficult to find any new report on crypto or blockchain technology without terms like “scam” or “bubble” or “pyramid scheme” coloring the perception of the general consumer. Misinterpretations of hearsay use-cases silo the public’s understanding of the technology as well, equating corner-case adoption with corner-case potential. For the last near-decade, connotations of digital currency have prevented it from being a viable alternative coin in the global marketplace.

But why is this? Why are cryptocurrencies so often associated with hackers, pirates, fascists, and traffickers? The declarations by Jaime Dimon, CEO of JP Morgan Chase, last month of Bitcoin being only applicable to “Venezuela or Ecuador or North Korea” struck an underlying anxiety event amongst investors and contributed to crypto markets falling over 30%. Anonymity is shamed as shady and transparency is understood as anti-liberty.

Bad press aside, there is the notorious condition of volatility. “Why would I spend Bitcoin on a carton of milk when it may cost double that amount tomorrow?” And the same problems persists inversely when markets are good - “Why would I spend several Bitcoin on a car now when I may only have to spend half that number in a few months?” The combination of price volatility and intangibility nurture a distrust that this is in any way a practical or trustworthy currency.

Capturing Value

At least not “currency” in the same way we weigh euros, pesos, and yen. It isn’t meant to be valued always in relation to the US Dollar, despite constant market evaluations, and it isn’t designed to maintain a predetermined monetary worth. “Currency” is a historical misnomer from when the progenitorial Bitcoin was wholly considered to be a direct fiat alternative and implies that it would be used only outwardly to purchase and sell another product or service.

Think about how you use your cash in your wallet. It comes and goes whenever you earn it from providing something or spend it from wanting something else. Cash is only a mediating tool from person to person, service to thing. If you piled all your available fiat money in front of you, it would indicate almost nothing other than your economic level and security - It tells nothing of how you earned it, why you earned it, how you intend to use it, and other implications of your professional or personal standing in the world.

A Missing Link?

Tokens, another moniker for digital currencies, absorb that missing knowledge. They can be designed to capture that value and portray much more than a singular monetary amount. We see this happening with more recent applied tokens that have correlating applications and communally integrated technologies. Have 50,000 STEEM? You are most likely an avid and valued content producer on a website like Steemit.com, where blog posts and curation are rewarded with STEEM tokens. Have 100,000 Siacoin? You probably share a great deal of cloud storage through their decentralized desktop application that allows you to rent out or borrow excess hard-drive space. As specialized tokens are distributed for specialized work, cryptocurrencies capture more meta and social data than a purely monetary purchase. Cryptocurrency thus maintains an innate trust system such as “proof-of-work” or “proof-of-stake” that verifies one’s measurable authenticity from their work or effort to earn it. In a traditional market, do you inherently trust someone more for having $10,000 in their bank compared to $1,000? Decentralized verification with crypto and blockchain DAOs is opening the doors for a more integrated trust network.

Think of it as a point system, something we implicitly use on a daily basis. We earn points for completing levels of Candy Crush, drinking enough Starbucks lattes, or topping off our metro passes. Yet the greatest issue concerning existing systems such as these are that the points are non-transferable to other sub-economies and not even reverse-transferrable to fiat currency. It may say that you have $10 remaining on your coffee gift card but that value means nothing beyond the uniformed cashier and barista. Utilizing autonomous cryptocurrency systems overcomes those blockades. As those crypto “points” reach a recognized demand, they can begin to be traded between each other (one latte for a single ride) without the fear of loss in value.

This actually treats currency more akin to mercantile eras when wheat was traded for corn and silk for spices. The “currency” embodied the metadata of the producer’s skill, locational knowledge, and much more, all while prices were constantly in negotiation (or “volatile”) in relation to supply and demand. Price of the currency was thus highly dependent on the merchant’s personal skill as well on a case-by-case basis. Today’s standardization in a fiat economy betrays those relationships as Big Macs are stuck at $4.99 and a pair of Nikes at roughly $90, irregardless of their actual value at any moment in the marketplace.

Access, Empowerment & Craft

Not only does this empower the local maker to actively influence the value of his/her service, but also allows them to begin valuing their work divorced from local economy health and social conditions. Craftsmen shoemakers no longer need to work at odds with East Asian mass producers who undercut their global competitiveness. They can instead be valued differently in a profession-specific guild system that transgresses borders. Even though the artisan can be momentarily undermined by external competitors, they can sustain their worth and reputation within the community by offering a diversifying array of services and knowledge not typically provided by other corporate structures. That value, until now, has been encased in their product without opportunity to be shared autonomously.

Homogenization of fiat also obscures the value of services and skills. Distinct operations, even within the same profession, are subsumed into an average hourly wage or salary and ultimately places great emphasis on the outcomes of work rather than the aspects of work itself. A dynamic token system dismantles these broad assignments of professional value and motivate a different incentivization strategy. A more difficult hour of work should be worth more than a less difficult one and a distinct skill should be valued...

These factors and qualities constitute cryptocurrency into something very different than just a monetary amount and upturns our current relationship with value - value in our personal lives, professional work, and each aspect of our lives.

So How Should We Treat Crypto?

Current hype around blockchain buzzwords and investment returns is actually highly distracting from the true adoption of cryptocurrencies as a value mechanism. This is understandable as tokens sales have skyrocketed past VC investments and status quo equity distribution, but the stereotype remains that access into crypto holdings and use relies on dollar purchases and personal investment. This could not be further from the truth.

The world of cryptocurrencies is no longer nearly as monolithic as it was even a few years ago. Consumers are able to purchase, hold, and use from almost 1,300 different tokens, even though only a fraction of that selection has functioning applications and use-cases today. Most importantly, they’re able to earn specialized tokens by performing desirable tasks - gaming, storing data, producing blog posts, peer-reviewing articles, verifying work authenticity, and an ever-increasing list of valued services. Better iterations of those services are rewarded with higher amounts of the corresponding crypto.

So no longer does the user have to worry or hold any amount of Bitcoin for example, and can instead focus completely on the token that concerns their work and/or interest.

Cryptocurrencies have now become a vehicle for self-investment and self-establishment in unique global economies. Crypto is your stake in something, whether a hobby, service, or skill, that is nurtured personally. And now that those points are seamlessly transferable between each other, there is no barrier to fear with emerging opportunities - for example, from transitioning as a publicized MySpace user to a Facebook figure to an Instagram influencer.

Finally, the individual user’s capacity to drive the growth of a token and determine its functionality is one of the most exciting parts of the blockchain ecosystem. This sort of idea exists in theory with fiat systems, for example trickle-down economics or a focus on small-businesses, where driving factors influence the overall population’s economic health, but a cryptocurrency explicitly outlines the direct connection. No matter the health of the US economy, a quarter maintains a quarter’s worth and will most likely only net you a gumball now and years down the line. Especially during these initial development stages for blockchain technologies, the success or defeat of a new token economy will be determined by its use-cases and circulation, i.e its users. The cryptocurrency holder is the equity holder.

So ultimately, cryptocurrency becomes much more than having a finite amount of dollars and cents in your personal account. Crypto is meant to be earned through a variety of specialized actions and services. It is meant to be bolstered by personal dedication. It is meant to determine one’s standing in a growing global audience of like-minded users. It is meant to drive different forms of personal growth and communal sharing in a manner that has never been effectively incentivized before.

As with any disruptive new tech, what exactly things are and how they’ll transform the world are still nebulous terms and analogies. More accurate jargon will emerge as theoretical advances incrementally mesh with the real working world, during which the abstract terminology today will be replaced with precise experience. “Currency” is one of those placeholder terms, tentatively used for now to vaguely understand the economy that is not yet here.

What a powerful article and it deserves in my eyes much more exposure! Awesome work, again!!!

As soon as you veered over to the trust issue, the reader turns 90 degrees and keeps on reading. by the time you hit the "The “currency” embodied the metadata of the producer’s skill, locational knowledge, and much more", we're hooked till we reach "Cryptocurrencies have now become a vehicle for self-investment and self-establishment in unique global economies."

Underlining the aspects of our liberties and freedoms being incentivized by the rise of crypto currencies gives great power in the legitimacy of these new economic tools. Some call them cryptocurrencies, but really, when it comes to their usage, the greatly vary in function and applicability (Which you pointed at too) and can't all fall under one umbrella. Bitshares, for instance, falls under the category of "Securities". Others fall under many other labels "Coupons", "Smart Coins", "Shares of Bonds", "Share of Stock", etc. depending on what they represent within the blockchain systems, they will slowly get the recognition they deserve.

Thanks a lot for this sharing of knowledge, wisdom and history this is hghly valuable a post. Upvoted 100%, resteemed and shared!

Namaste :)

It also been reported that an Australian company that allows its customers to make payments via credit card, direct bank, or BPAY using eleven different cryptocurrencies, has revealed that the company is now processing approximately $1 million AUD (roughly $ 756,000 USD) worth of bill payments each week.

Is that amazing?

Thank you so much for the informative response @eric-boucher! It is a tremendous idea to start diversifying the specific functions of these currencies and we're also looking forward to other terminology that comes up during this development.

Namaste!

Now that my fairly limited understanding of cryptos deepened a bit, I do see that there are multiple aspect of the blockchain technology other than creating value for "digital money".

Its a great start and I sincerely hope for them to be using Bitshares as a platform to do so. this way, they can stay infinitely scalable, the fastest provider and most adaptable they can possibly be.

Thanks for sharing this good news! Namaste :)

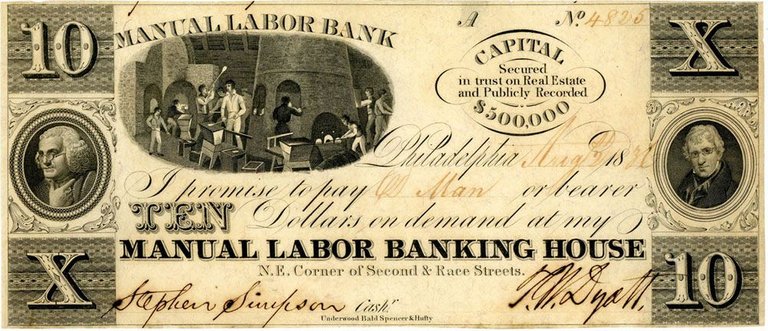

Here's something from the deep, dark past that might offer us something of a lesson: The entrepreneur and an visionary Thomas W. Dyott went from polishing boots to mixing his own bootblack to manufacturing elixirs, to owning the largest patent medicine businessman in the United States. He needed bottles and so he bought a bottle factory that soon employed 400. In 1836 he launched The Manual Labor Bank which was a brilliant tactic to build community around a new currency with a specific focus.

(Source)

If we can look at Dyott's efforts and what they were supposed to achieve for the community and not what actually happened: the Panic of 1837, Dyott's desperate manipulations, his celebrity trial and prison sentence for “defrauding the community” - if we can get past all that - I think there's some valuable lessons to "mine" from this example. Both pitfalls and successes.

This is a really cool piece of history I wasn't aware of and from which the crypto-currencie aficionados could learn from, no doubt!

Thanks for sharing, namaste :)

This is a great post @sndbox, and there's really very little I can say, aside from this being an excellent exploration of one of the challenges we face. The framework outlined here is a great representation of what's on offer.

The immediate thing that came to mind as I was reading is that this is very much a "top down" process. And it takes time.

Our most immediate piece of history for comparison is the Internet. At first, for a handful of hardcore developers and universities. Then for more general geeks... while everyone else thought it "creepy" and "a passing fad with limited applications." Then... "for nerds and the handful of people who could afford a computer." Everyone else? Skeptical and calling it a "scary place where pedophiles hang out." Then broader adoption as barriers to access come down-- price of connecting, price of computers decline.

There were fewer than one million global Internet users when I got my first connection in 1993... and everyone around me thought I was a freakazoid risking life and limb by connecting to "this internet thing." And it would be eight years before being online even reached 5% of the population.

My point here is that our possible "growing pains" are pretty similar to the Internet, itself. And right now? It's super early days... and we're at the "specialty niche for nerds and criminals" stage (in terms of public perception) and our job is to EDUCATE. And introduce cryptos to what I call "the next marginal user," the least skeptical person looking at what we're doing.

Wow ... Such a well illustrated and lenghty post, i must really say most people dobt know much and have believe in cryto ... They just want the money and that is it without understanding about it ... Thanks for the enlightenment and its really nice of you making thr effort in sharing this

Thank you for reading and the support @dray91eu!

Great article. Very powerful.

Thank you for reading!

I really have never understand the theory of tokens so well illustrated. The whole subject is mysterious, but this she'd some light on the varying cryptos and their role in transactions. Nicely penned. Thanks

Thanks for reading!

Crazy times and new #bitcoin high coming soon, strong long, on bitmex you can trade bitcoin contract features a high leverage of up to 100x.

https://www.bitmex.com/register/HJfZyC

Very interesting points and you touch upon a few things that have been bothering me for awhile.

As you say, it is hard to view something as a currency that fluctuates so wildly day to day. Not to mention the distribution issue and of course that you're using currency in order to purchase it in the first place, so why not cut out the middle man?

You used the examples Steemit and Siacoin, and I think this is at the heart of the issue. Both of these coins represent value on different levels and therefore should be more accurately classed as cryptoassets.

However we might take another coin that represented not only value, but real world applications as well. In this scenario they may more rightly be called tokens.

All of this begs the question of course, is what is the ideal crypto to use as currency? Is it something like Lite coin or Doge, which actually concentrate on trying to act like a currency; or maybe something as yet unseen?

Who knows? But you raise some really interesting points, and what is clear we do need a rebranding and rethinking of how we view and present crypto to new players coming into the markets.

Cryptogee

Excellent, thank you for the great feedback and questions @cryptogee. They make us want to write addenda or a part 2 right away. The classifications will surely unfold over time as there is no way we can keep calling 1300+ cryptocurrencies "currencies" when they perform vastly different operations, capture wildly different forms of value, and overall defy any form of stable medium. As for the best actual digital currency, I agree with you - who knows? Most financially oriented cryptos have promoted their "security" and "transferability" but maybe the way we exchange coin will be vastly different in the years to come. Most cryptos have diverged greatly from just being a digital monetary value and we expect their nature to evolve even more in the near future.

Lots to think about!

Lots to think about indeed! I look forward to part 2 :-)

Cg

You can find Russian version of this post HERE

Русская версия тут

Отличный перевод! 👍

Lovely post! Thank you!

Probably, of all the cryptocurrency, I chose SmartCash just because it is not just an ordinary currency, like many. It allows you to choose the path of development, enabling the most ordinary users to vote for different ideas. And this is not the only advantage! Perhaps in the future it will be able to replace even bitcoin.

Very true. Digital coin might work better.

The last sentence of your second paragraph says it all, "Anonymity is shamed as shady and transparency is understood as anti-liberty."

IMO, it's the reason "they" call the truly FREE market the "Black Market." It gives people the incessant mental reminder that anything that rests outside the borders of government control is "bad" for you and you should steer clear of it, lest you be labeled a "criminal" yourself.

I really enjoyed your article and find your writing style easy to read and understandable. Peace, my friend. Upvoted 100%

P.S. what mark up language do you use to create that animation effect at the end of your articles for your logo?

The animation is a gif. You can view it here.

All of the markup used in this article can be viewed on steemd.com

I'm not the anarchist type but I agree with your facts. the "free" market is nowhere it used to be, the amounts of consolidation in the late neo-liberal age is staggering.

Thank you for reading and for the comment! It will be interesting to see how the general public treats these market in the coming months/years.

Also as noted below, it is indeed a gif made through After Effects.

interesting topic very good way to explain thank you

Glad this article resonated with you, thanks for reading!

thanks for great news,

@followed and upvoted

Nice post

Thanks!

Insightful understanding of cryptocurrency (now I'm cringing to use the term) :) Upvoting.

Haha thanks @bitstudio!

I am afraid that all this is wonderful and all but only if the gov will leave it alone...which is impossible! I am hearing and believing more and more that false flags attempts are building up momentum for the gov to take over everything in a nutshell... things like "terrorist" attack sponsored by cryptos and that would be it! crackdown to a smackdown ... let's just hope it is a couple of years from now or more... things are getting hotter though...North Korea designated as terrorist state, Putin evermore standing next to Assad and that cover from 1988 of the economist talking about the "rise of the phoenix" in 2018 as a one world currency is ever more happening...

Hi senior steemian member i vote, follow and resteem this post

gud post

This is a great perspective you have shared here. This has given a new light to "cryptocurrency" for me that I now can hold and share with others. To have something more diverse and be able to bring humanity more together as a community and help each other is wonderful! I truly hope that once fiat currency fades out of the picture and this new realm of earning and sharing take-over, it will help the world go round in a much happier and helpful way.

We are in full support of this!

I agree with your opinions .. really the individual user’s capacity to drive the growth of a token and determine its functionality is one of the most exciting parts of the blockchain ecosystem.

Absolutely, it's really empowering and SMT's will surely provide a whole new layer for individuals to create value surrounding their shared work and ideas.

I will enjoy watching these exciting developments ..

I had phobia for the prefix 'crypto' until I joined steemit. Now, I am dealing with it and I am sure I will be fine at the end. If my metaphor can be excused

"Crypto" and "currency" both contain huge mental barriers for people. Steemit is beginning to humanize the conversation, but there's still a long way to go.

A great piece of quality writing- i'm just reading it through for the 2nd time.

Thank you @opheliafu!

Thank you for a very insightful article!! :)

Thank you for reading!

ya its true. Digital coin might work better

I doubt there is even a single example of someone with 50,000 STEEM that earned it entirely for blogging on steemit in the last 12 months.

Not really possible to do that in the last 12 months.

Some old timers may remember that from the "good ole days" in 2016. Largely irrelevant to current steemit

Point being - fiat is fiat and doesn't carry any story or history behind it. The amount of STEEM you earn through blogging correlates to the value of the content you've created and shared. This is "Value 2.0" because there is a legacy behind the tokens that yield information about that person that could never be determined by looking at pure dollars and cents.

I'm skeptic to those cryptocurrencies out there EXCEPT, Steem! 😎

Haha we know! This kool-aid tastes so much better ;)

You got some great art assets on this thing

Thanks!

Great post!

I especially liked your analogy comparing cryptocurrencies to the trading mechanisms of the mercantile eras. Seems kind of obvious in hindsight but reading that completely transformed my understanding of the utility of this technology!

And it will only get more diverse and nuanced as the community grows!

Absolutely! I think one of the crypto communities biggest weaknesses at present is a lack of demographic diversity in the space. That's what I love about Steemit, it really seems to be a good step forward in opening up the crypto community to a wider demographic. I see a great diversity of people on here and it's fantastic!

Please just use the term "Token" It doesn't have any of the connotation that would lead people to misunderstand the full scope of these new blockchain based assets.

The term Token can unfortunately also be misinterpreted in ways that 'currency' has been as well. Until we have some better terminology that accurately describes that multi-faceted function of specific cryptos, we're tasked with illustrating the bigger picture.

Wow I didnt know that all this is happening out there. Thank you for sharing this. It is very informative and useful for many new people who joined the crypto currency recently. Keep up the good work!

Glad to be of help @hanen!

This was incredibly well-written. You made great points all throughout. Originally I thought your post was going to focus more on the "crypto" aspect of "cryptocurrency" (as I think that "crypto" has a negative connotation to it), but it was interesting to see you focus on the "currency" aspect of the world. Nonetheless, I completely agree with you and like @eric-boucher said, this post deserves far more exposure!

Thanks @omah! "Crypto" is also a very misleading and highly connotative part of the phrase ;)

Thank you for your thorough study of the matter. I can not even prove to my family that there is a future for this and I do not need to be afraid of this

It's all because of the lack of government regulations, the inability to self-regulate and the attraction of rebellious outlaws.

Crypto Currency attracts a certain type of individual attempting to beat the system for various, and often - illegal reasons. AND - it's been this way from the beginning and the embarrassing days of Silk Road. (For every Silk Road that's busted 10 more pop up and never get busted).

It's seen as the Wild West, where it's every man for himself and that opens the door to small and big-time hustlers.

Don't get involved with no-name exchanges. Don't get involved with ICOs. Don't buy shady coins. Don't get into investment companies. Don't get involved with crypto-IRAs. Don't get involved with special, new crypto packages filled with promises they can't deliver.

We HAVE TO do a better job of educating newbies before they get trapped into these scams, and if we can't do this - the crypto-market in America is doomed.

Got to be the best article I've read all week.

nice

wow great article...

this is wonderful, not only for the thoughtfulness of the content but also for the way its is written. sent to my parents, both 65+ & will resteem.

Nice post, kind of why I´m excited of this technology and the people behind!

I hope for a more “Star Trek” world with this – someone into an Enterprise token yet? ;D

What about "digicash?"

I’m finishing up a post today as a response to this, but I’m wondering if anybody has thoughts on net neutrality and how significant it is to not only the transmission of tokens, but the potential psychic effect of a slower blockchain; I assume this is one effect of throttling the internet with fiat money?

@sndbox good job on this piece,

As you noted" Cryptocurrency thus maintains an innate trust system such as “proof-of-work” or “proof-of-stake” that verifies one’s measurable authenticity from their work or effort to earn it. In a traditional market, do you inherently trust someone more for having $10,000 in their bank compared to $1,000? Decentralized verification with crypto and blockchain DAOs is opening the doors for a more integrated trust network."

It Really the case

What a well illustrated post! This article really deserves awards.

Suffice to say that this is the real gist. I think I have found my favorite blog. Thanks very much for

Thanks @eurogee!

The concepts and potential realities underneath cryptocurrencies are so expansive and mind-bending because they really can't be compared to anything else we know of! The more you, we, all discuss the subject the more light is shed and I appreciate your exploration here. Even though I understand much more than any friend I'm explaining this to, I still learn nearly every time I hear someone else explain some aspect of cryptoc or explain it myself.

Thank you so much for the support @natureofbeing! We all have so much the learn together, which makes all of this so exciting ;)

This is an utterly magnificent post @voronoi. Although I understand the specialized actions and services behind each "currency", I hadn't seen how this could create a different system of trade that changes how we value ourselves, each other, what we do and truly makes a valuable space for any and all that each person has to offer. The individual can thrive doing what s/he does best rather than trying to fit his/her skill into a trend or paradigm that doesn't fully value it.

And beautifully said -

I'm so glad that I read this post even if 2 months late, it has opened my mind to expansive horizons. And glad that I upvoted at the time, I only wish it had been at 200%!

crypto must've a tightened security to avoid those jerks. But anyways thanks for the suggestions and advice you have given here, i am very much delighted to follow your guidelines.