Hai all Steemians

In addition, I'm sure you'll continue to mine the crypto currency next summer as well. If I? No. I can explain why.

It's simple - mine is not an ICO. And I've decided myself that investing in ICO gives me more profit. Let's compare!

Mining and mining of clouds

Crypto crypto mining, as you know, is the process of obtaining crypto currency. Crypto currency is derived in two ways:

Independently use equipment that is freely sold. Of course, the price is very high and the cost for the power you need is even greater.

Using cloud mining, you can rent powerful equipment, you pay by hashrate, and you will earn crypto or fiat currency worth in an electronic wallet account.

First Choice: We assume that you have purchased expensive equipment, consider the cost of electric power, and start generating crypto currency, for example in bitcoin (the most famous crypto currency), more or less at home. How big is your annual income?

By using the most powerful equipment with kW / hour without calculating inflation, your income will reach no more than 40% per year. Looks like it sounds a lot, but ... it if in ideal condition. Because the power costs are not the same every day and the equipment may not work all day, this equipment will overheat and require cooling. It spends time and spends money anyway. In addition, please note that all the equipment could have just broken.

Second choice: Cloud mining. In this case, you no longer have to worry about the cost of electricity and buy expensive equipment. Simply find the service that best fits you; pay rent for a month, half a year, or a year, etc.; and do the mining! If you do not mine bitcoin (which becomes increasingly difficult to obtain) but maybe, ether, eat your income may reach 60-70% per year.

.jpg)

Do you think this is as simple and beneficial as that? No. And here's why:

No one will sell power to you in accordance with the original cost and price engineering always reduce your income.

This service also always attracts a percentage of cost. In other words, you will not get most of the crypto currency you mine.

The service can be terminated at any time and you can not control it. This means the risk is inevitable. Add again, I can tell you that 90% of cloud mining services are a fraud! They work on pyramid schemes and in a few months, after collecting enough money, they will just disappear. You will never find them.

For myself I think this conclusion will be sufficient to understand how unfavorable today's crypto-mining mining is in any form. But in any case, another gold argument left in my opinion:

DIFFICULTY MINING MORE THAN ANY MORE!

What does this mean? This means that the number of miners continues to grow. And the more they are, the less bitcoin, ether, real, etc. that you can generate in a single unit of time. The number of people who want to generate crypto currency increases every day, which means the difficulty of mining continues to rise.

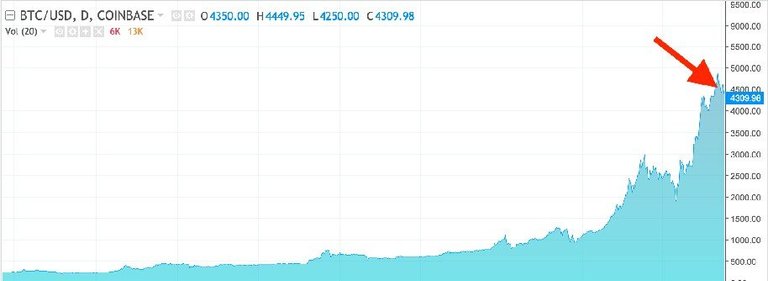

In this case, the request generates an offer, and the offer generates a request. Therefore, the idea of becoming a crypto currency holder remains tempting. Consider for yourself: for example, Bitcoin is not considered as something serious in 2009 and its value is almost zero, but by 2017, its value exceeds gold! Therefore, it becomes more difficult to mine Bitcoin.

Price comparison:

Gold Price USD1346:

Price BTC USD4309:

Ethereum has encountered quite a few troublesome problems. All crypto currencies will sooner or later experience the same fate.

That's the situation ... All the pros and cons I've managed to realize for myself, that's why I speak very confidently about this. Of course, there are little things that you will understand if you delve deeply into this alone. It would be better if I tell you that the field of investment is a direction that will become a trend in the future.

Project financing with the assistance of ICO implementation.

Mastering the art of calculated investment and writing a guide for it will take a lifetime. That's not my word, but I agree 100% with that statement. So, I will not claim my point of view as an absolute truth.

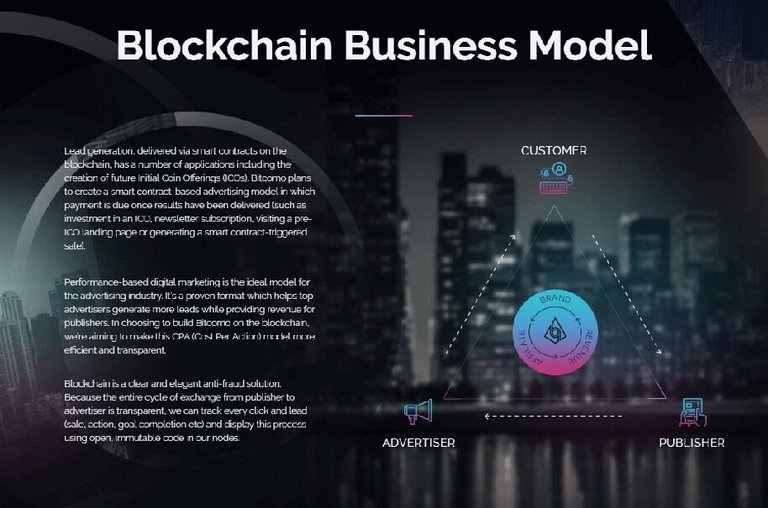

Anyhow, I will remind you what it is ICO actually. ICO is an abbreviation of an initial coin offering - ICO or this inaugural coin offering is almost the most popular way to attract capital for projects based on blockchain technology. In other words, in ICO, companies offer their own crypto and token currencies, which are expected to grow in price, while the revenue generated not only goes to the company but also to investors, this is similar to an IPO (initial public offering) when a the company issues the shares and offers to the investors to buy them.

Well, unlike the shares of corporations and ordinary enterprises, the purchase of the crypto currency token gives the right to profit share of the project, which ... has not yet been released. What are you doing? How can you guess how successful a project will be? This is hard, but not impossible.

From my experience, I can say that there are some things that must be considered by investors. If all these things you can clearly understand, then you can be assured (indeed, the risk will always exist, but the possibility will be minimal) to invest your funds. So, those things are:

- White Books Everyone interested in a project offered by a company should have a "white paper" that outlines the project goals, business plans, project financing stages, etc. which can be reached easily and clearly expressed. Meanwhile, the white book should not contain too many obscure terms, vague statements, and the like. This is how bad companies often hide

- Roadmap. This is simple, on the ICO website all stages of financing and timing of implementation should be clearly stated. Just look at these stages, make sure that everything written in the white paper is all right, evaluate its ability to be implemented within the specified time range, and verify that blockhain has reasonable grounds to use in this project. If the time period of the various stages itself raises doubts - we should not take part in such ICO. A good project only sets a relief goal!

- Team. Of course, everyone can write anything in a website. But! If one of the participants of a project has had a successful experience in the field of blockchain projects, it is very easy to test it. Information on all major and successful ICOs is available online.

Here is an example: one of the most successful ICO is Stratis. Their crypto currency has exploded up in just a few months. Stainless tokens sold in summer 2016 worth USD 0.007 In a year the price has reached USD 10.58 and continues to grow !!! In other words, in 1 year they have grown to more than 150,000%

Therefore, people who invest only $ 10 in the early stages in Stratis earn more than $ 15,000 in a year alone! Is not the risk worth the great advantage given?

There are other examples of very successful ICO, although not as successful as Bitcoin. I am talking about Storj. The value grew by 17,700%, up from the initial offering of $ 0.010 per token to $ 1.77.

People who invest $ 10, earn $ 1,770. This is a great investment.

Now our approach:

the amount you pay to get a token when financing a blockchain project is totally incomparable to the cost of bulk mining or a minimal deposit when using cloud mining

It turns out that ICO can be affordable for all investors with all budgets. ALL BUDGETS!

Right now there are many projects that have run, but me and you are only interested in prospective ICO. In other words, where can we invest the minimal funds in order to generate huge profits? In this case, I began to get excited, analyze all the offers, and make conclusions.

Thanks to visiting my blog!