Introduction

People, like markets, are irrational. For those that aren’t familiar with the terms ‘bull’ and ‘bear’ when applied to trading, think of it as when the market is in a frenzy, it runs like the bulls. Similarly, when the market is calm and/or fearful, it sleeps (or hibernates) like the bears. Apply this to an immature asset class like cryptocurrencies and you get the violent price swings that are seen every day.

I’m sure many of you are aware by now of the current state of the cryptocurrency markets. Ethereum is down 180% (from an all-time-high of $420USD to $150USD at time of writing) and Bitcoin is down from an all-time-high of almost $3000USD to $1900USD (a 170% retrace). The ‘alt-coins’ are also down a lot more considering most of them are pegged to the BTC and ETH trading pairs.

Why? Why did this happen? It may seem simple at face value - the price of cryptocurrencies went up too fast and this is simply the market correcting itself down to what they should be worth. This explanation is accurate but I like to study all the other contributing factors that compounded to turn what was an extremely feverish bull market into a potential bear market in just 1 month. Keep in mind that bear markets typically last a while (6 months+) so calling what we are currently in a bear market may be premature.

If you’d just like the TL;DR (too long; didn’t read) - I attribute the price rise to hype, greed and FOMO (fear of missing out) and the price fall to fear, impatience and lack of knowledge.

If you want to know how I came to these conclusions, read on!

Please keep in mind that nothing I outline in this piece should be taken as actual investment advice. I am not responsible for any losses that you incur due to investments that you participate in.

Media Frenzies, Hype, Greed and the Fear of Missing Out (FOMO)

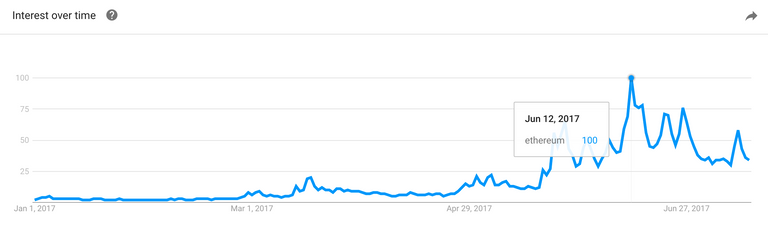

The latest price rise of Cryptocurrencies began in February of this year (2017) and continued until around mid-June 2017. We stayed in a bull market for a good 5 months - almost every week saw new gains across the board (with some cryptocurrencies up 50% on any given day). This, of course, led to a massive amount of attention from the media.

Ethereum’s bull run from $10USD to $420USD (a 4200%, or 42x, return), began on the announcement of the Ethereum Enterprise Alliance (EEA). I’ve spoken about the EEA before, but it is basically a coalition of organizations (such as Microsoft, IBM, JP Morgan etc) who have expressed interest in working with blockchain technology (specifically the technology that powers Ethereum). Although the EEA was announced in February 2017, Ethereum’s price managed to climb from $6USD to $10USD in the 2 months beforehand.

The EEA announcement was the beginning of the media frenzy that focused squarely on Ethereum. Many news sources were covering Ethereum’s price rise daily and commenting on its chance of overtaking Bitcoin (commonly referred to as ‘The Flippening’). This led to an incredible amount of mainstream awareness and then subsequent investment from people who didn’t understand anything about how cryptocurrencies or blockchains worked, but wanted in on the massive gains that were constantly being reported on.

Google search interest over time for Ethereum

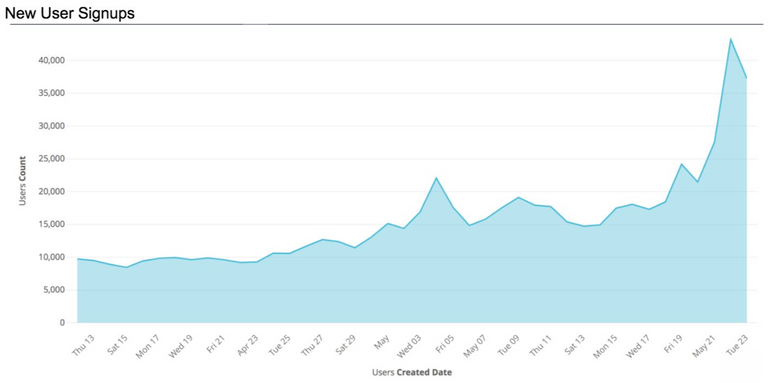

Then, a second round of companies joined the EEA at the peak of the cryptocurrency frenzy. I watched the announcement and subsequent price rise in real time - it happened over the course of a few hours and it was insane to say the least. I think this is when peak greed set in and people were feverishly trying to get in on what was being hailed as a ‘once in a lifetime opportunity’. Trading exchanges saw peak user sign-ups during this time - Coinbase reported 40,000 user sign-ups in one day - you can see from the chart below that this was 4 times more than just a month earlier.

As you can imagine, all of this added fuel to an already extremely violent fire.

In the end, this led to the self-fulfilling prophecy that has been seen in every single type of market - people kept buying, which made the price rise, which made people keep buying - do you see where I’m going with this?

So, what happens when people stop buying? What happens when people start losing money? What happens when people lose faith?

Fear

Commonly referred to as the most powerful of human emotions, fear plays a massive role in how markets (and humans) operate. People make mistakes when they are fearful. They make irrational decisions based on emotion rather than logic. They become impatient. Fear grabs ahold of them and won’t let go until they do the exact thing that will remove that fear - which, in this case, was sell while you’re still in profit.

This is exactly what happened. People started selling. Just like how people kept buying because the price kept going up, they did the exact opposite when prices kept going down. This domino effect leads us into what we have been seeing from mid-June to mid-July - a potential bear market.

I believe that most price crashes, small or large, can be directly attributed to fear (which leads to impatience). If you had just held through the price crashes you would of eventually turned a profit. This profit isn’t guaranteed but it has held true from what happened the last time cryptocurrencies saw a massive rise (back in late 2013/early 2014).

For a quick recap, Bitcoin shot up to a new all-time-high (ATH) of $1100USD in December of 2013 and then didn’t return to this price until December 2016 (while falling to as low as $150USD in the meantime). Bitcoin has since surpassed its old ATH and set a new one of $2900 and subsequently fallen to $1900USD at time of writing.

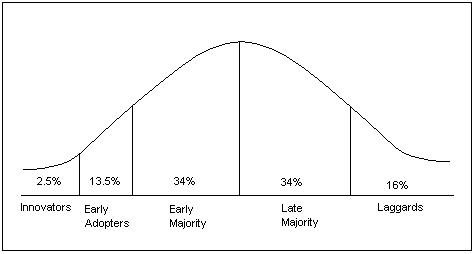

The Adoption Model

We can attempt to plot the phases of the Ethereum price rise to each phase of the above model. Keep in mind that this is an adoption model that was created to illustrate adoption of different products and technologies over a long period of time but I think it can also work to show the adoption during price cycles of particular assets.

Ethereum began life at around 50 US cents at their original Initial Coin Offering (ICO) so I believe that anyone who bought in at this price should be placed in the ‘innovators’ section.

Then, it’s subsequent price rise from 50 cents to around $10USD could be placed in the ‘early adopters’ section. Do keep in mind though, that before February of this year, Ethereum had already risen from 50 cents to $20USD and fallen back down to $6USD.

Next, we can call the ‘early majority’ the investors who got in any time between $6USD and $100USD. Then, we can call anyone who bought in between $100USD and $250USD the ‘late majority’.

Finally, we can attribute the ‘laggards’ phase of the model to anyone who bought in between $250USD and the all-time-high of $420USD.

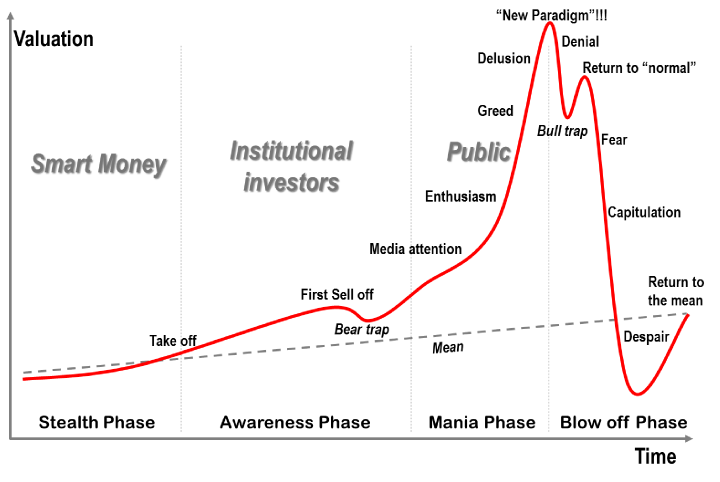

Cycles and Bubbles

As you can probably see, markets work in cycles and these cycles can be either long or short. What determines the length of a cycle is dependent on a number of compounding factors (many of which I covered prior). These cycles are healthy for markets and work to build resilience and investor confidence over time. I debated whether to include the below model in this piece as it has been proven to be inaccurate for many stronger and more seasoned asset classes (such as stocks) but I think it applies pretty well to something as immature as cryptocurrencies.

The above model illustrates a ‘bubble’. Bubble is the name given to an asset that has risen in price too quickly and is believed to be overvalued. You’ve probably heard the term quite a lot recently. For example, in Australia, housing prices are currently very high and as a result have priced most first-home buyers out of the market. Many people are currently referring to this as a bubble. Another example is the U.S stock market - many people believe it to also be in a bubble.

But how do you accurately call something a bubble? Can you look at the past to determine what will happen in the future? Can you predict the future? Of course you can’t.

The Turkey Fallacy & Black Swan Events

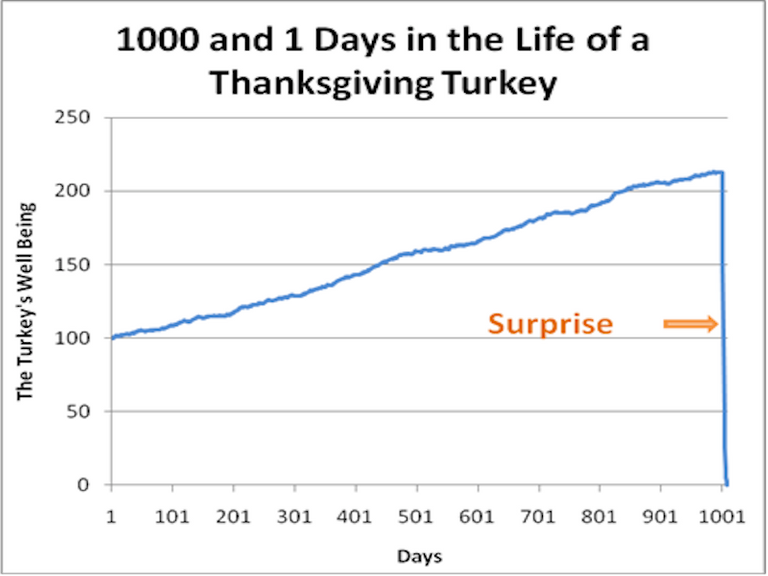

I always like to reference the turkey fallacy whenever someone brings up past performance of a cryptocurrency (or any asset for that matter). The Turkey Fallacy is the notion that just because something has acted one way in the past, doesn’t guarantee it will act that way in the future. Or, it works until it doesn’t.

As Nassim Nicholas Taleb put it in his piece, The Black Swan: The Impact of the Highly Improbable,

| Consider a turkey that is fed every day. Every single feeding will firm up the bird's belief that it is the general rule of life to be fed every day by friendly members of the human race "looking out for its best interests," as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief. |

The hypothetical turkey's sense of safety would have been at its highest right before its greatest danger (being killed and then eaten). But turkeys aren't the only ones to have this problem. Humans have it too. As Taleb points out, it is a problem inherent in empirical knowledge:

| Something has worked in the past, until--well, it unexpectedly no longer does, and what we have learned from the past turns out to be at best irrelevant or false, at worst seriously misleading. |

The Turkey Fallacy also relates to what is referred to as a black swan event. This event has such a remote chance of happening that no one could foresee it and if it was to happen it could mean the end of whatever it happened to. An example of this would be a critical bug in a cryptocurrencies code (such as Ethereums) that would render it completely useless. Given that the code for Ethereum is open source (which means anyone can view it) and has been vetted by thousands of different people and organizations, the chance of there being a critical bug is remote. But, there’s still a chance.

So what would happen to the price of Ethereum (or any other cryptocurrency) if the technology behind it was rendered completely useless by a critical bug (such as one that allows the creation of infinite Ether)? The price would (in theory) drop to near-zero and never recover (or only recover if the bug was fixed before irreparable damage was done). The chance of the bug being fixed and deployed in time for something as popular and widely used as Ethereum is incredibly slim. It probably has the same chance as the black swan event happening in the first place.

Traders, Bots, Technical Analysis

Traders are normally a lot more experienced than your average investor. Traders comprise of single traders, groups of traders and entire institutions dedicated to trading. They all make profit from basically selling high and buying back in at a lower price. So, for example, if a trader sells at $100 and then the price dips to $80 and they decide to buy back in, they will have a net profit of $20. Do this enough times (and in greater amounts) and you can see why these traders do what they do.

Technical analysis (TA) is a tool used by traders in order to get an idea of when the right time to buy or sell is. All technical analysis is performed on trading charts and, in turn, what has happened in the past (if you recall the turkey fallacy, you can see why this can be considered a bad idea). There are a multitude of different technical indicators that make up a technical analysis model but one of the main points of TA is to find patterns and then exploit them for profit.

Technical Analysis isn’t meant to predict the future with 100% accuracy, but it is meant to give traders a better idea of what could happen instead of just trading completely blind.

The technical definition of TA is: Technical analysis employs models and trading rules based on price and volume transformations, such as the relative strength index, moving averages, regressions, inter-market and intra-market price correlations, business cycles, stock market cycles or, classically, through recognition of chart patterns.

Traders contribute to price movements because they make up a majority of trades that happen during sideways movements (the price doesn’t go up or down by any large margin but rather continues to trend sideways). Profit can be made at any price point and so traders will continue to ‘short’ the market (the process of selling their asset because they believe the price will go down) or go ‘long’ (the process of buying more assets because they believe the price will go up). Traders can buy at $100 or $1000, it doesn’t matter to them. The only thing that matters is the profit. If enough traders believe that the price will move from $100 to $200 then, in theory, the price should move higher because there are less traders selling. This is classic supply and demand.

Bots also play a role in price movements, albeit smaller. Bots typically trade for smaller amounts and at faster intervals (what’s commonly referred to as ‘high frequency trading’) and work best when they are most efficient. There are a multitude of bots currently active across a wide range of exchanges. Bots can be programmed in many different ways based on many different factors (technical analysis plays a role here). You can also buy bots on the open market but then you’ll have the same bot that many other people may have and they are all trading based on the same parameters. This is why the most successful bots are often ones that are not shared with anyone and written completely from scratch.

Survivorship Bias

Survivorship Bias applies to many different things (not just trading) but it is a very important concept to study to understand another driving force behind price rises. Survivorship Bias is basically the concept that for every success, there are many failures. For example, for every 1 successful trader that you hear about making millions or billions of dollars, there are thousands, if not tens of thousands, that have lost money overall or gone broke.

Why is this concept so powerful? Because we only hear about the successes. We hardly ever hear about the thousands that failed. It’s not glamorous or exciting for the media to report on those that have failed. This can, and does, lead to false assumptions about certain things. In relation to trading, it can lead to the false assumption that because this person was successful, I can be successful as well.

This concept applies very well to business. 9 out of 10 business’ will fail within the first 3 years of operation but people still pursue business interests whether they know the odds or not. They may do this because they think they can be the one that succeeds because they see and hear about all the success that the 10% of companies have and not all the trials and tribulations that the other 90% had before ultimately failing.

The Trouble with Bitcoin

Bitcoin is currently in the midst of a potential major transformation. For the first time in its history, there is a chance that the Bitcoin blockchain will hard fork due to the on-going ‘scaling debate’. What this means is that the Bitcoin blockchain may split into two chains (or more) which would result in everyone having Bitcoins on all chains. This, in theory, would subsequently lead to Bitcoin’s price adjusting to how many circulating Bitcoins there are across all active blockchains. Hard forks (and soft forks) are a lot more complicated and take a while to get your head around. If you’d like to know more, I’d highly recommend watching this video.

Currently, many traders are getting out of cryptocurrency as a hedge against the possibility of a massive dump in prices across the board if Bitcoin splits. They are sitting in fiat (USD, AUD etc) and are waiting to see what happens. Many people believe that if Bitcoin doesn’t split (which could happen in the coming weeks) then we will see another bull run (which in itself could just be another self-fulfilling prophecy). It is important to understand that this event may also end up as being the ‘y2k of cryptocurrencies’. For those unfamiliar with y2k, head here for an explanation.

This hedging against an uncertain future could be a major reason why the markets are continuing to see sustained sell pressure - as well as companies who have raised Ethereum in this space ‘cashing out’ due to wanting to lock in the money that they raised through their Initial Coin Offering.

Conclusion

I hope I was able to give you a better understanding on how markets work and quell some of the fears that you have. We can study and try to bring rationality to markets, but we can never predict with 100% accuracy where they are going to go. If you want to try and day-trade, then that’s your choice. It’s important to understand that you are competing with experienced traders and bots. You are also competing with players who have a lot more money than you (commonly referred to as ‘whales’) - they have enough money to manipulate the price all on their own.

In closing - make educated investments, know what you’re buying into and the risks associated, be fearful when others are greedy and remember:

Markets can remain irrational for longer than you can remain solvent.

Man, you really invest in this article. It's very good. Makes me understand or clarify some things. In any markets we will see "Gauss bell" trends! For me, wich I'm not a trader I'll always gonna think long term. Last year the BTC was $500. Now is fourt times more valuable! This means for me a long-term investment. On the other hand, no interest in this world was so big to beat the BTC!

Thanks for reading :)

Great post. This is a must read for most noob traders.

General rule of investing; Sell on the low in a panic, you totally give up your position. Then when all the little players are flushed out, in comes the money and gobbles it up at a deep discount.

Well researched and well written.

You've highlighted a number of drivers (i.e. bots, traders, upcoming Bitcoin) as well as adoption cycles. A great framework for an beginner to consider when looking into any give currency.

Cheers!

Thanks for the kind words :)

A lot of good points there. On Ethereum: it is my experience that a good bear market for a coin takes off about 90-95% of the price. So for ethereum that would mean going back to 20-40 bucks. That seems too extreme unless Bitcoin goes in bear market territory as well. If we stay out of a Bitcoin bear market, ETH $100-125 seems like a good price area to start accumulating again.

I agree. I mentioned it may be too early to call this a bear market. I'm not confident we will see sustained price depression in something like Ethereum due to the massive amounts of activity in the space.

Upvoted

TOO LONG............

Steemit is a blogging platform so not sure why you're on here if you're afraid of long posts :P

There is nothing lost by providing a summary on top. Not everyone devours text like us.

There is a summary in the introduction :)

i like tem Australia

This was very informative and gives me a little bit more confidence with regard to my investment in bitcoin and steem. I think that people need to think long term rather than just buying and selling in the short term.