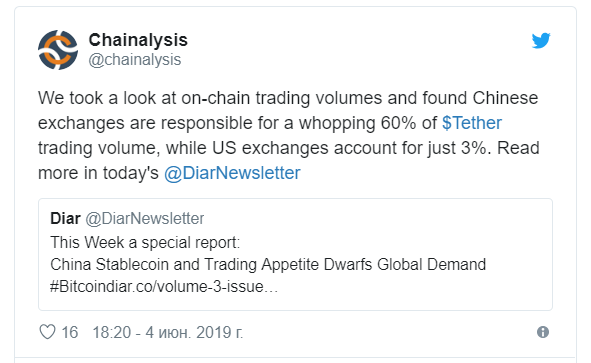

More than half of the total amount of Tether's stable on-line transactions falls on Chinese trading floors. This is evidenced by the new report of the company Diar.

According to data obtained from analysts of blockchain-startup Chainalysis, more than 60% of onchain transactions worth more than $ 10 billion in USDT have passed through Chinese exchanges since the beginning of this year.

For comparison, US exchanges account for only 3% of the total volume of transactions with Tether. It is noteworthy that in 2017 they accounted for 39% of transactions, while Chinese trading platforms accounted for only 12%.

It is likely that such a significant decline in the US is due to stricter regulation of the industry. So, on many American cryptocurrency platforms it is now necessary to undergo verification, and regulators closely monitor what is happening on the market.

The study also notes that the share of global exchanges, such as Binance and Bitfinex, is about 31% of the total. Previously, they accounted for almost half of transactions (47%).

At the same time, it is important to note, according to a recent Bitwise report, 95% of trading volumes on unregulated cryptobirths are fake and devoid of any economic sense.

BTI analysts emphasize that various steablecoins are usually represented on exchanges with fake volumes. Among them are both the familiar Tether and the relatively recent GUSD, DAI, TUSD and PAX. Of all stable coins, the largest share of real volume trading falls on USDC.