Temporarily, a development beneath the $6,300 check is more probable than a surge to the $7,000 district, because of the absence of volume of bitcoin.

Powerless Volumes Once Again

In the course of recent hours, the day by day exchanging volume of bitcoin has diminished from $4.6 billion to $3.9 billion, by around 15 percent. The every day volume of ether, the local digital money of the Ethereum blockchain convention, has likewise declined by a vast edge, dropping by more than 31 percent.

In the mean time, the day by day volume of Tether has expanded 10 percent to $2 billion, implying that brokers on cryptographic money trades like Binance have begun to support the estimation of major advanced resources against the estimation of the US dollar through stablecoins.

Since July 2, the cost of bitcoin has remained generally stable in the mid-$6,000 district, recording slight instability in the scope of $6,300 to $6,700 area. In any case, all through the previous five days, bitcoin has additionally attempted to start a noteworthy development on both the upside and the drawback, principally because of the low day by day volume of BTC.

For the time being, it is more probable for bitcoin to tumble to the lower end of $6,000 than transcend the $7,000 check. Both BTC and ETH have neglected to anchor force on the upside after solid restorative energizes.

Be that as it may, in the mid-term, if a noteworthy break over the slipping trendline since late December can be recorded, an extensive rally can be normal. A few financial specialists including BitMEX CEO Arthur Hayes said that a noteworthy administrative leap forward or an endorsement of an openly tradable resource could permit bitcoin and whatever is left of the Cryptocurrency market to anchor an extensive rally.

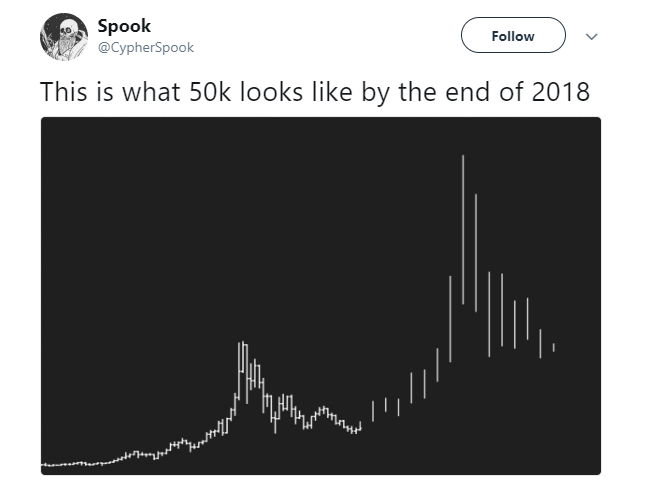

CypherSpook, a support investments dealer and bitcoin specialist, recommended that BTC could accomplish $50,000, as Hayes proposed, upon a noteworthy break over its plunging trendline since December and a spike in volume.

Volume is the Real Concern

In past restorative revitalizes amid which the cost of BTC bounced back to significant help levels at $10,000 and $12,000, the volume of BTC effortlessly outperformed $7 billion and floated around $9 to $10 billion.

As of now, the volume of BTC is attempting to stay above $4 billion and is showing a volume that is like that of Tether (USDT). While most speculators stay sure that the cost of BTC will rise generously close to the final quarter of 2018, it is hard to foresee when the market will in all probability start the following rally because of the unconventionality of the market's day by day volume.

Like the redress in 2014, the Cryptocurrency market should encounter a time of security and recuperation before surging to the $500 billion level it recorded in November and thusly, a full recuperation to November and December levels will in all likelihood take four to five months at any rate, regardless of whether a noteworthy change in the administrative structure around Cryptocurrencies is made.