Part 1: Chinese cryptocurrency ecosystem, an overview Part 1 — Steemit

In the previous article of this series we examined the Chinese cryptocurrency mining and open source communities, analyzing how collectivism could play a key role in the decision-making among them. This week we’ll take a closer look at the cryptocurrency exchanges based in China. By the end I hope you’ll have a better understanding of how these exchanges operate and and their outlook for the future.

( )

)

Numbers: Real or Fabricated?

Currently seven China based exchanges are in the top 30 ofmarket volume based on daily trading activity , and they are listed below*

- OkCoin - 6th ($121,277,100)

- Huobi - 9th ($69,422,800)

- CHBTC - 12th ($53, 583, 550)

- Yunbi - 14th ($44,170,743)

- BTCC - 18th ($25,691,379)

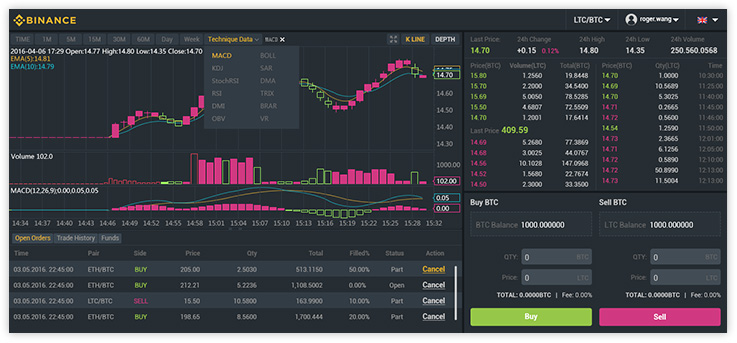

- Binance - 26th ($7,834,223)

- Jubi - 27th ($7,206,392)

*snapshot of market volumes taken on July 30, 4:47 JST (Since I began this article it seems like Binance has jumped significantly in the list)

In a 24 hour period these seven exchanges account for a total of approximately 320 billion dollars worth of volume which, at the time of writing, accounted for 15.8% of the total 2.1 billion market volume. Six out of the seven of these exchanges deal in CNY/BTC trades and other fiat pairs, whereas one, Binance deals exclusively in cryptocurrency pairs. We’ll examine the implications of this later on.

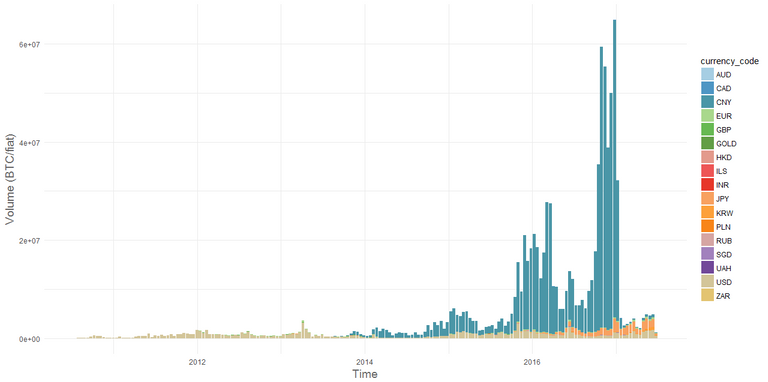

For most westerners, these exchanges only produced noteworthy news in 2013 when OkCoin and Huobi, the two largest exchanges, were accused of faking trade volume. This came in the aftermath of the legendary Mt. Gox crash, when the reputation of cryptocurrency exchanges was at an all time low. Perhaps in response to Mt. Gox, Chinese regulators began to crack down the unregulated nature of exchanges. However, it seems that these regulations may have not led to as much of an effect as hoped. As late as 2016, the same accusations were being made. CEO of BTCC, Bobby Lee, stated that

“[OkCoin and Huobi] use [trading volume] for bragging purposes. They try to outdo each other. It’s not regulated yet so they don’t get slapped on the wrist for doing that. China does have big trading but we are not talking about orders of magnitude higher. If you were to believe the numbers you would think the world is 95% Chinese.” Source

This brings an interesting perspective on the volume numbers that I referenced in a previous article.

( )Analyzing Ethereum, Bitcoin, and 1200+ other Cryptocurrencies using PostgreSQL

)Analyzing Ethereum, Bitcoin, and 1200+ other Cryptocurrencies using PostgreSQL

In early 2017, the downtrend in market volume in Chiba was due to the freezing of withdrawals on major exchanges. However given the accusations from above, did this new round of regulations in 2017 actually effect the amount of volume on Chinese exchanges, or was this the date that were forced to stop “cooking the books”? The official reason that withdrawals were forced to stop according to the government was as follows

“According to the inspection findings, the relevant administrative penalty resolution has been drafted and the paper is being reviewed. Two key issues must be corrected: one is the fiat and BTC lending business and the second is the flawed AML(Anti Money Laundering) system.” Source

However, if the exchanges complied with these requests then there is no reason for the volume to not return to previous levels. However, it hasn’t even come close to recovering, so either these exchanges were massive hotbeds for money laundering due to poor AML methods, or the volumes were indeed fake. My theory is that when the regulators stepped in to force the exchanges to comply with additional regulations, the exchanges took this time to rectify any and all of the “shady” dealings that may have been happening. It seems there were a number of issues, which seems to have been confirmed by then-CTO of OkCoin Zhao ChengPeng. Fake volumes, fake proof of reserves, poor cold wallet security, opaque financials, insider trading etc appeared to be a normal occurrence. I encourage a full read of this post for anyone interested in the topic.

Just imagine what consequences there would be if these issues occurred at any other traditional financial institution; but today these top exchanges are still up and running, and these scandals have gone largely unnoticed.

Regulatory Considerations

So regulators in China said they were going to come down hard on Chinese exchanges in 2013, and then it appears that they actually did in 2017. However, since then, the Chinese cryptocurrency scene has seen another interesting development: the opening of binance.com, the first exchange in China that deals exclusively with cryptocurrency pairs. This exchange was founded by a familiar face, none other than the former CTO of OKCoin, Zhao ChengPeng.

Binance holds another first in China, it is the first exchange in Asia that has raised money through ICO. Most exchanges that have ICO’d for example Lykke, OpenAnx, and NVO exchange follow the decentralized exchange model, where token value is typically derived from some sort of revenue sharing. Binance, on the other hand, retains the centralized exchange model and the token value derives from the ability to use it for fees on the network. In the white paper it does state that they may move towards a decentralized model in the future, however I do not expect this shift to occur for a long time, but I will be very interested in the progression of that if it does occur.

Now this is particularly interesting because crypto only exchanges are floating in a bit of a regulatory grey zone. In the USA, if an exchange has a fiat trading pair then it must be registered as a Money Service Business or MSB.

The term "money services business" includes any person doing business, whether or not on a regular basis or as an organized business concern, in one or more of the following capacities:

- Currency dealer or exchanger.

- Check casher.

- Issuer of traveler's checks, money orders or stored value.

- Seller or redeemer of traveler's checks, money orders or stored value.

- Money transmitter.

- U.S. Postal Service.

Money Services Business Definition | FinCEN.gov

So exchanges like Poloniex, GDAX, and Gemini must register as an MSB because they deal with fiat currencies. However, since Bitcoin is currently considered a commodity (like oil) by the US government, an exchange dealing only in crypto pairs should not be subject to these same regulations. Despite this, Bittrex an exchange dealing in crypto-only pairs is still registered as an MSB. This is seems like a clear inconsistency in the application of the law, which is likely indicative of the fact that regulators simply don’t know what to do right now in regards to cryptocurrencies.

Alternatively, in Japan bitcoin has been regulated as a currency. this is significant because it allows for the trading of bitcoin derivatives (options, futures, etc.) just like in any other forex market. It also puts any exchange dealing with bitcoin in the same regulatory group as any other traditional financial institution.

China has decided to follow along the same lines USA and list Bitcoin as a commodity rather than a currency. http://beijing.pbc.gov.cn/beijing/132005/3230072/index.html

With this classification crypto-only exchanges should theoretically be subject to a different set of regulations than any exchange dealing in fiat. As I mentioned before when listing bitcoin as a commodity, I believe that regulators are trying to buy time to establish proper governance. The regulation has been unable to keep pace with the development of the technology, or the money flowing into the space.

So with actual regulators falling behind, and previous examples of untrustworthy behavior amongst exchanges, it is no surprise that many crypto veterans advise new investors to pull their money away from exchanges as quickly as possible. To combat this negative perception, exchanges should take steps to introduce some form of self regulations amongst themselves, before the hammer of government regulations comes down on them. Exchanges should seek to be as transparent with their customers, but at the end of the day this still requires on believing a trusted entity with your money which I would consider against the spirit of bitcoin and the cryptocurrency space.

Moving Forward

There are a number of things that an exchange could do to improve trust, both with regulators and customers, but I will focus on one for the rest of this article: proof of reserves and liquidity. Without any form of publicly auditable proof of reserves, it is impossible to tell whether or not an exchange is actually liquid or not. Put it this way, if there is a run on a bank, then the federal government will guarantee most of your money no matter what. If there is a run on an illiquid exchange, then your money could be lost.

Some exchanges, such has Kraken, have taken some measure to ensure proof of reserves with a third party auditor Though, It should be noted that Stefan Thomas was the same person who carried out the audit for OkCoin.cn, and it is claimed that this audit was a sham. These types of problems will of course continue in any system that requires a trusted third party.

However there are methods for an exchange to prove it’s proof of reserves in a trustless environment. The original proposal was developed by bitcoin core developer, Greg Maxwell. It uses a merkle tree approach of customer balances, similar to the data structure used in the bitcoin blockchain itself. Although this system would allow for cryptographic proof of reserves, it would also expose customer information which is undesirable for most exchanges. Kraken, itself cited this is as the reason that they used a third party auditor for its proof of reserve.

However in 2015 a new approach was proposed by researchers at Stanford and Concordia Universities that built off of Maxwell’s original proposal. Thus approach would provide the same cryptographic evidence while maintaining user privacy. Although the technical specifications of this system are outside the scope of this article I may dedicate a full article to this system in the future.

I hope forward thinking exchanges will take time to examine these proposals, especially in countries such as China and the USA where regulators simply do not understand the technical details of cryptocurrencies, as seen by the rushed label of commodity to bitcoin. Adopting this sort of system would lead to increased transparency, foster good will between the exchanges, customers, and regulatory bodies. Taking steps like these will prevent any future sort of Mt.Gox, and hopefully shift the common advice away from never keeping any significant amount of cryptocurrency on exchange.

Conclusion

In this article we had a brief overview of the leading Chinese exchanges, and inspected the significance of the first crypto-only exchange in China. Additionally we saw how regulators in countries in the USA and China have simply not been able to keep pace with the growth of these exchanges which has lead to strange regulatory labeling by the regulators, and potentially shady behavior by the exchanges. Finally we examined how exchanges could potentially adopt some of the core technology itself to provide cryptographically secure proof of reserves.

In my next article we’ll look more closely at the retail investor in China, and how the average citizen may be affected by the cryptocurrency boom.

Please follow me for more articles providing an in-depth analysis of the cryptocurrency space, and if have any suggestions feel free to leave a comment. Lastly please check out my sponsor below!

Thank you binance for your support in writing this article. Binance is a world class exchange offering high liquidity and high performance, capable of transacting 1,400,000 orders per second. Check them out while they still offering zero fee trading!